Market Definition

A market refers to the segment of the automotive industry focused on vehicles equipped with mild hybrid electric systems. These systems typically include a small electric motor that assist the internal combustion engine (ICE) during acceleration, enable regenerative braking, and improve fuel efficiency.

This market encompasses passenger cars, light commercial vehicles, and heavy-duty vehicles utilizing mild hybrid technology. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Mild Hybrid Vehicles Market Overview

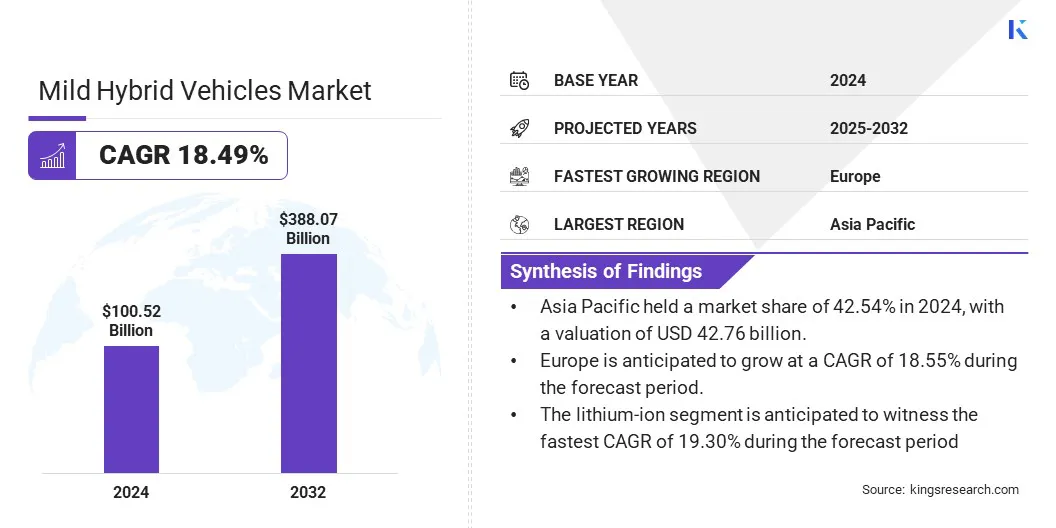

The global mild hybrid vehicles market size was valued at USD 100.52 billion in 2024 and is projected to grow from USD 118.35 billion in 2025 to USD 388.07 billion by 2032, exhibiting a CAGR of 18.49% during the forecast period. Rising consumer demand for fuel efficiency and lower emissions is driving the adoption of mild hybrid vehicles.

Additionally, The growing integration of 48V systems across various vehicle segments including passenger cars, commercial vehicles, and SUVs is enhancing engine performance, fuel efficiency, and emissions reduction. This improves driving experience and meets stricter environmental regulations, increasing consumer appeal.

Major companies operating in the mild hybrid vehicles industry are MARUTI SUZUKI INDIA LIMITED, AUDI AG, BMW, Hyundai Motor Company, KIA, Mercedes-Benz of Easton, Volvo Car Corporation, Ford Motor Company, Nissan Motor Co., Ltd., JAGUAR LAND ROVER LIMITED, Volkswagen, Groupe PSA, Volkswagen, Škoda Auto a.s., and Mazda Motor Corporation.

Advancements in powertrain integration have improved mild hybrid vehicle performance and efficiency. The use of efficient electric motors and advanced battery management, combined with 48V architecture, enables smoother energy transfer between the engine and motor. These improvements boost fuel economy, reduce emissions, and support power assist during acceleration and energy recovery during braking.

- In March 2025, researchers from the Technical University of Darmstadt, Germany highlighted that electric motor support during drive-off procedures in 48V mild hybrid powertrains effectively reduces clutch thermal load and fuel consumption.

Key Highlights:

- The mild hybrid vehicles market size was recorded at USD 100.52 billion in 2024.

- The market is projected to grow at a CAGR of 18.49% from 2025 to 2032.

