Meat Substitute Market Size

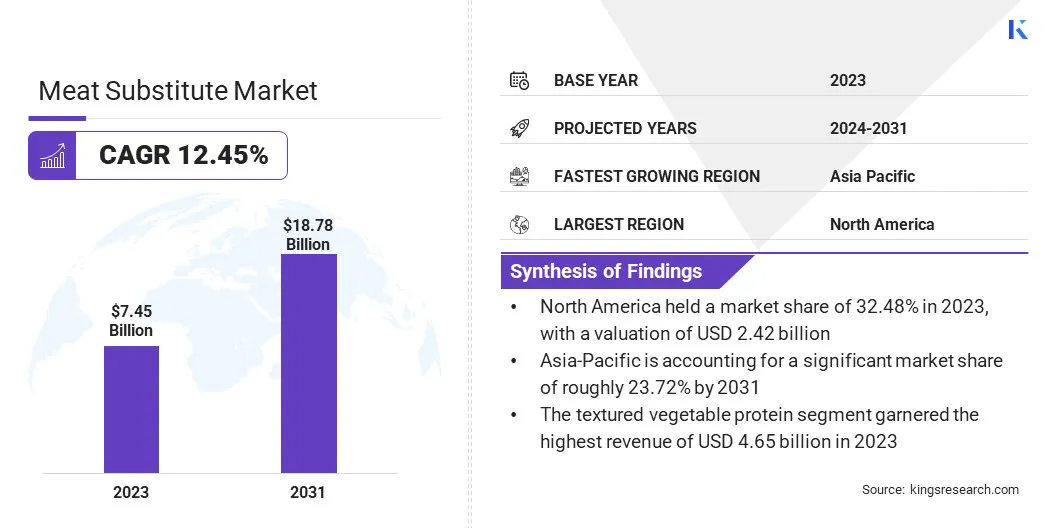

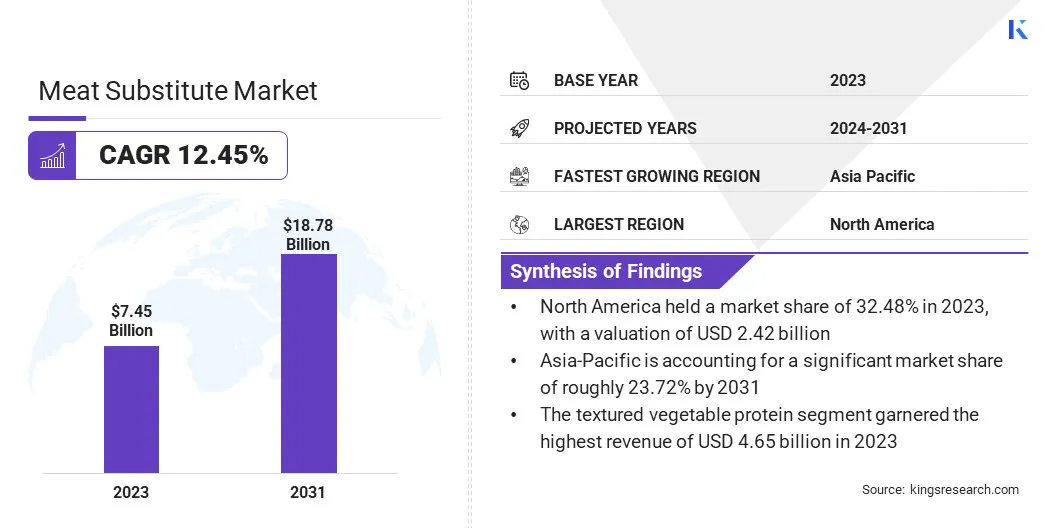

Global Meat Substitute Market size reached USD 7.45 billion in 2023, with projections indicating that the industry revenue is likely to be USD 8.26 billion by the end of 2024. The meat substitute industry is anticipated to be valued at USD 18.78 billion by 2031, exhibiting a compound annual growth rate (CAGR) of 12.45% between 2024 and 2031.

In the scope of work, the report includes products offered by companies such as Cargill, Incorporated., House Foods America Corporation, Impulse Foods, Nasoya, Roquette Frères, Taiki Bussan Co., LTD., Tofurei Engel, Tootie’s Tempeh, DSM, MEIJI TOFU CO., and others.

