Microcars Market Size

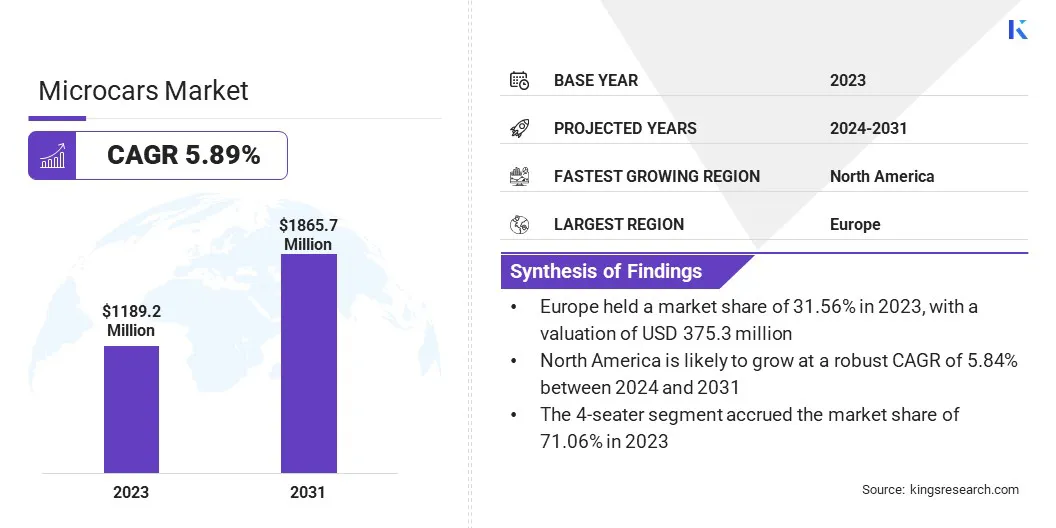

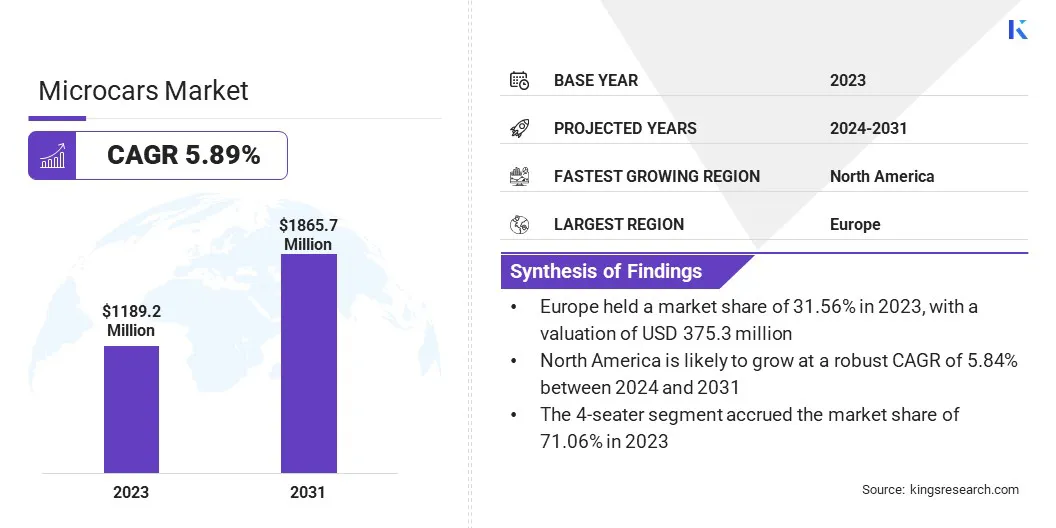

The global Microcars Market size was valued at USD 1,189.2 million in 2023 and is expected to attain USD 1,865.7 million by 2031, exhibiting a staggering CAGR of 5.89% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Toyota Motor Corporation, Renault Group, STELLANTIS NV, PMV Electric Pvt. Ltd., General Motors, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Strom Motors, Chery, Squad Mobility BV, Microlino AG and Others.

The microcars market is experiencing a surge in demand, primarily driven by growing urbanization and increasing traffic congestion in cities worldwide. Microcars, also known as city cars or bubble cars, are gaining immense popularity as a practical solution for navigating congested urban streets. These small and lightweight vehicles offer fuel efficiency and maneuverability, making them ideal for city driving.

Additionally, the market outlook for microcars remains positive, with continued urbanization projected to fuel market growth. As an increasing number of people migrate to urban areas, the need for compact and efficient transportation options is likely to continue to drive demand for microcars. With advancements in technology and shifting consumer preferences towards eco-friendly and compact vehicles, the microcars market is poised to experience steady growth in the coming years.

