Market Definition

The market refers to the integration of Internet of Things (IoT) technologies within the insurance industry to enhance risk assessment, improve underwriting accuracy, streamline claims processing, and enable personalized policy offerings. This market includes IoT-enabled devices such as telematics, wearables, smart home sensors, and industrial monitoring tools that collect real-time data.

Insurers use this data to monitor policyholder behavior, detect anomalies, and prevent potential losses. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

IoT Insurance Market Overview

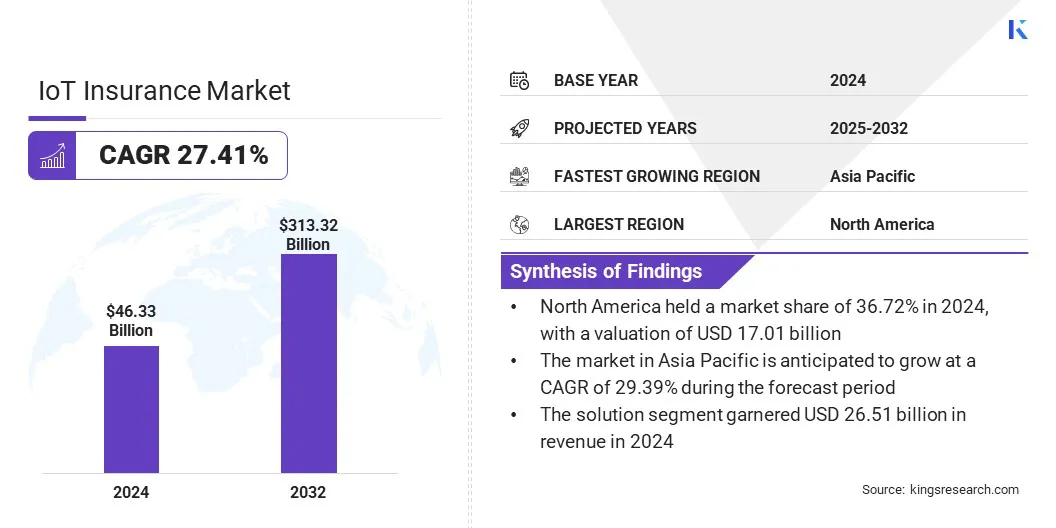

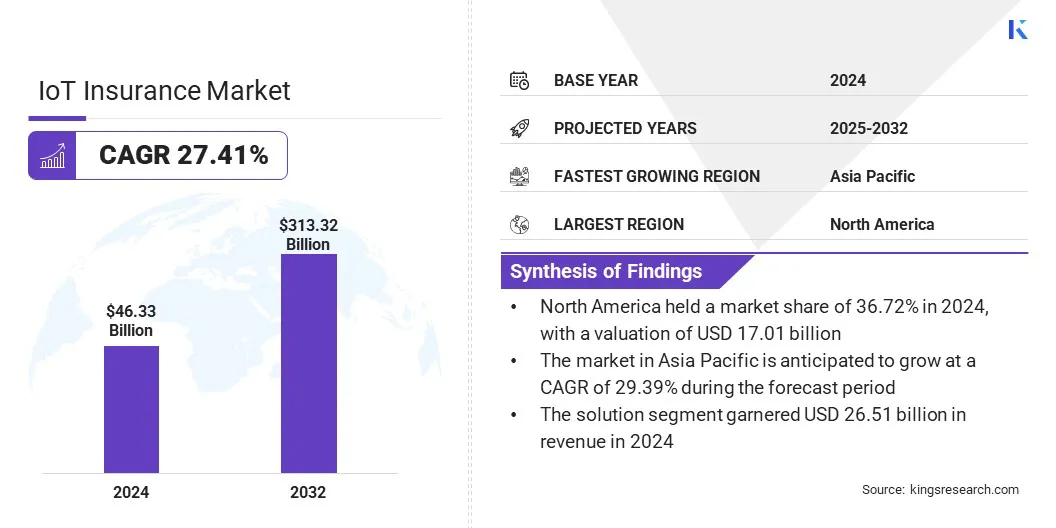

The global IoT insurance market size was valued at USD 46.33 billion in 2024 and is projected to grow from USD 57.50 billion in 2025 to USD 313.32 billion by 2032, exhibiting a CAGR of 27.41% during the forecast period.

This significant growth is driven by the increasing deployment of connected devices across sectors such as automotive, healthcare, smart homes, and commercial property. Additionally, rising demand for usage-based and behavior-driven insurance models is fueling market expansion.

