Market Definition

The market covers the production and use of magnesium stearate, a salt obtained from stearic acid and magnesium. It is widely used in tablets and capsules as a lubricant and anti-adherent agent. This market includes pharmaceutical, cosmetic, food, and plastics sectors.

The manufacturing of magnesium stearate involves precipitation or fusion methods. It is used in powder blending, tablet pressing, and as a stabilizer in plastics. The market’s scope spans industrial processing, formulation technology, and regulatory-compliant applications.

Magnesium Stearate Market Overview

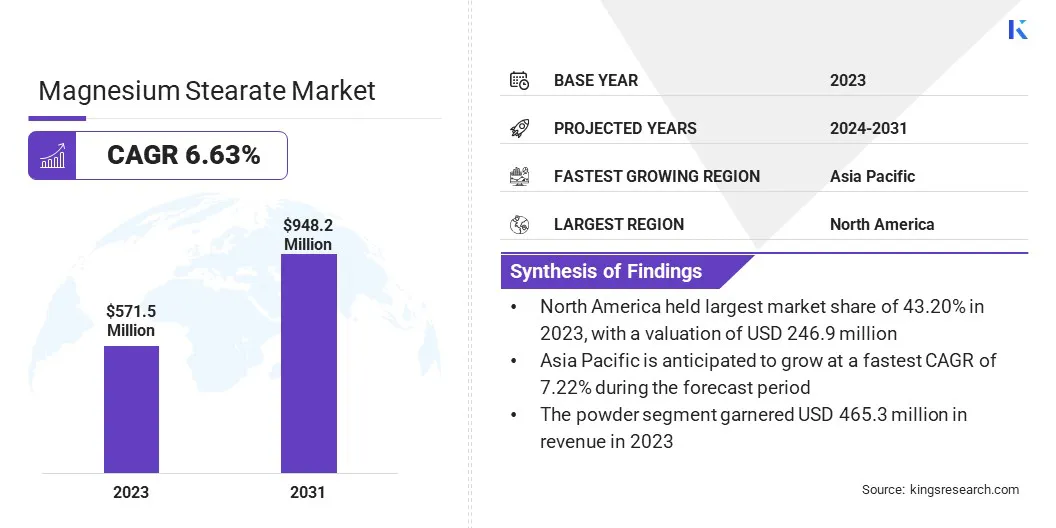

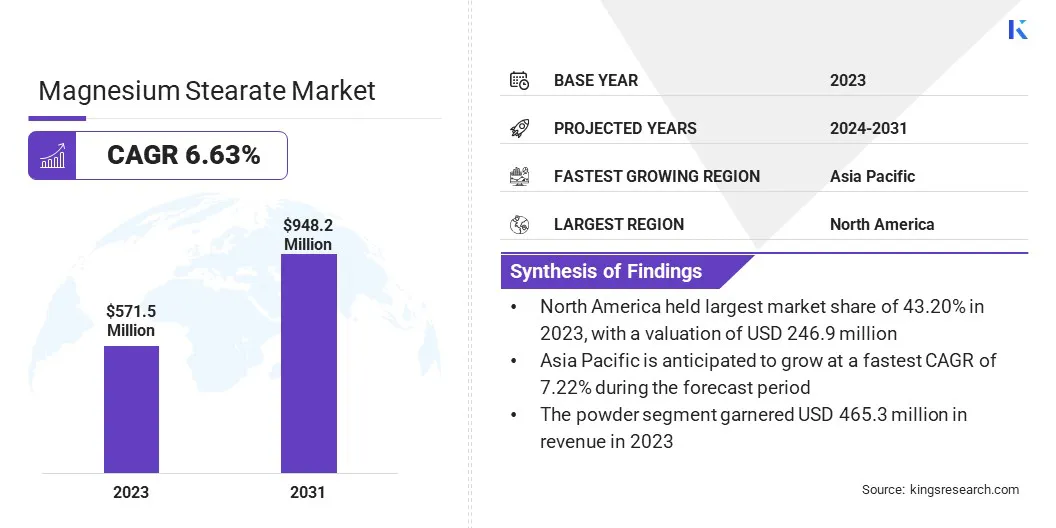

The global magnesium stearate market size was valued at USD 571.5 million in 2023 and is projected to grow from USD 605.0 million in 2024 to USD 948.2 million by 2031, exhibiting a CAGR of 6.63% during the forecast period.

