Market Definition

Luxury jewelry refers to high-end adornments crafted from precious metals, gemstones, and innovative materials, designed to convey exclusivity, craftsmanship, and status. The market includes fine necklaces, rings, bracelets, earrings, brooches, and timepieces offered by premium brands and bespoke designers.

It covers traditional and contemporary designs sold through retail, online, and private channels. The market primarily serves high-net-worth and ultra-high-net-worth individuals globally, addressing their needs for personal use, gifting, investment, and cultural or ceremonial purposes.

Luxury Jewelry Market Overview

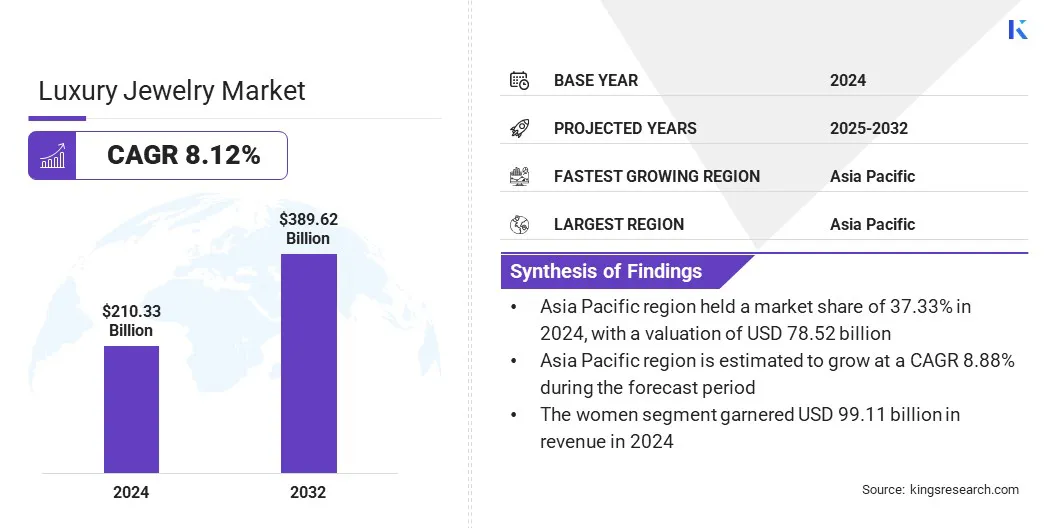

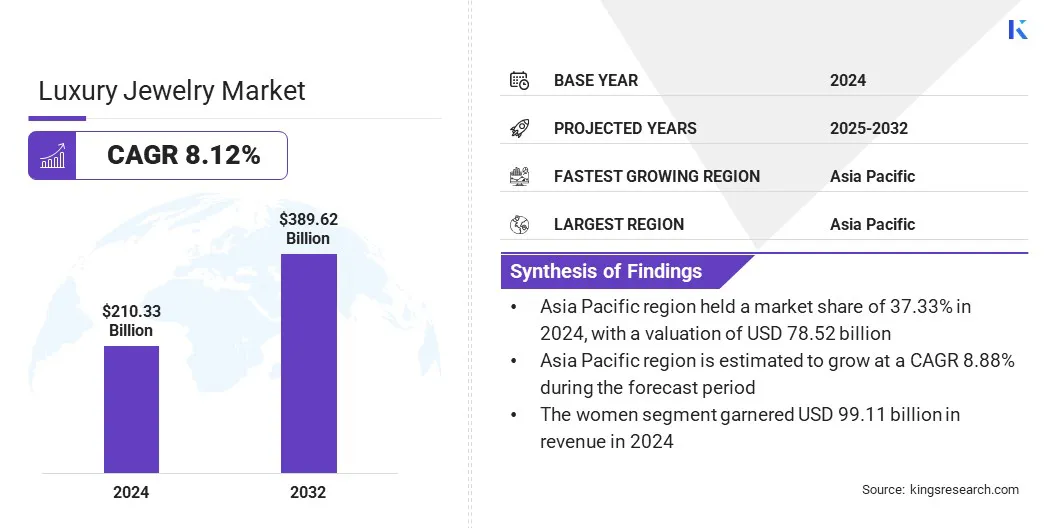

The global luxury jewelry market size was valued at USD 210.33 billion in 2024 and is projected to grow from USD 225.60 billion in 2025 to USD 389.62 billion by 2032, exhibiting a CAGR of 8.12% during the forecast period.