Insurers are leveraging real-time data from IoT-enabled devices to enhance risk assessment, reduce fraudulent claims, and improve customer engagement.

Major companies operating in the IoT insurance industry are Zurich, Munich Re Group, American International Group, Inc., Progressive Corporation, State Farm Mutual Automobile Insurance Company, Liberty Mutual Insurance Company, Nationwide Mutual Insurance Company, MetLife Services and Solutions, LLC, John Hancock, Assicurazioni Generali S.p.A., Ping An, Talanx AG, Octo Group S.p.A, Verisk Analytics, Inc., and Swiss Re.

The growing adoption of smart homes, telematics in vehicles, and wearable health monitors is enabling insurers to offer personalized premiums and proactive risk mitigation services.

Additionally, advancements in data analytics and cloud infrastructure are accelerating the integration of IoT into insurance operations, supporting more agile and data-centric decision-making across the industry. These developments are driving demand for IoT-enabled insurance solutions, thereby contributing to the growth of the IoT in insurance market.

- In February 2023, the United Services Automobile Association (USAA), a financial services group serving military members and their families, strengthened its position in the connected insurance space by integrating telematics and IoT technologies into its offerings. This strategic focus was demonstrated through the acquisition of Noblr, aimed at expanding its usage-based insurance capabilities. By leveraging data-driven innovations, USAA seeks to deliver more personalized and responsive insurance solutions tailored to the specific needs of its member base.

Key Highlights

- The IoT insurance market size was valued at USD 46.33 billion in 2024.

- The market is projected to grow at a CAGR of 27.41% from 2025 to 2032.

- North America held a market share of 36.72% in 2024, with a valuation of USD 17.01 billion.

- The solution segment garnered USD 26.51 billion in revenue in 2024.

- The automotive/vehicle insurance segment is expected to reach USD 117.59 billion by 2032.

- The individual consumers segment is expected to reach USD 138.26 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 29.39% during the forecast period.

Market Driver

Cybersecurity Risks Driving Growth in IoT Insurance

The market is witnessing significant growth driven by the increasing cybersecurity risks in IoT environments. As more devices and systems are becoming interconnected, the potential for security breaches and cyber-attacks is escalating, making robust cybersecurity solutions essential.

IoT devices provide greater convenience and efficiency but often introduce security vulnerabilities that cybercriminals can exploit. This is increasing the need for comprehensive insurance products tailored to protect businesses and individuals against IoT-related security risks.

Insurers are offering more robust coverage solutions, focusing on the unique security challenges posed by decentralized IoT and edge computing environments, thereby driving market growth.

- In March 2025, IDT Corporation partnered with AccuKnox to deploy Zero Trust CNAPP for IoT/Edge Security. The solution uses AccuKnox’s KubeArmor, which applies eBPF telemetry and Linux Security Modules (LSM) to strengthen the protection of enterprise assets against evolving threats in IoT and Edge environments.

Market Challenge

Managing Data Privacy and Security

In the IoT insurance market, one of the key challenges is ensuring the privacy and security of the vast amounts of sensitive data generated by IoT devices. As insurers adopt real-time monitoring to assess and protect assets, the data collected often includes personal or business-critical information.

Ensuring secure storage and compliance with privacy regulations remains a top priority. The highly interconnected nature of IoT ecosystems expands the attack surface, increasing vulnerability to cyber threats.

To mitigate these risks, insurers are turning to advanced data protection measures such as end-to-end encryption, secure storage protocols, and decentralized data frameworks. Adopting multi-layered security systems with continuous threat monitoring is further supporting proactive risk management.

Market Trend

Growing Use of IoT Sensors for Real-Time Property Protection

The market is increasingly adopting sensor technology to enable real-time monitoring and early detection of risks such as water leaks and frozen pipes in residential and commercial properties.

This integration allows insurers to offer proactive risk management solutions that minimize damage, reduce claim occurrences, and enhance customer experience. By leveraging real-time data, insurance providers can deliver more personalized and adaptive coverage, driving greater efficiency and transforming property risk management.

- In May 2025, HSB introduced Meshify Defender Slim, its latest and thinnest IoT sensor, powered by Amazon Sidewalk. Meshify Defender Slim is able to help protect small commercial locations, habitational buildings, and residential homes from water leaks and frozen pipes. The sensors connect to Amazon Sidewalk and deliver HSB’s next generation of protection, available through insurance companies that partner with HSB.

IoT Insurance Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Service

|

|

By Type of Insurance

|

Automotive/Vehicle Insurance, Home Insurance, Health and Life Insurance, Commercial/Business Insurance

|

|

By End User

|

Individual Consumers, Small and Medium-Sized Enterprises (SMEs), Large Enterprises

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution, Service): The solution segment earned USD 26.51 billion in 2024 due to the growing adoption of IoT platforms and analytics tools that enable real-time risk monitoring and policy customization.

