Market Definition

Liver health supplements comprise dietary formulations designed to support detoxification, antioxidant activity, and optimal liver function. These products include ingredients such as milk thistle, N‑acetylcysteine, and herbal extracts that promote cellular protection and regeneration. The market spans applications like preventive wellness, chronic liver condition support, and post-exposure recovery in clinical and consumer health settings.

Manufacturers and healthcare professionals recommend these supplements to enhance metabolic balance, reduce oxidative stress, and maintain overall hepatic resilience for individuals at risk of liver dysfunction.

Liver Health Supplements Market Overview

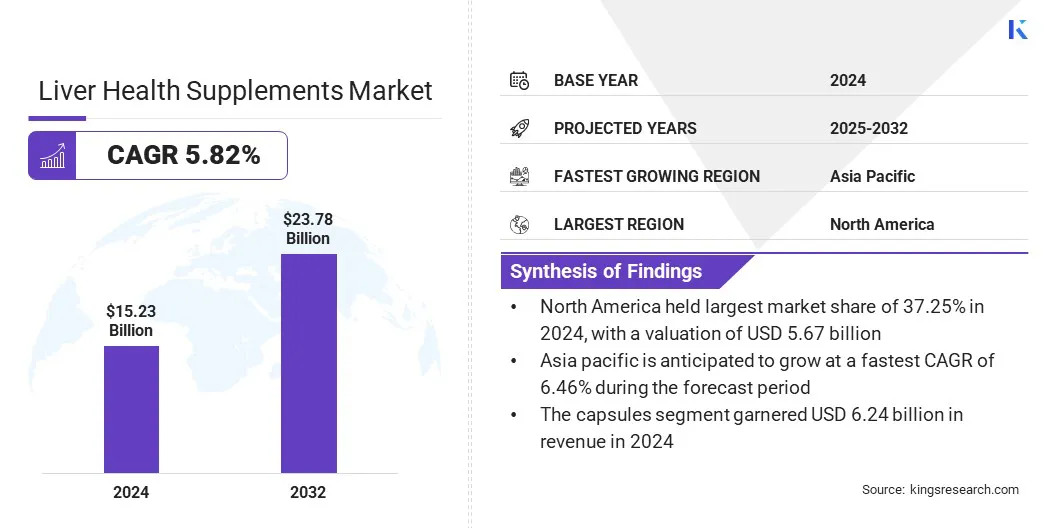

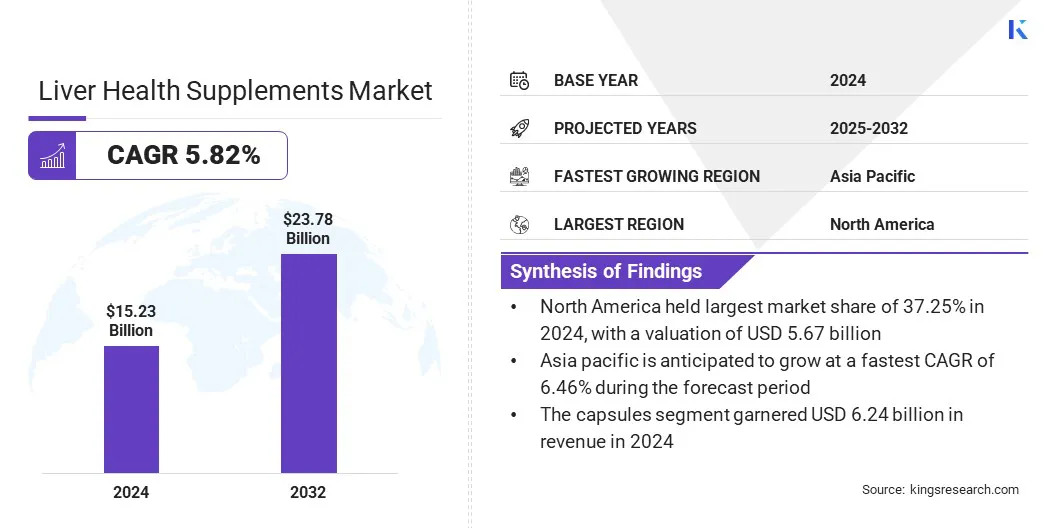

The global liver health supplements market size was valued at USD 15.23 billion in 2024 and is projected to grow from USD 16.00 billion in 2025 to USD 23.78 billion by 2032, exhibiting a CAGR of 5.82% during the forecast period.

This market is largely driven by increasing consumer preference for natural and herbal ingredients, such as milk thistle and turmeric, which are safer for long-term use. Additionally, the rising adoption of personalized formulations tailored to individual health profiles is driving the demand for targeted, lifestyle-based liver support solutions.

