Market Definition

Lime is an inorganic material that is derived from limestone. It is primarily composed of calcium oxide (quicklime) or calcium hydroxide (slaked lime), and has applications in construction, agriculture, and chemical manufacturing.

Lime Market Overview

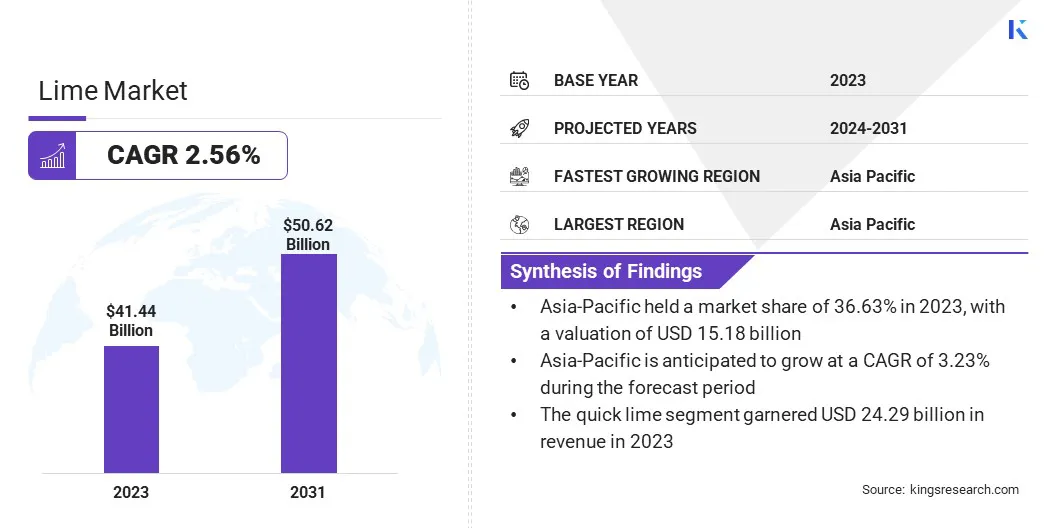

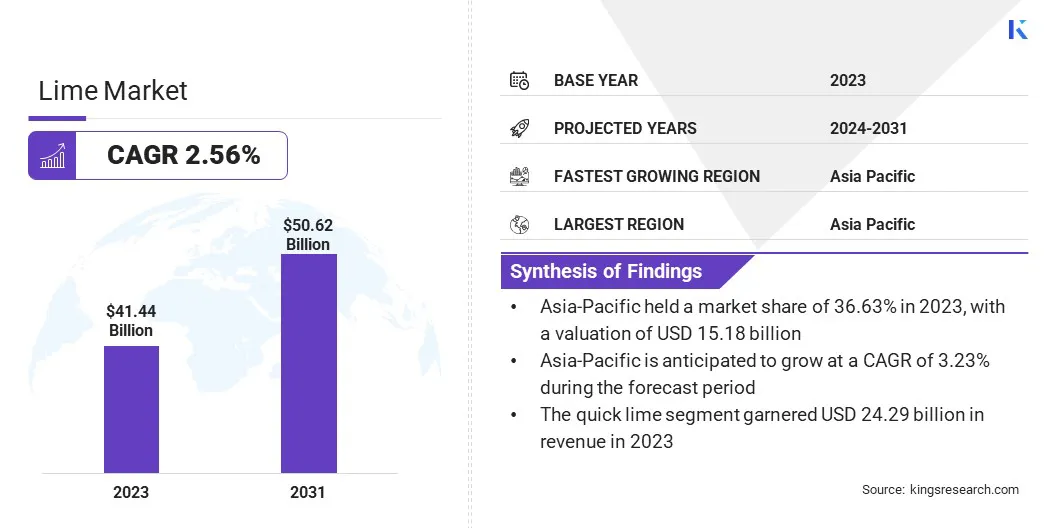

The global lime market size was valued at USD 41.44 billion in 2023 and is projected to grow from USD 42.40 billion in 2024 to USD 50.62 billion by 2031, exhibiting a CAGR of 2.56% during the forecast period.

The increasing demand for lime in infrastructure development, soil stabilization, and industrial water treatment is fueling the market. Additionally, the expansion of steel & chemical industries, along with stringent environmental regulations promoting the use of lime for air & water purification, is contributing to market expansion.

Major companies operating in the lime industry are Carmeuse, Graymont Limited, Imerys, Minerals Technologies Inc., Lhoist Group, MLC, United States Lime & Minerals, Inc., Cheney Lime & Cement Company, SigmaRoc plc., Omya International AG, Grupo CALIDRA, CRH plc, CEMEX S.A.B de C.V, SCHAEFER KALK GmbH & Co. KG, and Mitsubishi International Corporation.