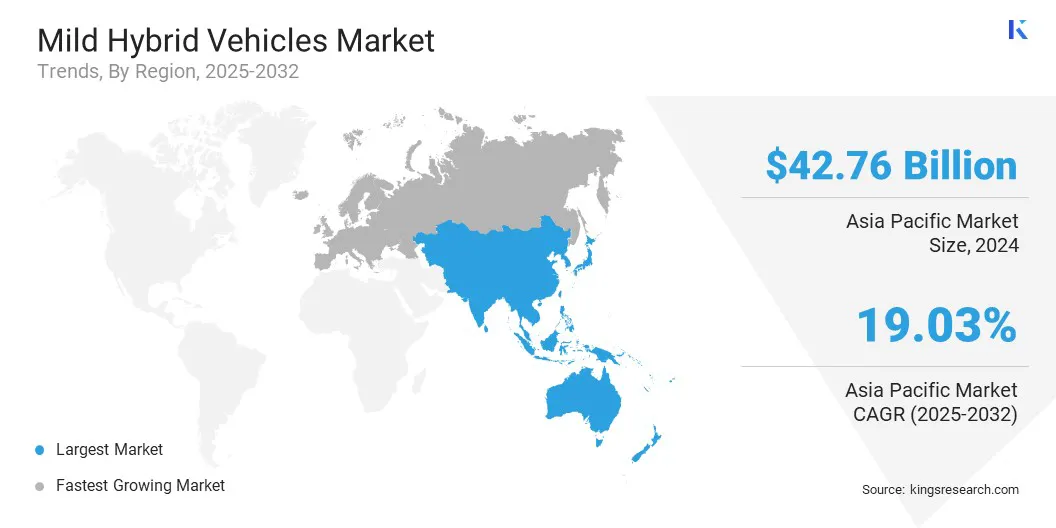

- Asia Pacific held a market share of 42.54% in 2024, with a valuation of USD 42.76 billion.

- The 48 V and above segment garnered USD 94.46 billion in revenue in 2024.

- The passenger cars segment is expected to reach USD 322.18 billion by 2032.

- The lithium-ion segment is anticipated to witness the fastest CAGR of 19.30% during the forecast period

- Europe is anticipated to grow at a CAGR of 18.55% during the forecast period.

Market Driver

Rising Consumer Demand for Fuel Efficiency and Lower Emissions

In the market, growing consumer demand for lower emissions and improved fuel efficiency is driving adoption. Mild hybrid vehicles reduce fuel consumption and CO₂ output without requiring major changes in driving habits or performance.

This aligns with consumer preferences for cost-effective and environmentally responsible transportation. As awareness of climate change and fuel costs increases, adoption is expanding across multiple vehicle segments.

- In January 2025, Audi launched the MHEV plus technology, featuring a powertrain generator, belt alternator starter, and lithium iron phosphate battery. This system aims to enhance efficiency, reduce CO₂ emissions, and improve driving comfort in mild hybrid vehicles.

Market Challenge

High Initial Cost and Consumer Perception

A key challenge facing the mild hybrid vehicles market is the higher initial investment compared to traditional vehicles. The relatively high initial expense acts as a deterrent for cost-sensitive buyers, especially in price-competitive markets where affordability heavily influences purchasing decisions.

Additionally, limited consumer awareness about the benefits and functionality of mild hybrid systems affects overall adoption. To address this, automakers are investing in consumer education, introducing flexible financing schemes, and optimizing production processes to reduce costs and make mild hybrids more accessible.

Market Trend

Growing Integration of 48V Systems Across Vehicle Segments

The market is shifting with the increasing integration of 48V systems across passenger vehicle categories. These systems allow manufacturers to improve fuel efficiency and reduce CO₂ emissions by adding components without extensive redesign of existing vehicle architecture.

This lowers development costs and speeds market adoption. The technology supports smoother start-stop, regenerative braking, and enhanced driving comfort.

- In July 2023, BMW launched the new X5 in India featuring 48V mild hybrid technology for both petrol and diesel variants. Through this launch, BMW aims address the rising demand for performance-driven yet fuel-efficient vehicles in the luxury SUV segment.