The growth of the market is influenced by the expanding nutraceutical industry, where magnesium strearate is widely used as a flow agent in dietary supplements. Advancements in formulation technology are also improving product stability and efficiency, prompting higher demand across pharmaceutical and nutraceutical applications.

Major companies operating in the magnesium stearate industry are Peter Greven GmbH & Co. KG, Baerlocher GmbH, Struktol Company of America, LLC, Dover Chemical Corporation, Mallinckrodt, Roquette Frères, Hebei Fengse New Material Technology Co., Ltd., Parchem Fine & Specialty Chemicals, PMC Group, Inc., Norac Additives, LLC, Sinwon Chemical Co., Ltd., Valtris Specialty Chemicals, Kyowa Chemical Industry Co., Ltd., Croda International Plc, and BASF.

The increasing output of pharmaceutical tablets and capsules is significantly driving the growth of the market. This compound functions as a critical lubricant and anti-adherent during tablet compression. With the expansion of generic drug manufacturing and rising global healthcare access, manufacturers continue to depend on magnesium stearate to meet efficiency, quality, and stability requirements.

Key Highlights

Key Highlights

- The magnesium stearate industry size was valued at USD 571.5 million in 2023.

- The market is projected to grow at a CAGR of 6.63% from 2024 to 2031.

- North America held a market share of 43.20% in 2023, with a valuation of USD 246.9 million.

- The Powder segment garnered USD 465.3 million in revenue in 2023.

- The Pharmaceuticals segment is expected to reach USD 474.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.22% during the forecast period.

Market Driver

Expanding Nutraceutical Industry

The growing popularity of nutraceutical products among health-conscious consumers is contributing to the growth of the market. Used in dietary supplements to aid in powder flow and ensure consistent capsule content, magnesium stearate helps improve production efficiency.

As consumers seek preventive health solutions and adopt regular supplement use, manufacturers are increasing output, which has accelerated the adoption of magnesium stearate in formulation processes across global markets.

In February 2025, A clinical study conducted by the research team at Bionos Biotech SL and Lubrizol Nutraceuticals confirmed that Lubrizol's MAGSHAPE magnesium microcapsules provide enhanced magnesium absorption. This innovation could influence the use of magnesium compounds, including magnesium stearate, in nutraceutical formulations.

Market Challenge

Regulatory Compliance and Quality Assurance

A significant challenge for the growth of the magnesium stearate market is ensuring compliance with stringent regulatory standards across various regions. With varying requirements in the pharmaceutical and food industries, manufacturers must constantly adapt to new regulations to maintain product quality and safety.

To address this challenge, key players are investing in advanced quality control systems, enhancing their research and development processes, and seeking certifications like GMP (Good Manufacturing Practice). Additionally, some players are increasing collaborations with regulatory bodies to stay updated on changes and improve their ability to meet compliance requirements efficiently.

Market Trend

Advancements in Formulation Technology

Innovations in solid dosage formulation and direct compression technology have enhanced the role of excipients such as magnesium stearate. Manufacturers are optimizing processes for speed, cost, and dosage control.

Magnesium stearate’s consistent lubrication properties and compatibility with a wide range of APIs make it vital for modern formulation systems. These technical improvements are helping fuel the growth of the market across diverse product categories.

- In August 2024, Clariant introduced VitiPure HCO, a micronized hydrogenated castor oil designed as a tablet lubricant or sustained-release agent. This product serves as a hydrophobic lubricant suitable for direct compression or dry granulation processes, offering a potential alternative to magnesium stearate in solid oral dosage formulations. Its consistent particle size distribution enhances its suitability for modern formulation systems.

Magnesium Stearate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Powder, Flakes

|

|

By Application

|

Pharmaceuticals, Personal Care, Food and Beverages, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Form (Powder, Flakes): The Powder segment earned USD 465.3 million in 2023, owing to its superior flowability and ease of incorporation in pharmaceutical and nutraceutical formulations, enhancing production efficiency and consistency.

- By Application (Pharmaceuticals, Personal Care, Food and Beverages, and Others): The Pharmaceuticals segment held 48.49% of the market in 2023, due to its essential role as a lubricant and flow agent in tablet and capsule formulations, ensuring better consistency, manufacturing efficiency, and compliance.

