Market Definition

Military vehicle sustainment involves the ongoing maintenance, repair, and support of vehicles to ensure operational readiness and reliability throughout their lifecycle. It improves fleet availability, reduces downtime, and enhances mission performance.

The market encompasses services such as overhauls, upgrades, spare parts supply, and technical training. These services are applied across armored vehicles, military trucks, and combat support vehicles by army, navy, and air force.

Military Vehicle Sustainment Market Overview

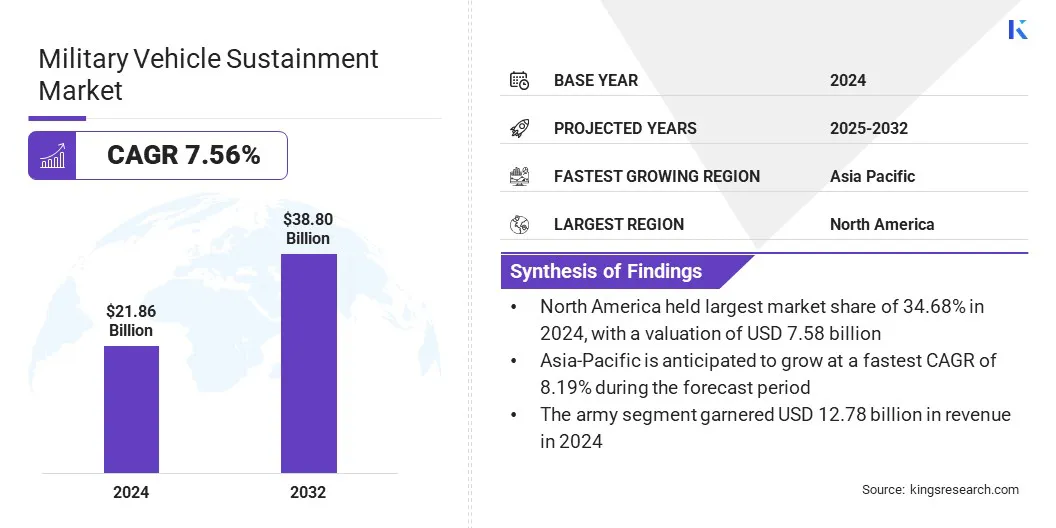

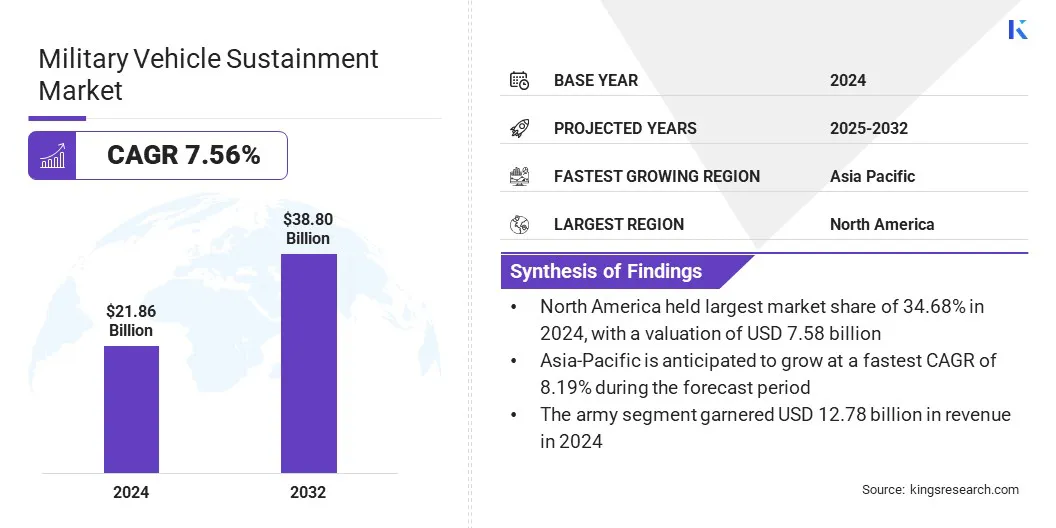

The global military vehicle sustainment market size was valued at USD 21.86 billion in 2024 and is projected to grow from USD 23.30 billion in 2025 to USD 38.80 billion by 2032, exhibiting a CAGR of 7.56% during the forecast period. This growth is attributed to increasing defense budgets and the need to modernize aging military vehicle fleets to ensure operational readiness.

The rising adoption of advanced maintenance, repair, and overhaul solutions, along with predictive maintenance technologies and digital fleet management systems, is further fueling market expansion across army, naval, and air force operations.

