Market Definition

Medical plastics refer to specialized polymeric materials designed for use in healthcare applications, including medical devices, surgical instruments, drug delivery systems, and implants. These plastics must meet stringent biocompatibility, sterilization, and durability requirements to ensure patient safety and regulatory compliance.

Common types include polyvinyl chloride (PVC) for tubing, polyethylene (PE) for prosthetics, and polycarbonate (PC) for surgical instruments. Medical plastics offer advantages such as chemical resistance, lightweight properties, and the ability to be molded into complex shapes, making them essential in modern medical technology and disposable healthcare products.

Medical Plastics Market Overview

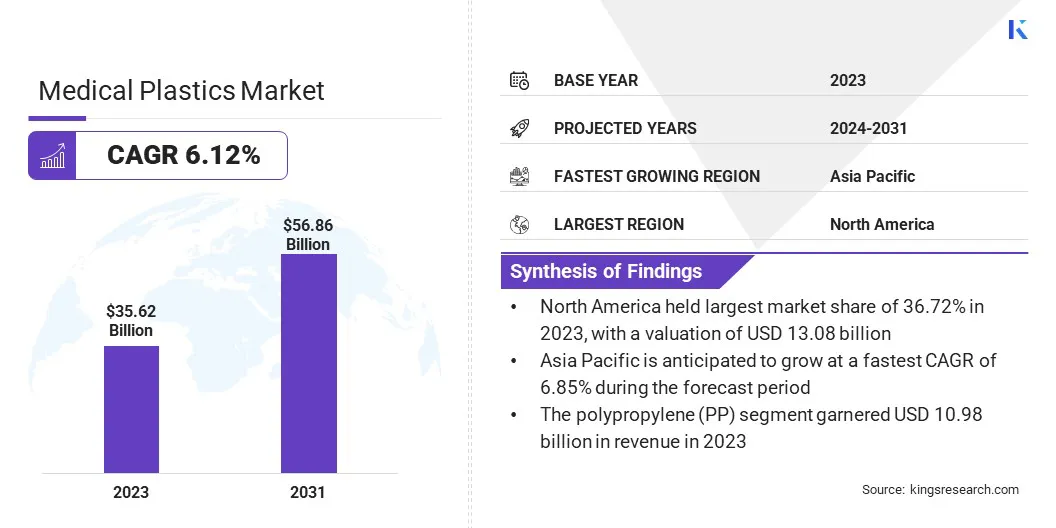

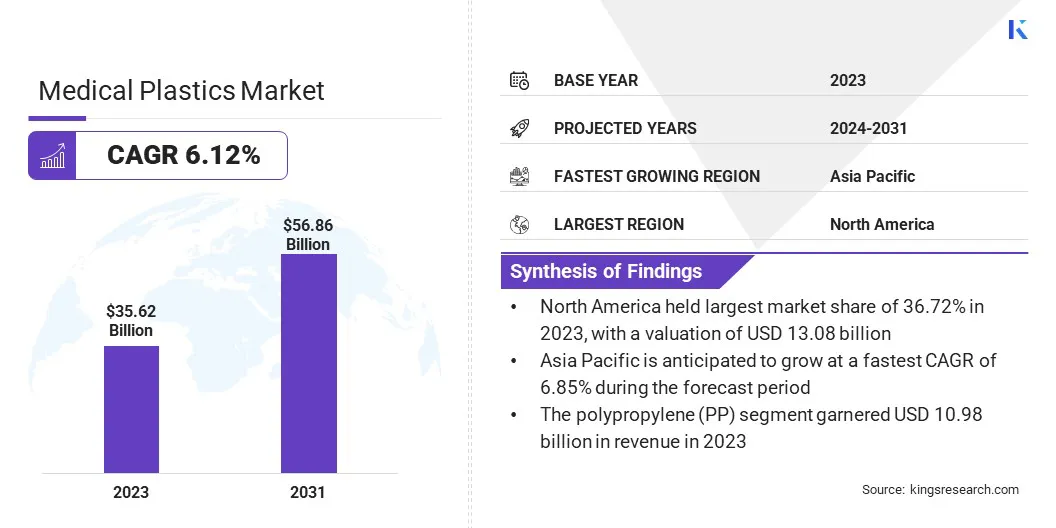

The global medical plastics market size was USD 35.62 billion in 2023, which is estimated to be valued at USD 37.52 billion in 2024 and is projected to reach USD 56.86 billion by 2031, growing at a CAGR of 6.12% from 2024 to 2031.

The growth of the market is driven by increasing demand for advanced medical devices, particularly in minimally invasive surgeries and home healthcare. Advancements in 3D printing and bioresorbable polymers are further accelerating innovation in custom implants and drug delivery systems.

Additionally, the growing focus on infection prevention and sustainability is promoting the adoption of biodegradable and antimicrobial plastics, contributing to market expansion in various healthcare applications.

