Market Definition

The large format printer covers digital printing systems engineered to deliver wide-format output on porous, non-porous, and synthetic media across professional applications. Key offerings include printers, RIP software, and after-sales services such as installation, maintenance, and workflow optimization. Connectivity options range from wired to wireless models.

Technologies are primarily ink-based and toner-based, with print widths from under 24” to above 72”. Ink types include aqueous, solvent, UV-cured, latex, and dye sublimation, tailored to specific end-use requirements. Applications span apparel, textile, signage, advertising, décor, and CAD/technical printing. The market serves print service providers, retailers, and industrial users, with procurement decisions often guided by sustainability and compliance considerations.

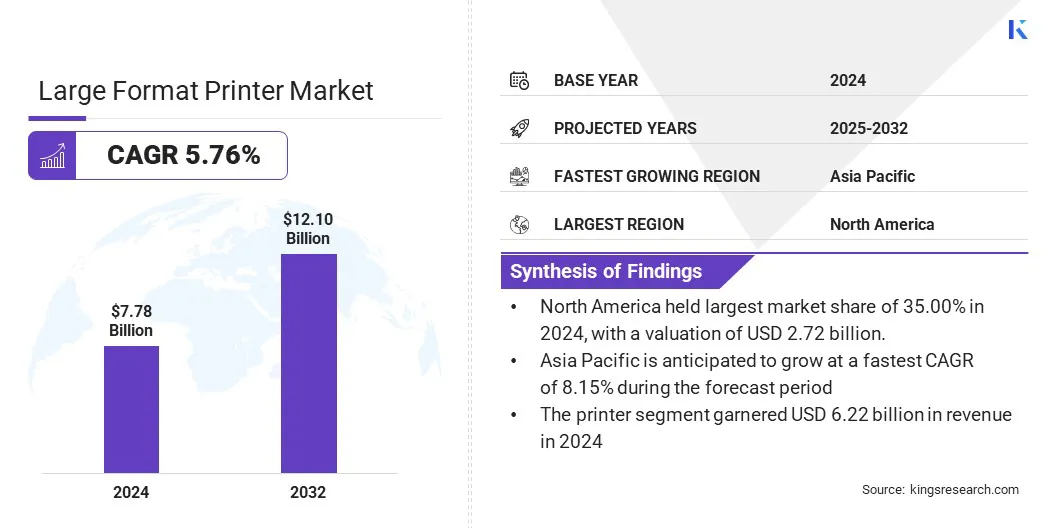

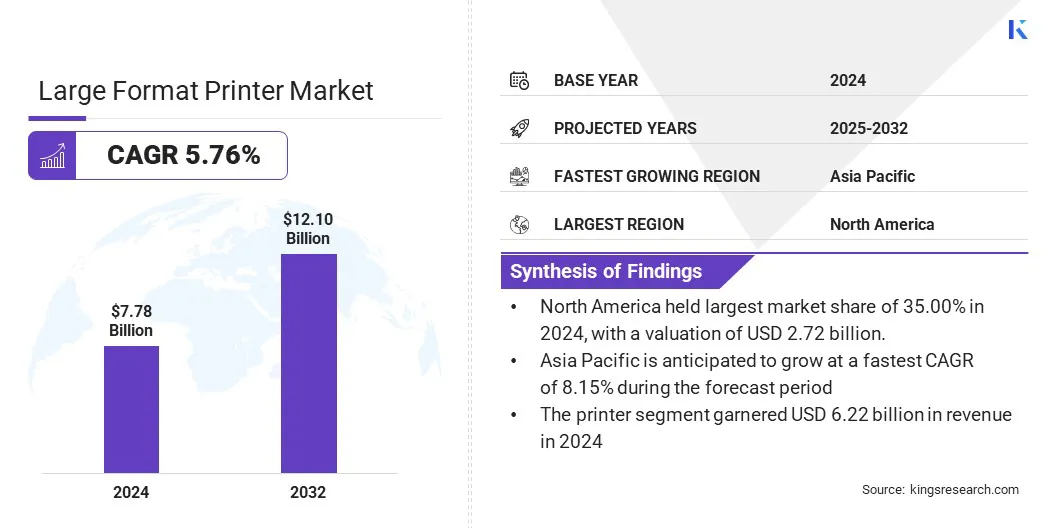

The global large format printer market size was valued at USD 7.78 billion in 2024 and is projected to grow from USD 8.18 billion in 2025 to USD 12.10 billion by 2032, exhibiting a CAGR of 5.76% during the forecast period.

