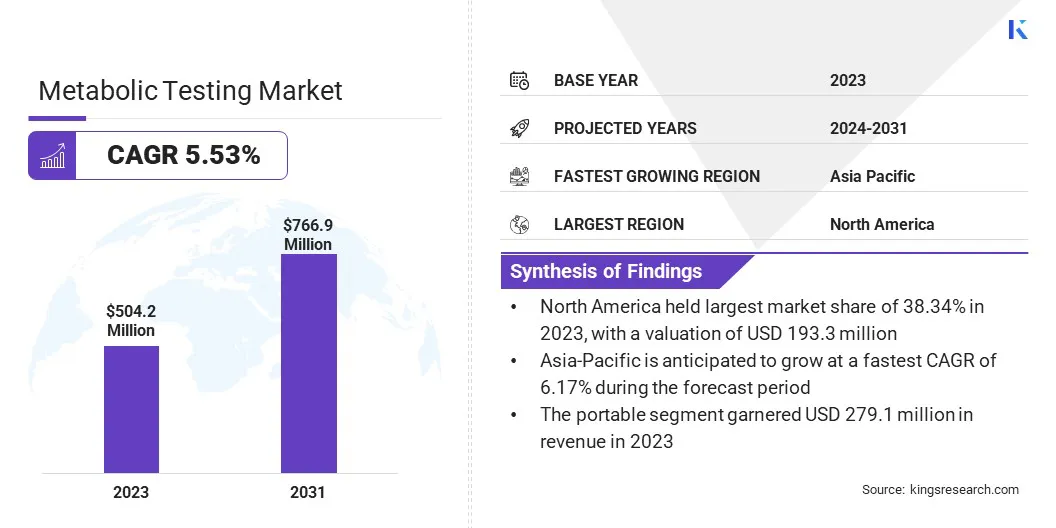

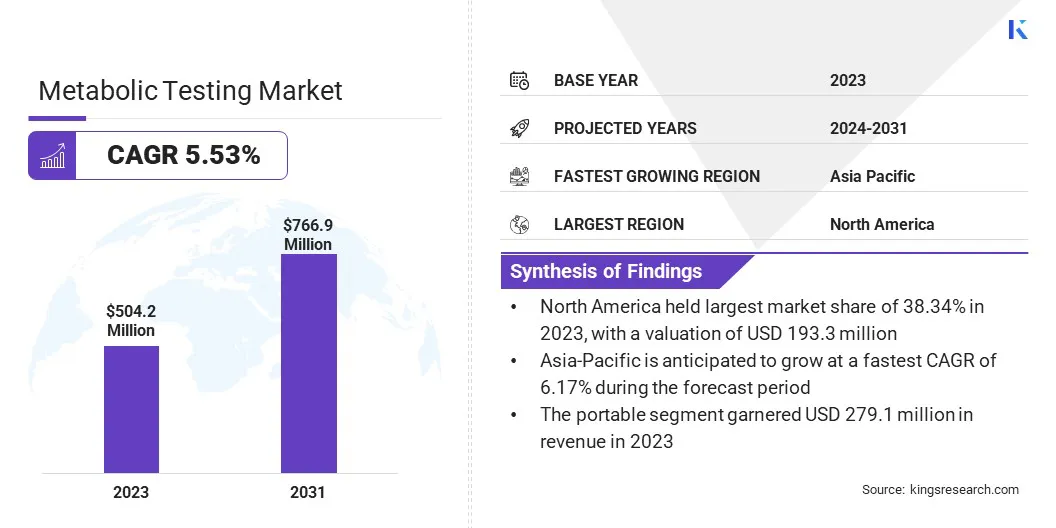

The global Metabolic Testing Market size was valued at USD 504.2 million in 2023 and is projected to grow from USD 526.2 million in 2024 to USD 766.9 million by 2031, exhibiting a CAGR of 5.53% over the forecast period.

The growing focus on preventive healthcare is a major factor driving the market. Individuals and healthcare systems are prioritizing early detection and management of metabolic disorders, leading to increased demand for testing to prevent chronic diseases and optimize health.

In the scope of work, the report includes products and solutions offered by companies such as Koninklijke Philips N.V., Geratherm Medical AG, General Electric Company, KORR Medical Technologies, Parvo Medics, Microlife Medical Home Solutions, Promega Corporation., Metabolon, Inc., COSMED srl, Abbott, and others.

The market is undergoing rapid expansion due to increasing availability of diagnostic tools to assess a range of metabolic health diseases. This market encompasses various testing methods, including clinical diagnostics, fitness assessments, and at-home testing kits, to evaluate metabolic function.

Advancements in technology and research, along with a growing focus on preventive healthcare, have significantly improved the accessibility and effectiveness of metabolic tests, making them more reliable and available to a broader patient base. As consumers and healthcare providers recognize the importance of metabolic monitoring, the market is poised for continued expansion across multiple sectors.

