Market Definition

The market focuses on the development, production, and distribution of electronic devices designed to alert medical personnel or caregivers during health emergencies. These systems typically include wearable devices, in-home sensors, and mobile units, primarily serving elderly or chronically ill individuals.

The market encompasses a range of products and services, including fall detection, GPS tracking, and 24/7 monitoring solutions. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Medical Alert Systems Market Overview

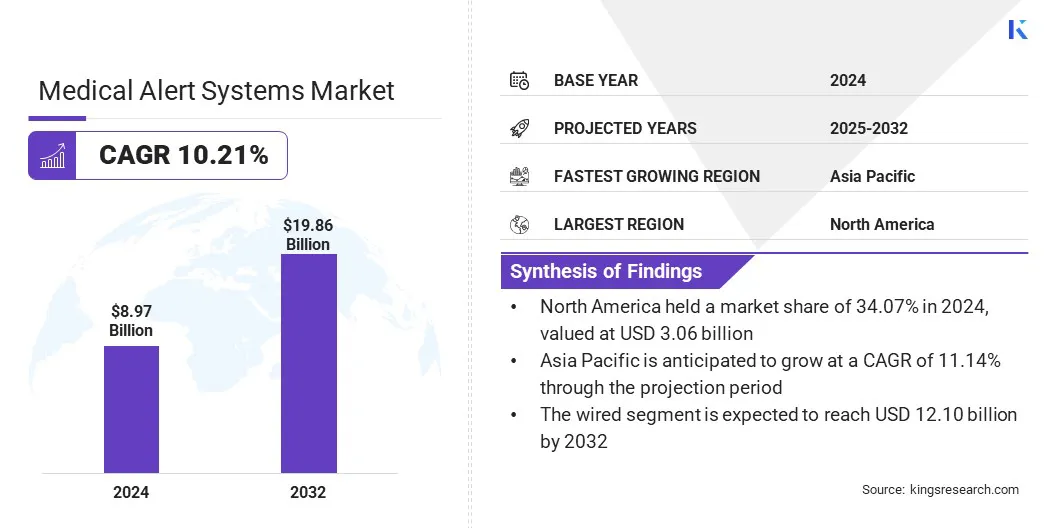

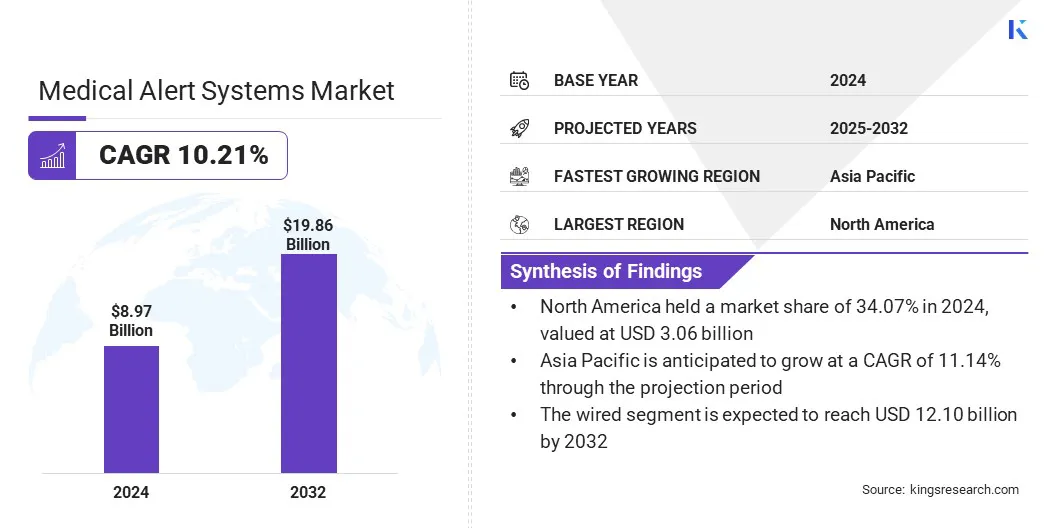

The global medical alert systems market size was valued at USD 8.97 billion in 2024 and is projected to grow from USD 9.80 billion in 2025 to USD 19.86 billion by 2032, exhibiting a CAGR of 10.21% during the forecast period.