This growth is driven by the shift of brand campaigns and wayfinding solutions to digitally printed, short-run formats, along with the adoption of inkjet technology in décor and soft-signage. Manufacturers are introducing hybrid and roll printers with features such as white ink, automation, and integrated cutters to increase throughput and substrate versatility.

Key Highlights:

- The large format printer industry size was recorded at USD 7.78 billion in 2024.

- The market is projected to grow at a CAGR of 5.76% from 2025 to 2032.

- North America held a share of 35.00% in 2024, valued at USD 2.72 billion.

- The printers segment garnered USD 6.22 billion in revenue in 2024.

- The wired segment is expected to reach USD 6.77 billion by 2032.

- The porous segment garnered USD 4.28 billion in revenue in 2024.

- The ink-based segment is expected to reach USD 9.46 billion by 2032.

- The 44–60″ segment registered USD 2.33 billion in revenue in 2024.

- The aqueous segment is estimated to reach USD 2.65 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 8.15% over the forecast period.

Major companies operating in the large format printer market are HP Development Company, L.P., Canon Inc., Seiko Epson Corporation, Brother Industries, LTD., Mimaki Engineering Co. LTD., Roland DGA Corporation, RICOH, Durst Group AG, Xerox Corporation, Konika Minolta, Inc., Agfa-Gevaert Group, Electronics For Imaging, Inc., Kyocera Corporation, Fujifilm Holdings Corporation, and swissQprint AG.

The market is witnessing notable activity with the launch of new hybrid and roll printers, along with resin and UV platforms. These developments highlight continued investment in productivity and media versatility.

At the same time, buyers in public and enterprise sectors are increasingly specifying ENERGY STAR and EPEAT certifications to align with sustainability goals, which is reinforcing refresh cycles. To strengthen their reach, companies are broadening their market presence by introducing products through local and regional partnerships.

- In August 2025, Agfa and Artwork Systems Nordic entered a non-exclusive reseller agreement to distribute Agfa’s Anapurna inkjet portfolio in Denmark, Sweden, and Norway. This partnership strengthens Agfa’s market presence in the Nordic region while enabling Artwork Systems Nordic to expand its offerings with Agfa’s wide-format printers and inks.

Market Driver

Rising Demand for Application Versatility Fuels Market Expansion

The growth of the large format printer market is fueled by rising demand for versatile applications from brands and print providers. Organizations are seeking multifunctional devices capable of managing both porous and non-porous substrates to support diverse, high-value outputs. This demand is driving vendors to introduce hybrid architectures, expand ink portfolios, and deploy automated workflows.

Modern hybrid systems can accommodate rigid boards and flexible rolls, making them suitable for retail graphics, exhibition panels, and related formats. Meanwhile, resin and UV platforms enable faster turnaround times and durable performance across indoor and outdoor environments.

In the public sector, procurement preferences for EPEAT- and ENERGY STAR-certified systems are reinforcing fleet renewal cycles. Together, these factors are expanding addressable applications and improving utilization rates for print service providers.

- In January 2025, Agfa introduced the Anapurna Ciervo H2500, a 2.5 m hybrid inkjet printer complementing the larger Ciervo H3200. The H2500 features six-color plus white inks, UV LED curing, and a 70% productivity boost to 59 m²/h. Both models offer optional corrugated media feed guides, enhancing versatility for packaging and point-of-sale applications.

Market Challenge

Balancing Cost Efficiency with Environmental and Workflow Standards

The expansion of the large format printer market is impeded by rising operational costs and stricter sustainability compliance requirements. Print providers need to manage expenses across ink, energy use, media waste, and labor, while ensuring adherence to workflow and environmental standards.

