Market Definition

The metal forming market involves shaping and transforming metal materials into specific forms through various mechanical processes. These processes include techniques such as stamping, forging, rolling, extrusion, bending, and drawing, which involve the application of force, pressure, or heat to manipulate metals into desired shapes and dimensions.

This market serves a wide array of industries, including automotive, aerospace, construction, and consumer goods, where metal components are essential for the production of durable, high-performance products.

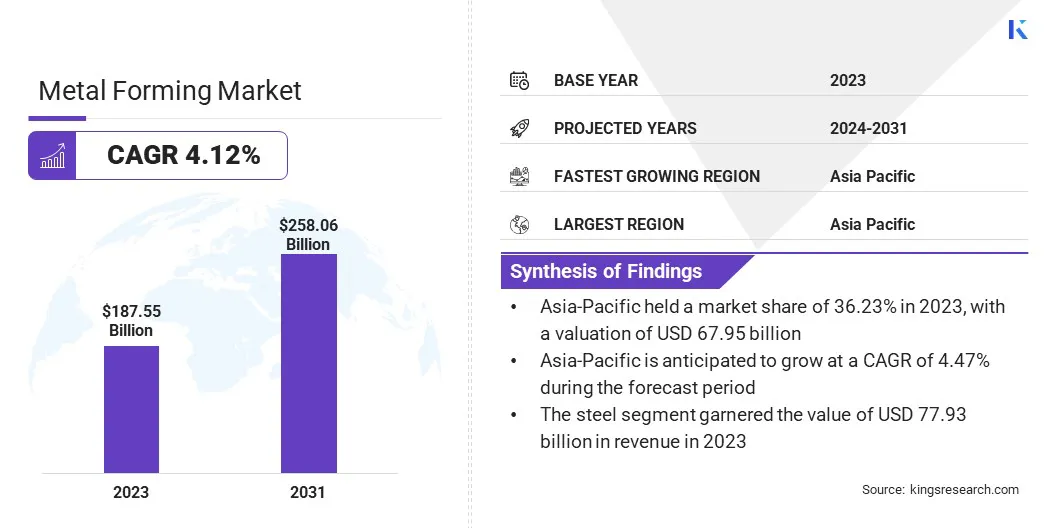

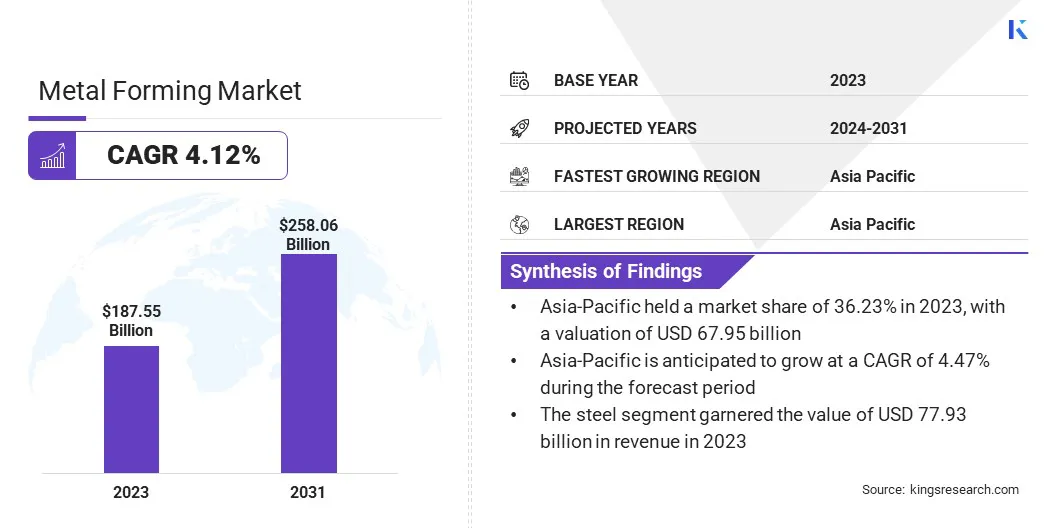

The global metal forming market size was valued at USD 187.55 billion in 2023 and is projected to grow from USD 194.48 billion in 2024 to USD 258.06 billion by to 2031, exhibiting a CAGR of 4.12% during the forecast period.

This is attributed to the rising demand for metal components across various industries, including automotive, aerospace, and construction, coupled with the increasing need for advanced and cost-effective manufacturing techniques to produce complex metal parts

Major companies operating in the global metal forming Industry are Magna International Inc., BENTELER International AG, TOYOTA BOSHOKU CORPORATION, AISIN CORPORATION, CIE Automotive, AUTOKINITON, The Bradbury Co., Formtek, Westway Machinery Ltd, Hirotec Corporation, AES Automotive Company, Samco Machinery Ltd, Schuler Group GmbH, SMS group GmbH, and Komatsu Ltd.

The expansion of the market underscores the growing significance of metal forming processes in the production of durable, high-performance products on a global scale. The demand for these processes is anticipated to persist, as industries continue to seek innovative and efficient methods for manufacturing intricate metal parts and components for a wide range of applications.

