Milk Protein Hydrolysate Market Size

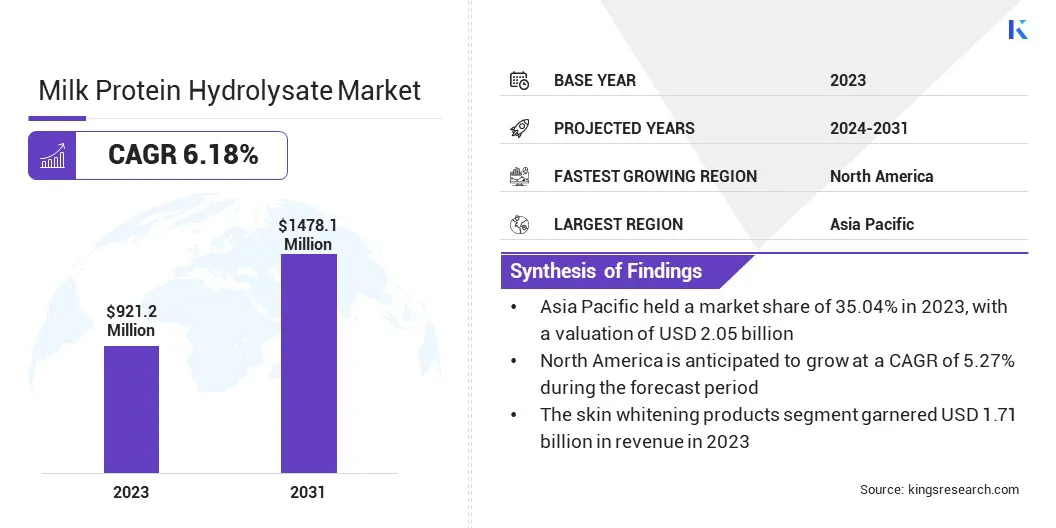

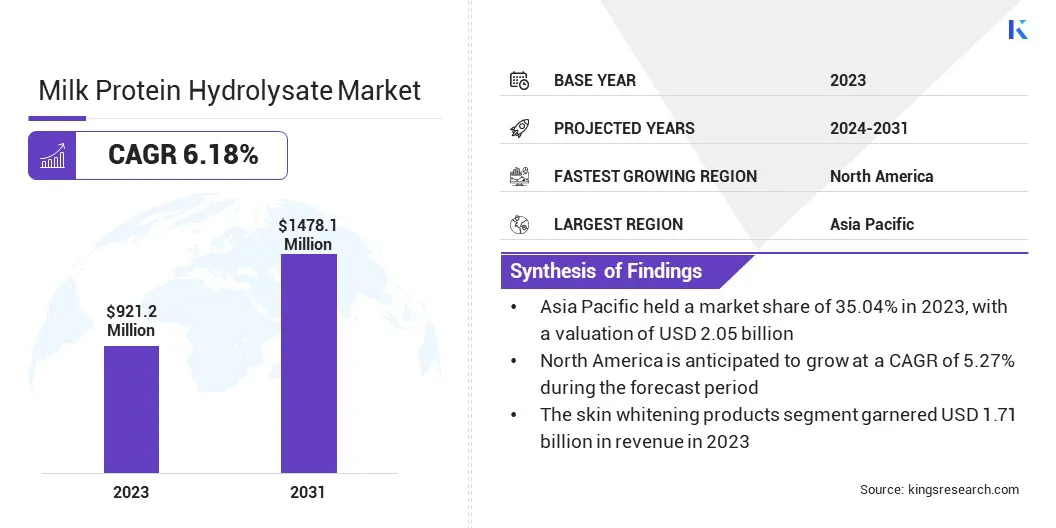

The global Milk Protein Hydrolysate Market size was valued at USD 921.2 million in 2023 and is projected to grow from USD 971.2 million in 2024 to USD 1,478.1 million by 2031, exhibiting a CAGR of 6.18% during the forecast period. The expanding sports and fitness culture globally has led to a surge in demand for protein supplements.

With a rising number of individuals engaging in sports and fitness activities, there is a surging demand for protein supplements that support muscle recovery and growth. Milk protein hydrolysates are favored by athletes and fitness enthusiasts due to their rapid absorption and ability to support muscle recovery.

In the scope of work, the report includes products offered by companies such as Lactalis American Group, Inc, Arla Foods Ingredients Group P/S, Kerry Group plc, Fonterra Co-operative Group Limited, Royal FrieslandCampina, Glanbia plc, Costantino & C. spa, Tatua Co-operative Dairy Company Limited, Hilmar Ingredients, AMCO Proteins and others.

