Market Definition

Location analytics refers to the collection, visualization, and interpretation of geospatial data to support business and operational decisions. It integrates geographic information systems with data analytics tools to identify spatial patterns and relationships.

The market encompasses solutions and services across sectors such as retail, transportation, government, healthcare, and real estate. Applications include supply chain optimization, customer engagement, urban planning, and risk management.

Location Analytics Market Overview

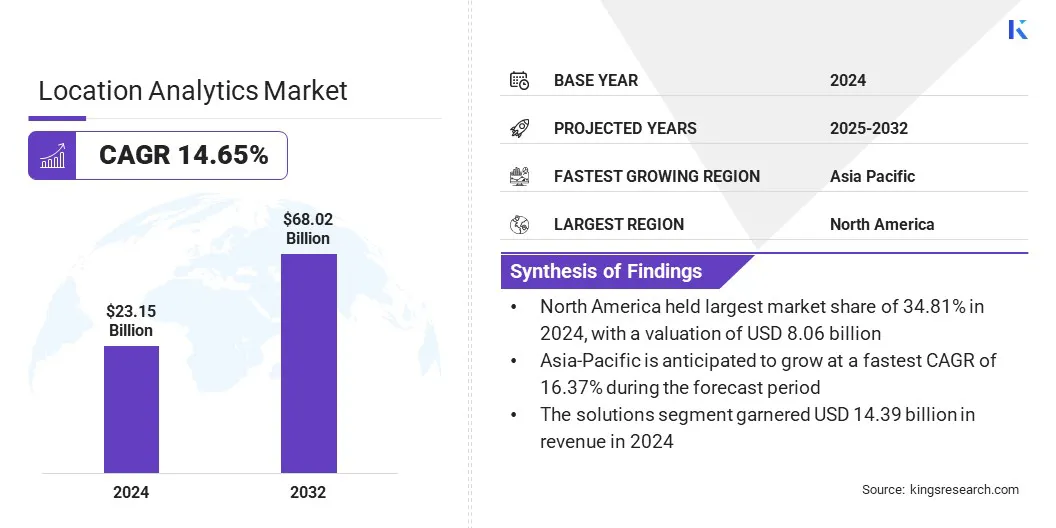

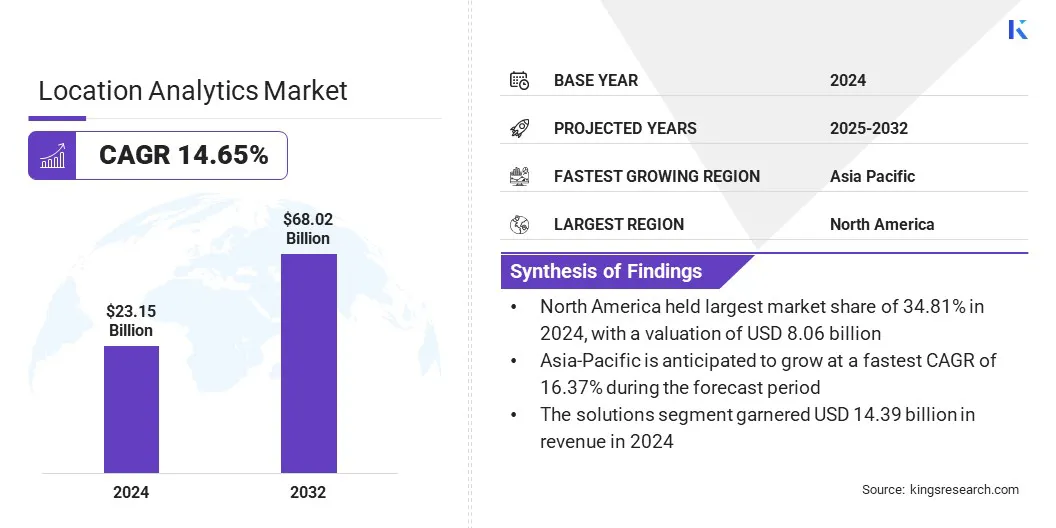

According to Kings Research, the location analytics market size was valued at USD 23.15 billion in 2024 and is projected to grow from USD 26.12 billion in 2025 to USD 68.02 billion by 2032, exhibiting a CAGR of 14.65% during the forecast period. This growth is attributed to the rising need for geospatial insights that enhance data-driven decision-making and operational efficiency.

Expanding use of location analytics across retail, transportation, government, and healthcare sectors is fueling demand for advanced solutions and services.

Key Market Highlights:

- The location analytics industry size was recorded at USD 23.15 billion in 2024.

- The market is projected to grow at a CAGR of 14.65% from 2025 to 2032.

- North America held a share of 34.81% in 2024, valued at USD 8.06 billion.

- The solutions segment garnered USD 14.39 billion in revenue in 2024.

- The outdoor location segment is expected to reach USD 40.76 billion by 2032.

- The cloud segment is anticipated to witness the fastest CAGR of 15.67% over the forecast period.

- The sales & marketing optimization segment is projected to hold a share of 27.80% by 2032.