- In September 2023, AutoForm announced the release of AutoForm FormingR11, a new version of its sheet metal forming simulation software. This update introduces significant improvements in accuracy, particularly in simulating material behavior, handling complex geometries, and enhancing predictive capabilities. These advancements help manufacturers reduce physical prototyping, streamline development cycles, and achieve better product designs, ultimately lowering costs and improving quality in industries like automotive sheet metal forming.

Key Highlights:

- The global metal forming market size was valued at USD 187.55 billion in 2023.

- The market is projected to grow at a CAGR of 4.12% from 2024 to 2031.

- Asia Pacific held a market share of 36.23% in 2023, with a valuation of USD 67.95 billion.

- The steel segment garnered USD 77.93 billion in revenue in 2023.

- The rolling segment is expected to reach USD 96.72 billion by 2031.

- The automotive segment is anticipated to register the fastest CAGR of 4.78% during the forecast period

- The market in North America is anticipated to grow at a CAGR of 4.02% during the forecast period.

Market Driver

"Growing need for lightweight materials"

One of the most significant drivers of the global metal forming market is the growing demand for lightweight materials, particularly within the automotive and aerospace sectors.

As manufacturers strive to improve fuel efficiency, reduce emissions, and enhance overall performance, lightweight materials such as high-strength steel, aluminum, and advanced alloys have become essential.

Metal forming techniques, including stamping, forging, and extrusion, are critical for shaping these materials into the complex forms and dimensions required for automotive components, aerospace parts, and other high-performance applications. This trend is particularly pronounced with the rise of electric vehicles (EVs), which require lighter components to optimize range and efficiency.

The increasing demand for lightweight materials is fostering innovations and advancements in metal forming processes, positioning it as a key factor in the continued growth and expansion of the market.

- In December 2023, Desktop Metal announced the first commercial shipments of its Figur G15, a Digital Sheet Forming (DSF) machine that shapes sheet metal without the need for custom tooling. The machine uses a software-driven ceramic toolhead to apply up to 2,000 lbs of force, capable of working with steel up to 2.0 mm thick and aluminum up to 2.5 mm thick. The Figur G15 accommodates sheet sizes up to 1600 x 1200 mm (63 x 47 inches) and can form parts with a draw depth of up to 400 mm (16 inches). This innovative system is aimed at industries such as automotive, aerospace, and appliances, offering a cost-effective alternative to traditional forming processes.

Market Challenge

"Rising Raw Material Costs are Hindering the Market"

Fluctuations in the prices of essential materials such as steel, aluminum, and advanced alloys can significantly impact production costs. These price increases, driven by factors like supply chain disruptions, geopolitical tensions, and global demand fluctuations, can erode profit margins for manufacturers.

As raw material costs continue to rise, manufacturers must explore ways to optimize material usage, improve efficiency, and reduce waste to maintain profitability and competitiveness in the market.

Manufacturers can optimize material usage by employing advanced simulation software to minimize waste and adopting Design for Manufacturability (DFM) principles to enhance production efficiency. Implementing closed-loop recycling systems and effective scrap recovery processes can further reduce reliance on new materials.

Diversifying suppliers and strategically stockpiling critical materials can mitigate the impact of price volatility and ensure supply chain stability. These approaches enable manufacturers to better manage costs and maintain profitability.

Market Trend

"Advancements in automation propels the market"

Advancements in automation within the metal forming market have significantly transformed production processes, leading to greater efficiency, precision, and cost-effectiveness.

Robotic systems, particularly robotic arms and collaborative robots (cobots), are increasingly used to handle tasks such as stamping, welding, and material handling, which reduces labor dependency and enhances precision.

Servo-driven presses are replacing traditional mechanical presses, offering better control over force, speed, and stroke, which allows for more flexible and energy-efficient production.

Digital twin technology, along with real-time process monitoring, allows manufacturers to simulate and optimize processes before physical production begins, ensuring higher consistency and minimizing errors.

- In September 2023, Machina Labs introduced its Machina Deployable System for metal forming at FABTECH 2023. The system uses robotic automation and machine learning to accelerate the production of high-precision metal parts in industries like aerospace, automotive, and defense. It enables rapid prototyping, customization, and on-demand production with advanced die-less forming and impact techniques, offering flexibility and cost savings.

|

Segmentation

|

Details

|

|

By Material

|

Steel, Aluminum, Titanium, Others

|

|

By Process

|

Stamping, Forging, Rolling, Others

|

|

By End-use Industry

|

Automotive, Aerospace, Construction, Energy, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Steel, Aluminum, Titanium, Others): The steel segment earned USD 77.93 billion in 2023, due to its widespread use in industries such as automotive, construction, and heavy machinery, where its strength, versatility, and cost-effectiveness are highly valued.

- By Process (Stamping, Forging, Rolling, Others): The rolling segment held 38.02% share of the market in 2023, due to its ability to produce large quantities of high-quality metal sheets, plates, and strips, which are widely used in industries such as automotive, construction, and manufacturing.