Analyst’s Review

The greener future of urban driving is closely linked to the increasing adoption of microcars in densely populated cities. As concerns over environmental sustainability continue to rise, there is a growing emphasis on reducing emissions and promoting eco-friendly modes of transportation. Microcars, with their compact size and fuel-efficient engines, are well-positioned to meet this demand for greener urban mobility solutions.

Moreover, the microcars market outlook for microcars in the forecast years remains optimistic, driven by ongoing efforts to promote sustainable urban transportation initiatives. With advancements in electric and hybrid microcar technology, coupled with supportive government policies aimed at reducing carbon emissions, urban driving is anticipated to transition toward increased eco-friendliness.

Market Definition

Microcars, also known as city cars or bubble cars, are compact vehicles designed primarily for urban transportation. These vehicles typically feature a compact size, with a limited seating capacity (usually for two to four passengers), and are characterized by their lightweight construction.

Microcars can be powered by various propulsion systems, including traditional gasoline engines, electric motors, or hybrid powertrains. Their applications range from personal commuting vehicles to fleet operations for car-sharing services or urban delivery services. Microcars are designed to navigate narrow city streets, making them ideal for urban dwellers looking for practical and efficient transportation solutions.

Microcars Market Dynamics

Growing urbanization and traffic congestion are significant factors fueling the demand for microcars. As a growing number of people migrate to urban areas, cities are experiencing increasing levels of traffic congestion, making it challenging for traditional vehicles to navigate through crowded streets.

Microcars, with their compact size and maneuverability, offer a practical solution for urban commuting in densely populated areas. These vehicles are well-suited to navigate narrow city streets and congested traffic conditions, providing a convenient transportation option for city dwellers.

- Additionally, the growing emphasis on reducing emissions and promoting sustainable transportation solutions drives the demand for fuel-efficient microcars in urban environments.

Limited charging infrastructure poses a significant restraint to the widespread adoption of electric microcars in the global market. While electric microcars offer numerous benefits, including zero emissions and lower operating costs, the lack of sufficient charging infrastructure presents a major barrier to their widespread adoption.

Without access to convenient charging stations, consumers may be hesitant to switch to electric microcars due to concerns over range anxiety and the inconvenience of recharging. Moreover, the upfront cost of installing charging infrastructure can be prohibitively expensive for both consumers and businesses, thereby hindering the adoption of electric microcars in the market.

Segmentation Analysis

The global market is segmented based on seating capacity, drive type, application, and geography.

By Seating Capacity

Based on seating capacity, the market is bifurcated into 2-seater and 4-seater. The 4-seater segment accrued the microcars market share of 71.06% in 2023 on account of several factors, including the increasing demand for microcars as practical family vehicles and the availability of a wider range of options available in the four-seater segment.

Additionally, four-seater microcars offer greater versatility and passenger capacity compared to smaller two-seater models, making them more appealing to a broader range of consumers.

By Drive Type

Based on drive type, the microcars market is divided into AWD, 2WD, and FWD. The AWD segment is set to grow at a robust CAGR of 6.55% over the forecast period.

This growth is mainly driven by several factors, including the increasing consumer preference for AWD vehicles due to their enhanced traction and stability, especially in adverse weather conditions. Additionally, advancements in AWD technology, such as improved fuel efficiency and performance, are driving the adoption of AWD microcars in the market.

By Propulsion

By propulsion, the microcars market is divided into ICE, electric, solar, and hybrid. The electric segment is poised to grow at a substantial CAGR of 6.65% between 2024 and 2031, spurred by the strong performance of electric microcars in the market.

Furthermore, the growth of the segment is fueled by increasing consumer demand for eco-friendly transportation solutions, supportive government incentives and subsidies for electric vehicles, and advancements in electric vehicle technology, such as improved battery range and charging infrastructure.

