Market Definition

Intravenous immunoglobulin is a blood-derived product consisting pooled antibodies that support immune system function in patients with immune deficiencies or autoimmune disorders. This therapeutic solution provides essential immunoglobulins intravenously, ensuring rapid and sustained immune support.

The market finds applications across hospital settings and specialty clinics, particularly in treating primary immunodeficiencies, chronic inflammatory demyelinating polyneuropathy, and immune thrombocytopenia. Clinicians utilize this therapy to replace missing antibodies, modulate immune responses, and reduce infection risk in vulnerable patient populations.

Intravenous Immunoglobulin Market Overview

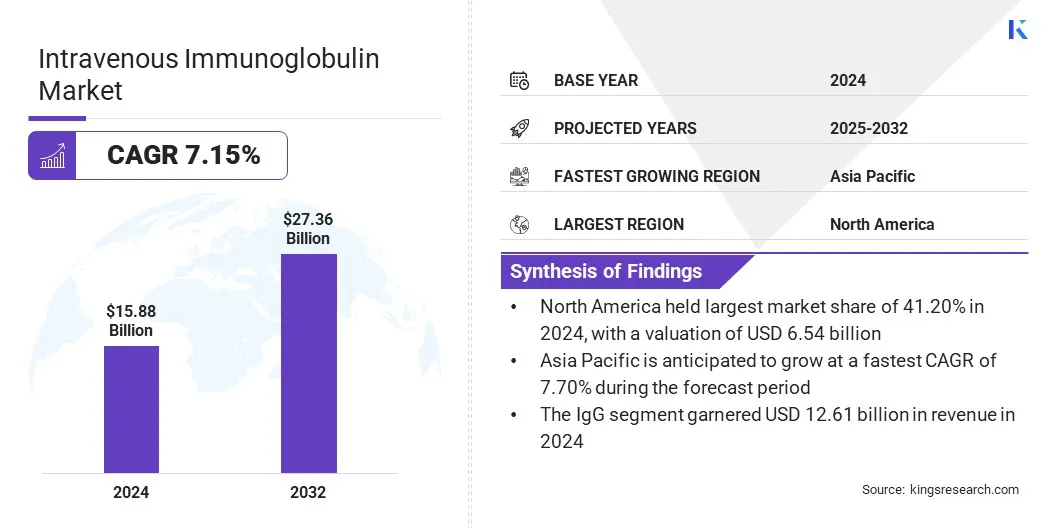

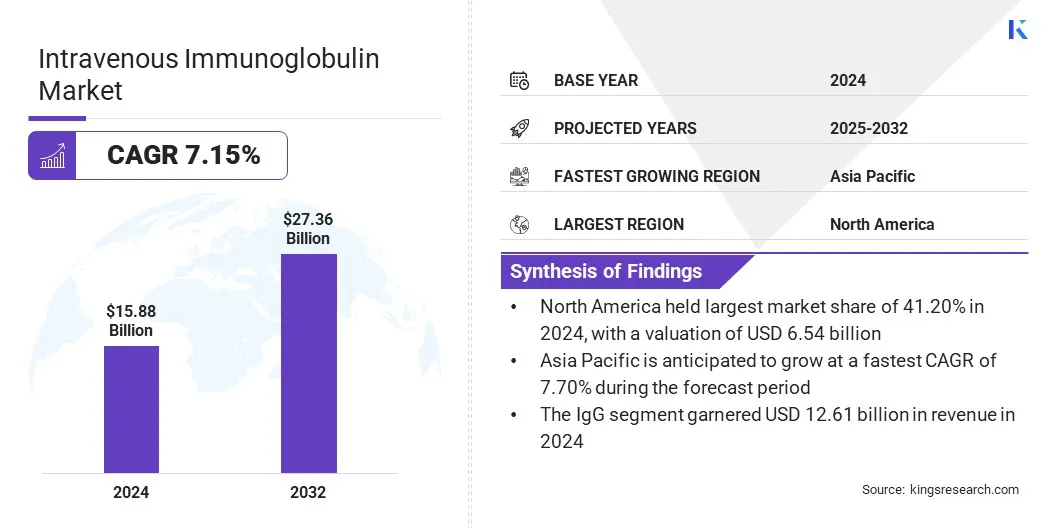

The global intravenous immunoglobulin market size was valued at USD 15.88 billion in 2024 and is projected to grow from USD 16.87 billion in 2025 to USD 27.36 billion by 2032, exhibiting a CAGR of 7.15% during the forecast period.