Moreover, the growing awareness of health and wellness significantly boosts the demand for milk protein hydrolysate. As consumers increasingly prioritize their health, the demand for protein-rich diets has increased. Milk protein hydrolysates are regarded as a high-quality protein source, making them particularly appealing to health-conscious individuals.

Additionally, the increasing prevalence of lactose intolerance has spurred the demand for lactose-free or low-lactose products. Milk protein hydrolysates, which often have reduced lactose content, are designed to cater to this specific consumer segment, thereby enhancing their market appeal.

Furthermore, the expanding sports and fitness culture globally has contributed to the growth of the market. With a rising number of individuals engaging in sports and fitness activities, there is an increased demand for protein supplements that support muscle recovery and growth. In addition, the introduction of stringent safety and suitability regulations for protein hydrolysates in infant formula products is supporting the milk protein hydrolysate market growth.

- For instance, in February 22, 2022, a new EU regulation concerning infant formulas and follow-on formulas containing protein hydrolysates came into effect. This regulation requires companies to submit detailed dossiers on their ingredients for evaluation by the European Food Safety Authority (EFSA) to assess their safety and suitability. Following this regulation, EFSA published a positive opinion confirming that Arla Foods Ingredients' Peptigen IF-3080 protein hydrolysate is safe for use in infant formulas and follow-on formulas in the EU.

Milk protein hydrolysate is a form of milk protein that has been broken down into smaller peptides and amino acids through a process called hydrolysis. This enzymatic or chemical process makes the protein easier to digest and absorb in the human body.

Milk protein hydrolysates are commonly used in various food and nutritional products, including infant formulas, sports nutrition supplements, and medical nutrition, due to their high bioavailability, reduced allergenicity, and beneficial nutritional profile. They often contain minimal lactose, making them suitable for individuals who are lactose intolerant.

Analyst’s Review

The versatility of milk protein hydrolysates is being fully leveraged by manufacturers to expand their presence across multiple segments, including functional foods, beverages, dietary supplements, sports nutrition, and medical nutrition. By developing a broad range of formulations, companies are catering to specific consumer demands, such as products designed for rapid recovery in athletes or formulations that support muscle maintenance in older adults.

Collaborations with food and beverage companies have further facilitated the integration of milk protein hydrolysates into innovative product lines, thus enhancing the milk protein hydrolysate market reach.

Moreover, manufacturers are expanding their geographical presence to capitalize on the growing middle-class population and increasing disposable incomes in emerging markets. This expansion is supported by strategic partnerships with distribution partners, the establishment of localized production facilities, and targeted marketing campaigns.

By understanding and adapting to local consumer preferences and dietary habits, companies are successfully penetrating new markets and offering competitively priced, high-quality products that align with local tastes and expectations.

- In February 2023, Kerry Group initiated a collaboration with Azelis and Caldic as distribution partners for their products to selected customers in the European region. This partnership is set to expand Kerry’s market presence, allowing the company to supply a wider customer base with their leading products and technologies.

Milk Protein Hydrolysate Market Growth Factors

Recent innovations in processing technologies have substantially transformed the production landscape for milk protein hydrolysates, resulting in significant improvements in both efficiency and quality. Advanced hydrolysis techniques, including the development of more precise enzymatic methods and optimized chemical processes, have enabled manufacturers to produce milk protein hydrolysates with enhanced purity and functionality.

Furthermore, advancements in processing technologies have enhanced the quality of milk protein hydrolysates, ensuring that they meet rigorous standards for nutritional content, bioactivity, and digestibility.

However, the advanced technologies and specialized processes required for producing high-quality milk protein hydrolysates result in increased production costs. This often leads to higher product prices, making them less accessible to price-sensitive consumers and limiting market penetration.

The rising popularity of plant-based proteins and other alternative protein sources poses a significant challenge. As consumers increasingly opt for non-dairy options, the demand for milk protein hydrolysates may be constrained, thereby limiting their market potential. To mitigate this challenges, leading manufacturers are continuously innovating in product development.

By introducing novel applications of whey protein hydrolysates, such as clear protein-enriched beverages and fermented protein drinks, companies are meeting the surging consumer demand for high-protein, functional products that offer both appealing taste and texture. These advancements expand the range of whey protein-based products available to consumers and align with evolving health and wellness trends, thereby bolstering the milk protein hydrolysate market growth and increasing consumer adoption.

