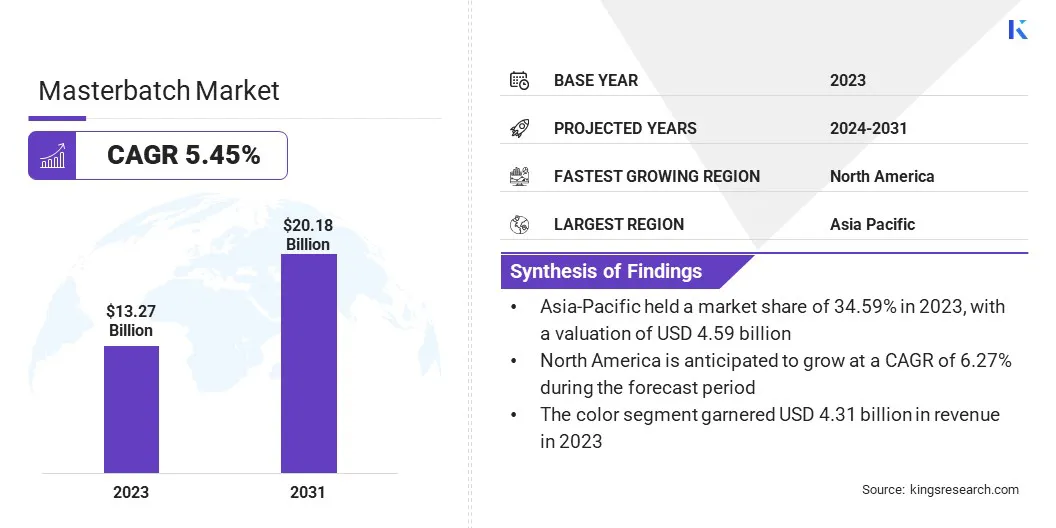

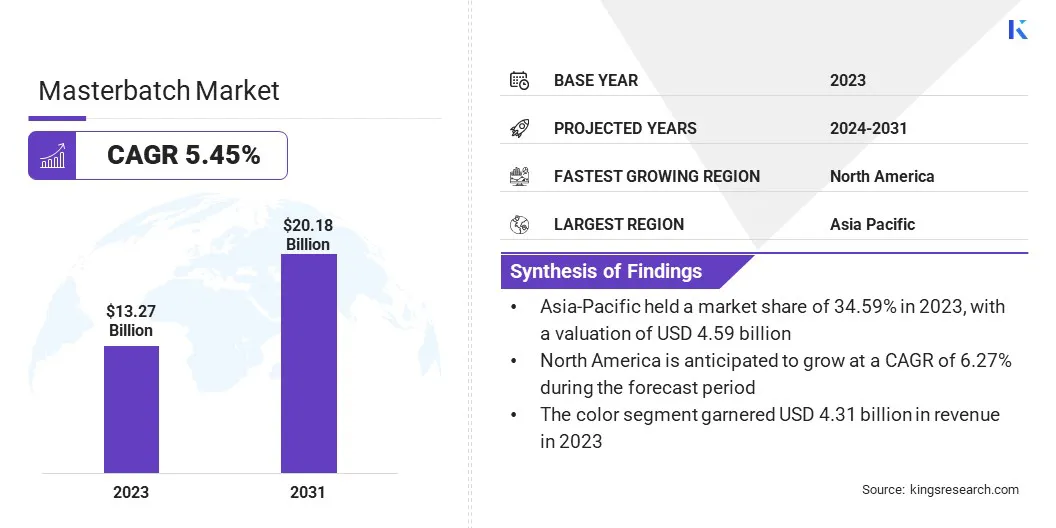

Masterbatch Market Size

Global Masterbatch Market size was recorded at USD 13.27 billion in 2023, which is estimated to be at USD 13.91 billion in 2024 and projected to reach USD 20.18 billion by 2031, growing at a CAGR of 5.45% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Americhem, Ampacet Corporation, Avient Corporation, Cabot Corporation., Hubron International, LyondellBasell Industries Holdings B.V., Penn Color Inc., Plastiblends, Plastika Kritis S.A., Tosaf Group Ltd., and others.

The growth of the masterbatch market is driven by the growing demand for plastic products across various industries such as packaging, automotive, and consumer goods. Rapid urbanization and industrialization in emerging economies contribute to higher consumption of plastics, thereby boosting masterbatch demand.

Additionally, the rising focus on sustainability and the need for recyclable and eco-friendly plastic products are fueling market growth. Technological advancements in the production of masterbatch, enabling enhanced product performance and customization, further play a significant role in augmenting market expansion.

