Market Definition

The market encompasses advanced directed energy technologies designed for precision targeting, surveillance, communication, and threat neutralization across air, land, and naval defense platforms.

These systems utilize various laser formulations, including solid-state, fiber, and chemical lasers, through intricate optical amplification processes and beam control mechanisms.

They are also integrated into weapon systems for target designation, range finding, and countermeasure deployment against UAVs, missiles, and optical sensors. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Military Laser Systems Market Overview

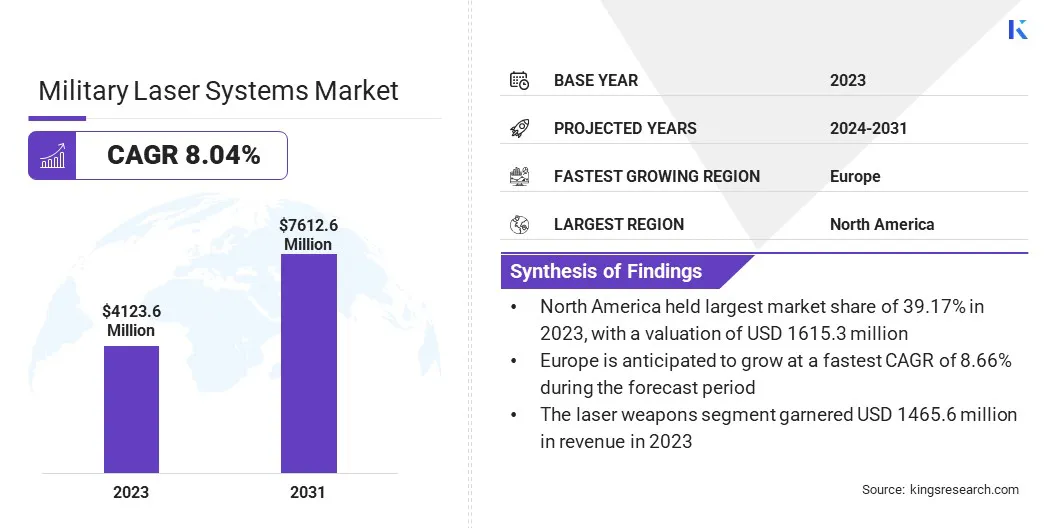

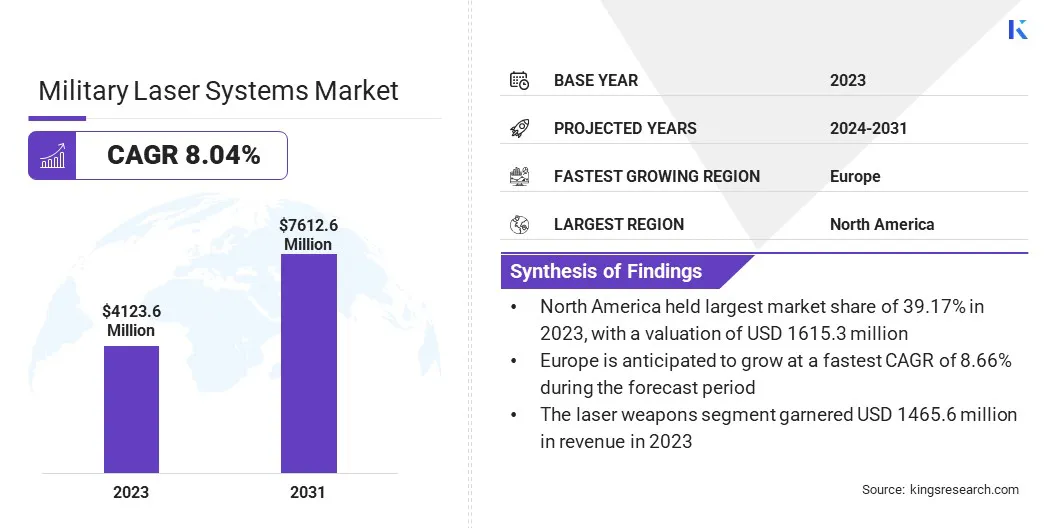

The global military laser systems market size was valued at USD 4,123.6 million in 2023 and is projected to grow from USD 4,430.7 million in 2024 to USD 7,612.6 million by 2031, exhibiting a CAGR of 8.04% during the forecast period.