Major companies operating in the liver health supplements industry are Himalaya Wellness Company, 1MD Nutrition, Nutreance LLC, organifi, Gaia Herbs, Jarrow Formulas, Inc., Enzymedica, NOW Foods, iHerb, LLC., Life Extension, Thorne, Nature's Way Brands, LLC., Irwin Naturals, Doctor Berg, and Bronson.

The rising prevalence of liver diseases is driving demand for liver health supplements across the global consumer and healthcare industry. Conditions such as non-alcoholic fatty liver disease (NAFLD), hepatitis, and cirrhosis are affecting a growing percentage of the adult population.

- According to a 2024 report by the American Diabetes Association, the prevalence of nonalcoholic fatty liver disease (NAFLD) in the U.S. has reached 38%, marking a 50% increase over the past three decades. Consumers are turning to supplements containing ingredients like milk thistle, turmeric, and antioxidants to support liver detoxification and function. Healthcare professionals are also recommending liver health formulations to support prevention and recovery in patients.

Key Highlights

- The liver health supplements industry size was valued at USD 15.23 billion in 2024.

- The market is projected to grow at a CAGR of 5.82% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 5.67 billion.

- The Herbal Supplements segment garnered USD 8.07 billion in revenue in 2024.

- The Capsules segment is expected to reach USD 9.25 billion by 2032.

- The Pharmacies/Drug Stores segment secured the largest revenue share of 38.00% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 6.46% during the forecast period.

Market Driver

Shift to Natural and Herbal Formulations

The shift toward natural and herbal formulations is driving strong growth in the liver health supplements market. Consumers are increasingly choosing supplements made with plant-based and clean-label ingredients that support holistic wellness. Herbal components such as milk thistle, turmeric, dandelion, and artichoke extract are gaining popularity for their proven liver-supportive and detoxifying properties.

Concerns regarding side effects from synthetic compounds are encouraging people to adopt naturally derived alternatives. Manufacturers are responding by developing transparent and evidence-based products that highlight traditional medicinal benefits.

- In January 2024, Cymbiotika launched Liver Health+. The product is a blend of vitamins and herbs, including milk thistle and curcumin, formulated for liver detoxification, inflammation reduction, bile support, and enzyme regulation.

Market Challenge

Limited Scientific Evidence and Efficacy Data Undermining Credibility

A key challenge in the liver health supplements market is the lack of robust clinical evidence supporting the effectiveness of these products, particularly for use in healthy individuals. Even with consumer demand remaining high, many supplements rely on traditional claims or preliminary studies that do not meet scientific standards. This gap in validated data is raising concerns among healthcare professionals and regulatory bodies about product credibility and safety.

To address this challenge, market players are investing in well-designed clinical trials, collaborating with research institutions, and publishing peer-reviewed studies to build scientific validation. Companies are also enhancing transparency in labeling and focusing on evidence-based formulations to strengthen consumer trust.

Market Trend

Rising Adoption of Personalized Formulations

A key trend in the liver health supplements market is the growing interest in personalized nutrition and customized formulations. Companies are offering supplements tailored to individual needs based on genetic data, lifestyle factors, and specific health conditions. These solutions allow more targeted liver support, improving the relevance and potential effectiveness for each user.

Consumers are increasingly seeking products that align with their unique wellness goals rather than general formulations. Advances in diagnostics and health monitoring are supporting the development and delivery of such personalized options.

- In June 2025, Guttify introduced Liver Lift, a clinically-informed, at-home solution designed to support the management of fatty liver disease. This launch addresses the rising consumer demand for preventive healthcare, specifically among health-conscious individuals with limited time. The Liver Lift kit combines plant-based supplements, including milk thistle, dandelion, and moringa, with expert-driven dietary guidance and personalized lifestyle recommendations.

Liver Health Supplements Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Herbal Supplements, Vitamins & Minerals, Others

|

|

By Dosage Form

|

Capsules, Tablets, Liquid, Powder, Others

|

|

By Sales Channel

|

Pharmacies/Drug Stores, Supermarkets/Hypermarkets, Online Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Herbal Supplements, Vitamins & Minerals, and Others): The herbal supplements segment earned USD 8.07 billion in 2024, due to strong consumer demand for plant-based and clean-label products perceived as safer and natural alternatives for long-term liver support.

- By Dosage Form (Capsules, Tablets, Liquid, Powder, and Others): The capsules segment held 41.00% of the market in 2024, attributed to its convenience, precise dosage delivery, longer shelf life, and consumer preference for easy-to-swallow formats that mask the taste of herbal ingredients.