Major companies operating in the medical plastics industry are SABIC, BASF, Celanese Corporation, EVONIK, Solvay, Covestro AG, Eastman Chemical Company, Trinseo, Saint-Gobain, Dow, Avantor, Inc., Nolato AB, Röchling, HMC Polymers Company Limited, B. Braun Melsungen AG, and others.

The increasing reliance on disposable medical products is boosting market growth. Single-use syringes, IV bags, dialysis cartridges, and surgical gloves are widely adopted to minimize contamination risks and enhance patient safety. Polypropylene, polyethylene, and polyvinyl chloride (PVC) are the most commonly used plastics in these applications due to their cost-effectiveness and ease of sterilization.

The global emphasis on infection control, particularly following the COVID-19 pandemic, has accelerated demand for disposable medical plastics, prompting manufacturers to enhance production capacities and develop sustainable alternatives.

Key Highlights:

- The medical plastics industry size was recorded at USD 35.62 billion in 2023.

- The market is projected to grow at a CAGR of 6.12% from 2024 to 2031.

- North America held a share of 36.72% in 2023, valued at USD 13.08 billion.

- The polypropylene (PP) segment garnered USD 10.98 billion in revenue in 2023.

- The medical devices segment is expected to reach USD 16.19 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.85% over the forecast period.

Market Driver

"Increasing Demand for Advanced Healthcare Solutions"

The rising need for high-performance medical devices and equipment is propelling the growth of the medical plastics market. Hospitals and healthcare facilities are prioritizing lightweight, durable, and cost-effective materials that enhance patient safety and device efficiency.

The growing prevalence of chronic diseases and the increasing number of surgical procedures are further fueling market expansion.

- The June 2024 report from the International Society of Aesthetic Plastic Surgery (ISAPS) indicates a 5.5% rise in surgical procedures, with plastic surgeons performing over 15.8 million surgeries and 19.1 million non-surgical procedures. Over the past four years, the total growth has reached 40%.

Medical plastics play a crucial role in the production of diagnostic instruments, surgical tools, and implantable devices. Their biocompatibility and resistance to chemicals ensure reliability in medical applications, positioning them as essential materials in the modern healthcare sector.

Market Challenge

"Regulatory and Environmental Compliance Challenges"

A critical challenge hindering the growth of the medical plastics market is navigating stringent regulatory requirements and increasing environmental concerns. Manufacturers must ensure that medical plastics comply with international safety standards and biocompatibility criteria while also addressing the growing demand for sustainable and eco-friendly materials.

To address these challenges, companies are investing in R&D to develop new biodegradable and recyclable plastics that meet regulatory requirements.

Additionally, manufacturers are working closely with regulatory bodies to streamline compliance processes, adopt sustainable production practices, and reduce the environmental impact of medical plastic products without compromising performance and safety.

Market Trend

"Increasing Focus on Sustainable and Biodegradable Plastics"

The rising emphasis on environmental sustainability is influencing the medical plastics market, with manufacturers shifting toward biodegradable and bio-based polymers. Regulatory pressures, coupled with industry initiatives to reduce plastic waste, are accelerating the adoption of sustainable alternatives in medical packaging, disposable devices, and drug delivery systems.

Materials such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are gaining traction for their biodegradability and compatibility with sterilization processes.

- In October 2023, researchers from the University of New South Wales collaborated with Ecopha Biotech to advance biodegradable plastic packaging solutions. The project secured a $3 million grant from the Cooperative Research Centres Projects (CRC-P) for a three-year development period. This initiative focuses on creating next-generation sustainable healthcare packaging using polyhydroxyalkanoates (PHAs), a biodegradable polymer derived from the fermentation of canola oil. These innovative products are designed to replace conventional petroleum-based healthcare packaging, ensuring safety, high performance, and environmental sustainability.

Companies are investing in research and development to enhance the performance of eco-friendly medical plastics, ensuring compliance with global sustainability goals while maintaining product safety and functionality.

Medical Plastics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyethylene (PE), Polypropylene (PP), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polystyrene (PS), Others

|

|

By Application

|

Medical Devices, Packaging, Orthopedic Products, Wound Care, Drug Delivery, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Polyethylene (PE), Polypropylene (PP), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polystyrene (PS), and Others): The polypropylene (PP) segment earned USD 10.98 billion in 2023 due to its excellent chemical resistance, cost-effectiveness, and widespread use in manufacturing medical devices such as syringes, catheters, and sterile packaging.

- By Application (Medical Devices, Packaging, Orthopedic Products, Wound Care, and Others): The medical devices segment held a share of 28.21% in 2023, due to the increasing demand for advanced, biocompatible, and durable polymer-based components in the production of critical healthcare devices, including surgical instruments, diagnostic tools, and implants.

Medical Plastics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America medical plastics market captured a share of around 36.72% in 2023, valued at USD 13.08 billion. North America has witnessed an increased focus on innovative drug delivery solutions such as insulin pens, pre-filled syringes, and inhalers.

The U.S. Food and Drug Administration (FDA) continues to approve new drug delivery systems designed with advanced plastics that are both biocompatible and lightweight.