The increasing use of lime in agriculture for soil conditioning and pH balance to enhance crop yields is also driving the market. Lime helps improve soil structure, reducing compaction and enhancing water retention and aeration.

- In December 2024, the Land and Environment Court approved Nordkalk’s permit for continued and expanded limestone operations at Klinthagen, Gotland. The decision ensures long-term access to high-quality lime while supporting local employment and adhering to strict environmental standards.

Key Highlights:

Key Highlights:

- The global lime industry size was valued at USD 41.44 billion in 2023.

- The market is projected to grow at a CAGR of 2.56% from 2024 to 2031.

- Asia Pacific held a market share of 36.63% in 2023, with a valuation of USD 15.18 billion.

- The market in the region is anticipated to grow at a CAGR of 3.23% during the forecast period.

- The quick lime segment garnered USD 24.29 billion in revenue in 2023.

- The powders segment is expected to reach USD 23.28 billion by 2031.

- The construction segment is expected to reach USD 17.49 billion by 2031.

Market Driver

"Growing Demand from the Construction Sector and Rising Environmental Regulations"

The lime market is registering significant growth, driven by the increasing demand for lime from the construction & infrastructure sector in cement production, soil stabilization, and water treatment. Rapid urbanization and large-scale infrastructure projects, particularly in emerging economies, are further fueling the need for high-quality lime products.

Strict environmental regulations and sustainability initiatives are contributing to the increased use of lime in flue gas desulfurization and wastewater treatment. Lime helps reduce sulfur dioxide emissions, neutralize acidic waste, and improve water quality.

The demand for low-carbon lime products is rising as industries move toward carbon neutrality, with innovations like carbon capture and alternative fuels enhancing their sustainability.

- For instance, in July 2024, Blastr Green Steel partnered with Lhoist to secure the supply of low-carbon lime and dolime for its future steel plant in Inkoo, Finland, aiming to reduce Scope 3 emissions by up to 50 kg CO₂ per tonne of steel and support ultra-low CO₂ steel production.

Market Challenge

"High Carbon Emissions and Regulatory Compliance"

The lime market faces significant challenges, due to the energy-intensive nature of lime production, which requires heating limestone to temperatures exceeding 1,000°C. This leads to high operational costs and substantial CO₂ emissions, raising environmental concerns.

The combination of fuel combustion and the decomposition of limestone results in a significant carbon footprint, driving the need for cleaner production methods. Companies are investing in alternative energy sources such as biomass, hydrogen, and electrification while adopting advanced kiln technologies to improve energy efficiency.

Additionally, growing environmental regulations impose stricter emission limits and sustainability requirements, increasing compliance costs and operational complexities for lime producers.

Non-compliance can result in financial penalties and production restrictions, affecting profitability. Thus, manufacturers are actively developing carbon capture and utilization technologies, optimizing production processes, and implementing sustainable methods to meet regulatory standards while maintaining efficiency and competitiveness.

- In September 2024, the National Lime Association (NLA) filed a legal challenge and an administrative petition for reconsideration against the Environmental Protection Agency’s (EPA) new air emissions rule for the lime industry, arguing that it imposes unnecessary USD 2 billion costs and increases Greenhouse Gas (GHG) emissions.

Market Trend

"Increasing Demand for Sustainable Materials and Advancements in Technologies"

The lime market is registering a shift toward sustainability, driven by advancements in green construction and carbon capture technologies. Lime-based products like lime mortar and limecrete are gaining popularity as the demand for eco-friendly building materials grows, due to their carbon sequestration properties, durability, and energy efficiency.

Simultaneously, innovations in carbon capture and utilization (CCU) are revolutionizing lime production by reducing CO₂ emissions. Companies are investing in cutting-edge CCU technologies to trap and repurpose emissions from lime kilns, aligning with global decarbonization goals and reinforcing the industry's commitment to sustainability.

- For instance, in November 2023, Nordkalk launched sustainable lime product lines, Next and Complete, using recycled materials and fossil-free energy. The company aims for zero emissions by 2040 through energy-efficient lime production, carbon capture, and biofuel transition.

Lime Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Quick Lime, Hydrated Lime

|

|

By Form

|

Powders, Pellets, Slurries

|

|

By Application

|

Agriculture, Construction, Water Treatment, Chemical Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Quick Lime, Hydrated Lime): The quick lime segment earned USD 24.29 billion in 2023, due to its widespread use in steel manufacturing, construction, and environmental applications.

- By Form (Powders, Pellets, and Slurries): The powders segment held 47.63% share of the market in 2023, due to its high demand in construction, steel, and chemical industries, along with its quick reactivity in various applications.