- By End-use Industry (Automotive, Aerospace, Construction, Energy, Others): The automotive segment is projected to reach USD 99.13 billion by 2031, owing to the increasing demand for lightweight, high-strength components.

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a metal forming market share of around 36.23% in 2023, with a valuation of USD 67.95 billion. This dominant position is driven by strong industrial growth, especially in sectors like automotive, aerospace, and electronics, alongside increasing demand for advanced manufacturing technologies and lightweight materials. The region's robust manufacturing capabilities and investments in innovation continue to support its leading role in the global market.

- In December 2024, IIT Ropar successfully hosted the Sheet Metal Forming (SMF) 2024 conference, drawing national and international delegates. Featuring esteemed speakers from IITs and leading industry players like Autoform, Tata Steel, and Ford India, the event, organized by SMFRA, served as a premier platform for global researchers and developers to exchange insights on advanced metal forming technologies.

The metal forming Industry in Europe is poised for significant growth at a robust CAGR of 4.25% over the forecast period. This growth is driven primarily by the automotive and aerospace industries, which are increasingly adopting advanced metal forming technologies to meet the demand for lightweight and high-performance materials.

Europe’s strong commitment to sustainability and carbon reduction is accelerating the use of eco-friendly materials and driving further innovation in metal forming processes. This combination of industrial demand, technological innovation, and environmental focus is positioning Europe for continued growth in the market.

- In April 2024, Thyssenkrupp AG announced a strategic partnership with EP Corporate Group (EPCG), a leading European energy company. EPCG will acquire a 20 percent stake in Thyssenkrupp's steel business, marking the first step in a planned 50/50 joint venture between the two companies.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) established the Nonferrous Metals Forming and Metal Powders Effluent Guidelines to regulate the discharge of pollutants into the environment from the nonferrous metals forming and metal powders industries. These guidelines set limits on contaminants such as heavy metals, oils, and other waste products generated during manufacturing processes, aiming to protect water quality and promote cleaner production methods.

- The Defense Federal Acquisition Regulation (DFARS) 252.225-7009 regulation prohibits the acquisition of articles, materials, or supplies containing specialty metals unless they are domestically sourced or meet specific exceptions. Specialty metals, including steel, stainless steel, and alloys of titanium, nickel, and cobalt, are essential for applications requiring high performance, such as in aerospace and defense industries.

- Regulation (EC) No 1907/2006, known as REACH, was adopted by the European Union to improve the protection of human health and the environment from the risks of chemicals. REACH places responsibility on manufacturers and importers to assess and manage the risks posed by chemicals they place on the market.

- RoHS Directive (EU) 2017/2102 of the European Parliament and of the Council amends Directive 2004/37/EC concerning the protection of workers from the risks of exposure to carcinogens or mutagens at work. The directive aims to enhance workplace safety by setting more stringent occupational exposure limits (OELs) for carcinogenic and mutagenic substances and adding new chemicals to the list of hazardous substances.

- The Toxic Substances Control Act (TSCA) administered by the EPA regulates the production, use, and disposal of chemicals that may pose risks to human health or the environment. TSCA empowers the EPA to require testing, restrict, or ban dangerous chemicals and ensures manufacturers provide safety information.

Competitive Landscape:

The global metal forming market is characterized by several participants, including both established corporations and rising organizations. Companies are focusing on innovation, advanced technologies, and strategic partnerships to gain a competitive edge in the continuous evolving market.

Established corporations are investing heavily in automation, smart manufacturing, and robotics to improve efficiency, reduce production costs, and enhance product quality.

Meanwhile, emerging companies are leveraging cutting-edge techniques like 3D metal printing, additive manufacturing, and high-strength alloy development to create lightweight, high-performance components for industries such as automotive, aerospace, and consumer electronics.

List of Key Companies in Metal Forming Market:

- Magna International Inc.

- BENTELER International AG

- TOYOTA BOSHOKU CORPORATION

- AISIN CORPORATION

- CIE Automotive

- AUTOKINITON

- The Bradbury Co.

- Formtek

- Westway Machinery Ltd

- Hirotec Corporation

- AES Automotive Company

- Samco Machinery Ltd

- Schuler Group GmbH

- SMS group GmbH

- Komatsu Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Quintus Technologies successfully installed a state-of-the-art sheet metal press at PIMCO's facility in Florida. This new installation, which utilizes Quintus' advanced high-pressure forming technology, will allow PIMCO to significantly enhance its production capabilities for automotive and aerospace applications.

- In March 2024, Safran announced the acquisition of 3D Metal Forming (3DMF), a pioneering company renowned for its advanced expertise in high-energy hydro-forming technology. This strategic acquisition strengthens Safran's capabilities in the field of metal forming, a crucial component in the production of aerospace and defense systems.

- In July 2023, Aperam, a global leader in stainless steel production, announced the acquisition of Mecorad, a specialist in high-performance steel solutions for the aerospace and energy industries. This strategic move is aimed at enhancing Aperam’s portfolio of advanced materials and expanding its capabilities in the growing aerospace and energy markets.