- For instance, in November 2023, Arla Foods Ingredients showcased innovative applications of its whey protein range at the Gulfood Manufacturing event in Dubai. The products included a fermented protein drink made with Lacprodan HYDRO.365 and Nutrilac FO-8571, as well as a clear protein-enriched juice drink featuring Lacprodan ISO.Clear. These 100% whey-based hydrolysates are ideal for creating clear fermented beverages. Lacprodan ISO.Clear offers a great taste without a dry mouthfeel, contains no added sugar, and can be fortified with vitamins and minerals.

Milk Protein Hydrolysate Market Trends

The growing consumer focus on health and wellness is a significant factor aiding the growth of the market. As awareness grows regarding the benefits of protein-rich diets and functional foods, consumers are increasingly seeking products that support their overall well-being.

Milk protein hydrolysates, known for their high-quality protein content and ease of digestion, are gaining immense popularity among health-conscious consumers. This trend is particularly evident in segments such as sports nutrition, where athletes and fitness enthusiasts require rapid recovery solutions, and in medical nutrition, where easily digestible proteins are essential for patients with specific dietary needs.

Additionally, consumers are increasingly looking for products tailored to their individual dietary needs, health conditions, and lifestyle choices. This shift toward customization has led manufacturers to develop specialized milk protein hydrolysate products that cater to specific health concerns, such as weight management, muscle maintenance, and immune support.

Personalized nutrition is fostering innovation in both product formulations and packaging, as companies strive to provide targeted solutions that align with consumers' unique preferences and requirements. This trend is expected to gain traction as advancements in genomics and digital health technologies facilitate the provision of personalized dietary recommendations.

Moreover, there is a growing emphasis on sustainable and ethical production practices, including the use of environmentally friendly packaging and sourcing of raw materials. Companies that demonstrate a commitment to these values are likely to gain a competitive edge and attract environmentally conscious consumers.

- For instance, Nestlé plans to ensure that all of its plastic packaging is recyclable and to achieve a recycling rate exceeding 95% by 2025.

- The Government of India has identified and banned single-use plastic items with low utility and high littering potential, effective from July 1, 2022. Additionally, plastic packaging materials must comply with the prescribed overall migration limits and specific migration limits.

Segmentation Analysis

The global market is segmented based on form, source, end use industry, and geography.

By Form

Based on form, the market is segmented into powder and liquid. The liquid segment led the milk protein hydrolysate market in 2023, reaching the valuation of USD 533.2 million. This leading position is reinforced by its superior solubility, ease of incorporation, and versatility in various applications. Liquid formulations are ideal for creating high-protein drinks, shakes, and smoothies, meeting the growing consumer demand for convenient, on-the-go nutrition.

Additionally, they offer excellent digestibility and bioavailability, making them highly suitable for sensitive consumer groups such as infants, the elderly, and patients who need easily digestible proteins. Furthermore, advances in processing and packaging technologies enhance the shelf life and stability of liquid products, ensuring their widespread availability and appeal across different distribution channels.

By Source

Based on source, the milk protein hydrolysate market is classified into casein hydrolysate and whey hydrolysate. The whey hydrolysate segment secured the largest revenue share of USD 533.2 million in 2023, primarily due to its superior nutritional profile and digestibility.

Whey hydrolysates offer a high concentration of essential amino acids, particularly branched-chain amino acids (BCAAs), which are crucial for muscle repair and growth. This makes them highly sought after in sports nutrition and fitness products.

Additionally, the growth of the fitness and wellness industry has increased the demand for products that support muscle recovery and overall health, thereby enhancing the market presence of whey hydrolysates. Their versatility, coupled with a strong brand presence and consistent demand, solidifies the position of the whey hydrolysate segment.

By End Use Industry

Based on end use industry, the market is divided into infant nutrition, RTE & dairy products, dietary supplements, functional foods & beverages, cosmetics and others. The dietary supplements segment is poised to wtiness significant growth at a robust CAGR of 8.42% through the forecast period as a result of its high demand and growth potential.

The increasing consumer focus on health, fitness, and personalized nutrition has led to a rise in demand for supplements containing these hydrolysates. Additionally, the segment benefits from robust expansion of fitness and wellness industry.

