Market Definition

The low dielectric materials market involves the use of materials with low dielectric constants, which are designed to reduce electrical signal loss, interference, and delay in high-frequency electronic applications.

These materials are crucial for enhancing the performance of devices and systems such as printed circuit boards (PCBs), antennas, capacitors, and other electronic components that require minimal signal degradation.

Low Dielectric Materials Market Overview

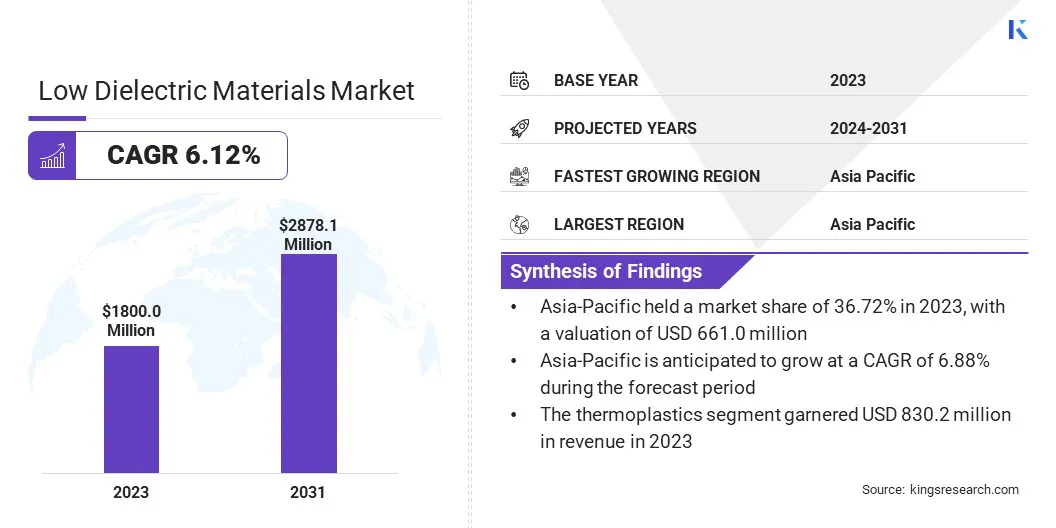

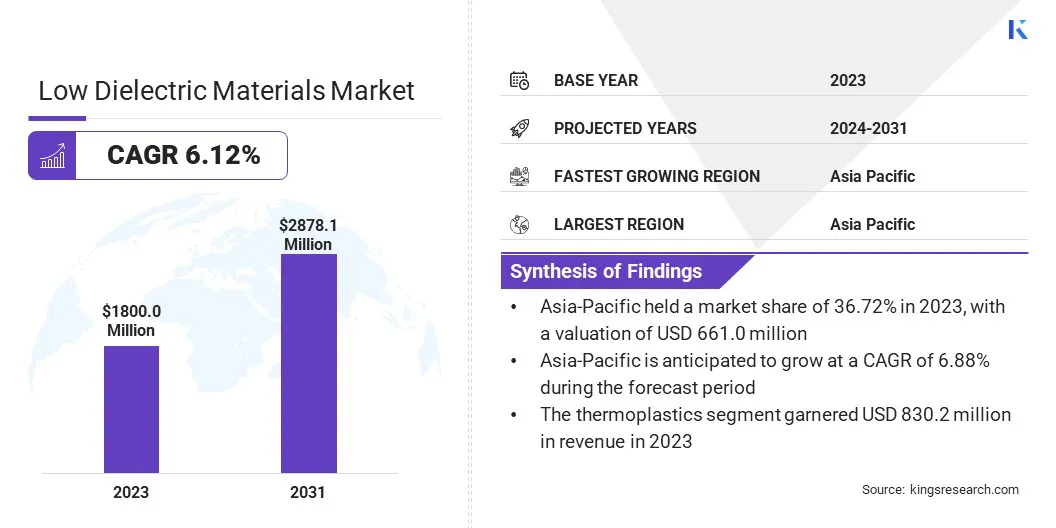

The global low dielectric materials market size was valued at USD 1,800.0 million in 2023 and is projected to grow from USD 1,898.8 million in 2024 to USD 2,878.1 million by 2031, exhibiting a CAGR of 6.12% during the forecast period.

This growth is driven by the increasing demand for high-performance electronics and advanced communication systems, such as 5G, IoT devices, and aerospace technologies, which require materials that minimize signal loss and enhance data transmission speeds.

Major companies operating in the global low dielectric materials industry are Asahi Kasei Corporation, Huntsman International LLC, SABIC, ZEON CORPORATION, The Chemours Company, DIC CORPORATION, Solvay, Saint-Gobain, Mitsubishi Corporation, DuPont, Arkema, Sumitomo Chemical Co., Ltd., TEIJIN LIMITED, Showa Denko Sichuan Carbon Inc., and Evonik Industries AG.

