Market Definition

Lead acid batteries are rechargeable energy storage devices that use lead and sulfuric acid to generate power. Known for their reliability, they are widely used in starting and deep-cycle applications.

The market includes various construction methods such as flooded and valve-regulated designs, including AGM and gel types. These batteries are essential for automotive systems, uninterruptible power supplies, telecom infrastructure, and renewable energy storage due to their cost-effectiveness and durability.

Lead Acid Batteries Market Overview

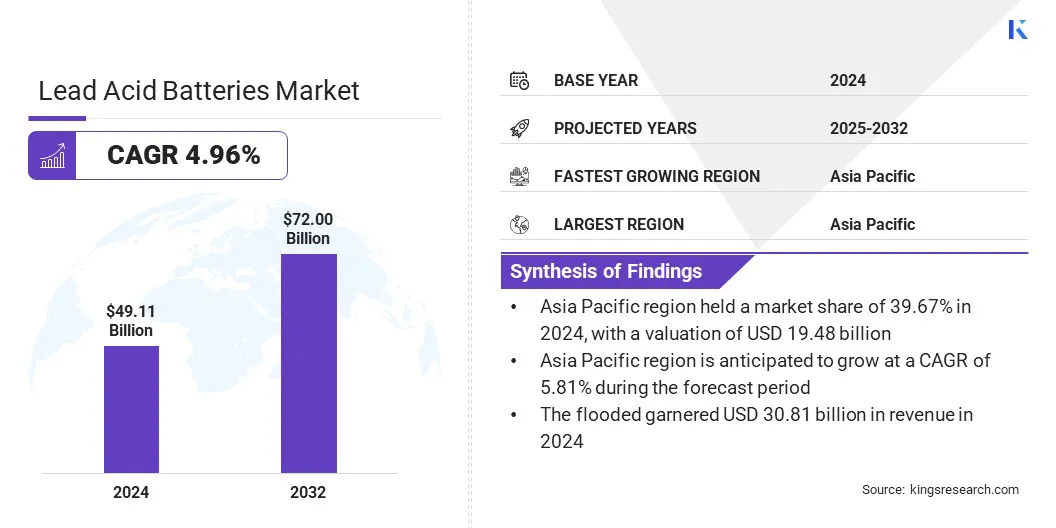

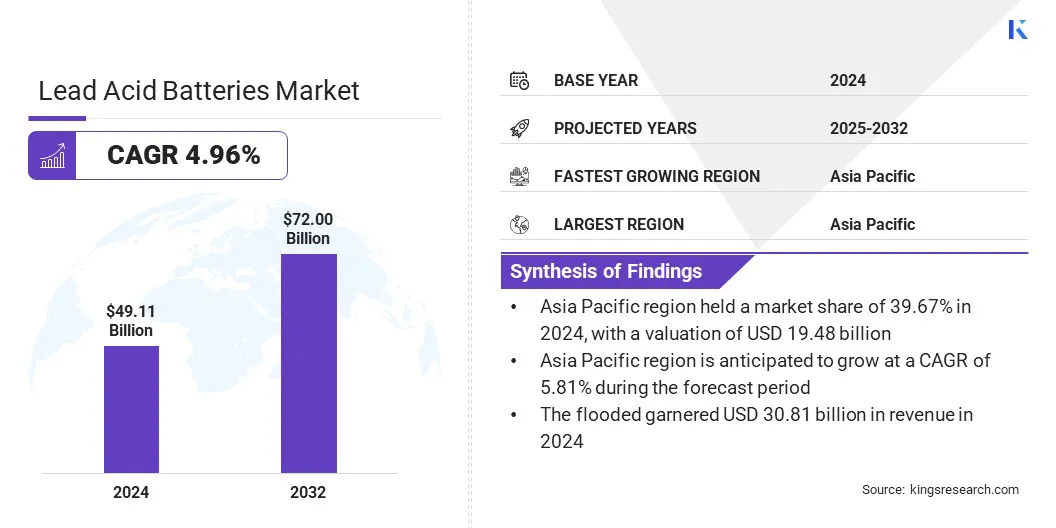

The global lead acid batteries market size was valued at USD 49.11 billion in 2024 and is projected to grow from USD 51.30 billion in 2025 to USD 72.00 billion by 2032, exhibiting a CAGR of 4.96% during the forecast period. This growth is fueled by the increasing demand for reliable power backup solutions in telecom and data centers.