Regulations such as ENERGY STAR v3.2 and EPEAT Climate+ add further complexity by requiring additional validation and documentation during procurement, slowing adoption cycles. To address these challenges, manufacturers are standardizing on certified devices, integrating RIP software with automated nesting and color management, and developing inks and media with recognized indoor air quality and safety certifications.

- In November 2024, the Global Electronics Council (GEC) released updated Imaging Equipment Consumables Criteria for the EPEAT ecolabel. The criteria, effective November 1, 2025, set standards for minimizing consumable use, incorporating recycled content and remanufactured cartridges, ensuring indoor air quality compliance, and promoting take-back programs to support circularity.

Market Trend

Transitioning to Hybrid, White Ink, and Automated Workflows

The large format printer market is witnessing a notable shift toward hybrid systems capable of handling both rolls and rigid materials, with added capabilities such as white and clear inks for layered effects.

New models emphasize higher speeds, extended uptime, and unattended operation, while vendors emphasize end-to-end workflow integration to minimize manual touchpoints. Sustainability is increasingly embedded in product design and procurement. These developments are expanding use cases in retail décor, exhibition graphics, packaging mock-ups, and soft signage, supporting broader adoption.

|

Segmentation

|

Details

|

|

By Offering

|

Printers, RIP Software, After-Sales Service

|

|

By Connectivity

|

Wired, Wireless

|

|

By Printing Material

|

Porous, Non Porous Materials (Synthetic Paper, Others)

|

|

By Technology

|

Ink-Based, Toner Based

|

|

By Print Width

|

Under 24″, 24–36″, 36–44″, 44–60", 60–72″, Above 72″

|

|

By Ink Type

|

Aqueous, Solvent, UV-Cured, Latex, Dye Sublimation

|

|

By Application

|

Apparel and Textile, Signage and Advertising, Decor, CAD and Technical Printing

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Printers, RIP Software, and After-Sales Service): The printers segment earned USD 6.22 billion in 2024, primarily due to ongoing hardware updates for hybrid and roll devices that enhance media versatility and support certified procurement in public and enterprise fleets.

- By Connectivity (Wired and Wireless): The wired segment held a share of 65.00% in 2024, as gigabit Ethernet remains standard in professional devices, ensuring reliable, high-volume data transfer in production environments.

- By Printing Material (Porous and Non Porous Materials (Synthetic Paper and Others)): The porous segment is projected to reach USD 6.15 billion by 2032, supported by consistent demand for paper-based signage and posters, and compatibility with large format printers across aqueous, latex, and resin platforms.

- By Technology (Ink-Based and Toner Based): The ink-based segment recorded USD 5.84 billion in 2024, reflecting its wide application scope in signage, décor, and textiles, enabled by latex, UV-cured, dye-sublimation, and aqueous inks.

- By Print Width (Under 24″, 24–36″, 36–44″, 44–60", 60–72″, and Above 72″): The 44–60″ segment held a share of 30% in 2024, favored for retail signage, posters, and vehicle graphics, with strong device availability and broad media options.

- By Ink Type (Aqueous, Solvent, UV-Cured, Latex, and Dye Sublimation): The latex segment is projected to reach USD 2.71 billion by 2032, supported by low-odor indoor suitability and third-party indoor air certifications, making it attractive for retail and education procurement.

- By Application (Apparel and Textile, Signage and Advertising, Decor, CAD and Technical Printing): The signage and advertising segment is projected to reach USD 4.96 billion by 2032, propelled by steady out-of-home, retail promotional cycles, along with faster turnaround times enabled by hybrid and roll platforms.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America large format printer market share stood at 35% in 2024, valued at USD 2.72 billion. This dominance is reinforced by procurement in government, education, and healthcare, where ENERGY STAR and EPEAT requirements are embedded in RFP processes, influencing fleet upgrade decisions.

Vendors are focusing on professional signage solutions and expanding hybrid portfolios to meet demand for retail décor and institutional wayfinding. Key developments include the enforcement of ENERGY STAR v3.2 for imaging equipment, updates to the EPEAT Climate+ registry, and vendor showcases emphasizing end-to-end signage workflows tailored to the U.S. market.