This growth is attributed to the rising demand for advanced safety and monitoring systems among the aging population and individuals with chronic health conditions. This growth is further supported by increasing awareness of health risks and the need for timely medical intervention. The growing preference for independent living and remote healthcare monitoring is further contributing to market expansion.

Major companies operating in the medical alert systems industry are Bay Alarm Medical, Medical Guardian LLC, ADT, LifeFone Medical Alert Services, Life Alert Emergency Response, Inc., LifeStation, Inc., MobileHelp, GETSAFE, LLC, Aloe Care Health, AlertOne Services, LLC., Lifeline, Connect America, Rescue Alert, LogicMark, and ModivCare.

Furthermore, technological advancements in wearable devices, GPS tracking, and fall detection systems, along with the integration of Internet of Things (IoT) and artificial intelligence (AI) in healthcare, are driving market growth. The increasing adoption of home-based healthcare solutions, coupled with supportive government initiatives aimed at improving elderly care, further influence the market.

- In September 2023, the Illinois Department on Aging introduced enhancements to its Emergency Home Response Service (EHRS), allowing participants to incorporate fall detection and GPS tracking features into medical alert devices. These additions expand protection beyond the home and were announced during Falls Prevention Awareness Week to improve safety for seniors.

Key Highlights

Key Highlights

- The medical alert systems industry size was valued at USD 8.97 billion in 2024.

- The market is projected to grow at a CAGR of 10.21% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, valued at USD 3.06 billion.

- The landline-based segment garnered USD 3.45 billion in revenue in 2024.

- The wired segment is expected to reach USD 12.10 billion by 2032.

- The nursing homes segment is anticipated to witness the fastest CAGR of 10.49% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 11.14% through the projection period.

Market Driver

Escalating Rates of Chronic Medical Conditions

The medical alert systems market is expanding steadily, fueled by the rising prevalence of chronic diseases such as cardiovascular conditions, diabetes, and respiratory disorders across both developed and developing regions. The rising prevalence of chronic conditions, particularly among aging populations, is increasing demand for continuous health monitoring and timely emergency responses.

Medical alert systems serve as an essential safety tool, enabling rapid communication with healthcare providers or caregivers during health emergencies, thereby reducing complications and hospital readmissions.

Moreover, growing healthcare awareness, the shift toward home-based care, and the need for long-term disease management solutions are expected to accelerate the adoption of medical alert systems in the coming years.

- In November 2024, Vesta Healthcare and Medical Guardian partnered to advance chronic care management and remote patient monitoring for Medicaid and Medicare beneficiaries. This collaboration integrates Medical Guardian’s monitoring devices and emergency response systems with Vesta’s around-the-clock clinical supervision to promote proactive home-based care. The initiative aims to enhance health outcomes and decrease hospital admissions by enabling timely data collection and early intervention.

Market Challenge

Infrastructure and Network Accessibility Constraints

Infrastructure and network accessibility constraints pose a critical challenge to the expansion of the medical alert systems market, particularly in remote and rural regions where reliable internet and cellular connectivity is limited or inconsistent. Advanced medical alert systems often rely on continuous network access to enable real-time monitoring, emergency communication, and location tracking.

However, inadequate telecommunications infrastructure in underserved areas can lead to frequent signal interruptions, delayed emergency responses, and reduced system reliability. These limitations undermine user confidence and hinder adoption among high-risk populations.

To address this issue, system manufacturers are adopting multi-network communication models that incorporate cellular, Wi-Fi, and landline connectivity to ensure continuous operation across varying environments. The development of devices with offline functionality capable of storing critical health data and executing basic alerts without active connectivity also enhances system resilience.