- According to the Global Wellness Institute report, the global wellness economy was valued at USD 5.6 trillion in 2022, marking a nearly 14% increase from 2019. The GWI forecasts an average annual growth rate of 8.6%, projecting that the wellness economy is expected to reach USD 8.5 trillion by 2027.

Milk Protein Hydrolysate Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific milk protein hydrolysate market share stood around 36.78% in 2023 in the global market, with a valuation of USD 338.8 million. The increasing incidence of lifestyle-related diseases, such as obesity and diabetes, is boosting the demand for health-focused dietary solutions in Asia Pacific.

- According to the World Obesity Atlas, by 2030, 12.09% of children aged 5-9 and 7.52% of adolescents aged 10-19 in the Southeast Asian region are projected to be affected by obesity, totaling over 45 million individuals aged 5-19. Moreover, it is expected that half of the countries in this region are likely to each have more than 1 million children affected by obesity by 2030.

Milk protein hydrolysates are popular among individuals seeking to manage their health through functional foods and supplements. This trend highlights the need for effective nutritional interventions, thereby bolstering the demand for milk protein hydrolysates in the region.

Moreover, rapid urbanization in countries such as China and India is leading to lifestyle changes that include a major focus on fitness and dietary supplements. Urban consumers are increasingly inclined to invest in health products, including milk protein hydrolysates, due to their convenience and nutritional benefits, thereby augmenting regional market growth.

North America is poised to witness significant growth at a robust CAGR of 7.48% over the forecast period due to the region’s substantial investment in premium health and nutrition products. The willingness to spend on high-quality protein supplements, including milk protein hydrolysates, reflects a growing need for these products.

Additionally, innovations in processing technologies and product formulations are significantly enhancing the appeal of milk protein hydrolysates. Advances in these areas have broadened their applications across various food and beverage products, making them increasingly accessible to consumers.

- According to the U.S. Dairy Export Council, U.S. ingredient processors have increasingly specialized in milk protein production, with milk protein concentrate (MPC) production more than doubling over the past decade. Additionally, micellar casein concentrate (MCC) has become available as a new commercial ingredient, highlighting the expanding range and capabilities of milk protein products.

Furthermore, innovations in food processing technologies in North America have improved the production efficiency and quality of milk protein hydrolysates. These advancements ensure a consistent supply of high-quality products that meet the stringent demands of health-conscious consumers, which is contributing significantly to domestic market development.

Competitive Landscape

The global Milk Protein Hydrolysate Market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives such as investing in research and development, establishing new manufacturing facilities, and optimizing the supply chain can open up new opportunities for the market growth.

List of Key Companies in Milk Protein Hydrolysate Market

- Lactalis American Group Inc,

- Arla Foods Ingredients Group P/S

- Kerry Group plc

- Fonterra Co-operative Group Limited

- Royal FrieslandCampina

- Glanbia plc

- Costantino & C. spa

- Tatua Co-operative Dairy Company Limited

- Hilmar Ingredients

- AMCO Proteins

Key Industry Developments

- April 2024 (Acquisition): Arla Foods Ingredients entered into an agreement to acquire the Whey Nutrition division of Volac's business by purchasing shares in Volac Whey Nutrition Holdings Limited and its subsidiaries, Volac Whey Nutrition Limited and Volac Renewable Energy Limited. This acquisition is crucial to Arla Foods Ingredients' future strategy, as it plans to transform the Felinfach site into a global production hub. The site is anticipated to serve as a key component in expanding and enhancing their product offerings across the performance, health, and food sectors.

- May 2024 (Expansion): FrieslandCampina’s subsidiary, Dutch Lady Milk Industries Berhad (DLMI), inaugurated a new state-of-the-art dairy plant, DLMI@Enstek, in Bandar Enstek, Negeri Sembilan, Malaysia. This advanced facility is equipped with the latest technology, enabling DLMI to double its production capacity. The expansion aims to meet the rising demand for high-quality and nutritious dairy products in the region.

- July 2023 (Product Launch): Hilmar Cheese Company, Inc. introduced a new product targeting the Sports and Healthy Living nutrition markets. Hilmar PROtelyze Extend is a premium hydrolyzed whey protein isolate designed for nutrition bars. It enhances protein content while maintaining an appealing texture throughout its shelf life.

The global Milk Protein Hydrolysate Market is segmented as:

By Form

By Source

- Casein Hydrolysate

- Whey Hydrolysate

By End Use Industry

- Infant Nutrition

- RTE & Dairy Products

- Dietary Supplements

- Functional Foods & Beverages

- Cosmetics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America