- The retail & e-commerce garnered USD 5.71 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 16.37% over the forecast period.

Major companies operating in the location analytics market are Microsoft, HERE, Google, TomTom International BV, Esri, Hexagon AB, CARTO, Mapbox, SAP SE, IBM, Cisco, Zebra Technologies Corp., SAS Institute Inc., Precisely, and Galigeo.

Increasing reliance on mobile devices, connected sensors, and Internet of Things technologies is boosting the adoption of location analytics. Additionally, advancements in cloud-based platforms, integration of artificial intelligence and real-time analytics, and growing investments in smart city initiatives are contributing to market growth.

- In January 2024, INRIX, Inc. partnered with Kalibrate to integrate connected-device mobility data, covering vehicle movement patterns and parking trends, into the Kalibrate Location Intelligence platform. This collaboration enhances site selection analysis by improving accuracy, efficiency, and decision-making for businesses evaluating new locations.

Market Driver

Expansion of Mobile and IoT Ecosystems

The growth of the market is propelled by the rapid expansion of mobile devices and Internet of Things (IoT) ecosystems that generate continuous streams of geospatial data. The increasing use of smartphones, wearables, and connected sensors across industries is creating opportunities to capture and analyze location-based information in real time.

Organizations are leveraging this data to improve asset tracking, enhance logistics efficiency, deliver targeted customer engagement, and support predictive maintenance. The ability to integrate IoT devices with advanced analytics platforms is strengthening operational agility and enabling smarter decision-making.

The shift toward mobile and IoT-driven data ecosystems is further supported by rising investments in digital transformation initiatives and the growing emphasis on real-time intelligence. The increasing reliance on connected technologies is fueling widespread adoption of location analytics solutions.

Market Challenge

Data Privacy and Regulatory Compliance

Data privacy and regulatory compliance are major challenges hampering the growth of the location analytics market, as organizations handle large volumes of sensitive geospatial information. Regulations such as the General Data Protection Regulation (GDPR) in Europe, along with similar frameworks in North America and Asia, impose strict rules on data collection, storage, and processing.

Non-compliance can result in significant financial penalties and reputational damage, while stringent consent and cross-border data requirements restrict the deployment of advanced analytics solutions. These restrictions often slow down innovation and hinder the delivery of personalized services at scale.

To address these challenges, organizations are adopting privacy-first data strategies, implementing advanced anonymization techniques, and strengthening governance frameworks. Such measures help safeguard consumer trust, ensure regulatory compliance, and support the responsible growth of location analytics solutions globally.

Market Trend

Emergence of Cloud-Centric Location Analytics Models

The emergence of cloud-centric location analytics models is influencing the market by offering scalable, cost-efficient, and easily deployable platforms for geospatial intelligence. Cloud-based solutions eliminate the need for heavy on-premises infrastructure, enabling organizations to access advanced analytics tools and integrate data streams from diverse sources in real time.

Unlike traditional deployment models, cloud-centric platforms provide greater flexibility, faster implementation, and the ability to support a wide range of applications, including fleet monitoring, customer behavior analysis, and smart city planning. These benefits are particularly valuable for enterprises seeking agility and responsiveness in dynamic business environments.

Moreover, advancements in cloud security, artificial intelligence integration, and interoperability standards are strengthening the reliability and scalability of cloud-enabled analytics platforms, supporting the adoption of location analytics solutions.

Location Analytics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Solutions, and Services

|

|

By Location Type

|

Indoor Location, and Outdoor Location

|

|

By Deployment

|

On-premises, and Cloud

|

|

By Application

|

Risk Management, Emergency Response Management, Operational / Field Analytics, Supply Chain Management, Sales & Marketing Optimization, and Others

|

|

By Vertical

|

BFSI, Government & Defense, Media & Entertainment, Retail & E-commerce, Transportation & Logistics, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Solutions and Services): The solutions segment earned USD 14.39 billion in 2024, mainly due to the rising adoption of advanced platforms that provide real-time geospatial insights and decision-making capabilities.

- By Location Type (Indoor Location and Outdoor Location): The outdoor location segment held a share of 61.36% in 2024, attributed to its extensive use in transportation, logistics, urban planning, and infrastructure management applications.

- By Deployment (On-premises and Cloud): The cloud segment is projected to reach USD 35.11 billion by 2032, owing to its scalability, cost efficiency, and ability to support real-time integration of diverse geospatial data sources.

- By Application (Risk Management, Emergency Response Management, Operational / Field Analytics, Supply Chain Management, Sales & Marketing Optimization, and Others): The sales & marketing optimization segment is anticipated to grow at a robust CAGR of 15.36% over the forecast period, propelled by increasing demand for location-based insights that enhance customer targeting, optimize store placement, and improve campaign effectiveness.

- By Vertical (BFSI, Government & Defense, Media & Entertainment, Retail & E-commerce, Transportation & Logistics, and Others): The retail & e-commerce segment is projected to reach USD 18.56 billion by 2032, stimulated by rising adoption of location analytics for personalized customer engagement, demand forecasting, and optimizing store networks and delivery operations.