Magnesium Stearate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America magnesium stearate market share stood at around 43.20% in 2023 in the global market, with a valuation of USD 246.9 million. North America has a high concentration of pharmaceutical manufacturers producing prescription and over-the-counter drugs. Major firms rely on excipients like magnesium stearate to ensure smooth tablet production and consistent dosage.

The North America magnesium stearate market share stood at around 43.20% in 2023 in the global market, with a valuation of USD 246.9 million. North America has a high concentration of pharmaceutical manufacturers producing prescription and over-the-counter drugs. Major firms rely on excipients like magnesium stearate to ensure smooth tablet production and consistent dosage.

The region’s focus on efficient manufacturing processes and compliance with regulatory standards supports continuous demand, fueling the growth of the market. Moreover, the expanding processed and convenience food segments in North America have aided the demand for anti-caking agents to maintain product quality.

Magnesium stearate helps maintain powder flow in dry mixes, spices, and functional food ingredients. With the growing consumption of packaged and ready-to-cook products, food processors continue to adopt magnesium stearate in manufacturing lines, supporting market growth.

The Asia Pacific magnesium stearate industry is poised for significant growth at a robust CAGR of 7.22% over the forecast period. Asia Pacific is a hub for cosmetic and personal care product production, with significant demand for high-quality excipients like magnesium stearate.

The region’s growing middle-income groups, with higher disposable incomes and demand for premium personal care products, has increased its use in cosmetics formulations, further boosting the market.

The Indian Brand Equity Foundation (IBEF) reported in December 2023 that the Indian cosmetic industry is projected to reach USD 20 million by 2025, growing at a CAGR of 25%. By that time, India will account for 5% of the global cosmetics market and secure a spot among the top five markets worldwide in terms of revenue.

The Indian beauty market remains one of the fastest-growing globally, with domestic brands facing intense competition as more international companies enter the Indian personal care and cosmetics sector.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) classifies magnesium stearate as Generally Recognized As Safe (GRAS) under 21 CFR Part 182 for food use. In drug formulations, magnesium stearate is used as a lubricant and is included in the FDA's Inactive Ingredient Database. The FDA's Guidance for Industry on Drug Products, including biological products, that contain nanomaterials provides recommendations on the use of excipients like magnesium stearate in drug products.

- The European Food Safety Authority (EFSA) classifies magnesium stearate as a permitted food additive with established safety limits. In pharmaceuticals, it is included in the European Pharmacopoeia and regulated by the European Medicines Agency (EMA). Products must comply with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations for excipients.

- The National Medical Products Administration (NMPA) regulates magnesium stearate under the Chinese Pharmacopoeia. It is approved for pharmaceutical use, provided it meets the defined purity and safety benchmarks, and is also permitted in some food applications. Manufacturers must register formulations and follow the national standards for excipient testing and product quality.

- The Therapeutic Goods Administration (TGA) permits magnesium stearate in complementary medicines and pharmaceuticals. It is classified as a glidant and lubricant. The ingredients must comply with specifications under the Australian Regulatory Guidelines for Complementary Medicines (ARGCM), including GMP standards and mandatory listing of excipients in product applications.

Competitive Landscape

Market players in the magnesium stearate industry are increasingly adopting technologies to enhance production quality and streamline operations. These include the integration of high-shear mixing equipment, precision milling systems, and automated material handling to improve particle uniformity and reduce contamination risks.

Several manufacturers are also investing in real-time process monitoring and control systems to ensure compliance with stringent pharmaceutical and food-grade standards. These innovations boost product reliability and regulatory approval rates and also improve operational efficiency.

List of Key Companies in Magnesium Stearate Market:

- Peter Greven GmbH & Co. KG

- Baerlocher GmbH

- Struktol Company of America, LLC

- Dover Chemical Corporation

- Mallinckrodt

- Roquette Frères

- Hebei Fengse New Material Technology Co., Ltd.

- Parchem Fine & Specialty Chemicals

- PMC Group, Inc.

- Norac Additives, LLC

- Sinwon Chemical Co., Ltd.

- Valtris Specialty Chemicals

- Kyowa Chemical Industry Co., Ltd.

- Croda International Plc

- BASF

Recent Developments (M&A)

In September 2022, Roquette acquired Crest Cellulose, an excipient manufacturer based in India. This move strengthens Roquette’s capacity to deliver pharmacopoeia-compliant, high-quality, and fully traceable excipient solutions. Its global customer network will gain from enhanced support in addressing complex drug delivery challenges.