Moreover, strategic collaboration with telecom providers and public sector stakeholders supports infrastructure expansion in underserved regions. Incorporating user-friendly interfaces and automatic diagnostics helps mitigate connectivity issues at the user level, while continued investment in IoT-based solutions and edge computing technologies ensures that medical alert systems remain functional, reliable, and accessible even in low-connectivity settings.

- In February 2024, KORE and Medical Guardian launched the MGMini, the first eSIM-powered medical alert device. The device uses OmniSIM technology to switch between network carriers for continuous connectivity. It features two-way communication to connect users with emergency services and caregivers, improving user safety and addressing connectivity issues.

Market Trend

Increasing Penetration of Wearable and Mobile Alert Solutions

Wearable and mobile alert solutions are significantly transforming the medical alert systems market by enhancing user mobility, convenience, and continuous health monitoring. Modern devices, such as smartwatches, pendants, and wristbands, are equipped with advanced sensors that track vital signs, detect falls, and provide GPS location data, enabling real-time health status monitoring and emergency alerts.

These intelligent features allow for immediate detection of emergencies and rapid communication with caregivers or monitoring centers, reducing response times and improving patient safety.

Integration with smartphones and telehealth platforms further facilitates seamless data sharing, supporting proactive healthcare management and remote monitoring. Additionally, customizable alert settings and two-way communication capabilities improve user engagement and ensure personalized care.

The advancement and accessibility of wearable technologies are driving the adoption of medical alert systems and supporting the broader shift toward connected, patient-centered healthcare solutions.

- In September 2024, Consumer Cellular launched the IRIS Ally, a wearable medical alert device featuring fall detection, GPS tracking, and two-way communication. The lightweight, waterproof device includes fall detection at no additional cost and is available online and through select retailers. It is designed to provide reliable and accessible emergency assistance.

Medical Alert Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Landline-based, Cellular-based, Standalone-based

|

|

By Connection

|

Wired, Wireless

|

|

By End Use

|

Home-based users, Nursing homes, Assisted living facilities, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Landline-based, Cellular-based, and Standalone-based): The landline-based segment earned USD 3.45 billion in 2024 due to its widespread availability, affordability, and reliability in providing emergency communication for elderly users.

- By Connection (Wired and Wireless): The wired segment held a share of 61.92% in 2024, propelled by its stable connectivity, lower susceptibility to signal interference, and established infrastructure in residential settings.

- By End Use (Home-based users, Nursing homes, Assisted living facilities, and Others): The home-based users segment is projected to reach USD 6.54 billion by 2032, owing to the increasing preference for aging in place and the growing demand for independent living supported by remote monitoring technologies.

Medical Alert Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America medical alert systems market share stood at around 34.07% in 2024, valued at USD 3.06 billion. This dominance is attributed to the region’s well-established healthcare infrastructure, high healthcare expenditure, and widespread adoption of advanced medical technologies.

The North America medical alert systems market share stood at around 34.07% in 2024, valued at USD 3.06 billion. This dominance is attributed to the region’s well-established healthcare infrastructure, high healthcare expenditure, and widespread adoption of advanced medical technologies.

Furthermore, increasing investments in remote patient monitoring and aging-in-place initiatives, along with growing awareness of senior safety and chronic disease management, are propelling market expansion.

The region’s strong regulatory environment, including data privacy and medical device standards, supports the development and adoption of innovative medical alert solutions. Additionally, the presence of major market players and ongoing advancements in wearable and IoT-enabled alert systems strengthen regional market in North America.

- In April 2025, LogicMark’s Freedom Alert Max medical alert device was approved by the U.S. General Services Administration, allowing federal agencies such as the Veterans Administration to procure it. The Freedom Alert Max is equipped with AI-driven fall detection, 4G LTE connectivity, GPS tracking, two-way communication, and around-the-clock professional monitoring.