- In May 2024, Cabot Corporation unveiled its latest REPLASBLAK universal circular black masterbatches, featuring certified sustainable materials. This launch marked the introduction of two pioneering products, recognized as inaugural universal circular black masterbatches in the industry with International Sustainability & Carbon Certification (ISCC PLUS) certified content.

The masterbatch market is experiencing significant growth due to the rising demand for high-performance plastics in various sectors, including packaging, where lightweight and durable materials are essential; automotive, where materials with specific mechanical properties are required; and construction, where weather-resistant plastics are in higher demand.

Innovations in masterbatch formulations are enabling the development of products with enhanced functionalities, such as UV resistance, antimicrobial properties, and improved mechanical strength. Additionally, the growing shift toward sustainable and biodegradable masterbatch solutions is gaining significant traction, aligning with global environmental goals and regulations.

Masterbatch refers to a concentrated mixture of additives and/or pigments encapsulated during a heat process into a carrier resin, which is then cooled and cut into granules. This product is used to impart color and enhance the properties of plastic products. Masterbatches offer several advantages over raw additives, such as ease of handling, enhanced dispersion of pigments/additives, and improved product consistency.

They are utilized in various manufacturing processes, including injection molding, blow molding, and extrusion. They play a crucial role in the plastic industry by ensuring uniformity and quality in the final products.

Analyst’s Review

Manufacturers in the masterbatch market are making significant efforts to innovate and address concerns regarding sustainability in the industry. Investment in R&D to develop biodegradable and recyclable masterbatches is a key strategy adopted by prominent players, which aligns with global environmental goals.

Development of new products with enhanced functionalities, such as UV resistance and antimicrobial properties, are being introduced to meet diverse industry needs. These advancements are expected to drive market growth and cater to evolving consumer and regulatory demands.

Masterbatch Market Growth Factors

The increasing demand for lightweight and durable materials in the automotive industry is contributing to the progress of the masterbatch market. Automakers continuously seek ways to improve fuel efficiency and reduce emissions, which leads to a preference for high-performance plastic components over traditional metal parts.

Masterbatch additives enhance the properties of these plastics, making them highly suitable for various automotive applications. This is particularly prominent in electric vehicles, where weight reduction is critical. The versatility and cost-effectiveness of masterbatch solutions render them an attractive option for manufacturers aiming to meet stringent environmental regulations and consumer expectations.

- According to the U.S. Energy Information Administration, in 2023, the combined sales of plug-in hybrid electric, hybrid and battery electric vehicles rose to 16.3% of the total sales of light-duty vehicle sales in the country.

The environmental impact of plastic waste poses a key challenge to market development. The growing concern over plastic pollution and stringent regulations are placing pressure on manufacturers to adopt more sustainable practices. To overcome this challenge, industry players are increasingly prioritizing the development and use of biodegradable and recyclable masterbatch solutions.

Investment in research and development to create eco-friendly additives without compromising performance is essential. Additionally, the promotion of the use of recycled plastics and the implementation of efficient recycling systems helps mitigate the environmental impact and aligns with global sustainability goals.

- According to the World Economic Forum, approximately 400 million tons of plastic waste was generated globally (2023), accounting for 12% of the overall solid waste generated in middle and low-income countries.

Masterbatch Market Trends

The increasing adoption of sustainable and eco-friendly solutions is a major trend shaping the market landscape. This trend has prompted manufacturers to develop biodegradable masterbatches and solutions that are compatible with recycled plastics to address rising environmental concerns. This shift is further propelled by stringent regulations aimed at reducing plastic waste, along with rising consumer inclination toward greener products.

Companies are investing heavily in research to create high-performance, sustainable additives that maintain the quality and functionality of conventional plastics. This helps align the plastic industry with global sustainability initiatives, thus promoting a circular economy and reducing the environmental footprint of plastic products.

The growing use of advanced technologies in masterbatch production is resulting in innovations such as the integration of nanotechnology and the development of smart additives to enhance the functionality of masterbatches. This leads to improved properties such as increased strength, UV resistance, and antimicrobial effects.

These advanced masterbatches are gaining significant traction in high-demand sectors such as healthcare, automotive, and packaging. The integration of such technologies is enabling manufacturers to meet specific industry requirements and offer tailored solutions, thereby expanding the applications of masterbatches and stimulating market growth.

Segmentation Analysis

The global masterbatch market is segmented based on type, polymer, application, and geography.