The growth of the market is primarily driven by the increasing adoption of counter-unmanned aerial system solutions to enhance defense capabilities against evolving aerial threats.

Additionally, the integration of advanced laser systems into next-generation combat platforms to improve precision and efficiency in military operations is further boosting their adoption.

Major companies operating in the military laser systems industry are Lockheed Martin Corporation, Northrop Grumman Corporation, RTX, Boeing, Leonardo DRS, BAE Systems, Thales, L3Harris Technologies, Inc., Rheinmetall AG, Elbit Systems Ltd., Textron Systems, Bharat Dynamics Limited, American Laser Enterprises, Newport Corp., and BlueHalo.

The market is growing due to the rising emphasis on high-accuracy targeting in modern warfare environments. Laser-based directed energy weapons allow defense forces to neutralize threats such as drones, missiles, and small boats with minimal collateral damage.

The need for pinpoint accuracy in tactical operations is pushing armed forces to invest in scalable, mission-ready laser systems for real-time response and reduced reliance on conventional munitions.

- In August 2024, Northrop Grumman Corporation was selected by the U.S. Army to lead the initial phase of the Improved Threat Detection System program, incorporating its Advanced Tactical Hostile Engagement Awareness (ATHENA) sensor. Designed for seamless integration with aircraft using flare or laser-based countermeasure systems like the Common Infrared Countermeasure (CIRCM), ATHENA provides high-resolution threat detection and geolocation capabilities against a wide range of threats, including anti-tank guided missiles, small arms, medium- and large-caliber machine guns, rocket-propelled grenades.

Key Highlights

- The military laser systems industry size was recorded at USD 4,123.6 million in 2023.

- The market is projected to grow at a CAGR of 8.04%from 2024 to 2031.

- North America held a market share of 39.17% in 2023, with a valuation of USD 1,615.3 million.

- The laser weapons segment garnered USD 1,465.6 million in revenue in 2023.

- The solid-state lasers segment is expected to reach USD 2,994.8 million by 2031.

- The directed energy weapons (DEWs) segment secured the largest revenue share of 45.05% in 2023.

- Europe is anticipated to grow at a CAGR of 8.66% during the forecast period.

Market Driver

"Strategic Focus on Counter-Unmanned Aerial System (C-UAS) Solutions"

The military laser systems market is expanding rapidly due to the proliferation of unmanned aerial systems (UAS) in modern warfare. Defense agencies are prioritizing high-energy laser (HEL) systems to counter drone swarms as they are difficult to intercept using conventional methods.

Laser-based C-UAS solutions offer low operational cost, high efficiency, and scalable output, making them viable for mobile and stationary defense infrastructures across all environments.

- In October 2024, Leonardo DRS introduced a new counter-drone variant of the 8×8 Stryker light armored vehicle, equipped with a suite of advanced weaponry and sensors. This version features a 26-kilowatt laser directed energy weapon mounted on a retractable platform at the rear of the vehicle’s hull and it is adapted from BlueHalo’s LOCUST system.

Market Challenge

"High Development and Integration Costs"

A significant challenge hindering the growth of the military laser systems market is the high development and integration costs associated with advanced laser technologies. These systems require substantial investments in research, development, and testing to meet military-grade standards.

To address this challenge, companies are leveraging modular designs and scalable solutions to reduce production costs while enhancing system flexibility. By improving manufacturing efficiency and implementing cost-effective design strategies, market players are working to make military laser systems more affordable and accessible to defense organizations.