For instance, the FDA-approved pen injectors used for diabetes treatment rely heavily on plastic materials, offering a safer and more efficient method of drug administration compared to traditional syringes. The demand for these devices continues to rise as the prevalence of diabetes increases across North America.

With the aging population and the increasing prevalence of chronic diseases in the region, there is a growing demand for home healthcare devices such as glucose meters, blood pressure monitors, and portable oxygen concentrators.

- The U.S. Department of Health and Human Services (HHS) projects that by 2060, the population of Americans aged 65 and older will more than double, creating a strong demand for medical plastics in home healthcare products.

Asia Pacific medical plastics industry is set to grow at a CAGR of 6.85% over the forecast period. The region has seen significant advancements in healthcare infrastructure, particularly in China, India, and Japan, supported by increased public and private sector investment.

- A joint report by the World Bank and the Chinese government revealed that China's health spending would rise to USD 2.5 trillion by 2035, compared to USD 543.5 billion in 2014. The Chinese government has initiated significant reforms to address the escalating healthcare costs and implement major structural changes.

Moreover, various government schemes across Asia, such as China’s Healthy China 2030 and India’s Ayushman Bharat, are boosting the expansion of healthcare services. These initiatives aim to provide broader healthcare access to underserved populations, increasing the demand for medical devices.

Medical plastics, due to their affordability and versatility, play a key role in these devices, including syringes, gloves, and diagnostic equipment, boosting regional market expansion.

Regulatory Frameworks

- In the U.S., the FDA regulates medical devices, including those made from medical plastics. The FDA’s Center for Devices and Radiological Health (CDRH) provides detailed guidelines for these products.

- In Europe, the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) govern medical devices, including medical plastics. Post-Brexit, the UK has adopted similar regulations to the EU’s MDR, managed by the MHRA.

- In China, The NMPA (National Medical Products Administration), formerly known as the CFDA, regulates medical devices in China, including plastics used in devices. China adheres to GB/T 16886 (National Standards for Biocompatibility Testing of Medical Devices), aligning with ISO 10993.

- Japan enforces the Pharmaceutical and Medical Device Act (PMD Act) and regulates medical devices under the PMDA. Medical plastics must undergo biocompatibility testing per international standards.

- India's medical device regulations are overseen by CDSCO (Central Drugs Standard Control Organization), which enforces the Medical Device Rules 2017.

- South Korea regulates medical devices, including plastics, through the MFDS (Ministry of Food and Drug Safety). The MFDS enforces the safety and effectiveness of medical devices, including those incorporating plastics, ensuring compliance with international standards.

Competitive Landscape

The global medical plastics market is characterized by a number of participants, including both established corporations and emerging players. Key marketparticipants are increasingly adopting strategies such as partnerships and collaborations to address the growing need for plastic recycling.

By forming alliances with recycling firms, these companies aim to enhance the sustainability of medical plastics, reduce waste, and develop innovative recycling technologies. Additionally, collaborations with governments and NGOs align recycling efforts with regulatory standards, promoting eco-friendly practices across the industry.

These initiatives support environmental sustainability and ensure compliance with global regulations, thus propelling regional market growth.

- In February 2023, BD and Casella Waste Systems partnered on a medical plastics recycling initiative aimed at advancing the recycling of used medical plastics, particularly those used in healthcare settings. The initiative seeks to develop closed-loop recycling solutions that can recover and reuse medical plastics, reducing waste and improving sustainability in the healthcare industry. This collaboration highlights the industry's shift toward more sustainable practices while enhancing the market's growth potential.

List of Key Companies in Medical Plastics Market:

- SABIC

- BASF

- Celanese Corporation

- EVONIK

- Solvay

- Covestro AG

- Eastman Chemical Company

- Trinseo

- Saint-Gobain

- Dow

- Avantor, Inc.

- Nolato AB

- Röchling

- HMC Polymers Company Limited

- Braun Melsungen AG

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2025, SABIC demonstrated the feasibility of recycling used medical plastics back into the medical materials supply chain. The company converted used medical plastics from Jessa Hospital into pyrolysis oil through an advanced recycling process. This oil was then used as a circular feedstock for producing Trucircle polymers in medical-grade quality, maintaining the same performance, purity, and physiological safety as virgin medical-grade polymers.

- In January 2023, Celanese Corporation showcased an expanded range of polymer solutions for the healthcare market at MD&M West 2023 in California. Following its 2022 acquisition of the majority of DuPont’s Mobility & Materials (M&M) business, Celanese now offers materials such as Zytel PA, Hytrel TPC-ET, Crastin PBT, and Micromax to meet the evolving needs of the healthcare industry.

- In January 2024, Covestro introduced Apec 2045, a high-heat-resistant copolycarbonate that allows molders and medical OEMs to significantly reduce production time and costs while maintaining quality, performance, and appearance. Additionally, this innovative material supports sustainability objectives, offering the potential for circular business models through both close- and open-loop recycling, along with the option of incorporating bio-circular content.