By Type

Based on type, the market is categorized into white, black, color, additive, and filler. The color segment led the market in 2023, reaching a valuation of USD 4.31 billion. This growth is majorly attributed to the rising demand for aesthetically appealing plastic products across various industries. The packaging sector is experiencing strong demand, as brands increasingly seek to differentiate their products on shelves through vibrant and attractive packaging.

Additionally, advancements in color masterbatch formulations are enabling better customization and performance, which is appealing to manufacturers in the consumer goods and automotive industries. This is further supported by the increasing use of plastics over traditional materials, which necessitates the use of high-quality color masterbatches.

By Polymer

Based on polymer, the market is segmented into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and other carrier polymers. The polypropylene (PP) segment secured the largest market share of 34.56% in 2023. This notable growth is primarily fueled by its widespread use across various applications, such as packaging and automotive components, due to its versatility, cost-effectiveness, and excellent mechanical properties.

Masterbatches offer high chemical resistance and can be easily processed into various forms, contributing significantly to segmental growth. The growing demand for lightweight and durable materials in the automotive and packaging industries is further driving the use of polypropylene, as manufacturers increasingly seek efficient and reliable materials for diverse applications.

By Application

Based on application, the market is classified into packaging, building & construction, consumer goods, automotive & transportation, agriculture, and other end-uses. The building & construction segment is poised to witness significant growth, recording a CAGR of 7.28% through the forecast period (2024-2031). The surging demand for durable, weather-resistant, and cost-effective materials is boosting the use of masterbatches in construction applications.

Additionally, advancements in additive masterbatches are providing enhanced functionalities such as UV protection, flame retardancy, and improved structural integrity, which are crucial for building materials. The increasing adoption of sustainable construction practices is further promoting the use of eco-friendly masterbatch solutions, which is supporting the growth of this segment.

Masterbatch Market Regional Analysis

Based on region, the global masterbatch market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Masterbatch Market share stood around 34.59% in 2023 in the global market, with a valuation of USD 4.59 billion, mainly propelled by its robust industrial growth and high plastic consumption. Rapid urbanization and industrialization in major countries such as China and India are leading to the increased demand for plastics across diverse sectors such as packaging, automotive, and construction.

Additionally, the region’s strong manufacturing base and increasing investments in advanced production technologies are enhancing the quality and performance of masterbatch products. The growing focus on sustainable and recyclable plastics further supports the dominance of Asia-Pacific in the global masterbatch market.

North America is set to observe significant growth in the masterbatch market, with a CAGR of 6.27% over the forecast period. This remarkable growth is fostered by the increasing demand for high-performance and sustainable plastic products. The automotive industry, a major consumer of masterbatches, is increasingly focusing on the development of lightweight materials to improve fuel efficiency and reduce emissions.

Additionally, advancements in packaging technologies and the growing e-commerce sector are boosting the demand for innovative packaging solutions. The region's strong emphasis on environmental regulations and sustainability is leading to the widespread adoption of eco-friendly masterbatch formulations, thereby fueling North America masterbatch market growth in the forecast duration (2024-31).

Competitive Landscape

The global masterbatch market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Masterbatch Market

- Americhem

- Ampacet Corporation

- Avient Corporation

- Cabot Corporation.

- Hubron International

- LyondellBasell Industries Holdings B.V.

- Penn Color Inc.

- Plastiblends

- Plastika Kritis S.A.

- Tosaf Group Ltd.

Key Industry Developments

- April 2023 (Expansion): Penn Color, Inc. expanded its manufacturing capabilities by opening a new facility in Pluak Daeng Subdistrict, Thailand. Situated in the Eastern Economic Corridor, near major industrial areas and ports in the country, this new plant enables Penn Color to supply high-quality colorant and additive masterbatches across the Asia-Pacific region. This facility complements its Technology Center in Singapore, thereby enhancing the product delivery speed to the market and improving operational flexibility.

- November 2023 (Partnership): Americhem, Inc., leading provider of polymer solutions, partnered with Nexeo Plastics to distribute engineered compounds in North America. Nexeo Plastics became the preferred distributor for Americhem's engineered compounds across Canada, Mexico, Puerto Rico, and the United States. This collaboration reflects Americhem’s dedication to providing top-notch engineered compounds and services to customers in North America. The agreement covers Americhem's renowned ColorFast, ColorRx, InColor, InElec, InLube, and InStruc compounds, which are known for their ability to optimize performance and aesthetics in thermoplastic products.

The Global Masterbatch Market is Segmented as:

By Type

- White

- Black

- Color

- Additive

- Filler

By Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Other Carrier Polymers

By Application

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Other End-Uses

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America