Market Trend

"Integration of Laser Systems into Next-Generation Combat Platforms"

Ongoing modernization programs by global defense organizations are contributing significantly to the growth of the military laser systems market. Militaries are integrating advanced laser systems into emerging platforms such as unmanned aerial vehicles (UAVs), rotary-wing aircraft, and naval vessels.

These integrations support multi-mission capabilities ranging from surveillance to threat deterrence. The compatibility of laser systems with modular architecture makes them an essential component of future-oriented combat strategies.

- In June 2024, Leonardo DRS secured a production contract from Northrop Grumman Corporation to deliver its advanced Quantum Cascade Laser (QCL) technology for integration into Common Infrared Countermeasure (CIRCM) systems. This QCL solution enhances the CIRCM’s ability to neutralize incoming missile threats with unlimited engagements. Designed with reduced weight and increased power output, the high-performance laser system is engineered to safeguard both current and next-generation U.S. Army rotary-wing aircraft, significantly boosting their defensive capabilities.

Military Laser Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

3D Scanning, Laser Weapons, Laser Range Finders, LiDAR, Laser Designators, Ring Laser Gyros, Laser Altimeters

|

|

By Technology

|

Solid-State Lasers, Fiber Lasers, Chemical Lasers, CO₂ Lasers, Semiconductor Lasers

|

|

By Application

|

Directed Energy Weapons (DEWs), Guidance Systems, Laser Countermeasures, Laser Communication Systems, Target Designation and Ranging, Defensive Countermeasures

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (3D Scanning, Laser Weapons, Laser Range Finders, LiDAR, Laser Designators, Ring Laser Gyros, Laser Altimeters): The laser weapons segment earned USD 1,465.6 million in 2023 due to its ability to provide precise, scalable, and cost-effective solutions for countering a wide range of aerial and ground-based threats.

- By Technology (Solid-State Lasers, Fiber Lasers, Chemical Lasers, CO₂ Lasers, Semiconductor Lasers): The solid-state lasers segment held 39.16% of the market in 2023, due to their superior efficiency, compact size, and scalability.

- By Application (Directed Energy Weapons (DEWs), Guidance Systems, Laser Countermeasures, Laser Communication Systems, Target Designation and Ranging, Defensive Countermeasures): The directed energy weapons (DEWs) segment is projected to reach USD 3,555.5 million by 2031, owing to its ability to deliver precise, rapid-response targeting with minimal collateral damage.