This market is driven by improved diagnosis rates and broader healthcare access, enabling the earlier detection and treatment of immune-related conditions. Additionally, the development of next-generation recombinant and enhanced IVIG products is improving safety, consistency, and availability, further supporting market expansion and clinical adoption.

Key Highlights

- The intravenous immunoglobulin industry size was valued at USD 15.88 billion in 2024.

- The market is projected to grow at a CAGR of 7.15% from 2025 to 2032.

- North America held a market share of 41.20% in 2024, with a valuation of USD 6.54 billion.

- The IgG segment garnered USD 12.61 billion in revenue in 2024.

- The plasma-derived segment is expected to reach USD 22.97 billion by 2032.

- The liquid segment secured the largest revenue share of 71.30% in 2024.

- The small & medium pharma segment is poised for a robust CAGR of 7.32% through the forecast period.

- The primary immunodeficiency segment is expected to secure the largest revenue share of 25.07% in 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.70% during the forecast period.

Major companies operating in the intravenous immunoglobulin industry are CSL Limited, Grifols, S.A., Octapharma AG, Takeda Pharmaceutical Company Limited, Biotest AG, Kedrion S.p.A., Baxter International Inc., ADMA Biologics, Inc., LFB Group, China National Biotech Group, Hualan Biological Vaccine Inc., Pfizer Inc., Kamada Pharmaceuticals, Sichuan Yuanda Shuyang Pharmaceuticals Co. Ltd., and BHARAT SERUMS AND VACCINES LIMITED.

Expanding treatment applications are driving the demand for IVIG across global healthcare systems. IVIG is being increasingly adopted for managing conditions such as primary immunodeficiency (PID), chronic inflammatory demyelinating polyneuropathy (CIDP), immune thrombocytopenia (ITP), Guillain–Barré syndrome, and Kawasaki disease.

Growing clinical acceptance and efficacy evidence are supporting the use of IVIG in treating a wide range of autoimmune and neurological disorders. Physicians are also exploring emerging off-label uses where IVIG shows significant potential in managing difficult-to-treat inflammatory and immune-mediated conditions. The rising patient awareness and diagnosis rates are contributing to the greater utilization of immunoglobulin therapies in hospital and outpatient settings.

Market Driver

Rising Diagnosis and Healthcare Access

The rising rates of diagnosis and improved healthcare access are driving the adoption of IVIG therapies across global markets. Advancements in diagnostic technologies are enabling earlier and more accurate identification of immunodeficiency and autoimmune conditions.

Increase in clinician awareness is leading to more frequent and timely IVIG prescriptions, especially in neurology, hematology, and immunology specialties. Governments and health systems are increasingly including IVIG in essential drug lists and reimbursement programs.

- In March 2025, the World Health Organization (WHO) reported that over 50 low- and middle-income countries have recently expanded their essential medicines lists to include IVIG therapies. This inclusion, coupled with growing national insurance schemes, has increased patient access to IVIG treatments for immunodeficiency and autoimmune disorders globally.

Market Challenge

Plasma Supply Constraints Increasing Supply-Chain Risk

A key challenge in the intravenous immunoglobulin market is reliance on human plasma, which is primarily collected from compensated donors. This dependence makes the supply chain vulnerable to disruptions caused by donor availability, regulatory restrictions, and collection bottlenecks. Limited plasma supply can lead to shortages, which impact treatment availability for patients with immune disorders.

Market players are expanding plasma collection networks, investing in donor recruitment programs, and enhancing collection efficiency through advanced technologies. Companies are also partnering with blood centers and increasing capacity at fractionation facilities to improve supply stability.

