Market Definition

The market focuses on materials engineered with properties that not found in naturally occurring substances. These materials are designed using unique structures that can manipulate electromagnetic waves, sound, or heat.

The market spans across various sectors, including telecommunications, defense, healthcare, and energy. Metamaterials are used in applications such as advanced antennas, sensors, and lenses with superior optical properties.

Their formulation involves precise design and fabrication at microscopic scales to achieve specific performance characteristics, making them essential for innovation in multiple industries. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

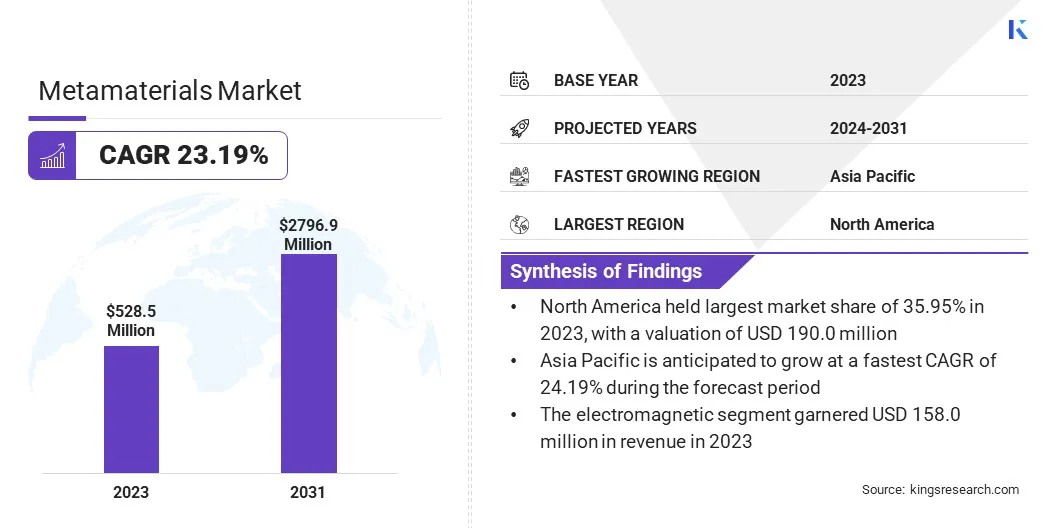

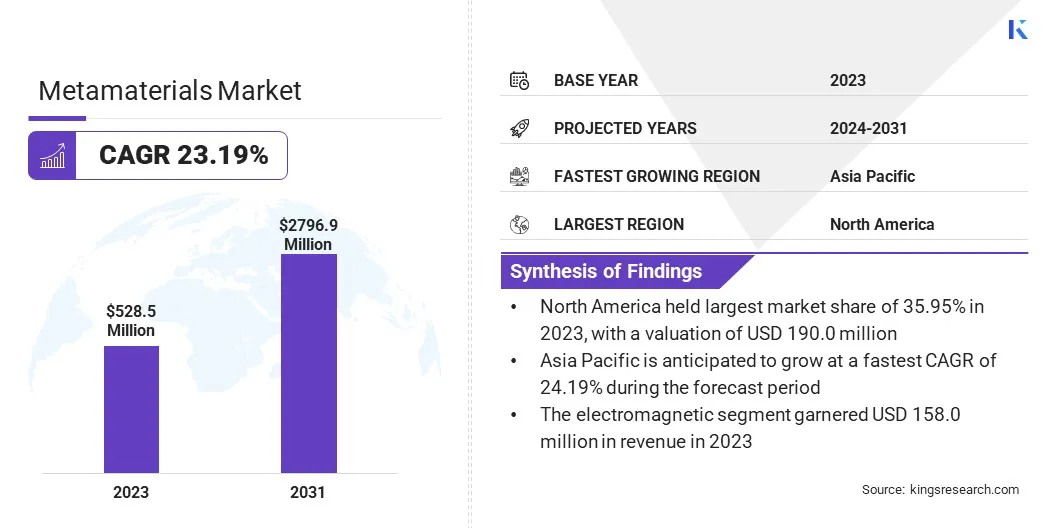

The global metamaterials market size was valued at USD 528.5 million in 2023 and is projected to grow from USD 649.4 million in 2024 to USD 2796.9 million by 2031, exhibiting a CAGR of 23.19% during the forecast period.

Market growth is fueled by increasing demand for advanced sensing technologies and compact optical components in defense and aerospace sectors. Additionally, the integration of metamaterials in next-generation communication systems is expanding due to their ability to enhance signal control and performance, supporting sustained market expansion.

Key Market Highlights

- The metamaterials industry size was valued at USD 528.5 million in 2023.

- The market is projected to grow at a CAGR of 23.19% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 190.0 million.

- The electromagnetic segment garnered USD 158.0 million in revenue in 2023.

- The antenna & radar segment is expected to reach USD 697.6 million by 2031.

- The healthcare segment secured the largest revenue share of 24.12% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 24.19% over the forecast period.