Mild Hybrid Vehicles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Capacity

|

Less than 48V, 48V and above

|

|

By Vehicle

|

Passenger cars, Commercial vehicles

|

|

By Battery

|

Lithium-ion, Lead Acid, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Capacity (Less than 48V, and 48V and above): The 48V and above segment earned USD 94.46billion in 2024 due to its increased adoption in response to rising fuel efficiency demands and stricter emission regulations.

- By Vehicle (Passenger cars, and Commercial vehicles): The passenger cars segment held 81.85% of the market in 2024, due to their higher adoption rate of mild hybrid systems driven by consumer demand for fuel efficiency and reduced emissions in personal vehicles.

- By Battery (Lithium-ion, Lead Acid, Others): The lithium-ion is projected to reach USD 353.69 billion by 2032, due to its widespread use in mild hybrid vehicles

Mild Hybrid Vehicles Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific mild hybrid vehicles market share stood around 42.54% in 2024 in the global market, with a valuation of USD 42.76 billion. Growth in the region is supported by a strong manufacturing base, with local production and technological capabilities enabling broader adoption of mild hybrid systems.

Rising consumer preference for fuel-efficient, low-emission vehicles is further driving demand, positioning mild hybrids as a cost-effective and sustainable mobility option across key markets like China, Japan, and India.

- In October 2024, Suzuki launched its Fronx compact SUV in Japan, featuring a 1.5L K15C engine with mild hybrid technology. This model caters to the growing demand for fuel-efficient, eco-friendly vehicles in Japan.

Europe mild hybrid vehicles industry is poised for significant growth at a robust CAGR of 3.84% over the forecast period. Mild hybrid vehicles offer a significant cost advantage over full hybrids and electric vehicles, making them an attractive option for cost-conscious consumers. Their simpler design and smaller battery systems reduce manufacturing and maintenance expenses.

As a transitional technology, mild hybrids bridge the gap between traditional internal combustion engines and fully electrified vehicles. This makes them a practical choice for consumers hesitant to switch directly to EVs, while supporting automakers in gradually electrifying their fleets.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) enforces vehicle safety and fuel efficiency standards, including CAFE regulations, to reduce emissions and promote cleaner transportation.

- In the europe, the european Commission’s Directorate-General for Climate Action (DG CLIMA) sets and enforces vehicle CO₂ emission standards, supported by the European Environment Agency (EEA) for monitoring and reporting.

Competitive Landscape

The mild hybrid vehicles market is witnessing significant growth through strategic mergers, acquisitions, collaborations, and investments. Key players are expanding their product offerings by partnering with technology firms to develop advanced hybrid systems.

They are also investing in sustainable manufacturing and acquiring EV companies to strengthen their position and comply with evolving emissions regulations.

- In February 2025, Eberspaecher and Farasis Energy Europe formed a strategic partnership to develop 12V and 48V lithium-ion battery systems for mild hybrid vehicles. The collaboration combines battery management and cell technology of both the companies to support high-performance low-voltage solutions for automotive applications.

List of Key Companies in Mild Hybrid Vehicles Market:

- MARUTI SUZUKI INDIA LIMITED

- AUDI AG.

- BMW

- Hyundai Motor Company

- KIA

- Mercedes-Benz of Easton

- Volvo Car Corporation

- Ford Motor Company

- Nissan Motor Co., Ltd.

- JAGUAR LAND ROVER LIMITED

- Volkswagen

- Groupe PSA

- Volkswagen

- Škoda Auto a.s.

- Mazda Motor Corporation

Recent Developments (Product Launches)

- In May 2024, Volkswagen introduced a 48V mild hybrid system in its Passat eTSI, featuring a belt starter generator and lithium-ion battery. This targets the growing demand for fuel-efficient vehicles that do not rely on external charging.

- In March 2024, Suzuki launched the mid-sized SUV NEW SUZUKIXL7 HYBRID in Thailand with an Integrated Starter Generator (ISG) and lithium-ion battery to meet demand for affordable, fuel-efficient mild hybrid vehicles.

requirements