Continuous network expansion and the rising volume of data traffic require an uninterrupted power supply, which creates strong demand for high-capacity batteries. The shift toward graphene-enhanced lead acid batteries is enabling improved conductivity, higher charge acceptance, and extended operational life. Incorporating graphene into battery components allows faster charging and better energy efficiency, addressing limitations of conventional designs.

Key Highlights:

- The lead acid batteries industry size was recorded at USD 49.11 billion in 2024.

- The market is projected to grow at a CAGR of 4.96% from 2025 to 2032.

- Asia Pacific held a share of 39.67% in 2024, valued at USD 19.48 billion.

- The flooded segment garnered USD 30.81 billion in revenue in 2024.

- The starting, lighting, ignition (SLI) segment is expected to reach USD 35.21 billion by 2032.

- The automotive segment is projected to generate a revenue of USD 30.62 billion by 2032.

- North America is anticipated to grow at a CAGR of 4.51% over the forecast period.

Major companies operating in the lead acid batteries industry are Clarios, Exide Technologies, GS Yuasa International Ltd., EnerSys, East Penn Manufacturing Company, C&D Technologies, Inc., Amara Raja Energy & Mobility Limited, leoch International Technology Limited Inc, CSB Energy Technology Co., Ltd., Hangzhou Eumo Technology Co.,Ltd., Tianneng Holding Group, FIAMM Energy Technology S.p.A., Crown Battery Manufacturing, HOPPECKE Batterien GmbH & Co. KG, and Teledyne Technologies Incorporated.

Market growth is propelled by technology advancements in AGM separators, which improve electrolyte absorption and reduce internal resistance, enhancing battery efficiency and reliability. These advancements enable faster charging, better vibration resistance, and extended cycle life, making AGM-based lead acid batteries suitable for high-demand applications.

This is leading to the widespread adoption in automotive start-stop systems, industrial backup solutions, and renewable energy storage projects that require durable and maintenance-free power solutions.

- In March 2025, Ahlstrom launched an advanced Absorbent Glass Mat (AGM) battery separator platform at its Turin facility. The platform offers customizable solutions with optimized fiber dispersion, superior electrolyte retention, and low electrical resistance to enhance battery efficiency and lifespan. It supports flexible configurations for automotive, renewable energy, telecom, and industrial backup applications.

Market Driver

Increasing Demand for Reliable Power Backup Solutions in Telecom and Data Centers

The growth of the lead acid batteries market is driven by the increasing demand for reliable power backup solutions in telecom and data centers. Rapid growth in internet penetration and digital services is leading to significant expansion of telecom infrastructure and cloud computing facilities. These operations require continuous power to maintain network stability and data security during outages.

Lead acid batteries remain the preferred choice for backup systems as they provide dependable performance, quick discharge capability, and cost efficiency. Their established recycling processes and widespread availability further boost their adoption in these critical applications, contributing significantly to market expansion.

Market Challenge

Limited Energy Density

A major challenge hindering the expansion of the lead acid batteries market is the low energy density compared to advanced battery technologies such as lithium-ion. This limitation affects their suitability for applications that require high power output and compact size, including electric vehicles and portable devices. Moreover, adoption in emerging high-energy applications remains limited.

To overcome this challenge, manufacturers are focusing on technological improvements such as advanced plate designs and optimized material formulations. These innovations aim to enhance performance while retaining the cost advantages of lead acid batteries.

Market Trend

Shift Toward Graphene-enhanced Lead-acid Batteries

The lead acid batteries market is experiencing a significant shift toward graphene-enhanced lead acid batteries, which incorporate graphene to improve electrical conductivity and energy efficiency. The technology offers faster charging, improved charge acceptance, and a longer service life, which addresses performance limitations of traditional designs.

These advantages make graphene-enhanced batteries suitable for high-demand applications such as automotive starting systems, renewable energy storage, and backup power solutions. Leading manufacturers are increasing research efforts and pilot production to integrate this technology and gain a competitive edge in the evolving energy storage sector.

Lead Acid Batteries Market Report Snapshot

|

Segmentation

|

Details

|

|

By Construction Method

|

Flooded, Valve Regulated Lead Acid (VRLA) (Absorbent Glass Mat (AGM), Gel)

|

|

By Product

|

Starting, Lighting, Ignition (SLI), Stationary, Motive

|

|

By Application

|

Automotive, UPS, Telecom, Renewable energy storage, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Construction Method (Flooded and Valve Regulated Lead Acid (VRLA)): The flooded segment earned USD 30.81 billion in 2024, primarily due to its low manufacturing cost and widespread use in automotive and industrial applications.