Market Trend

Next-gen Recombinant & Enhanced IVIG Products

A key trend in the intravenous immunoglobulin market is the development of next-generation IVIG products using advanced formulation technologies. Manufacturers are working on recombinant IVIG and nanoparticle-based variants to address supply limitations and improve therapeutic performance. These innovations are aiming to enhance product safety, reduce the risk of adverse reactions, and increase treatment consistency.

Efforts are directed toward low-viscosity and high-purity formulations that allow easier administration and better patient tolerance. Research and development pipelines are expanding to support broader clinical applications and improve manufacturing scalability.

- In May 2024, Gliknik announced that its lead recombinant IVIG mimetic candidate, GL‑2045, received FDA Orphan Drug designation for the treatment of Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). GL‑2045 is designed to mimic only the active Fc portion of IVIG, which allows lower dosing, improved safety by avoiding blood-borne pathogen risk, and enhanced manufacturing scalability.

Intravenous Immunoglobulin Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

IgG, IgA, IgM

|

|

By Source

|

Plasma-derived, Recombinant

|

|

By Dosage Form

|

Liquid, Lyophilized

|

|

By End User

|

Big Pharma, Small & Medium Pharma, Biotech Companies

|

|

By Application

|

Primary Immunodeficiency, CIDP, Guillain–Barré Syndrome, Hypogammaglobulinemia, ITP (Immune Thrombocytopenic Purpura), Myasthenia Gravis, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (IgG, IgA, and IgM): The IgG segment earned USD 12.61 billion in 2024, due to its broad clinical application across multiple immune deficiencies and autoimmune disorders, coupled with the high demand for well-established and effective IgG-based therapies.

- By Source (Plasma-derived and Recombinant): The plasma-derived segment held 85.60% share of the market in 2024, due to its proven clinical efficacy, established manufacturing processes, and widespread regulatory approval for treating a broad range of immunological and neurological disorders.

- By Dosage Form (Liquid and Lyophilized): The liquid segment is projected to reach USD 19.02 billion by 2032, owing to its ready-to-use format, reduced preparation time, and lower risk of contamination.

- By End User (Big Pharma, Small & Medium Pharma, and Biotech Companies): The small & medium pharma segment is poised for significant growth at a CAGR of 7.32% through the forecast period, due to their growing role in niche therapy development, faster regulatory approvals, and agile production models that enable targeted distribution and faster market access in underserved regions.

Intravenous Immunoglobulin Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America intravenous immunoglobulin market share stood at around 41.20% in 2024, with a valuation of USD 6.54 billion. This dominance is largely driven by the region's well-established plasma collection infrastructure, especially in the U.S., where public and private entities operate a widespread network of donation centers. These facilities adhere to stringent regulatory standards and play a major role in global plasma supply.

The consistent and large-scale availability of raw plasma enables manufacturers to maintain stable production and effectively meet rising clinical demand with minimal supply chain disruptions.

- In October 2024, CSL Plasma introduced the Rika Plasma Donation System at seven Houston-area centers. The Rika system, developed by Terumo Blood and Cell Technologies, accelerates plasma collection to an average of 35 minutes, which is about 15 minutes faster than standard machines, while limiting extracorporeal blood to no more than 200 mL for donor safety.

The intravenous immunoglobulin industry in Asia Pacific is set for a significant CAGR of 7.70% over the forecast period, owing to increasing autoimmune diseases, such as myasthenia gravis and Guillain–Barré syndrome, and neurological disorders that respond well to IVIG treatment.

- In March 2024, the National Library of Medicine reported that the Guillain–Barré syndrome in Asia Pacific is rising, with Taiwan recording 1.71 cases per 100,000 person-years and cases in South Korea increasing from 1.28 to 1.82. In East Asia, the rates range from 0.44 to 0.67, with prevalence rising to 20% every decade.

Factors such as lifestyle changes, aging populations, and improved diagnostics are leading to more frequent identification of these conditions. As awareness among physicians grows, IVIG is becoming a more commonly prescribed treatment, boosting market demand.

