Market Definition

The market includes integrated hardware and software solutions that automate the precise guidance, positioning, and operation of heavy equipment and industrial machinery. These systems deliver real‐time data and automated control capabilities that significantly boost operational efficiency and resource utilization.

The report provides insights into the core drivers of the market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Machine Control System Market Overview

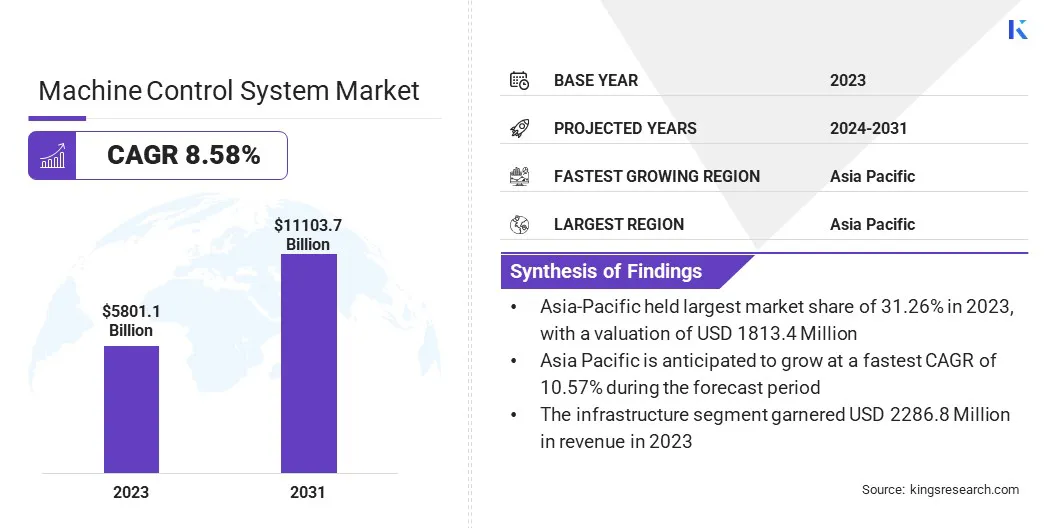

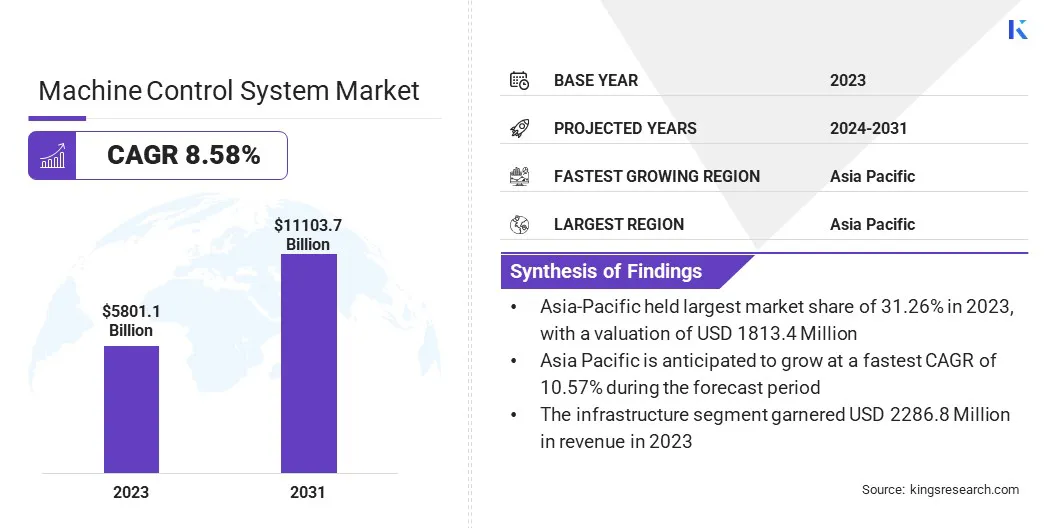

The global machine control system market size was valued at USD 5,801.1 billion in 2023 and is projected to grow from USD 6,241.1 billion in 2024 to USD 11,103.7 billion by 2031, exhibiting a CAGR of 8.58% during the forecast period.

The increasing demand for precision farming, automation in agriculture, and the need for enhanced safety and productivity in construction are driving the market. These factors enable efficient resource management, reduced operational costs, and improved operational precision.

Major companies operating in the machine control system industry are Topcon, Trimble Inc., Hexagon AB, MOBA Mobile Automation AG, Hemisphere GNSS, Inc., Komatsu, Caterpillar, EOS Positioning Systems, Inc., Deere & Company, Liebherr, Honeywell International Inc., AB Volvo, Prolec, RIB Software GmbH and its subsidiaries, and Carlson Software.