Military Laser Systems Market Regional Analysis

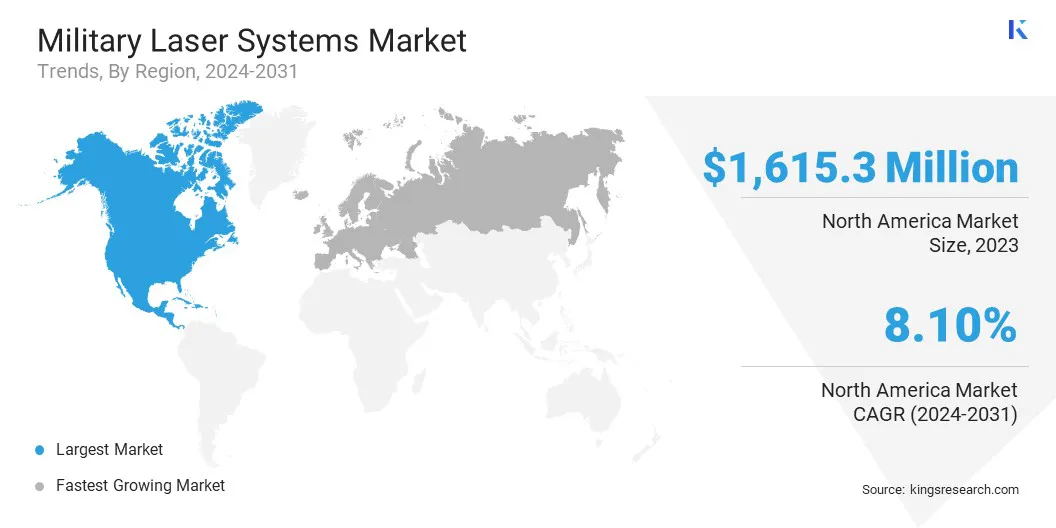

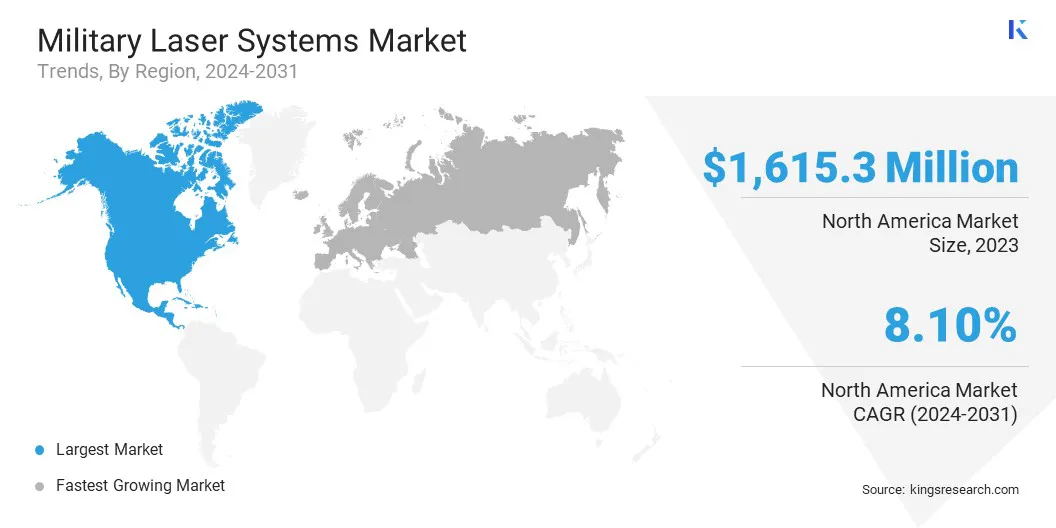

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America military laser systems market share stood around 39.17% in 2023 in the global market, with a valuation of USD 1,615.3 million. The growth of the market is supported by strategic collaborations between leading North American defense contractors, such as Raytheon, Lockheed Martin, Northrop Grumman, and the U.S. Department of Defense.

These partnerships are enabling rapid development and deployment of high-energy laser systems integrated into tactical vehicles, aircraft, and naval vessels.

- In July 2023, Lockheed Martin advanced its laser technology with the development of a 500 kW-class laser, the most powerful system the company has produced to date. This surpasses the earlier 300 kW-class laser, which was created under a contract from the Department of Defense’s Office of the Under Secretary of Defense for Research & Engineering (OUSD (R&E)). The new 500 kW-class laser marks the second phase of the High Energy Laser Scaling Initiative (HELSI), awarded under a fresh contract by OUSD (R&E) to support continued progress in high-power directed energy capabilities.

Additionally, North America benefits from a robust network of specialized testing facilities, such as the White Sands Missile Range and the High Energy Laser Systems Test Facility (HELSTF), which play a vital role in advancing the market in this region. These infrastructures support high-intensity trials, simulation-based validation, and performance optimization in realistic operational environments.

Europe military laser systems industry is poised for significant growth at a robust CAGR of 8.66% over the forecast period. European defense forces are integrating laser systems into mobile and fixed ground-based air defense solutions to counter high-volume aerial threats such as drones and loitering munitions.

Ongoing demonstrations and procurement efforts by key players for laser-equipped vehicle-mounted interceptors are contributing to the expansion of the market, with several prototypes undergoing operational testing under EU-backed defense innovation programs.