- By Type of Insurance (Automotive/Vehicle Insurance, Home Insurance, Health and Life Insurance, Commercial/Business Insurance): The automotive/vehicle insurance segment held 42.07% of the market in 2024, due to the widespread integration of telematics and connected vehicle technologies that support usage-based insurance models.

- By End User (Individual Consumers, Small and Medium-Sized Enterprises (SMEs), Large Enterprises): The individual consumers segment is projected to reach USD 138.26 billion by 2032, owing to increasing demand for personalized insurance plans enabled by smart home devices, wearable health trackers, and in-vehicle sensors.

IoT Insurance Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 36.72% share of the IoT insurance market in 2024, with a valuation of USD 17.01 billion. This dominance is primarily attributed to the early adoption of connected insurance models by major insurers in the U.S. and Canada, coupled with the high penetration of IoT devices across automotive, home, and health segments.

The presence of well-established telematics programs, particularly in the U.S. auto insurance sector, and strong collaboration between insurers and tech firms for real-time claims processing and risk analytics are significantly contributing to the market growth. Additionally, the region’s mature digital infrastructure and high consumer awareness regarding smart insurance offerings are further supporting the widespread deployment.

The IoT insurance industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 29.39% over the forecast period. In the region, the growing adoption of smart devices and IoT technologies in emerging markets such as India and China is transforming the insurance landscape.

In India, increased use of mobile apps and digital platforms is accelerating demand for connected insurance products. China is experiencing rapid growth in IoT-enabled property and health insurance, as consumers adopt connected devices to manage risks more proactively.

Additionally, expanding e-commerce and a dynamic tech ecosystem are supporting the development of cost-effective, personalized insurance models tailored to regional needs. This is driving market expansion across Asia Pacific.

Regulatory Frameworks

- In Europe, insurance is regulated by the European Insurance and Occupational Pensions Authority (EIOPA) which serves as the central body for financial supervision in the EU, ensuring that EU-level regulations are consistently implemented.

- In India, the Insurance Regulatory and Development Authority of India (IRDAI) is the regulatory body for the insurance industry. IRDAI regulates, promotes, and ensures the orderly growth of the insurance and re-insurance business in India.

Competitive Landscape

The IoT insurance market is characterized by key players adopting various strategies to strengthen their market position. Insurers are forming partnerships with technology providers to integrate IoT-enabled platforms, leveraging real-time data analytics for more accurate risk assessments and personalized offerings.

Some companies focus on innovation, developing proprietary IoT solutions to differentiate their products. Additionally, insurers are expanding into emerging markets, tailoring their offerings to local consumer needs. The focus on enhancing customer experience through mobile apps and seamless digital interfaces, along with adopting usage-based insurance models, further strengthens their market position.

- In March 2025, HSB signed an agreement with Flume to refer its flow-based home water leak detection service to insurance clients. The Flume Home Water Protection Service uses a single IoT sensor to monitor water flow, detect leaks, and send alerts via a mobile app, aiming to reduce property damage and insurance claims.

List of Key Companies in IoT Insurance Market:

- Zurich

- Munich Re Group

- American International Group, Inc.

- Progressive Corporation

- State Farm Mutual Automobile Insurance Company

- Liberty Mutual Insurance Company

- Nationwide Mutual Insurance Company

- MetLife Services and Solutions, LLC

- John Hancock

- Assicurazioni Generali S.p.A.

- Ping An

- Talanx AG

- Octo Group S.p.A

- Verisk Analytics, Inc.

- Swiss Re

Recent Developments (Partnerships/Agreements/Product Launch)

- In July 2024, Divirod and SAS partnered within the SAS Internet of Things (IoT) Partner Ecosystem. The collaboration focused on leveraging Divirod's IoT water data collection technology and SAS' AI and IoT analytics to help organizations better manage and predict water-related risks caused by climate change.

- In March 2024, HSB launched Cyber for Auto, a new coverage designed to safeguard personal vehicles from cyber-attacks, ransomware, and identity theft. The coverage targets the increasing cybersecurity risks associated with connected vehicles and provides protection for data stored in cars and connected apps.

- In October 2023, Najm for Insurance Services partnered with IoT Squared to deliver advanced electronic services through an integrated platform. The collaboration aims to support insurance companies in adopting emerging technologies and enhancing operational efficiency by leveraging IoT-enabled solutions.

in the global market