Market Definition

The market encompasses the range of products, applications, and end users involved in detecting and monitoring microorganisms for disease diagnosis. It includes reagents, instruments, and consumables used in diagnostic procedures.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Microbiology Testing Market Overview

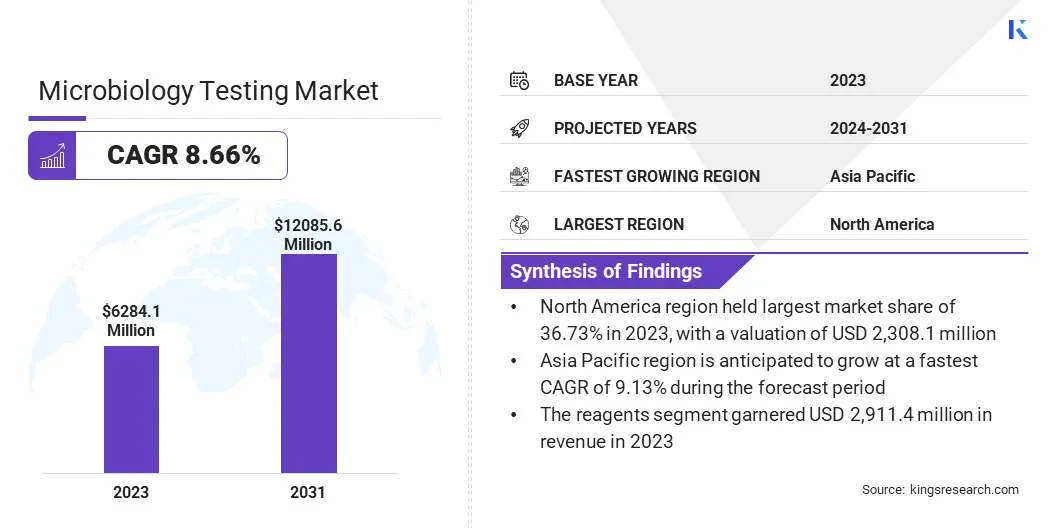

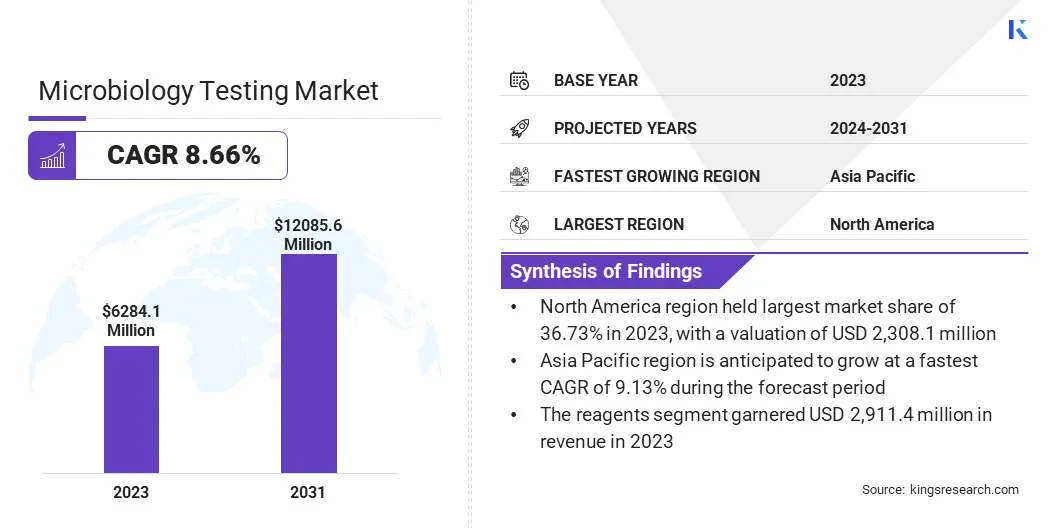

The global microbiology testing market size was valued at USD 6,284.1 million in 2023 and is projected to grow from USD 6,757.9 million in 2024 to USD 12,085.6 million by 2031, exhibiting a CAGR of 8.66% during the forecast period.

Market growth is driven by the increasing prevalence of infectious diseases, technological advancements in diagnostic methods, and growing investments in healthcare infrastructure. Additionally, the demand for rapid and accurate diagnostic solutions, coupled with the rise of personalized medicine and infection control initiatives, is propelling market expansion.

Major companies operating in the microbiology testing industry are Hologic, Inc., Sartorius AG, Abbott, Bio-Rad Laboratories, Inc., Siemens AG, Eppendorf SE, Thermo Fisher Scientific Inc., Merck KGaA, Becton, Dickinson and Company, FUJIFILM, DH Life Sciences, LLC., BIOMÉRIEUX, F. Hoffmann-La Roche Ltd, Roche Diagnostics, and QIAGEN.