Major companies operating in the metamaterials industry are Meta Materials Inc., Phoebus Optoelectronics Ltd., Nanohmics, Inc., Kymeta Corporation, Applied Metamaterials Ltd., Radiall, Elbit Systems Ltd., Infinera Corporation, HoloMetrix, MetaWaves Group, Multiwave Technologies AG, Echodyne Corp., NKT Photonics A/S, TeraView Limited, and Metalenz, Inc.

The shift to 5G and future wireless technologies is fueling the growth of the market. These materials enable the development of high-performance antennas that can operate efficiently at higher frequencies.

The need for miniaturized, tunable, and highly directional antennas across telecom infrastructure is increasing demand. Metamaterials provide the precision and control needed for signal optimization, making them integral to next-generation communication systems.

- In February 2025, researchers at Cornell University proposed a metasurface dome designed to reduce above-the-horizon grating lobes in 5G New Radio (NR) base station antennas. This innovation aims to mitigate interference with Earth Exploration-Satellite Services (EESS) by minimizing unwanted radiation during antenna scanning. The metasurface dome offers a lightweight, electrically thin solution to enhance signal directionality and compliance with international spectrum regulations.

Increased Investment in Defense and Aerospace Technologies

The defense sector’s focus on advanced sensing, radar, and stealth systems is accelerating the growth of the metamaterials market. Metamaterials improve radar cross-section reduction, signal absorption, and sensor accuracy.

Aerospace applications, such as lightweight shielding and compact, multifunctional surfaces, are benefiting from the design flexibility of these materials. Government contracts and R&D grants facilitate the integration of metamaterials into critical defense programs.

- In November 2024, the Indian Institute of Technology (IIT) Kanpur unveiled the Anālakṣhya Metamaterial Surface Cloaking System (MSCS), a groundbreaking stealth technology designed to enhance India's defense capabilities. This textile-based broadband metamaterial microwave absorber offers near-perfect wave absorption across a broad spectrum, effectively rendering objects invisible to radar detection, including Synthetic Aperture Radar (SAR) imaging.

High Production Costs and Scalability Issues

A major challenge limiting the growth of the metamaterials market is the high cost of production and the difficulty in scaling these materials for mass use. Precision manufacturing at the nanoscale often requires specialized equipment and processes, making large-scale production expensive and time-consuming.

To address this challenge, key players are investing in automated fabrication methods and exploring cost-effective alternatives such as roll-to-roll manufacturing. Some are partnering with academic institutions to improve design efficiency and reduce material waste. These efforts aim to make metamaterials more commercially viable and accessible for broader industry adoption.

Expansion of Smart Consumer Electronics

Wearable devices, smartphones, and AR/VR systems are incorporating metamaterials for improved performance and functionality. This trend is supporting the growth of the metamaterials market, with materials enabling better lens quality, thinner optical components, and precise signal control.

Compact and high-performing materials are critical for meeting consumer demand for lighter, faster, and more efficient electronics, promoting continuous innovation.

- In January 2025, XREAL introduced its XREAL One Series AR glasses at CES 2025, featuring the flagship XREAL One Pro and the modular XREAL Eye camera. The glasses incorporate the proprietary X1 Spatial Computing Chip, offering a 57-degree field of view (FoV) for the One Pro and a 50-degree FoV for the standard One. The One Pro’s advanced flat-prism optical design enables an immersive cinematic display in a slim, lightweight frame. The modular XREAL Eye camera supports first-person video capture and is set to enable multimodal AI capabilities later this year.

|

Segmentation

|

Details

|

|

By Type

|

Electromagnetic, Terahertz, Tunable, Photonic, Frequency Selective Surface, Others

|

|

By Application

|

Antenna & Radar, Sensors & Beam Steering Modules, Cloaking devices, Superlens, Light & Sound Filtering, Others

|

|

By End User

|

Healthcare, Automotive, Telecommunication, Aerospace & Defense, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Electromagnetic, Terahertz, Tunable, Photonic, Frequency Selective Surface, and Others): The electromagnetic segment earned USD 158.0 million in 2023 due to its widespread use in antennas, sensors, and communication systems, wirh sustained demand from the defense, aerospace, and 5G infrastructure sectors.

- By Application (Antenna & Radar, Sensors & Beam Steering Modules, Cloaking devices, Superlens, Light & Sound Filtering, and Others): The antenna & radar segment held a share of 24.88% in 2023, fueled by its critical role in enhancing signal precision, range, and performance in advanced defense and communication systems.

- By End User (Healthcare, Automotive, Telecommunication, Aerospace & Defense, Electronics, and Others): The healthcare segment is projected to reach USD 676.3 million by 2031, owing to rising demand for advanced diagnostic imaging, non-invasive sensing technologies, and precision medical devices that leverage the unique electromagnetic properties of metamaterials.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America metamaterials market share stood at around 35.95% in 2023, valued at USD 190.0 million. The U.S. Department of Defense is contributing significantly to this growth.

The North America metamaterials market share stood at around 35.95% in 2023, valued at USD 190.0 million. The U.S. Department of Defense is contributing significantly to this growth.