Key Highlights

- The military vehicle sustainment industry was valued at USD 21.86 billion in 2024.

- The market is projected to grow at a CAGR of 7.56% from 2025 to 2032.

- North America held a share of 34.68% in 2024, valued at USD 7.58 billion.

- The armored vehicles segment garnered USD 9.95 billion in revenue in 2024.

- The maintenance, repair, and overhaul (MRO) segment is expected to reach USD 14.52 billion by 2032.

- The air force segment is anticipated to witness the fastest CAGR of 7.92% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.19% through the projection period.

Major companies operating in the military vehicle sustainment market are BAE Systems, Rheinmetall AG, Oshkosh Defense, LLC, Lockheed Martin Corporation, Elbit Systems Ltd., General Dynamics Corporation, Northrop Grumman, Leonardo DRS, Honeywell International Inc., Thales, AM General, L3Harris Technologies, Inc., Babcock International Group, Indra Sistemas, S.A., and LARSEN & TOUBRO LIMITED.

Growing emphasis on enhancing vehicle availability, reducing downtime, and extending service life is accelerating the demand for sustainment services. Additionally, advancements in telematics, condition-based monitoring, and technical training, coupled with government initiatives supporting defense modernization programs, are contributing to market growth.

- In May 2025, L3Harris was selected by the Government of Canada, Lockheed Martin, and the F-35 Joint Program Office to establish a facility in Canada for maintenance, repair, overhaul, and upgrades of F-35 fighter aircraft. The facility will ensure long-term readiness of Canada’s F-35 fleet while leveraging L3Harris’s experience with the Royal Canadian Air Force.

Market Driver

Growing Adoption of Advanced Maintenance Technologies

The growth of the military vehicle sustainment market is propelled by aging defense fleets and the increasing need to maintain operational readiness. Expanding inventories of armored combat vehicles, tactical trucks, and combat support vehicles are increasing demand for maintenance, repair, and modernization.

Defense organizations are increasingly adopting advanced sustainment technologies, including predictive maintenance, telematics, and digital fleet management systems, to reduce vehicle downtime, extend service life, and improve mission effectiveness.

The shift toward technology-driven sustainment solutions is further supported by rising defense budgets and government initiatives focused on fleet modernization and readiness. The increasing implementation of integrated maintenance services and advanced monitoring technologies is further fueling this expansion.

- In June 2024, the U.S. State Department approved a USD 325 million Foreign Military Sale to Kuwait for he sustainment of its M1A2 and M1A2K Abrams tanks. The package includes repair parts, spare components, replacement materials, and logistics support, with General Dynamics Land Systems as the principal contractor. The sale is intended to support fleet readiness and strengthen Kuwait’s defense capabilities.

Market Challenge

Aging Vehicle Fleets & Obsolescence

The aging of military vehicle fleets & obsolescence of critical components pose a significant challenge to the growth of the military vehicle sustainment market, particularly for armed forces operating diverse platforms with long service lifespans. Wear and tear, outdated electronics, and diminishing sources for spare parts increase maintenance complexity and operational costs.

Obsolescence of vehicle systems, including communication modules, weapon integrations, and onboard electronics, reduces fleet availability and requires extensive overhaul and modernization programs.

To address these challenges, defense organizations are investing in recapitalization, component upgrades, and predictive maintenance technologies. These initiatives aim to extend vehicle service life, enhance operational readiness, and maintain mission effectiveness across land, naval, and air operations.

Market Trend

Expansion of Condition-Based & Predictive Maintenance Practices

The expansion of condition-based and predictive maintenance practices is influencing the military vehicle sustainment market by enabling proactive, data-driven, and efficient maintenance operations. Telematics, sensors, and real-time analytics allow armed forces to monitor vehicle health continuously, anticipate component failures, and schedule timely repairs, reducing unplanned downtime and optimizing fleet readiness.

Unlike conventional maintenance methods, predictive approaches offer significant advantages for large and diverse vehicle fleets, where reactive repairs can be costly and disruptive.

These practices improve operational availability across armored vehicles, military trucks, and combat support platforms, while enhancing lifecycle management and cost efficiency. Moreover, advancements in digital fleet management systems, predictive algorithms, and condition-monitoring technologies are increasing maintenance accuracy, reliability, and overall mission effectiveness.

Military Vehicle Sustainment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Armored Vehicles, Military Trucks, and Combat Support Vehicles

|

|

By Service

|

Maintenance, Repair, and Overhaul (MRO), Training and Support, Parts and Components Supply, and Upgrades and Modernization

|

|

By End User

|

Army, Navy, and Air Force

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Vehicle Type (Armored Vehicles, Military Trucks, and Combat Support Vehicles): The armored vehicles segment earned USD 9.95 billion in 2024, mainly due to high demand for fleet modernization and sustained operational readiness.