The market plays a crucial role in optimizing automation and enhancing operational efficiency across various industries. These systems improve productivity, reduce human error, and facilitate the seamless integration of complex production processes by ensuring precise control of machinery.

The adoption of machine control systems leads to cost savings by minimizing downtime and waste, enabling faster decision-making through real-time data analysis. The demand for these systems continues to grow as industries increasingly prioritize smart manufacturing and digital transformation, driving innovation and operational excellence.

- In August 2024, Spectra Precision acquired Unicontrol, a Denmark-based provider of customizable 3D machine control software systems, to strengthen its position in the construction automation market. This strategic move aims to enhance Spectra’s laser positioning portfolio by integrating Unicontrol’s intuitive, software-driven solutions, enabling greater efficiency and global reach in construction applications.

Key Highlights:

- The machine control system market size was valued at USD 5,801.1 billion in 2023.

- The market is projected to grow at a CAGR of 8.58% from 2024 to 2031.

- Asia-Pacific held a market share of 31.26% in 2023, with a valuation of USD 1,813.4 billion.

- The global navigation satellite systems (GNSS) segment garnered USD 2,027.5 billion in revenue in 2023.

- The excavators segment is expected to reach USD 3,857.8 billion by 2031.

- The infrastructure segment is anticipated to register the fastest CAGR of 10.01% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 6.50% during the forecast period.

Market Driver

Increasing Demand for Earthmoving

The increasing demand for earthmoving operations is driving the market. The need for precise and efficient earthmoving has increased as construction, mining, and infrastructure projects become more complex.

Machine control systems, which incorporate GPS, laser, and 3D modeling technologies, help automate tasks such as grading, excavation, and trenching, improving accuracy and reducing human error. These systems increase productivity, reduce material waste, and minimize the need for rework. The rising demand for efficient earthmoving solutions in global infrastructure projects continues to fuel the market.

- In July 2023, Liebherr, in collaboration with Leica Geosystems, expanded its range of semi-automatic machine control systems for Generation 8 crawler excavators. This new range features 2D "3D-ready" and 3D semi-automatic systems, targeting construction companies seeking more efficient, precise, and safe equipment for their projects. The systems are designed to enhance productivity, reduce rework, and optimize construction processes, catering to the growing demand for advanced machine control technology in the construction industry.

Market Challenge

High Initial Investment and Cost

High initial investment and ongoing maintenance costs are significant challenges for the machine control system market growth. The advanced technology and equipment required for machine control systems incur substantial upfront expenses, which can be a barrier for smaller companies or those with limited capital.

Additionally, regular maintenance and software updates are essential to ensure optimal performance, further increasing operational costs. These financial burdens can deter adoption, especially in industries where cost efficiency is crucial.

Providers are introducing flexible financing and rental agreements, subscription-based pricing, bundled solution offerings, extended product lifecycles, and thorough training and support programs to reduce barriers to adoption and lower the total cost of ownership.

Market Trend

Adoption of 3D Machine Control Systems

The adoption of 3D machine control systems is revolutionizing the market, especially in sectors like construction, mining, and agriculture. These systems leverage advanced technologies such as GPS and laser scanning to deliver precise data for real-time machine positioning, enhancing operational accuracy and reducing errors.

The integration of 3D control technology optimizes machine efficiency, reduces material waste, and minimizes labor costs, contributing to significant cost savings. Furthermore, the systems support autonomous operations, addressing labor shortages and improving safety by minimizing human intervention.

The use of 3D machine control systems is expected to result in increased productivity, safety, and profitability in industries reliant on heavy machinery.

- In April 2025, Komatsu announced the debut of its new-generation PC220LCi-12 hydraulic excavator at bauma 2025, addressing the demand for ICT construction equipment that enhances safety and efficiency. The European-spec model features intelligent machine control technology, automatic excavation movements, real-time payload display, and seamless connectivity with Smart Construction solutions.

Machine Control System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Total Stations, Global Navigation Satellite Systems (GNSS), Laser Scanners, Sensors

|

|

By Equipment

|

Excavators, Loaders, Graders, Dozers

|

|

By Vertical

|

Infrastructure, Commercial, Residential, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Total Stations, Global Navigation Satellite Systems (GNSS), Laser Scanners, Sensors): The global navigation satellite systems (GNSS) segment earned USD 2,027.5 billion in 2023, due to their widespread adoption for precise, real‑time positioning and automated control across construction, mining, and agriculture applications.

- By Equipment (Excavators, Loaders, Graders, and Dozers): The excavators segment held 31.63% share of the market in 2023, due to the extensive use of automated guidance systems and high demand for precision excavation in construction and mining projects.

- By Vertical (Infrastructure, Commercial, Residential, and Industrial): The infrastructure segment is projected to reach USD 4,865.3 billion by 2031, owing to accelerated urbanization and large‑scale infrastructure investments that drive the demand for precise and efficient machine control solutions.