- A study from King’s College London, published in Nature Medicine in September 2024, highlights how lipid-based blood tests can detect early metabolic diseases in children, such as obesity-related complications. This advancement enhances the accessibility and effectiveness of metabolic tests for early disease detection.

The market refers to the industry focused on diagnostic tests and tools used to evaluate an individual’s metabolic functions and health. These tests assess various aspects of the human body, such as how nutrients are processed, blood sugar is regulated, and fat and energy production is managed.

Metabolic testing includes laboratory-based diagnostic procedures, wearable devices, and at-home kits that provide insights into an individual’s metabolic health. These tests are crucial for detecting obesity, diabetes, and cardiovascular diseases, enabling early diagnosis, personalized treatment plans, and better management of chronic conditions. As awareness regarding metabolic health increases, the demand for these tests grows, contributing to the expansion of the market.

Analyst’s Review

Analyst’s Review

The market is witnessing a shift to more personalized and accessible solutions driven by consumer demand for health monitoring. Companies are focusing on using various techs, such as wearable devices and mobile apps, to enhance the user experience.

In response to the growing health-conscious consumer base, manufacturers are prioritizing the development of personalized, at-home testing kits and user-friendly platforms. This strategy increases market accessibility and allows for continuous monitoring, aligning with the broader trend toward preventative healthcare and proactive wellness management. The market is likely to see continued growth as more people seek to optimize their metabolic health.

- In August 2024, Levels, a metabolic health company, raised USD 10 million in a Series A Extension, with a focus on personalized solutions. The funding, which included USD 3 million from over 2,000 crowdfunding investors, highlights the growing demand for accessible and user-friendly platforms that cater to health-conscious consumers seeking proactive wellness management.

Improved reimbursement policies are a key factor favoring the metabolic testing market, as many insurance providers are expanding coverage for tests, especially for individuals at high risk of metabolic diseases like obesity and diabetes. These enhanced policies are making metabolic testing more accessible and affordable to a broader population.

As a result, more people are undergoing these tests for early detection and prevention of metabolic disorders, driving further growth and adoption of metabolic testing solutions.

- In June 2023, Senseonics Holdings, Inc. announced UnitedHealthcare’s coverage of the Eversense E3 CGM System for patients with Type 1 and Type 2 diabetes. This expanded coverage highlights the impact of improved reimbursement policies in the market, making advanced diagnostic tools like continuous glucose monitors more accessible to more people.

A significant challenge in the market is the lack of consumer awareness about the importance of early disease detection, which lowers the adoption rate. Many individuals are unaware of how metabolic tests can help identify risks for diabetes and heart disease. Awareness campaigns and targeted outreach through healthcare providers and digital platforms, can help uncover the benefits of metabolic testing, encouraging earlier adoption and proactive health management.

- Lancet reports that over 800 million adults are living with diabetes in 2024. This highlights the urgent need for global action. This study, conducted by the NCD Risk Factor Collaboration (NCD-RisC), with support from the WHO, emphasizes the importance of diabetes prevention and care to improve healthcare outcomes through targeted interventions.

The integration of AI and advanced data analytics is transforming the metabolic testing market by enhancing the accuracy and personalization of results. AI algorithms can process vast amounts of health data to identify patterns and predict metabolic risks more effectively. This allows for highly personalized health insights, enabling individuals to make improvements to their diet, exercise, and lifestyle.

The ability to tailor recommendations based on individual metabolic profiles is driving the adoption of more precise, proactive approaches to health management.

- In December 2024, RenaissThera, a Bengaluru-based biotech firm, closed its seed funding round to accelerate the development of small-molecule therapies targeting cardio-metabolic diseases. The company leverages AI and machine learning to rapidly identify and optimize therapies, with an aim to offer affordable, personalized solutions for diabetes and obesity.

A growing trend in the market is the increased focus on chronic disease management. Metabolic tests are essential for monitoring and managing chronic conditions like diabetes, obesity, and cardiovascular diseases. These tests enable proactive healthcare by providing continuous, real-time insights into an individual's metabolic health, allowing for early detection of potential issues.

By offering personalized data, metabolic testing helps healthcare providers tailor treatment plans, optimize disease management, and improve patient outcomes.

- In October 2024, Abbott announced that its FreeStyle Libre 2 and 3 systems can now be worn during imaging procedures like X-rays, CT scans, and MRIs, following FDA approval. This advancement allows diabetes patients to continuously monitor glucose levels, ensuring uninterrupted data and supporting proactive, convenient chronic disease management.

Segmentation Analysis

The global market has been segmented based on product type, product, application, technology, end user, and geography.

By Product Type

Based on product type, the market has been bifurcated into portable and bench-top. The portable segment led the metabolic testing market in 2023, reaching the valuation of USD 279.1 million.