The growth of the meat substitute market is driven by increasing consumer awareness concerning health and sustainability. Growing concerns regarding animal welfare and environmental impact are fostering an increased demand for plant-based alternatives. Additionally, technological advancements in food processing contribute to improved taste and texture of meat substitutes, thereby attracting a broader consumer base.

Moreover, the rise in vegetarian and flexitarian lifestyles is fueling market growth, as these individuals are seeking products that provide the same taste and mouthfeel as meat without compromising their dietary choices or ethical beliefs.

The meat substitute market exhibits robust growth, primarily driven by shifting consumer preferences toward healthier, more sustainable dietary options. Market players are extensively innovating, offering a diverse range of plant-based alternatives that closely mimic the taste and texture of meat products. This innovation, coupled with effective marketing strategies that highlight the health and environmental benefits of meat substitutes, is facilitating significant market penetration.

Furthermore, partnerships between food companies and renowned chefs are enhancing the culinary appeal of meat substitutes, attracting both health-conscious consumers and food enthusiasts. Meat substitutes encompass a diverse array of products such as textured vegetable protein, tempeh, tofu, seitan, and others to cater to diverse consumer preferences.

The meat substitute market encompasses plant-based products designed to replicate the taste, texture, and nutritional profile of conventional meat items. These products, often made from soy, wheat, pea protein, or other plant sources, are specifically tailored for individuals seeking to reduce their meat consumption due to health, environmental, or ethical considerations.

Analyst’s Review

Manufacturers are intensifying efforts to enhance meat substitute products, with a major focus on refining taste, texture, and nutritional profiles. They are launching new products featuring innovative ingredients and formulations that cater to diverse consumer preferences.

Significant investments in sustainable sourcing and packaging underline the industry’s commitment to eco-conscious practices. Continuous product innovation and effective marketing strategies aligning with consumer trends are likely to bolster market growth in the forecast duration (2024-2031).

Meat Substitute Market Growth Factors

The increasing consumer demand for healthier and more sustainable dietary options is leading to the increased demand for meat substitutes. Consumers are actively seeking plant-based alternatives to traditional meat products due to growing concerns regarding personal health and environmental impact.

The rising demand and subsequent sales of meat substitutes across various retail channels reflect a shift in consumer preferences toward more plant-centric diets. Companies in the market are capitalizing on this demand by continuously innovating and improving their product offerings to meet the evolving needs and preferences of health-conscious consumers.

The disparity in taste and texture compared to traditional meat poses a significant challenge to market development. To overcome this challenge, companies are focusing on research and development to enhance the sensory characteristics of their products.

Utilizing advanced food processing technologies and careful selection of plant-based ingredients is enabling manufacturers to create meat substitutes that closely mimic the texture, taste, and mouthfeel of conventional meat. Additionally, effective marketing strategies that effectively emphasize the culinary versatility and health benefits of meat substitutes are aiding in overcoming consumer skepticism while encouraging trial and adoption of these products.

Meat Substitute Market Trends

The increasing adoption of plant-based meat substitutes by mainstream fast-food chains and restaurants is gaining prominence in the market. Major players in the foodservice industry are incorporating plant-based options into their menus to cater to the growing demand from consumers who are seeking healthier and more sustainable choices.

This reflects a shift in consumer preferences toward flexitarian and vegetarian diets, thereby fostering innovation and collaboration between foodservice providers and meat substitute manufacturers. This is providing consumers with greater accessibility to plant-based options when dining out, thus, contributing to the overall growth and acceptance of meat substitutes in the market.

Expansion of the meat substitute market beyond traditional product categories is gaining traction in the market. While burgers and sausages initially dominated the market, manufacturers are increasingly focusing on diversification of product offerings to develop and incorporate plant-based alternatives for seafood, poultry, and dairy products.

This highlights the ongoing commitment to innovation and product development efforts within the industry to meet the varied dietary preferences of consumers. Companies are leveraging advanced food science and culinary expertise to develop a wide range of meat substitutes that replicate the taste and texture of animal-based products while offering nutritional benefits and sustainability advantages.