The market growth is attributed to the rising preference for branded and designer luxury jewelry, driven by consumer demand for premium craftsmanship and brand value. Growth is further supported by the rising popularity of men’s luxury pieces and gender-neutral jewelry, which is broadening the customer base and diversifying product offerings.

Key Market Highlights:

- The luxury jewelry industry size was recorded at USD 210.33 billion in 2024.

- The market is projected to grow at a CAGR of 8.12% from 2025 to 2032.

- Asia Pacific held a market share of 37.33% in 2024, with a valuation of USD 78.52 billion.

- The rings segment garnered USD 77.36 billion in revenue in 2024.

- The gold segment is expected to reach USD 131.61 billion by 2032.

- The men are poised for a robust CAGR of 9.35% through the forecast period.

- The mono-brand stores segment secured the largest revenue share of 39.51% in 2024.

- North America is anticipated to grow at a CAGR of 8.36% during the forecast period.

Major companies operating in the luxury jewelry market are Cartier, Tiffany & Co., Chopard, Harry Winston, Inc., Buccellati, BOUCHERON, Van Cleef & Arpels, David Yurman, Pandora, CHANEL, Piaget, Mikimoto, Chaumet, Pomellato, and Messika.

Cultural and occasion-based gifting traditions drive luxury jewelry demand, particularly in regions where adornments hold ceremonial and social value. In India and China, weddings, festivals, and milestones sustain consistent purchases of high-value gold, diamond, and gemstone pieces.

To address this demand, brands are launching targeted collections, offering personalized designs, and executing seasonal campaigns. This reinforces customer loyalty and ensures steady market growth across culturally driven economies with strong demand for premium jewelry.

Market Driver

Rising Preference for Branded and Designer Luxury Jewelry

Growing demand for branded and designer jewelry is driving market expansion, as consumers increasingly prioritize exclusivity, heritage, and superior craftsmanship. Buyers are seeking established luxury labels and contemporary designers for their signature aesthetics and long-term value.

The rising preference for branded offerings supports sustained interest in limited-edition and high-design collections. In response, manufacturers are enhancing brand positioning, investing in design innovation, and expanding digital engagement. These strategies are reinforcing brand appeal and contributing to sustained expansion across the global luxury jewelry landscape.

- For instance, in May 2025, Richemont reported an 11% year-on-year increase in jewelry sales for Q4 FY2025. Cartier and Van Cleef & Arpels contributed significantly to this performance, marking jewelry as the group’s strongest segment.

Market Challenge

Rising Raw Material Costs

High raw material cost is a key challenge in the luxury jewelry market, driven by fluctuations in gold, diamond, and gemstone prices.

This volatility affects production planning, pricing strategies, and profit margins, particularly for brands operating across multiple regions. Unstable input costs also increase financial risk, limiting flexibility in inventory and collection launches.

To mitigate this, manufacturers are optimizing supply chain operations, securing long-term sourcing contracts, and investing in recycled materials. These measures aim to stabilize cost structures and maintain pricing consistency while preserving brand value.

Market Trend

Expansion of Men’s Luxury and Gender-Neutral Jewelry

The expansion of the men’s luxury jewelry segment is emerging as a key trend, with rising demand for high-end rings, bracelets, brooches, and other gender-neutral designs. This shift reflects evolving consumer behavior as more male buyers seek luxury pieces for personal style, status, and gifting.

Designers are responding with inclusive collections that align with modern aesthetics and identity. This transition is broadening the customer base and contributing to category diversification, supporting market growth and long-term brand engagement.

- In January 2024, Louis Vuitton unveiled its Les Gastons Vuitton fine jewelry line for men. The 18-piece collection, features bold, gender-fluid designs, highlighting the brand’s focus on the growing male market.

