Lycopene Market Size

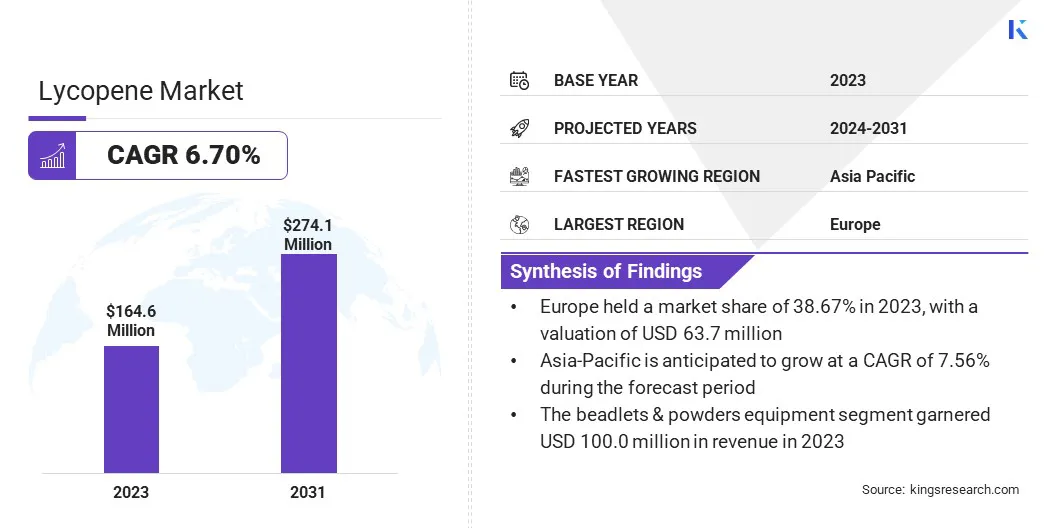

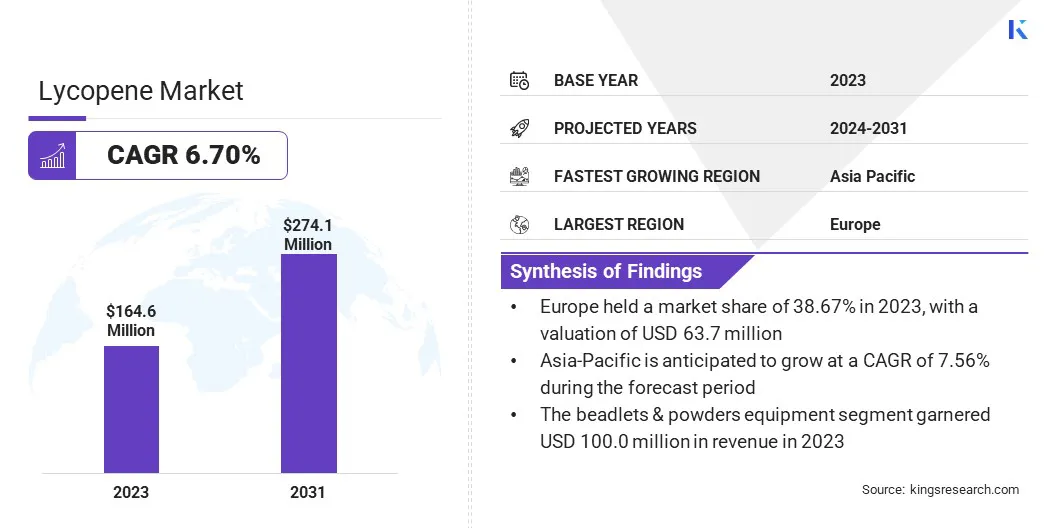

The global Lycopene Market size was valued at USD 164.6 million in 2023 and is projected to grow from USD 174.1 million in 2024 to USD 274.1 million by 2031, exhibiting a CAGR of 6.70% during the forecast period. The growth of the market is driven by increasing consumer demand for natural, health-enhancing products, rising awareness of lycopene's antioxidant benefits, and expanding applications in the food, pharmaceutical, and cosmetics industries.

In the scope of work, the report includes products offered by companies such as DSM, Döhler GmbH, Farbest Brands, Haihang Industry, Lycored, San-Ei Gen F.F.I., Inc., Shaanxi Huachen Biotech Co., Ltd., Sv Agrofood, Wellgreen Technology Co., Ltd., Xi'an Green Spring Technology Co., Ltd., and others.

The expansion of the market is fueled by increasing consumer awareness of the health benefits associated with the compound. Growing demand for natural and organic food products, coupled with the rising prevalence of chronic diseases, is propelling the growth of the market. Lycopene's antioxidant properties have been linked to reduced risks of certain cancers and cardiovascular diseases, leading to its increased use in dietary supplements and functional foods.