Location Analytics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America location analytics market share stood at 34.81% in 2024, valued at USD 8.06 billion. This dominance is reinforced by the strong adoption of geospatial intelligence across diverse industries, supported by advanced digital infrastructure and significant investments in technology modernization.

The presence of leading analytics providers, combined with early integration of cloud platforms and artificial intelligence, is enabling enterprises to derive real-time insights that improve operational efficiency and customer engagement.

Additionally, favorable regulatory frameworks and government-led digital initiatives are promoting the use of location-based intelligence in urban planning, public safety, and smart mobility projects. The growing focus on data-driven strategies in both private and public sectors is further accelerating the uptake of location analytics solutions.

Moreover, continuous advancements in connected devices, sensor technologies, and big data platforms are fostering innovation, ensuring scalability, and strengthening North America’s leading position.

- In February 2025, Dataminr partnered with Esri in North America, attaining Platinum Partner status. The collaboration integrates ArcGIS mapping and location services into Dataminr’s real-time AI platform, while Dataminr’s live event alerts become accessible across ArcGIS solutions. This integration enhances situational awareness, crisis response, and decision-making through a unified geospatial view.

The Asia-Pacific location analytics industry is set to grow at a robust CAGR of 16.37% over the forecast period. This growth is attributed to rapid urbanization, widespread smartphone adoption, and the increasing need for data-driven intelligence to manage expanding metropolitan regions.

The region’s strong e-commerce growth, rising cross-border trade, and large-scale logistics operations are boosting demand for advanced location analytics to optimize delivery networks and streamline supply chains.

Government-led investments in smart city programs, digital infrastructure, and public safety initiatives are accelerating the integration of geospatial intelligence across urban planning and transportation systems.

Additionally, partnerships between technology providers, telecom operators, and public agencies, supported by advancements in IoT connectivity and cloud-based analytics platforms, are enhancing scalability, enabling real-time insights, and supporting sustained regional market expansion.

Regulatory Frameworks

- In the U.S., the California Consumer Privacy Act (CCPA) regulates the collection and processing of personal data, including geolocation information. It grants consumers rights to know, access, and opt out of the sale of their location data, directly influencing the deployment of location analytics solutions.

- In the U.S., the Geospatial Data Act of 2018 (GDA) regulates the governance of geospatial data. It establishes federal data standards, promotes data-sharing, and ensures consistent practices, thereby strengthening transparency and efficiency in location analytics applications.

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, storage, and use of personal data, including geolocation. It enforces strict consent requirements and data protection standards, impacting the deployment of location analytics platforms across industries.

- In India, the National Geospatial Policy 2022 regulates the access, generation, and sharing of geospatial data. It liberalizes the geospatial sector, allowing private companies broader access to mapping and spatial datasets while safeguarding sensitive national security interests, thereby expanding opportunities for location analytics.

Competitive Landscape

Companies operating in the location analytics market are expanding their presence by advancing technological capabilities, diversifying solution portfolios, and forming strategic partnerships.

Key players are investing heavily in research and development to improve real-time geospatial data processing, predictive analytics, cloud integration, and data security, with a key focus on delivering scalable and cost-efficient platforms.

They are also introducing innovations such as AI-powered spatial intelligence, IoT-enabled location tracking, and advanced visualization tools to address the growing demand for industry-specific applications in retail, logistics, urban planning, and public safety.

Additionally, firms are collaborating with governments, enterprises, and telecom operators to support smart city initiatives, strengthen infrastructure modernization, and broaden adoption across developed and emerging economies. These strategies are enabling companies to secure long-term growth opportunities and reinforce their positions in the global market.

- In December 2023, Echo Analytics acquired Roam.ai to create a 360-degree location intelligence platform. The deal integrates Roam.ai’s mobile SDKs and APIs with Echo’s geospatial datasets, aimed at enhancing the delivery of seamless and privacy-focused location solutions.

Top Companies in Location Analytics Market:

- Microsoft

- HERE

- Google

- TomTom International BV

- Esri

- Hexagon AB

- CARTO

- Mapbox

- SAP SE

- IBM

- Cisco

- Zebra Technologies Corp.

- SAS Institute Inc.

- Precisely

- Galigeo

Recent Developments (M&A/Partnerships)

- In January 2025, TomTom International BV partnered with Esri to integrate its global mapping and real-time traffic data into the ArcGIS platform, providing governments and enterprises with advanced location analytics to support infrastructure planning, traffic management, and retail site selection.

- In September 2024, Smartvel acquired AVUXI, a provider of location-based content for the travel industry. The integration of AVUXI’s TopPlace platform with Smartvel’s AI tools enhances destination insights, expands product offerings, and strengthens their position in location-based travel solutions.

- In November 2023, Gravy Analytics merged with Unacast to consolidate leadership in location data and insights. The combined entity aims to advance machine learning, enhance self-service analytics, and expand proprietary API offerings to accelerate adoption in the location intelligence sector.

- In September 2023, Casafari acquired Targomo to integrate AI-driven location analytics with its real estate data platform. The unified solution provides enriched location insights and socio-demographic data, helping real estate professionals optimize investments and accelerate transactions.