- In April 2025, Agfa expanded its Anapurna Ciervo series by introducing the Ciervo H2050 and Ciervo H2500 at the ISA International Sign Expo 2025 in Las Vegas. The new models offered broader application capabilities, including support for corrugated media through optional feed guides. With improved productivity and flexible printing on rigid and flexible substrates, the Ciervo range strengthened its position in sign, display, and packaging applications.

The Asia-Pacific large format printer industry is expected to grow at a CAGR of 8.15% during the forecast period. Growth in the region is supported by strong manufacturing bases in Japan and China, and by rising adoption in India and Southeast Asia for retail, décor, and soft signage. In Japan, vendors have launched new hybrid platforms to expand applications and strengthen product portfolios.

Across the region, other key developments include launch of new products with wider product ranges in the large format segment and the rollout of India’s e-waste regulations are driving fleet replacement and promoting formal recycling practices.

Regulatory Frameworks

- In the European Union, RoHS restricts hazardous substances in electrical and electronic equipment, WEEE governs take-back and recycling, and REACH regulates chemicals used in inks and components. While large industrial tools may be exempt, most professional printers and consumables fall under these frameworks.

- In the U.S., ENERGY STAR Version 3.2 sets energy criteria for imaging equipment, while EPEAT defines lifecycle-based ecolabel standards widely applied in public procurement.

- In India, the E-Waste (Management) Rules, 2022 (in force from April 1, 2023), mandate registration of imaging equipment producers on the CPCB portal under an enhanced EPR regime.

- In Japan, the J-Moss (JIS C 0950) scheme requires marking and disclosure of certain substances in EEE, with industry guidance provided by JEITA.

- In China, “China RoHS” restricts hazardous substances in EEE, requiring manufacturers to disclose substance content and indicate environmental protection use periods.

Competitive Landscape

Major players in the large format printer industry are enhancing hybrid portfolios, integrating inline cutting and automated handling, and offering cloud-based fleet and color management solutions. ENERGY STAR and EPEAT certifications, media ecosystem expansion, subscription models, and partnerships with workflow providers are further boosting automation and efficiency.

- In March 2025, BHS Corrugated and Agfa entered a strategic agreement, with Agfa supplying printing engines for the BHS Jetliner Xceed and BHS Jetliner Monochrome and serving as a certified ink supplier. The collaboration focuses on advancing single-pass inkjet printing for corrugated applications, offering higher speeds, improved efficiency, and flexible production models, while supporting the industry’s shift from analog to digital pre-print and inline solutions.

Key Companies in Large Format Printer Market:

- HP Development Company, L.P.

- Canon Inc.

- Seiko Epson Corporation

- Brother Industries, LTD.

- Mimaki Engineering Co. LTD.

- Roland DGA Corporation

- RICOH

- Durst Group AG

- Xerox Corporation

- Konika Minolta, Inc.

- Agfa-Gevaert Group

- Electronics For Imaging, Inc.

- Kyocera Corporation

- Fujifilm Holdings Corporation

- swissQprint AG.

Recent Developments (Product Launches)

- In April 2025, HP introduced the Latex R530 Printer, a compact printer for both rigid and flexible applications. The model featured automatic recirculation, simplified installation with single-phase power, and sustainable components such as UL ECOLOGO-certified inks and recycled plastic components. It was designed to reduce waste, improve uptime, and support new application areas for print service providers.

- In January 2025, Canon India launched the imagePROGRAF TZ-5320 and TX Series large format printers, offering high-speed output, improved color reproduction with enhanced magenta ink, and advanced features such as automatic ink sensing and smart roll paper handling. The series supported CAD, posters, and corporate materials while incorporating energy-saving functions and eco-friendly packaging to improve productivity and align with sustainability requirements.

- In January 2025, Epson launched the SureColor G-Series, including its first wide-format printer for direct-to-film production, the SureColor G6060. Targeted at garment and merchandise manufacturing, it featured high duty cycles, low maintenance, and consistent output. Supporting both sheet-based and roll-based production with certified inks and integrated workflow tools, the model was scheduled for demonstration at PacPrint 2025 in Sydney.