Portable metabolic testing is experiencing significant expansion due to the increasing demand for at-home and on-the-go health monitoring solutions. Portable devices like wearable glucose monitors, at-home blood tests, and fitness trackers provide users with real-time insights into their metabolic health, such as glucose levels, metabolic rate, and calorie burn.

These devices are convenient, easy to use, and allow individuals to track their health metrics continuously, making metabolic testing more accessible. As consumer awareness of metabolic health grows, the adoption of portable testing solutions will continue driving market growth with more personalized and proactive health management.

By Product

Based on product, the market has been classified into CPET Systems, metabolic carts, body composition analyzers, and ECGs/EKGs attachable to CPET systems. The metabolic carts segment secured the largest revenue share of 29.93% in 2023.

Metabolic charts are driving significant expansion in the metabolic testing market by offering users clear, visual insights into their metabolic health. They display metabolic rate, calorie burn, and nutrient consumption, and allow individuals to track their progress over time. By providing easily understandable data, metabolic charts help users make informed decisions about their diet, exercise, and lifestyle.

The increasing popularity of health and fitness tracking, along with the growing demand for personalized wellness, is fueling the adoption of metabolic charts. As a result, they are playing a key role in expanding the market for metabolic testing solutions.

By Application

Based on application, the market has been classified into lifestyle diseases management, human performance testing, critical care, and clinical nutrition. The lifestyle diseases management segment will likely see significant growth at a CAGR of 5.93% over the forecast period.

The application of metabolic testing in lifestyle disease management is contributing to market growth by providing valuable insights for preventing and managing chronic conditions like diabetes, obesity, and cardiovascular diseases.

Metabolic testing helps individuals track key health indicators such as glucose levels, metabolic rate, and fat composition, for personalized recommendations on diet, exercise, and medication. With more people focusing on preventing lifestyle-related diseases through proactive health monitoring, the demand for metabolic testing solutions has surged.

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America metabolic testing market share stood at 38.34% in 2023 in the global market, with a valuation of USD 193.3 million. North America is a dominant market for metabolic testing due to its advanced healthcare infrastructure, high consumer awareness, and a strong focus on preventive healthcare.

The North America metabolic testing market share stood at 38.34% in 2023 in the global market, with a valuation of USD 193.3 million. North America is a dominant market for metabolic testing due to its advanced healthcare infrastructure, high consumer awareness, and a strong focus on preventive healthcare.

The region benefits from the widespread adoption of wearable devices, continuous glucose monitors, and AI-powered testing platforms. With a large number of individuals at risk for chronic conditions such as diabetes, obesity, and heart disease, the demand for metabolic testing solutions is high.

Favorable reimbursement policies, extensive research and development activities, and collaborations among healthcare providers and technology companies has further reinforced North America’s leadership in the market.

Asia-Pacific is expected to witness the fastest growth over the forecast period at a CAGR of 6.17% due to rapid urbanization, increasing healthcare awareness, and rising incidence of lifestyle-related diseases like diabetes, obesity, and cardiovascular conditions. The region's expanding middle class and growing focus on preventive healthcare are driving the demand for metabolic testing solutions.

Advances in medical technology and healthcare investments in China, India, and Japan are boosting market growth. As more individuals are adopting health monitoring devices and seeking personalized wellness solutions, Asia Pacific is expected to expand in terms of metabolic testing in the coming years.

Competitive Landscape

The metabolic testing industry report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players focus on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, are expected to create new opportunities for the market growth.

Key Companies in Metabolic Testing Market

- Koninklijke Philips N.V.

- Geratherm Medical AG

- General Electric Company

- KORR Medical Technologies

- Parvo Medics

- Microlife Medical Home Solutions

- Promega Corporation.

- Metabolon, Inc.

- COSMED srl

- Abbott

Key Industry Developments

- March 2024 (Launch): Labcorp's launched its Weight Loss Management portfolio, offering comprehensive tests for baseline and ongoing metabolic health indicators. By providing essential tests to monitor blood sugar, cholesterol, thyroid, and metabolic function, Labcorp is supporting personalized treatment plans, including lifestyle changes, GLP-1 medications, and bariatric surgery, driving further adoption of metabolic testing for chronic disease management and weight loss.

The global metabolic testing market has been segmented:

By Product Type

By Product

- CPET Systems

- Metabolic Carts

- Body Composition Analyzers

- ECGs/EKGs Attachable to CPET Systems

- Software

By Application

- Lifestyle Diseases Management

- Human Performance Testing

- Sports and Fitness

- Cardiac Rehabilitation

- Critical Care

- Clinical Nutrition

By Technology

- VO2 Max Analysis

- Resting Metabolic Rate (RMR) Analysis

- Lactate Threshold Testing

- Body Composition Testing

By End-User

- Hospitals

- Clinics

- Sports & Fitness Centers

- Homecare Settings

- Research Institutes

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America