- By Sales Channel (Pharmacies/Drug Stores, Supermarkets/Hypermarkets, Online Retail, and Others): The pharmacies/drug stores segment is projected to reach USD 8.84 billion by 2032, owing to strong consumer trust, immediate product availability, and the guidance of licensed pharmacists, which enhances purchase confidence for condition-specific supplements.

Liver Health Supplements Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America liver health supplements market share stood at 37.25% in 2024, with a valuation of USD 5.67 billion. North America's leading position in the market can be attributed to its well-developed natural and herbal supplements industry, supported by strong regulatory oversight and high consumer confidence in product safety.

The U.S. Dietary Supplement Health and Education Act (DSHEA) permits the promotion of liver health benefits, provided they do not claim to treat specific diseases, fostering product innovation. The region benefits from a robust retail ecosystem and specialized e-commerce platforms such as Amazon, iHerb, and Thrive Market, which effectively target health-conscious consumer groups, including fitness enthusiasts, vegans, and wellness-focused individuals.

Asia Pacific liver health supplements industry is poised for significant growth at a CAGR of 6.46% over the forecast period. This growth is supported by the region’s deep-rooted traditions in systems of medicine such as Ayurveda, Traditional Chinese Medicine (TCM), and Kampo, which have historically utilized herbal remedies for liver health.

Ingredients like turmeric, schisandra, licorice root, and artichoke are increasingly being adapted into modern supplement formats, including capsules, powders, and functional beverages. The blend of cultural familiarity with greater accessibility and convenience has made these products more attractive to a broader and health-aware consumer segment across the region.

- In May 2024, Singapore-based company Kinohimitsu launched JellyBoost DHM, a functional jelly drink formulated for liver support. The product includes dihydromyricetin (from the Japanese raisin tree), glutathione, and natural herbal extracts. It aligns with traditional liver-health remedies and appeals to younger Asian consumers seeking convenient, culturally familiar formats.

Regulatory Frameworks

- In the U.S., liver health supplements are regulated under the Dietary Supplement Health and Education Act (DSHEA) by the Food and Drug Administration (FDA). Products do not require pre-market approval unless they contain a new dietary ingredient. Manufacturers must comply with Current Good Manufacturing Practices (cGMPs) and may only make structure-function claims, not disease treatment claims. The FDA oversees post-market surveillance, while the Federal Trade Commission (FTC) monitors advertising practices.

- The European Food Safety Authority (EFSA) regulates liver health supplements under the General Food Law. Products must comply with food-grade safety standards and adhere to approved health claims listed in the EU Register of Nutrition and Health Claims. Manufacturers must submit scientific substantiation for any new claim.

- In China, liver health supplements fall under the regulatory authority of the National Medical Products Administration (NMPA) and must be registered as “Health Foods.” Products require pre-market approval, including safety assessments and clinical or scientific evidence supporting health claims. Labels must include the exact function and target population.

- Japan regulates liver health supplements through the Ministry of Health, Labour and Welfare (MHLW) under the Foods for Specified Health Uses (FOSHU) and Foods with Function Claims (FFC) frameworks. FOSHU products must undergo rigorous scientific and government review, while FFC products can be marketed with scientific substantiation and proper notification.

Competitive Landscape

Major players in the liver health supplements industry are adopting strategies such as product innovation, research and development (R&D), and the use of multifunctional ingredient combinations to meet growing consumer demand for effective liver health solutions.

Companies are focusing on developing advanced formulations that combine traditional herbal extracts with clinically supported compounds. Collaborations with nutrition experts and partnerships with research institutions are helping brands enhance product credibility and improve health outcomes.

- In June 2024, Infinite Future launched Liver Rejen, with six‑in‑one formula that combines milk thistle, curcumin, green tea extract, L‑tartaric acid, taurine, and alpha‑lipoic acid into a single supplement. This launch has contributed to the growing demand for multi-functional liver health supplements by addressing diverse detoxification and antioxidant needs in one product.

List of Key Companies in Liver Health Supplements Market:

- Himalaya Wellness Company

- 1MD Nutrition

- Nutreance LLC

- organifi

- Gaia Herbs

- Jarrow Formulas, Inc.

- Enzymedica

- NOW Foods

- iHerb, LLC.

- Life Extension

- Thorne

- Nature's Way Brands, LLC.

- Irwin Naturals

- Doctor Berg

- Bronson

Recent Developments (M&A)

- In May 2025, GSK plc acquired Boston Pharmaceuticals’ lead candidate, efimosfermin alfa, a phase III-ready and potential best-in-class treatment for steatotic liver disease (SLD). The asset is being developed for the treatment of metabolic dysfunction-associated steatohepatitis (MASH), including cirrhosis, with plans to expand its use to alcohol-related liver disease (ALD), both classified under SLD.