Additionally, point-of-care testing is contributing significantly to market expansion. The increasing demand for rapid, on-site diagnostic solutions is promoting the adoption of portable and user-friendly testing devices.

These devices enable healthcare providers to deliver faster results, improving patient management and treatment outcomes, particularly in remote or emergency settings.

- In January 2024, Rapid Micro Biosystems commercially launched the Growth Direct Rapid Sterility application. The application includes a proprietary test kit for the Growth Direct system, enabling organism detection in under 12 hours and delivering final results within 1 to 3 days, significantly faster than traditional methods.

Key Highlights:

Key Highlights:

- The microbiology testing industry size was recorded at USD 6,284.1 million in 2023.

- The market is projected to grow at a CAGR of 8.66% from 2024 to 2031.

- North America held a market share of 36.73% in 2023, with a valuation of USD 2,308.1 million.

- The reagents segment garnered USD 2,911.4 million in revenue in 2023.

- The bloodstream infection segment is expected to reach USD 3,992.5 million by 2031.

- The hospitals and diagnostic laboratories segment is estimated to generate USD 4,763.6 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 9.13% over the forecast period.

Market Driver

"Technological Advancements in Diagnostic Techniques"

The growth of the microbiology testing market is fueled by technological advancements in diagnostic techniques. Automation in microbiology testing has improved speed, accuracy, and consistency in detecting a wide range of pathogens.

Laboratories are increasingly adopting automated analyzers and rapid diagnostic systems to reduce manual errors and improve operational efficiency. The shift toward molecular diagnostic methods, such as PCR and nucleic acid amplification tests, is helping healthcare providers achieve faster turnaround times.

The demand for scalable, high-throughput solutions is rising as healthcare facilities focus on early detection, better patient outcomes, and cost-effective testing.

- In January 2025, Rapid Infection Diagnostics Inc. (RID), in collaboration with Alberta Precision Laboratories (APL), launched the BSIDx, an advanced microbiology testing system for bloodstream infections. The system provides pathogen identification and antibiotic susceptibility testing from positive blood cultures in under 5 hours, over 30 hours faster than conventional methods.

Market Challenge

"High Cost of Advanced Diagnostic Technologies"

A major challenge hindering the progress of the microbiology testing market is the high cost of advanced diagnostic technologies. Many cutting-edge microbiology testing systems, such as molecular diagnostics and automated platforms, require significant investment in both equipment and skilled personnel.

This can be a barrier for healthcare facilities, particularly in emerging markets or smaller institutions with limited budgets. To address this challenge, companies are increasingly focusing on developing cost-effective solutions, such as portable and user-friendly devices that require less infrastructure and training.

Market Trend

"Notable Shift Point-of-Care Microbiology Testing"

The microbiology testing market is experiencing strong growth, mainly due to the rising shift toward point-of-care microbiology testing. This trend is supported by the rising demand for on-site diagnostic solutions that support immediate clinical decisions.

Point-of-care testing reduces dependence on central laboratories, shortens turnaround times, and improves patient management. Healthcare providers are increasingly investing in portable and easy-to-use microbiology testing devices to enhance operational efficiency and deliver faster treatment.

Advancements in miniaturized technology and diagnostic platforms are further accelerating adoption across hospitals, clinics, and remote care settings.

- In June 2023, Sysmex Corporation launched the world’s first point-of-care testing system for antimicrobial susceptibility. Designed for primary care settings, the system enables rapid detection of bacteria and assessment of antimicrobial effectiveness using urine samples from patients with suspected urinary tract infections.

Microbiology Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Reagents (Antibiotic susceptibility testing reagents, PCR reagents, Immunodiagnostic reagents, Others), Instruments (Automated analyzers, PCR systems, MALDI-TOF mass spectrometers, Others), Consumables (Petri dishes, Swabs, Others)

|

|

By Application

|

Bloodstream Infection, Respiratory Diseases, Gastrointestinal Diseases, Urinary Tract Infections, Others

|

|

By End User

|

Hospitals and Diagnostic Laboratories, Academic and Research Institutes, Contract Research Organizations (CROs), Environmental Testing Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Reagents, Instruments, and Consumables): The reagents segment earned USD 2,911.4 million in 2023 due to their critical role in facilitating accurate and rapid microbiological testing across various medical conditions.

- By Application (Bloodstream Infection, Respiratory Diseases, Gastrointestinal Diseases, and Urinary Tract Infections): The bloodstream Infection segment held a share of 32.47% in 2023, fueled by the increasing prevalence of bloodstream infections and the demand for timely diagnostic solutions.