Microcars Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

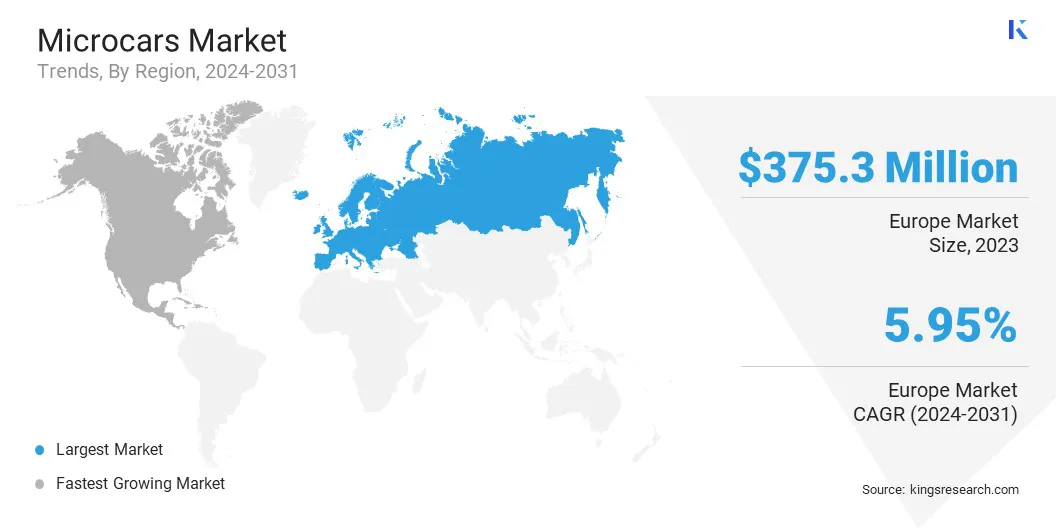

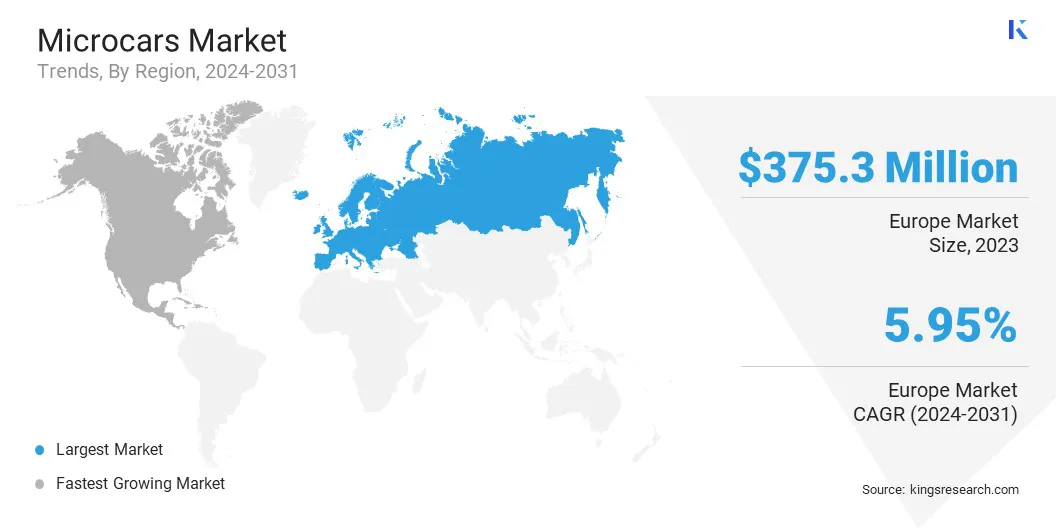

The Europe Microcars Market share stood around 31.56% in 2023 in the global market, with a valuation of USD 375.3 million, driven by several factors such as increasing urbanization, stringent emission regulations, and growing consumer awareness regarding environmental sustainability.

The region's mature automotive industry, coupled with supportive government policies promoting electric and hybrid vehicles, further contributed to Europe's dominance in the microcars market. Additionally, the presence of key market players and robust infrastructure for electric vehicle charging stations positioned Europe as a leading market for microcars.

North America is likely to experience significant growth at a 5.84% CAGR between 2024 and 2031, prompted by several factors such as increasing urbanization, rising concerns over traffic congestion and emissions, and government initiatives promoting sustainable transportation solutions.

Moreover, the growing consumer preference for compact and fuel-efficient vehicles, coupled with advancements in electric vehicle technology, is expected to drive the demand for microcars in the North American market. Additionally, the availability of supportive government incentives and investments in charging infrastructure is likely to accelerate the adoption of microcars in the region.

Competitive Landscape

The microcars market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Microcars Market

- Toyota Motor Corporation

- Renault Group

- STELLANTIS NV

- PMV Electric Pvt. Ltd.

- General Motors

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- Strom Motors

- Chery

- Squad Mobility BV

- Microlino AG

Key Industry Developments

- November 2023 (Joint Venture): SAIC Motor partnered with the JSW Group to provide advanced technology and products to deliver exceptional mobility solutions tailored to the Indian market.

- September 2023 (Launch): Honda Motor Co., Ltd unveiled an extensive range of motorcycles, automobiles, power products, aircraft, and other offerings, including demonstrations of CI-MEV and concept models, at the JAPAN MOBILITY SHOW 2023.

The global Microcars Market is segmented as:

By Seating Capacity

By Drive Type

By Propulsion

- ICE

- Electric

- Solar

- Hybrid

By Application

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America