The rise of miniaturized electronic components and the need for efficient power consumption are further fueling the market expansion. Innovations in material technologies and a shift toward flexible and lightweight substrate in electronic devices are also contributing to the growing adoption of low dielectric materials across various industries.

Key Highlights

- The global low dielectric materials market size was recorded at USD 1,800.0 million in 2023.

- The market is projected to grow at a CAGR of 6.12% from 2024 to 2031.

- Asia-Pacific held a market share of 36.72% in 2023, with a valuation of USD 661.0 million.

- The thermoplastics segment garnered USD 830.2 million in revenue in 2023.

- The fluoropolymers segment is expected to reach USD 895.8 million by 2031.

- The antennas segment is anticipated to witness fastest CAGR of 7.83% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.88% during the forecast period.

Market Driver

"Advancements in Telecommunications"

The rapid evolution of telecommunications, particularly the global deployment of 5G networks, is a key driver for the low dielectric materials market. 5G technology operates at higher frequencies, requiring materials that minimize signal loss and electromagnetic interference (EMI) to ensure reliable performance.

Low dielectric materials play a critical role in antenna systems, base stations, and wireless communication devices by maintaining signal integrity and enabling high-speed data transmission with reduced latency.

As IoT adoption expands, with billions of connected devices relying on uninterrupted communication, the demand for these materials continues to rise. Additionally, emerging technologies such as autonomous vehicles, smart cities, and satellite-based communication further accelerate the need for low-k materials to support advanced, high-frequency electronic systems.

- In August 2024, SCHOTT unveiled SCHOTT Low-Loss Glass, a specialized material engineered to enhance high-frequency applications in semiconductor manufacturing. This glass exhibits an exceptionally low dielectric loss tangent of 0.0021 at 10 GHz, significantly reducing signal attenuation and improving energy efficiency in radio frequency (RF) components. Its low dielectric constant of 4.0 facilitates high-performance broadband antenna designs, making it particularly suitable for advanced communication technologies such as 5G and 6G networks.

Market Challenge

"Balancing Performance Factors"

Balancing performance factors in low dielectric materials is a significant challenge, as these materials must meet a variety of critical requirements. While achieving a low dielectric constant is essential to minimize signal loss and interference in high-frequency applications such as 5G and IoT, this often results in trade-offs with other important material properties.

For example, low dielectric materials must possess adequate mechanical strength to withstand stresses in demanding environments, such as those found in aerospace or automotive applications.

Ensuring thermal stability is crucial, as these materials must perform reliably under high temperatures without degradation. Maintaining a low dielectric loss is also necessary to prevent energy dissipation, which can reduce efficiency and lead to overheating, particularly in microelectronics.

Manufacturers can focus on developing hybrid materials that combine the strengths of different substances, such as polymers and ceramics. The use of nanotechnology, advanced composites, and additives can enhance properties like mechanical strength and thermal stability without compromising dielectric performance.

3D printing and advanced manufacturing techniques enable precise material shaping and reduce waste. Collaboration between scientists and engineers, along with the use of simulation tools, can also help refine material formulations and optimize performance, ensuring that low dielectric materials meet the demands of high-frequency applications.

Market Trend

"Miniaturization and High-Density Electronics"

The miniaturization of electronic devices is driving demand for low dielectric materials. Manufacturers are developing smaller yet more powerful gadgets, including smartphones, wearables, and IoT devices.

Shrinking components while integrating advanced features requires materials that maintain signal integrity and reduce interference in compact spaces. Low dielectric materials minimize signal loss, ensure efficient data transmission, and support high-frequency operations.

Consumer expectations for faster speeds, better displays, and seamless connectivity are further increasing the need for these materials in densely packed electronic systems.

- In July 2024, Applied Materials introduced a new enhanced low dielectric material to improve semiconductor performance. This material reduces chip capacitance, minimizing signal delays and power consumption in advanced semiconductor devices. It also strengthens logic and DRAM chips, enhancing their structural integrity for advanced 3D stacking. This innovation enables the continued scaling of semiconductor architectures, supporting next-generation computing and AI applications while improving performance-per-watt in modern chip designs

Low Dielectric Materials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Thermoplastics, Thermosets, Ceramics

|

|

By Material Type

|

Fluoropolymers, Modified Polyphenylene Ether (mPPE), Polyimide, Cyclic Olefin Copolymer (COC), others (Cyanate Ester, Liquid Crystal Polymer (LCP))

|

|

By Application

|

Printed Circuit Boards, Antennas, Microelectronics, Wire and Cable, others (Radomes, Semiconductors, MEMS devices)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Thermoplastics, Thermosets, Ceramics): The thermoplastics segment earned USD 830.2 million in 2023 due to their flexibility, ease of processing, and widespread use in manufacturing high-frequency components for electronic devices.