Luxury Jewelry Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Rings, Necklaces & Pendants, Earrings, Bracelets & Bangles

|

|

By Material

|

Gold, Diamonds, Platinum, Silver

|

|

By Application

|

Women, Men, Children

|

|

By Distribution Channel

|

Mono-Brand Stores, Multi-Brand Boutiques, Brand Websites

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Rings, Necklaces & Pendants, Earrings, and Bracelets & Bangles): The rings segment earned USD 77.36 billion in 2024 due to its strong association with weddings, engagements, and milestone gifting, driving consistent high-value demand across regions.

- By Material (Gold, Diamonds, Platinum, and Silver): The gold segment held 36.12% of the market in 2024, due to its enduring cultural relevance, high intrinsic value, and strong consumer preference for investment-grade adornments.

- By Application (Women, Men, and Children): The women segment is projected to reach USD 167.36 billion by 2032, owing to sustained demand for premium adornments across personal use, gifting, and ceremonial occasions, reinforcing its position as the primary consumer base.

- By Distribution Channel (Mono-Brand Stores, Multi-Brand Boutiques, and Brand Websites): The mono-brand stores segment earned USD 83.10 billion in 2024 due to its ability to offer controlled brand experience, exclusive collections, and personalized services that enhance customer loyalty and drive premium sales.

Luxury Jewelry Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific luxury jewelry market share stood at 37.33% in 2024 in the global market, with a valuation of USD 78.52 billion. The dominance is attributed to the rising number of high-net-worth individuals across Asia Pacific, particularly in China and India, where economic growth is creating a concentrated base of high-income consumers.

This expanding wealth segment is driving demand for ultra-luxury and bespoke jewelry, reinforcing premium brand positioning. High-value purchases for investment, gifting, and status are becoming more frequent.

As a result, Asia Pacific continues to lead global consumption, supporting sustained growth and strengthening the region's position in market.

North America is poised for a significant CAGR of 8.36% over the forecast period. This growth is driven by the high penetration of online and omnichannel retail across North America, where digital-first strategies are reshaping luxury jewelry distribution.

Seamless integration of physical stores with e-commerce platforms is enhancing customer engagement and accessibility. Moreover, personalized online experiences, virtual consultations, and direct-to-consumer models are driving higher conversion rates.

This shift toward agile, tech-enabled retail formats is accelerating sales growth, positioning North America as the fastest growing region in the global market.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) oversees hallmarking for gold, silver, and platinum jewelry, ensuring compliance with the Compulsory Hallmarking Order and enforcing purity and ethical standards.

- In China, the State Administration for Market Regulation (SAMR) enforces Guobiao (GB) national standards for jewelry, regulating product quality, labeling, advertising, and retail operations across digital and physical channels.

Competitive Landscape

The competitive landscape of the luxury jewelry market is shaped by continuous product launches featuring exclusive collections, limited editions, and high-value bespoke designs.

These launches aim to strengthen brand positioning, cater to evolving consumer preferences, and capitalize on seasonal demand cycles. Companies are focusing on innovation in materials and design aesthetics, integrating gender-neutral and digitally influenced styles.

- In August 2024, Sylvie Jewelry introduced Solaz, the first of eight fine jewelry collections. Featuring yellow gold and diamond sun motifs, the collection reflects warmth and radiance, offering versatile, sun-inspired pieces that evoke a relaxed, light-filled aesthetic.

Key Companies in Luxury Jewelry Market:

- Cartier

- Tiffany & Co.

- Chopard

- Harry Winston, Inc.

- Buccellati

- BOUCHERON

- Van Cleef & Arpels

- David Yurman

- Pandora

- CHANEL

- Piaget

- Mikimoto

- Chaumet

- Pomellato

- Messika

Recent Developments (Launch)

- In April 2025, Bvlgari introduced Bvlgari Infinito, an immersive digital platform highlighting its jewelry. It offers interactive experiences, design exploration, and behind-the-scenes content on Serpenti jewelry, watchmaking, and digital art creation.