There is a consistent focus on radar-absorbing materials, electromagnetic shielding, and advanced communication systems for next-generation defense platforms, which accelerates the commercialization of metamaterials in the. Moreover, research institutions such as MIT, Stanford, and the University of California system are advancing metamaterials research.

These universities have direct partnerships with companies in telecommunications, aerospace, and photonics. In North America, the translation of academic research into commercial products enhances applied innovation, fostering regional market expansion.

- In March 2025, researchers at the University of California, Berkeley, developed a bioinspired electromagnetic metamaterial that dynamically switches between absorbing and transmitting microwave signals. Inspired by chameleons' color-shifting ability, the material absorb over 90% of microwaves in the 4–18 GHz range when collapsed, rendering it effectively invisible to radar. When expanded, it allows up to 24.2% signals, enabling controlled communication.

The Asia Pacific metamaterials industry is set to grow at a robust CAGR of 24.19% over the forecast period. Asia Pacific is witnessing increased deployment of 5G infrastructure, which creates demand for advanced antennas and communication systems based on metamaterials. Telecom companies require compact, high-efficiency antennas that can handle higher data rates, contributing significantly to regional market growth.

- In April 2025, Ericsson announced its plans to manufacture all telecom antennas for the Indian market locally. Fueled by the rising demand from Indian telecom companies such as Bharti Airtel and Jio amid 5G expansion, production will be carried out in Gurgaon in partnership with VVDN Technologies. A substantial share of these antennas is expected to be exported after meeting domestic needs.

Furthermore, Asia Pacific is a global hub for consumer electronics manufacturing. Companies are using metamaterials to improve lenses, sensors, and display technologies in smartphones, AR/VR devices, and wearable health monitors.

Regulatory Frameworks

- In the U.S., the Department of Commerce enforces strict export controls under the Export Administration Regulations (EAR), particularly for dual-use metamaterials. The Environmental Protection Agency (EPA) regulates materials under the Toxic Substances Control Act (TSCA), ensuring environmental and health safety, while the Food and Drug Administration (FDA) oversees metamaterials used in medical devices for efficacy and safety.

- The European Union regulates metamaterials through the REACH framework, requiring companies to register chemicals and assess their environmental and health risks. The Classification, Labelling, and Packaging (CLP) regulation ensures the safe communication of hazards, while the Critical Raw Materials Act secures essential materials, such as those used in metamaterials, for the green and digital transitions.

- China regulates the export of dual-use metamaterials through its Export Control Law, which mandates licenses from the Ministry of Commerce (MOFCOM) for controlled materials. Additionally, the country enforces strict environmental and safety standards for materials, ensuring their safe production and application, especially in defense and telecommunications sectors.

- India enforces regulations for the production and export of metamaterials under the Foreign Trade Policy, which controls the trade of sensitive materials. Additionally, the Ministry of Environment, Forest and Climate Change (MoEFCC) governs the environmental impact of materials, ensuring compliance with safety and environmental standards for their industrial use.

Competitive Landscape

Major players in the metamaterials industry are increasingly adopting strategies such as collaboration and technological advancements. By partnering with other industry leaders, companies can combine expertise to accelerate innovation and enhance product offerings.

Furthermore, advancements in technology enable the development of more efficient, compact, and cost-effective solutions, boosting market growth. These strategic initiatives ensure competitiveness and meet the growing demand for advanced, high-performance products.

- In May 2024, Atmospheric and Environmental Research (AER), Phoebus Optoelectronics, and BAE Systems, Inc. partnered to develop an innovative ultra-compact infrared instrument for atmospheric temperature and water vapor sounding. The advanced sounder replaces traditional bulky optical systems with a lightweight metamaterial spectral filter that precisely isolates center wavelengths, minimizing interference from noise signals.

Key Companies in Metamaterials Market:

- Meta Materials Inc.

- Phoebus Optoelectronics Ltd.

- Nanohmics, Inc.

- Kymeta Corporation

- Applied Metamaterials Ltd.

- Radiall

- Elbit Systems Ltd.

- Infinera Corporation

- HoloMetrix

- MetaWaves Group

- Multiwave Technologies AG

- Echodyne Corp.

- NKT Photonics A/S

- TeraView Limited

- Metalenz, Inc.

Recent Developments (Product Launch)

- In September 2023, Meta Materials Inc. introduced QUANTUM stripe, a banknote security solution featuring its KolourOptik technology. As the first product to combine movement, 3D stereoscopic depth, and multicolour effects in an ultra-thin design, it delivers advanced security and enhanced authentication. Leveraging META’s expertise in nanotechnology and metamaterials, it sets a new standard in currency protection.

The North America metamaterials market share stood at around 35.95% in 2023, valued at USD 190.0 million. The U.S. Department of Defense is contributing significantly to this growth.

The North America metamaterials market share stood at around 35.95% in 2023, valued at USD 190.0 million. The U.S. Department of Defense is contributing significantly to this growth.