The Asia-Pacific medical alert systems industry is estimated to grow at a robust CAGR of 11.14% over the forecast period. This growth is propelled by increasing healthcare awareness and a rapidly expanding elderly population, particularly in emerging economies such as China and India.

Government initiatives aimed at improving healthcare infrastructure and promoting digital health adoption are further fueling market expansion. Additionally, improving economic conditions and greater smartphone penetration are accelerating the demand for advanced, affordable medical alert solutions.

Moreover, a growing preference for home-based care models and the entrance of both global and local players offering innovative, cost-effective products are intensifying market competition and driving technological advancements across the region.

- In January 2023, FallCall Solutions, LLC collaborated with HSC Technology Group to introduce its mobile medical alert system in Australia. This partnership integrates FallCall’s mobile applications with HSC’s Talius Smart Care System and Bluetooth-enabled alert devices, providing users with 24/7 emergency response services upon fall detection. The solution aims to promote safer and more independent living for seniors.

Regulatory Frameworks

- In the United States, medical alert systems classified as medical devices are governed by the U.S. Food and Drug Administration’s (FDA) Quality System Regulation (21 CFR Part 820), which establishes current good manufacturing practices (CGMP) to ensure consistent design, production, and post-market handling of medical devices.

- In the European Union, medical alert systems are regulated under the Medical Device Regulation (MDR) (EU) 2017/745, which sets requirements for the safety, performance, and quality of medical devices, including conformity assessment procedures and the CE marking necessary for market approval.

- In Canada, medical alert systems classified as medical devices are regulated under the Medical Devices Regulations (SOR/98-282) by Health Canada, which mandate safety, effectiveness, labeling, and licensing requirements prior to market entry.

Competitive Landscape

The medical alert systems industry is characterized by a moderately consolidated competitive landscape, comprising a mix of established multinational healthcare technology firms and specialized medical device manufacturers. Key players are prioritizing strategies such as technological innovation, integration of wearable and IoT-enabled features, and enhancements in user interface design to meet diverse consumer needs and improve system reliability.

Companies are also investing in research and development to create compact, user-friendly devices that comply with healthcare regulations and data privacy standards while offering advanced functionalities such as AI-driven monitoring and real-time communication.

Moreover, strategic collaborations with healthcare providers, along with mergers and acquisitions, are being employed to expand market penetration, enhance service offerings, and strengthen presence across home-based, assisted living, and institutional care segments.

- In October 2024, Mytrex, Inc. partnered with Indie Health to launch a remote patient monitoring solution. The system integrates Mytrex’s MXD-LTE medical alert device with Indie Health’s devices and cloud platform to provide real-time health monitoring. This solution aims to improve patient care by delivering timely data to caregivers and healthcare providers.

List of Key Companies in Medical Alert Systems Market:

- Bay Alarm Medical

- Medical Guardian LLC

- ADT

- LifeFone Medical Alert Services

- Life Alert Emergency Response, Inc.

- LifeStation, Inc.

- MobileHelp

- GETSAFE, LLC

- Aloe Care Health

- AlertOne Services, LLC.

- Lifeline

- Connect America

- Rescue Alert

- LogicMark

- ModivCare

Recent Developments (M&A)

- In May 2024, Medical Guardian acquired MobileHelp from Advocate Aurora Enterprises, expanding its personal emergency response and remote patient monitoring services. The acquisition enhances Medical Guardian’s MGEngage360 platform to improve wellness outreach and care management. MobileHelp will continue operating under its brand in both direct-to-consumer and commercial markets.

Key Highlights

Key Highlights The North America medical alert systems market share stood at around 34.07% in 2024, valued at USD 3.06 billion. This dominance is attributed to the region’s well-established healthcare infrastructure, high healthcare expenditure, and widespread adoption of advanced medical technologies.

The North America medical alert systems market share stood at around 34.07% in 2024, valued at USD 3.06 billion. This dominance is attributed to the region’s well-established healthcare infrastructure, high healthcare expenditure, and widespread adoption of advanced medical technologies.