- In December 2024, Raytheon UK announced the successful live-fire trial of its High-Energy Laser Weapon System (HELWS) with the British Army, targeting moving aerial threats. This marked the British Army’s first test of a high-energy laser weapon integrated into an armored vehicle. The HELWS engages targets by emitting a concentrated energy beam, utilizing precision sensors and real-time tracking capabilities to ensure continuous lock-on and accurate engagement throughout the operation.

Regulatory Frameworks

- The U.S. regulates military laser systems under the International Traffic in Arms Regulations (ITAR), administered by the Directorate of Defense Trade Controls (DDTC). Laser systems are classified under Category XVIII of the U.S. Munitions List, encompassing directed energy weapons. Exporting such systems requires prior authorization from the Department of State. Additionally, the Arms Export Control Act (AECA) mandates that foreign recipients use U.S.-origin defense articles solely for legitimate self-defense purposes, with strict documentation and end-use monitoring.

- The UK's export of military laser systems is governed by the Export Control Order 2008, aligning with the Wassenaar Arrangement. The UK Strategic Export Control Lists specify controlled items, including directed energy weapons. Export licenses are issued by the Export Control Joint Unit (ECJU), which assesses applications based on criteria such as national security and international obligations.

- China has implemented stringent export controls on technologies with potential military applications, including laser radars and drones. The Ministry of Commerce and the Ministry of Science and Technology jointly issued an updated catalogue of technologies subject to export bans or restrictions, aiming to safeguard national security.

Competitive Landscape

Market players are increasingly adopting strategies focused on technological advancements to drive growth in the market. By enhancing the performance and efficiency of key components like inertial measurement units (IMUs) and laser systems, companies are positioning themselves to meet the growing demand for more compact, lightweight, and high-performance solutions.

These innovations enable the development of advanced, scalable laser systems that are more adaptable for various defense applications, such as aerial defense and armored vehicle systems.

As companies continue to integrate cutting-edge technologies, they are able to offer superior products that meet the evolving requirements of modern defense operations, thus contributing significantly to the expansion of the market.

- In April 2025, Thales unveiled a next-generation inertial measurement unit (IMU) that matches the high performance of its leading TopAxyz IMU, while significantly minimizing size, weight, and power (SWaP) requirements. The advanced system integrates a three-axis ring laser gyroscope (RLG) with three digital MEMS accelerometers into a streamlined, compact configuration.

List of Key Companies in Military Laser Systems Market:

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX

- Boeing

- Leonardo DRS

- BAE Systems

- Thales

- L3Harris Technologies, Inc.

- Rheinmetall AG

- Elbit Systems Ltd.

- Textron Systems

- Bharat Dynamics Limited

- American Laser Enterprises

- Newport Corp.

- BlueHalo

Recent Developments (Agreements)

- In February 2025, Thales and Bharat Dynamics (BDL) signed an agreement for the initial delivery of Laser Beam Riding Man Portable Air Defence Systems (LBRM), following a directive from the Indian Government aimed at strengthening the nation’s air defense framework. This first batch, which includes STARStreak high-velocity missiles and their corresponding launchers, is set for delivery within the year and represents India’s debut procurement of this cutting-edge Very Short Range Air Defence (VSHORAD) technology.

- In October 2024, Elbit Systems Ltd. secured a contract worth approximately USD 200 million from the Israeli Ministry of Defense (IMOD) to provide high-power laser systems for the "Iron Beam" air defense system. Under the "Iron Beam" project, Elbit Systems will deliver its advanced high-power laser solution, designed to offer a strong defense against a wide range of threats.

- In May 2024, BlueHalo was awarded a USD 95.4 million contract by the United States Army Space and Missile Defense Command (SMDC) as part of the Laser Technology Research and Advancement Program (LARDO) through the Aviation & Missile Technology Consortium. This contract enables BlueHalo to advance its development of next-generation directed energy prototypes, enhancing its capabilities in designing and building advanced laser weapon systems.