- According to the latest 2024 CDC data, heart disease was the leading cause of death among all genders and racial groups. In 2022, 702,880 people died from heart disease, accounting for 1 in every 5 deaths. Cardiovascular disease claimed one life every 33 seconds. From 2019 to 2020, heart disease cost approximately USD 252.2 billion, covering healthcare services, medications, and lost productivity.

Additionally, the cosmetic industry's growing interest in lycopene for skin protection and anti-aging solutions is fueling market growth. Moreover, technological advancements in extraction methods, which ensure higher purity and stability of lycopene, are supporting market expansion. Increasing demand from the pharmaceutical industry due to lycopene’s potential therapeutic benefits is a major factor contributing to the expansion of the market.

The global lycopene market is experiencing steady growth, driven by its expanding applications across various industries, including food, pharmaceuticals, and cosmetics. Europe currently dominates the market due to high consumer awareness and robust demand for dietary supplements.

However, the Asia-Pacific region is emerging as a key market for lycopene, propelled by rising disposable incomes and growing health consciousness among consumers. Challenges such as high production costs and the availability of synthetic alternatives may impede widespread adoption. However, the rising shift toward natural and organic products is expected to boost market growth in the forecast duration.

Lycopene is a naturally occurring carotenoid pigment primarily found in tomatoes, where it imparts their characteristic red color. It is a potent antioxidant that offers a range of health benefits, including reducing oxidative stress and preventing chronic diseases. Lycopene is widely used in the food and beverage industry as a natural colorant and dietary supplement.

Additionally, it has significant applications in the pharmaceutical and cosmetic industries. The market for lycopene encompasses both natural and synthetic sources. However, natural lycopene, primarily derived from tomatoes, is increasingly favored due to rising consumer preference for natural ingredients.

Analyst’s Review

Manufacturers in the lycopene market are focusing on innovation and sustainability to meet growing consumer demand for natural and health-enhancing products. Companies are investing heavily in advanced extraction technologies to improve both the yield and purity of natural lycopene, thereby making it more accessible and cost-effective.

New product developments, such as lycopene-enriched dietary supplements and functional foods, are gaining immense traction, especially in health-conscious markets. The trend and consumer focus towards natural, clean-label and organic products is prompting manufacturers to emphasize transparency and sustainability in their supply chains.

- In 2023, the International Food Information Council reported that 26% of US respondents identified "Natural" as the term most accurately defining healthy food, whereas "Non-GMO" was selected by a 14% respondents.

To maintain competitiveness, companies are recommended to prioritize research and development, expand their natural product offerings, and explore partnerships for sustainable sourcing. These efforts are essential for capturing market share in an increasingly health-focused consumer landscape.

Lycopene Market Growth Factors

The increasing focus on preventive healthcare is boosting the demand for lycopene. Consumers are becoming increasingly aware of the benefits of a balanced diet and the role of antioxidants in reducing the risk of chronic diseases. This awareness is leading to higher consumption of dietary supplements and functional foods that are enriched with lycopene. Additionally, the growing trend toward natural and organic ingredients in food and cosmetics is supporting market growth.

- According to the 2024 Organic Industry Survey conducted by the Organic Trade Association (OTA), in 2023, sales of certified organic products in the United States reached nearly USD 70 billion. The dollar sales in the American organic market increased by 3.4%, amounting to USD 69.7 billion.

Lycopene's proven efficacy in combating oxidative stress and its potential role in cancer prevention are attracting attention from both consumers and manufacturers, making it a crucial component in health-focused products.

A significant challenge impeding the development of the market is the high cost associated with production, particularly when sourcing natural lycopene from tomatoes. This challenge is hampering market growth, as consumers often find lycopene products to be expensive.

To overcome this challenge, manufacturers are exploring cost-effective extraction methods and sustainable farming practices. Investment in research and development continues to focus on improving yield and quality, with the goal of reducing production costs. By implementing these strategies, industry players are focusing on making lycopene more affordable and accessible to a broader range of consumers.

Lycopene Market Trends

A prominent trend in the market is the rising preference for natural and organic products. Consumers are increasingly seeking clean-label products, primarily due to rising health concerns and a growing awareness of the potential side effects associated with synthetic ingredients. This trend is particularly strong in the food and beverage industry, where natural lycopene is being increasingly used as a colorant and functional ingredient in a variety of products, including juices, sauces, and dietary supplements.

Furthermore, the cosmetics industry is witnessing a notable shift toward natural lycopene for its antioxidant properties, which are beneficial for skin health. This trend is prompting manufacturers to invest in natural lycopene production and innovate with new product formulations.

Additionally, the lycopene market is experiencing an increased focus on sustainable sourcing and production methods. As environmental concerns gain prominence, companies are implementing practices to reduce the environmental impact associated with lycopene extraction and production.