- By End User (Hospitals and Diagnostic Laboratories, Academic and Research Institutes, Contract Research Organizations (CROs), and Environmental Testing Laboratories): The hospitals and diagnostic laboratories segment is projected to reach USD 4,763.6 million by 2031, propelled by the rising number of infections and expanding healthcare infrastructure.

Microbiology Testing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America microbiology testing market share stood at around 36.73% in 2023, valued at USD 2,308.1 million. This dominance is reinforced by the advanced healthcare infrastructure, high healthcare expenditure, and strong support for R&D in microbiology.

North America microbiology testing market share stood at around 36.73% in 2023, valued at USD 2,308.1 million. This dominance is reinforced by the advanced healthcare infrastructure, high healthcare expenditure, and strong support for R&D in microbiology.

The presence of leading diagnostic companies and increasing investments in healthcare technologies have further boosted the demand for microbiological testing. Additionally, the high prevalence of infectious diseases, along with the growing need for rapid and accurate diagnostic tools, has contributed significantly to regional market expansion.

- In December 2024, the U.S. Department of Agriculture’s (USDA) Food Safety and Inspection Service (FSIS) implemented stronger measures to protect the public from Listeria monocytogenes. The agency outlined enhnaced strategies for mitigating foodborne pathogens, including improvements to its science-based approach, inspection workforce training, and oversight of regulated facilities, with a focus on data review and state inspection agreements.

The Asia Pacific microbiology testing industry is poised to grow at a CAGR of 9.13% over the forecast period. This growth is attributed to increasing healthcare investments, expanding healthcare infrastructure, and rising awareness of infectious diseases.

The growing population, coupled with an increasing incidence of both emerging and re-emerging infections, is generating a strong demand for microbiology testing. Additionally, government initiatives aimed at improving healthcare systems and funding for research in microbiology are contributing to regional market expansion.

Regulatory Frameworks

- In the U.S, the regulatory framework for microbiology testing is primarily governed by the Food and Drug Administration (FDA). The FDA ensures that microbiology testing products, including reagents, instruments, and diagnostic kits, meet safety and effectiveness standards through pre-market approval, clinical trials, and post-market surveillance.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates microbiology testing products. Under the Drugs and Cosmetics Act and Rules, microbiology testing devices and reagents must be approved for sale and use in the country after undergoing registration, quality control testing, and compliance with the required safety standards.

Competitive Landscape

Key players in the microbiology testing industry are prioritizing significant investments in product innovation, particulalry in rapid testing kits, molecular diagnostic tools, and automated platforms.

Strategic partnerships and collaborations with research institutions, hospitals, and other healthcare providers are also prevalent, facilitating broader market reach and enhanced offerings.

Additionally, companies are expanding into emerging markets driven by improving healthcare infrastructure. There is also a growing focus on integrated solutions that combine diagnostics with data analysis and management tools, offering a comprehensive approach to microbiology testing.

These strategies enable companies maintain competitiveness while meeting the evolving needs of the healthcare sector.

- In January 2024, QIAGEN launched the QIAstat-Dx Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel in India, following regulatory approval from the Central Drugs Standard Control Organization (CDSCO). These panels, along with the existing the Respiratory SARS-CoV-2 Panel, provide rapid, accurate diagnosis of infectious diseases using multiplex real-time PCR technology.

List of Key Companies in Microbiology Testing Market:

- Hologic, Inc.

- Sartorius AG

- Abbott

- Bio-Rad Laboratories, Inc.

- Siemens AG

- Eppendorf SE

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Becton, Dickinson and Company

- FUJIFILM

- DH Life Sciences, LLC.

- BIOMÉRIEUX

- F. Hoffmann-La Roche Ltd

- Roche Diagnostics

- QIAGEN

Recent Developments (Product Launch)

- In June 2024, QIAGEN launched 35 new digital PCR Microbial DNA Detection Assays for its QIAcuity platform. The assays target a wide range of pathogens linked to tropical diseases, urinary tract infections, and sexually transmitted infections, enhancing research and public health efforts in infectious disease detection.

Key Highlights:

Key Highlights: North America microbiology testing market share stood at around 36.73% in 2023, valued at USD 2,308.1 million. This dominance is reinforced by the advanced healthcare infrastructure, high healthcare expenditure, and strong support for R&D in microbiology.

North America microbiology testing market share stood at around 36.73% in 2023, valued at USD 2,308.1 million. This dominance is reinforced by the advanced healthcare infrastructure, high healthcare expenditure, and strong support for R&D in microbiology.