- By Material Type (Fluoropolymers, Modified Polyphenylene Ether (mPPE), Polyimide, Cyclic Olefin Copolymer (COC), others (Cyanate Ester, Liquid Crystal Polymer (LCP)): The fluoropolymers segment held 32.69% of the market in 2023, due to their excellent dielectric properties, high chemical resistance, and superior performance in high-frequency applications.

- By Application (Printed Circuit Boards, Antennas, Microelectronics, Wire and Cable, others (Radomes, Semiconductors, MEMS devices)): The printed circuit boards is projected to reach USD 1,094.6 million by 2031, owing to the increasing demand for high-speed, miniaturized electronic devices and the growing need for advanced, high-performance materials in electronic manufacturing.

Low Dielectric Materials Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific low dielectric materials market share stood around 36.72% in 2023 in the global market, with a valuation of USD 661.0 million. The Asia Pacific region is expected to maintain its dominance in the market due to the rapid expansion of electronics, telecommunications, and automotive industries in this region.

The rise of smart manufacturing and automotive electronics in the region is contributing to the demand for advanced materials that can withstand high frequencies and demanding conditions.

The region is also benefiting from significant investments in research and development, leading to innovations in material science that enhance the performance and cost-effectiveness of low dielectric materials.

- For instance, in October 2024, DIC Corporation developed a new specialty polyphenylene sulfide (PPS) film in collaboration with Japanese firm Unitika Ltd. that suppresses transmission loss at high frequencies. This product’s low dielectric properties make it suitable for use in a key for millimeter-wave printed circuit boards compatible with next-generation communications devices and for millimeter-wave radar.

Europe is expected to witness significant growth in the low dielectric materials industry, with a projected CAGR of 6.26% over the forecast period. This growth is driven by the increasing demand for high-frequency, high-performance applications across various industries.

The rapid advancement of smart devices, automated manufacturing, and electric vehicles has created a strong need for materials that enhance signal transmission and improve energy efficiency.

Additionally, the expansion of 5G infrastructure and the transition toward renewable energy and electronic mobility are further fueling the demand. The telecommunications and electric vehicle sectors, in particular, are key contributors to the rising adoption of low dielectric materials in this region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates chemicals through the Toxic Substances Control Act (TSCA). This regulation allows the EPA to assess and manage the safety of chemicals used in materials, ensuring they do not pose risks to human health or the environment

- The International Electrotechnical Commission (IEC) standard IEC 63185:2020 provides a measurement method for determining the complex permittivity of dielectric substrates at microwave and millimeter-wave frequencies.

- The European Chemicals Agency (ECHA) under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) ensures that chemicals used in materials, including those with low dielectric properties, are safely manufactured and used in the European Union.

Competitive Landscape

Key industry participants are actively investing in research and development to create materials that offer superior dielectric performance, thermal stability, and mechanical strength.

Manufacturers are also increasingly focusing on developing sustainable and eco-friendly materials in response to growing environmental concerns and stringent regulatory standards.

Companies are striving to capture market share by diversifying their product portfolios, enhancing the properties of existing materials, and expanding their geographical presence. Strategic collaborations, partnerships, and acquisitions are common as companies aim to leverage complementary expertise and strengthen their market position.

- In February 2025, Denka Company Limited launched SNECTON, a low dielectric organic insulating resin with the electrical properties required of materials to reduce the loss of electrical signals in next-generation high-speed communications.

List of Key Companies in Low Dielectric Materials Market:

- Asahi Kasei Corporation

- Huntsman International LLC

- SABIC

- ZEON CORPORATION

- The Chemours Company

- DIC CORPORATION

- Solvay

- Saint-Gobain

- Mitsubishi Corporation

- DuPont

- Arkema

- Sumitomo Chemical Co., Ltd.

- TEIJIN LIMITED

- Showa Denko Sichuan Carbon Inc.

- Evonik Industries AG

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In August 2024, Renegade Materials Corporation, a subsidiary of Teijin Holdings USA Inc., achieved NCAMP certification for its low-dielectric thermoset prepreg on quartz fabric. This material, designated as RM-2014-LDk-Tk-4581, is engineered to provide superior electrical insulation and signal integrity, making it ideal for applications such as aircraft radomes

- In December 2023, Garlock unveiled WavePro WP204, a low-loss dielectric material at the Microwave, Antennas, and Propagation Conference (MAPCON) in Ahmedabad, India. This addition expands the dielectric range of WavePro to dielectric constant (Dk) values between 2.5 and 20.4, offering enhanced performance for RF, microwave, and mmWave applications.