- By Application (Agriculture, Construction, Water Treatment, Chemical Manufacturing, and Others): The construction segment is projected to reach USD 17.49 billion by 2031, owing to increasing infrastructure development and the growing use of lime in cement, mortar, and soil stabilization.

Lime Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial lime market share of 36.63% in 2023, with a valuation of USD 15.18 billion. The region dominates the market, due to rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan.

Asia Pacific accounted for a substantial lime market share of 36.63% in 2023, with a valuation of USD 15.18 billion. The region dominates the market, due to rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan.

The increasing demand for lime in steel manufacturing, construction, agriculture, and water treatment is a key driver of the market. Additionally, government investments in smart cities, highways, and wastewater management projects are further propelling the market. The availability of abundant limestone reserves and expanding production capacities are strengthening the region’s position in the global market.

- In August 2024, Chememan Public Company Limited (CMAN) and Khimsar Mine Corporation (KMC) broke ground on a modern lime manufacturing plant in Khimsar Village, Rajasthan, with an initial annual production capacity of 100,000 tons and plans to expand to 500,000 tons.

The lime industry in North America is expected to register the fastest growth, with a projected CAGR of 2.12% over the forecast period. This growth is driven by rising construction activities, stringent environmental regulations, and increasing adoption of lime in wastewater treatment and industrial applications.

The U.S. and Canada are registering a surge in demand for lime, due to its widespread use in the chemical industry, flue gas desulfurization, and agricultural applications. Additionally, regional investments in green building technologies and environmentally friendly manufacturing practices are driving the increased use of lime for sustainable development.

Regulatory Frameworks:

- In the U.S., the lime industry is regulated by the EPA which oversees air emissions, water discharge, and waste management in lime production to minimize environmental impact. The EPA sets guidelines to control pollutants released from lime kilns under the Clean Air Act (CAA) and Clean Water Act (CWA).

- In Europe, the lime industry is regulated by the European Commission (EC) which enforces policies on air emissions, industrial waste, and sustainability, while the European Environment Agency (EEA) monitors the environmental impact of lime production to promote sustainable practices.

- In India, the Ministry of Mines regulates limestone extraction, the key raw material for lime production, while the Indian Bureau of Mines (IBM) ensures compliance with mining laws and environmental sustainability. These bodies oversee mining leases, exploration, and resource conservation under the Mines and Minerals (Development and Regulation) Act, 1957.

Competitive Landscape:

The global lime market is characterized by a large number of participants, including established corporations and rising organizations. The competitive environment in the market is evolving with growing product differentiation, emphasis on technological advancements, and sustainability.

Additionally, companies are increasingly adopting sustainable practices, such as low-emission production processes and the use of alternative raw materials, in response to the growing demand for eco-friendly solutions.

Key strategies employed by market players include strategic partnerships, mergers and acquisitions, and investments in Research and Development (R&D) to innovate and provide high-quality products.

- For instance, in November 2023, SigmaRoc plc agreed to acquire CRH’s European lime operations. The acquisition strengthens SigmaRoc’s position in the lime industry, adding 16 sites across Ireland, the UK, Germany, the Czech Republic, and Poland.

List of Key Companies in Lime Market:

- Carmeuse

- Graymont Limited

- Imerys

- Minerals Technologies Inc.

- Lhoist Group

- MLC

- United States Lime & Minerals, Inc.

- Cheney Lime & Cement Company

- SigmaRoc plc.

- Omya International AG

- Grupo CALIDRA

- CRH plc

- CEMEX S.A.B de C.V

- SCHAEFER KALK GmbH & Co. KG

- Mitsubishi International Corporation

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Valmet received an order to deliver a modern lime kiln to Kuantum Papers Limited in Punjab, India, increasing lime kiln production capacity to 200 tons per day, with installation planned for late 2025.

- In August 2024, Graymont launched a global branding initiative to reflect its industry-leading lime business and expanding portfolio of low-carbon, calcium-based solutions. Graymont aims to support customers in decarbonizing their supply chains by developing lower-carbon process inputs, products, and engineered solutions.

- In June 2024, Lhoist Group launched the GLOBE project to produce low-carbon dolime and lime at its Marche-les-Dames site. This project includes an Oxyfuel kiln by 2027, cutting CO₂ emissions by 30%, and carbon capture by 2031 to reduce emissions by 80%. The project supports green steel production and sustainability goals.

- In March 2024, Storage & Transfer Technologies, Inc., a subsidiary of Carmeuse, rebranded as Carmeuse Systems Inc., strengthening its focus on providing end-to-end solutions for lime handling, slaking, and transport systems. With this change, Carmeuse becomes the only provider in the industry offering comprehensive lime and limestone solutions, from production to handling system engineering.