Regulatory Frameworks

- In the U.S., IVIG is regulated by the Food and Drug Administration (FDA) under the Public Health Service Act and Title 21 of the Code of Federal Regulations (Parts 600–680). Manufacturers must submit a Biologics License Application (BLA) with clinical, manufacturing, and safety data. Plasma collection centers must be separately licensed. Current Good Manufacturing Practices (CGMP), post-marketing surveillance, and mandatory adverse event reporting ensure continued safety and product consistency.

- In the European Union (EU), IVIG is classified as a biological medicinal product and is regulated under Directive 2001/83/EC and Regulation (EC) No 726/2004. The European Medicines Agency handles centralized marketing authorizations, while national agencies manage batch release and pharmacovigilance. Manufacturers must comply with EU Good Manufacturing Practices, submit Periodic Safety Update Reports, and implement comprehensive risk management plans. EudraVigilance is used for adverse event monitoring across the member states.

- Japan regulates IVIG under the Pharmaceutical and Medical Devices Act. The Pharmaceuticals and Medical Devices Agency reviews clinical, non-clinical, and manufacturing data in line with International Council for Harmonisation (ICH) guidelines. Plasma collection and fractionation facilities must be licensed. Post-marketing obligations include adverse event monitoring, safety re-evaluations, and quality audits. The Ministry of Health, Labour and Welfare handles the reimbursement and policy-level oversight following product approval.

- China’s National Medical Products Administration governs IVIG through its biological product regulatory framework. Approval requires a full clinical, non-clinical, and CMC (Chemistry, Manufacturing, and Controls) data submission. Manufacturers must meet China GMP standards and participate in post-market surveillance. While there is no formal interchangeability pathway, domestic regulations increasingly reflect international norms, especially in adverse event monitoring, virus inactivation processes, and batch consistency reviews.

Competitive Landscape

Major players in the intravenous immunoglobulin industry are adopting strategies such as expanding manufacturing capabilities, investing in advanced production technologies, and pursuing regulatory approvals across multiple regions, which are contributing to the growth of the market.

Companies are also focusing on research and development to improve product purity and efficacy, while engaging in strategic collaborations to strengthen their global footprint. These efforts support faster product launches, wider treatment access, and overall market expansion.

- In June 2024, Biotest, a subsidiary of Grifols, received approval from the U.S. FDA for Yimmugo, an intravenous immunoglobulin (Ig) therapy designed to treat primary immunodeficiencies (PID). The therapy is manufactured using advanced processes at Biotest’s newly FDA-approved “Next Level” production facility in Dreieich, Germany, which had already been authorized for production and marketing within Europe.

List of Key Companies in Intravenous Immunoglobulin Market:

- CSL Limited

- Grifols, S.A.

- Octapharma AG

- Takeda Pharmaceutical Company Limited

- Biotest AG

- Kedrion S.p.A

- Baxter International Inc.

- ADMA Biologics, Inc.

- LFB Group

- China National Biotech Group

- Hualan Biological Vaccine Inc.

- Pfizer Inc.

- Kamada Pharmaceuticals

- Sichuan Yuanda Shuyang Pharmaceuticals Co. Ltd.

- BHARAT SERUMS AND VACCINES LIMITED

Recent Developments (Approval/Product Launch)

- In January 2024, Takeda received U.S. FDA approval for GAMMAGARD LIQUID. This 10% immune globulin infusion was approved as an IVIG therapy for the induction and maintenance treatment of chronic inflammatory demyelinating polyneuropathy (CIDP) in adults. The approval follows a Phase 3 ADVANCE-CIDP study demonstrating improvements in neuromuscular function.

- In January 2024, Takeda also received U.S. FDA approval for HYQVIA for CIDP maintenance therapy. HYQVIA combines 10% immune globulin with recombinant human hyaluronidase to enable facilitated subcutaneous administration once a month. Efficacy was demonstrated in the ADVANCE-CIDP 1 trial, significantly reducing relapse rates compared to placebo.

- In December 2023, GC Pharma introduced Alyglo, a sterile, 10% immunoglobulin G (IgG) liquid formulation approved by the U.S. Food and Drug Administration (FDA). Alyglo is specifically for adults who are 17 years and older suffering from primary humoral immunodeficiency. The drug offers 100 mg/mL of protein, with a minimum of 96% originating from human IgG derived from collective human plasma.