- By Product (Starting, Lighting, Ignition (SLI), Stationary, and Motive): The starting, lighting, ignition (SLI) segment held a share of 54.20% in 2024, propelled by high demand for vehicle starting power and consistent replacement needs in the automotive sector.

- By Application (Automotive, UPS, Telecom, Renewable energy storage, and Others): The automotive segment is projected to reach USD 30.62 billion by 2032, owing to increasing vehicle production and sustained demand for reliable starting batteries.

Lead Acid Batteries Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific lead acid batteries market share stood at 39.67% in 2024, valued at USD 19.48 billion. This dominance is reinforced by high automotive production and strong demand for two-wheeler and passenger vehicles across China, India, and Japan.

The growing electrification of transport fleets and the presence of large-scale automotive manufacturers are boosting battery consumption. Expanding industrialization and telecom infrastructure further increase the requirement for reliable backup power, which leads to large-scale adoption of lead acid.

The North America lead acid batteries industry is poised to grow at a significant CAGR of 4.51% over the forecast period. This rapid growth is bolstered by government collaborations and strategic investments aimed at advancing lead acid battery technologies.

Federal support for energy storage and hybrid automotive systems is generating demand for high-performance and recyclable batteries. Partnerships between manufacturers and research institutions are facilitating the development of products with improved energy efficiency and extended service life.

- In April 2024, Battery Council International launched the Consortium for Lead Battery Leadership in Long Duration Energy Storage with USD 5 million in DOE support. The consortium, comprising BCI, U.S. manufacturers, national labs, and the Consortium for Battery Innovation, aims to enhance battery efficiency, durability, and cost-effectiveness. Its focus areas include materials research, computer modeling, and new use-case development to support renewable energy, grid-scale storage, and industrial backup applications.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates lead acid batteries under the Resource Conservation and Recovery Act (RCRA) to manage hazardous waste and recycling requirements.

- In Europe, the Batteries Directive 2006/66/EC governs the collection, recycling, and disposal of lead acid batteries to minimize environmental impact.

- In India, the Central Pollution Control Board (CPCB) regulates lead acid batteries under the Batteries (Management and Handling) Rules, 2001 to enforce collection and recycling obligations.

- In Japan, the Ministry of the Environment oversees lead acid battery management under the Waste Management and Public Cleansing Law to promote safe disposal and recycling.

Competitive Landscape

Key players operating in the lead acid batteries industry are focusing on strengthening their position through technological advancements and sustainable practices. They are investing in advanced battery technologies to enhance performance, improve energy density, and increase lifecycle efficiency. Significant resources are allocated to research programs that optimize lead recycling processes and reduce environmental impact.

Several players are establishing new recycling facilities and upgrading existing infrastructure to meet regulatory requirements and improve recovery rates. Furthermore, partnerships with technology providers and local recyclers are also being formed to expand closed-loop recycling systems and ensure a consistent supply of reclaimed materials for production.

- In February 2025, JMJ Group Holding launched Nafees Batteries, a state-of-the-art lead-acid battery recycling facility in Mesaieed, Qatar. The facility transforms used batteries into high-purity lead alloys, supporting sustainable industrial growth, reducing environmental impact, and promoting energy-efficient practices. It aligns with Qatar’s National Vision 2030 and offers applications across industrial manufacturing, resource recovery, and environmental management.

Key Companies in Lead Acid Batteries Market:

- Clarios

- Exide Technologies

- GS Yuasa International Ltd.

- EnerSys

- East Penn Manufacturing Company

- C&D Technologies, Inc.

- Amara Raja Energy & Mobility Limited

- leoch International Technology Limited Inc

- CSB Energy Technology Co., Ltd.

- Hangzhou Eumo Technology Co.,Ltd.

- Tianneng Holding Group

- FIAMM Energy Technology S.p.A.

- Crown Battery Manufacturing

- HOPPECKE Batterien GmbH & Co. KG

- Teledyne Technologies Incorporated

Recent Developments (Product Launch)

- In November 2024, Ipower Batteries launched its Graphene Series lead-acid batteries across India, advancing energy storage for electric vehicles and telecom applications. The batteries integrate graphene to enhance conductivity, enable faster charging, and extend lifespan. The series caters to high-demand applications, including electric two-wheelers, industrial backup systems, and renewable energy storage, providing a more efficient and durable alternative to conventional lead-acid batteries.