This includes the use of eco-friendly extraction techniques, such as supercritical carbon dioxide extraction, which minimizes solvent use and waste. Additionally, there is a major focus on using by-products from the tomato processing industry, ensuring that raw materials are fully utilized. This trend is further fueled by both regulatory pressures and surging consumer demand for environmentally responsible products.

Segmentation Analysis

The global market is segmented based on form, type, end-user industry, and geography.

By Form

Based on form, the market is categorized into beadlets & powder, liquid, and suspension/ emulsion. The beadlets & powders segment led the lycopene market in 2023, reaching a valuation of USD 100.0 million. This notable expansion is largely attributed to its versatility and stability, which are highly valued in the food, pharmaceutical, and dietary supplement industries.

Beadlets and powders offer ease of incorporation into various products, including capsules, tablets, and food items, while preserving the original taste and appearance. Their extended shelf life and controlled release properties make them a preferred choice for manufacturers. Additionally, the rising demand for dietary supplements and fortified foods is leading to the widespread adoption of lycopene in beadlet and powder forms.

By Type

Based on type, the market is classified into natural and synthetic. The natural segment is poised to witness significant growth at a robust CAGR of 7.49% through the forecast period (2024-2031), primarily due to the rising consumer preference for clean-label and organic products. Increasing awareness regarding the health benefits of natural ingredients is leading consumers to prefer products that are free from synthetic additives.

This trend is particularly strong in the food, beverage, and dietary supplement industries, where natural lycopene is favored for its numerous benefits. Additionally, stringent regulations regarding food safety and labeling in regions such as Europe and North America are prompting manufacturers to adopt natural lycopene, thereby bolstering segmental growth.

By End-User Industry

Based on end-user industry, the market is segmented into dietary supplements, food and beverages, personal care and cosmetics, pharmaceuticals, and others. The food and beverages segment secured the largest lycopene market share of 45.67% in 2023, mainly propelled by the increasing demand for natural and functional ingredients.

Lycopene's use as a natural colorant and antioxidant in food products aligns with consumer trends favoring healthier and more nutritious options. The growing popularity of fortified foods and beverages, which offer additional health benefits, is further contributing to the expansion of the segment. Additionally, the rising awareness of lycopene's potential to prevent chronic diseases is leading to its inclusion in a variety of food and beverage products.

Lycopene Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe lycopene market captured a significant share of around 38.67% in 2023, with a valuation of USD 63.7 million. This dominance is reinforced by increased consumer awareness and strong demand for natural and health-enhancing products. The region's well-established food and beverage industry that emphasizes clean-label and organic ingredients is boosting the adoption of lycopene as both a natural colorant and antioxidant.

- The European Centre for the Promotion of Imports noted that organic retail sales in Europe increased by an average rate of 10% per year, growing from USD 41.81 billion in 2017 to over USD 58.85 billion in 2021. In 2023, organic-certified foods accounted for 3.9% of the European food and drink market, with a steady annual growth rate of 7.7% since 2014, and is projected to reach 4.8% by 2027.

Additionally, stringent regulations regarding food safety and labeling standards necessitate the use of high-quality, natural ingredients, thereby boosting the demand for lycopene. The region's leading pharmaceutical and cosmetics sectors further contribute to its market dominance, as lycopene is increasingly utilized for its health benefits and skin-protective properties.

Asia-Pacific is poised to experience robust growth at a CAGR of 7.56% over the forecast period. This considerable expansion is fueled by rising disposable incomes and increasing health consciousness among consumers. The region's expanding middle-class population is leading to increased demand for dietary supplements, functional foods, and natural ingredients, with lycopene gaining significant popularity for its antioxidant and disease-preventive properties.

Additionally, the rapid growth of the food and beverage industry in countries such as China and India is contributing to the surging demand for natural colorants and additives. Local governments are promoting the adoption of healthier products, thereby supporting regional market expansion.

Competitive Landscape

The global lycopene market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Lycopene Market

- DSM

- Döhler GmbH

- Farbest Brands

- Haihang Industry

- Lycored

- San-Ei Gen F.F.I.,Inc.

- Shaanxi Huachen Biotech Co., Ltd.

- Sv Agrofood

- Wellgreen Technology Co.,Ltd.

- Xi'an Green Spring Technology Co.,Ltd

Key Industry Development

- May 2023 (Expansion): Döhler expanded its presence in the U.S. by inaugurating a new office and lab hub in North Brunswick, New Jersey. This facility is dedicated to advancing innovation in taste and flavor modulation, thereby enhancing the company's global expertise in natural flavors. It further offers solutions that span from laboratory to industrial-scale solutions, catering to customers in the food and beverage industry.

The global lycopene market is segmented as:

By Form

- Beadlets & Powder

- Liquid

- Suspension/Emulsion

By Type

By End-User Industry

- Dietary Supplements

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America