Machine Control System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 31.26% share of the machine control system market in 2023, with a valuation of USD 1,813.4 billion, driven by rapid urbanization and large‑scale infrastructure investments in countries such as China and India.

Strong government support for automation, coupled with ongoing technological advancements in precision control and sensor integration, has accelerated adoption across construction, mining, and agriculture sectors.

Additionally, the cost‑effectiveness of automated workflows, through reduced labor requirements and minimized errors, has further bolstered demand. As a result, Asia Pacific remains a critical growth engine for the market

- In September 2024, China reached a significant milestone in its economic development, strengthening its innovation capabilities across various sectors such as robotics, Electric Vehicles (EVs), and pharmaceuticals. While China still lags in areas like AI and robotics, its rapid progress and massive scale make Chinese companies formidable global competitors. This growing innovation, supported by government policies, positions China to challenge established leaders in high-tech industries, potentially impacting sectors like machine control systems through increased competition and demand for advanced automation technologies.

The machine control system industry in the Middle East & Africa is poised for significant growth at a robust CAGR of 9.67% over the forecast period. This expansion is driven by large-scale infrastructure projects and urban development initiatives, particularly in countries like Saudi Arabia, the U.A.E., and Egypt.

Government-led economic diversification programs, such as Saudi Arabia’s Vision 2030, are accelerating investments in construction and smart city projects, creating strong demand for automated and precise construction technologies. Additionally, rising labor costs and the need for greater efficiency are pushing contractors toward adopting machine control systems.

Increased foreign investments, partnerships with global technology providers, and growing awareness of digital construction tools are further fueling the market in the region.

- In March 2025, Saudi Arabia unveiled several ambitious giga projects under Vision 2030, including NEOM Smart City, Red Sea Resort Project, and Qiddiya Entertainment City. These developments aim to diversify the economy and stimulate growth in tourism, transportation, and infrastructure. The expansion of these large-scale projects significantly drives the demand for advanced machine control systems in construction, facilitating precision operations and boosting efficiency.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) standards play a crucial role in regulating worker safety on construction sites. The implementation of machine control systems helps companies comply with these safety regulations by minimizing human error and enhancing the precision of equipment operations. Machine control systems aid in safer working conditions by automating tasks like grading and excavation, reducing the likelihood of accidents and improving overall site safety

Competitive Landscape

Key players in the machine control system market compete in terms of technological advancements, strategic acquisitions, and geographic expansion. The companies are investing heavily in R&D to develop advanced motion control systems that cater to the growing demand for smart manufacturing solutions.

They are expanding their market presence through acquisitions, partnerships, and alliances with technology firms to enhance product offerings and enter new regions. Additionally, the focus on sustainability is shaping the development of energy-efficient solutions, aligning with both environmental goals and cost-reduction strategies.

- In March 2025, Volvo CE partnered with Unicontrol to integrate the company's 3D machine control technology into Volvo excavators. This collaboration streamlined operations, offering flexible and cost-efficient solutions that enhanced productivity and simplified integration, empowering customers to optimize fleet management and improve construction site efficiency.

List of Key Companies in Machine Control System Market:

- Topcon

- Trimble Inc.

- Hexagon AB

- MOBA Mobile Automation AG

- Hemisphere GNSS, Inc.

- Komatsu

- EOS Positioning Systems, Inc

- Deere & Company

- Liebherr

- Honeywell International Inc

- AB Volvo

- Prolec

- RIB Software GmbH and its subsidiaries.

- Carlson Software

Recent Developments (Product Launches)

- In April 2025, Topcon Positioning Systems announced the compatibility of its MC‑Max Asphalt paving system with Dynapac’s SD25 and XD25 Highway Paver series, catering to the growing demand for automated precision paving solutions. This integration improves paving accuracy and labor efficiency, reducing material waste and streamlining operator training.

- In February 2025, MOBA Mobile Automation presented its next-generation machine control solutions at BAUMA 2025, aligning with the growing demand for precision and automation in construction machinery. The advanced sensors and control systems empowered the construction industry to enhance efficiency, improve safety, and simplify processes, contributing to smarter, more autonomous operations in road construction, cranes, and earthmoving.

- In January 2025, John Deere introduced new autonomous machines at CES, featuring its second-generation autonomy kit. Equipped with AI, computer vision, and 360-degree camera systems, the technology aims to tackle labor shortages in agriculture, construction, and landscaping. This move highlights John Deere’s push to expand machine control and autonomy across its equipment lineup.

- In January 2024, BUMA Australia implemented Carlson Machine Control solutions across its mining sites, aligning with the growing demand for precision and safety in mining operations. The machine guidance systems enhanced safety, productivity, and mine planning by providing accurate data to optimize operations and reduce risks in open‑pit mining.