- By Service (Maintenance, Repair, and Overhaul (MRO), Training and Support, Parts and Components Supply, and Upgrades and Modernization): The maintenance, repair, and overhaul (MRO) segment held a share of 39.56% in 2024, fueled by the critical need to ensure vehicle reliability, minimize downtime, and extend fleet service life.

- By End User (Army, Navy, and Air Force): The army segment is projected to reach USD 22.38 billion by 2032, owing to extensive fleet modernization programs and high operational requirements for armored and tactical vehicles.

Military Vehicle Sustainment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America military vehicle sustainment market share stood at 34.68% in 2024, valued at USD 7.58 billion. This dominance is reinforced by the widespread adoption of advanced maintenance technologies, robust fleet management practices, and strong government initiatives supporting defense modernization programs.

The region’s early implementation of predictive maintenance, telematics, and digital fleet monitoring systems, along with investments in vehicle upgrades and overhauls, is enhancing operational readiness and fleet efficiency.

Additionally, increasing collaboration between defense contractors and armed forces is enabling substantial investments in upgrading armored vehicles, tactical trucks, and combat support platforms, reducing downtime and maintenance costs.

The growing emphasis on extending vehicle service life and optimizing lifecycle performance is further accelerating regional market growth. Moreover, advancements in condition-based monitoring, data analytics, and integrated sustainment solutions are fostering continuous innovation, improving maintenance accuracy, and supporting long-term market expansion.

- In July 2025, Oshkosh Defense secured a $167 million contract from the U.S. Army for 225 trucks and 54 trailers under the Family of Heavy Tactical Vehicles (FHTV) program. The order includes HEMTT A4 models and autonomous-ready Palletized Load System (PLS) A2 vehicles to support Army modernization efforts, homeland defense, and air defense initiatives, with deployment across the National Guard, Reserve, and PEO Missiles & Space units.

The Asia-Pacific military vehicle sustainment industry is set to grow at a CAGR of 8.19% over the forecast period. This growth is attributed to rising defense budgets, expanding military vehicle fleets, and increasing focus on operational readiness. The region’s modernization programs, growing procurement of armored vehicles and tactical trucks, and expanding defense infrastructure are creating a strong demand for sustainment services.

Government initiatives aimed at fleet upgrades, predictive maintenance adoption, and lifecycle extension are accelerating implementation. Additionally, collaborations between defense forces and global contractors, along with advancements in telematics, digital fleet management, and condition-based maintenance, are enhancing efficiency and supporting regional market expansion.

Regulatory Frameworks

- In the U.S., the Federal Acquisition Regulation (FAR) regulates the procurement, sustainment, and lifecycle management of defense vehicles. It ensures that maintenance, repair, and overhaul (MRO) contracts comply with standardized procedures, cost controls, and quality requirements relevant to military vehicle sustainment.

- In the European Union, NATO Standardization Agreements (STANAGs) establish technical and operational standards for military vehicle maintenance and logistics support, supporting interoperability, fleet readiness, and cross-member compatibility.

Competitive Landscape

Companies operating in the military vehicle sustainment industry are leveraging advanced maintenance technologies, diversifying service offerings, and forming strategic partnerships. Key players are heavily investing in predictive maintenance, digital fleet management, telematics, and condition-based monitoring solutions, with a focus on improving fleet readiness, operational efficiency, and lifecycle cost optimization.

They are also developing modernization programs, vehicle overhauls, and upgrade solutions to address the evolving requirements of armored vehicles, tactical trucks, and combat support platforms. Additionally, firms are forming collaborations with defense agencies, armed forces, and global contractors to secure long-term contracts, expand service capabilities, and strengthen their positions in both mature and emerging regional markets.

Key Companies in Military Vehicle Sustainment Market:

- BAE Systems

- Rheinmetall AG

- Oshkosh Defense, LLC

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- Northrop Grumman

- Leonardo DRS

- Honeywell International Inc.

- Thales

- AM General

- L3Harris Technologies, Inc.

- Babcock International Group

- Indra Sistemas, S.A.

- LARSEN & TOUBRO LIMITED

Recent Developments (Agreements)

- In September 2023, GM Defense and NP Aerospace signed a Memorandum of Understanding to enhance global defense capabilities through R&D, post-production support, and logistics. The partnership combines GM Defense’s commercial technologies with NP Aerospace’s vehicle armor expertise to deliver advanced mobility solutions, including the Infantry Squad Vehicle and heavy-duty armored SUVs.