Segmentation Analysis

The global meat substitute market is segmented based on type, distribution channel, and geography.

By Type

Based on type, the market is categorized into textured vegetable protein, tempeh, tofu, seitan, and others. The textured vegetable protein segment led the market in 2023, reaching a valuation of USD 4.65 billion. The segment has experienced significant expansion as TVP offers a versatile and cost-effective alternative to meat, appealing to both budget-conscious consumers and food manufacturers.

Moreover, the increasing focus on plant-based diets and sustainability is boosting demand for TVP, as it is derived from plant sources and its a comparatively lower environmental footprint compared to animal-based proteins. Additionally, advancements in food technology have improved the taste and texture of TVP, making it more appealing to a wider consumer base.

By Distribution Channel

Based on distribution channel, the market is divided into food retail, foodservice (HoReCa sector), online retail, and other retail formats. The food retail segment secured the largest revenue share of 44.84% in 2023.

The segment is witnessing substantial expansion within the meat substitute market, primarily due to its widespread accessibility and convenience for consumers. Food retail outlets, including supermarkets, hypermarkets, and specialty stores, offer a diverse range of meat substitute products to accommodate diverse consumer preferences.

Moreover, the implementation of strategic merchandising and promotional efforts by retailers has increased consumer awareness, thus, stimulating the trial and adoption of meat substitutes. The growing demand for plant-based alternatives in mainstream retail channels is further fueling the expansion of the food retail segment, solidifying its position as the key distribution channel for meat substitute products.

Meat Substitute Market Regional Analysis

Based on region, the global meat substitute market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Meat Substitute Market share stood around 32.48% in 2023 in the global market, with a valuation of USD 2.42 billion. This dominance is largely attributed to the region’s well-established consumer base characterized by increased awareness regarding health and sustainability issues. This is leading to robust demand for plant-based alternatives in the region.

Additionally, the presence of key market players and extensive R&D activities contribute to product innovation and market penetration. Moreover, favorable government regulations and initiatives promoting plant-based diets are supporting North America meat substitute market growth.

Asia-Pacific is poised to witness significant growth over the forecast period, accounting for a significant market share of roughly 23.72% by 2031. Asia-Pacific is emerging as the fastest-growing region in the meat substitute market due to its large population base and increasing disposable income levels. This contributes to rising consumer awareness and demand for healthier food choices, including meat substitutes.

Additionally, shifting dietary preferences toward plant-based diets, facilitated by rising concerns regarding health, animal welfare, and environmental sustainability, boosts Asia-Pacific meat substitute market growth. Moreover, the growing presence of international food companies and increased investments in product development and marketing activities foster the adoption of meat substitutes.

Competitive Landscape

The global meat substitute market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Meat Substitute Market

- Cargill, Incorporated.

- House Foods America Corporation

- Impulse Foods

- Nasoya

- Roquette Frères

- Taiki Bussan Co., LTD.

- Tofurei Engel

- Tootie’s Tempeh

- DSM

- MEIJI TOFU CO.

Key Industry Developments

- February 2024 (Launch): Roquette expanded its NUTRALYS plant protein line by introducing four new pea proteins, including isolate, hydrolysate, and textured options. These innovations aimed to enhance taste, texture, and versatility in plant-based foods and high-protein products. The launch broaden the scope of diverse application within the food industry, addressing common challenges faced during the development of plant protein-based foods and beverages. The new ingredients offered improved textures and high protein content, thereby enriching products such as nutritional bars, protein drinks, and meat alternatives.

- October 2023 (Launch): Keystone Natural Holdings' Franklin Farms division introduced Chickpea Tempeh, a new plant-based product. This offereding presented soy-free options characterized by rich flavor profiles and nutritional benefits, catering to various dietary preferences. The product was launched at Price Chopper and Market 32 stores in the Northeast, thereby expanding its market reach and meeting the growing demand for innovative plant-based offerings.

The Global Meat Substitute Market is Segmented as:

By Type

- Textured Vegetable Protein

- Tempeh

- Tofu

- Seitan

- Others

By Distribution Channel

- Food Retail

- Foodservice (HORECA Sector)

- Online Retail

- Other Retail Formats

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America