Market Definition

Intrauterine devices (IUDs) are small, T-shaped contraceptive devices inserted into the uterus to prevent pregnancy through hormonal release or copper-based mechanisms. The market encompasses hormonal and copper IUDs distributed through hospitals, gynecology clinics, and community health centers.

It includes established brands and new entrants providing different sizes, durations, and designs tailored to address women’s reproductive health needs, while also reflecting regulatory frameworks, clinical practices, and regional availability.

Intrauterine Devices Market Overview

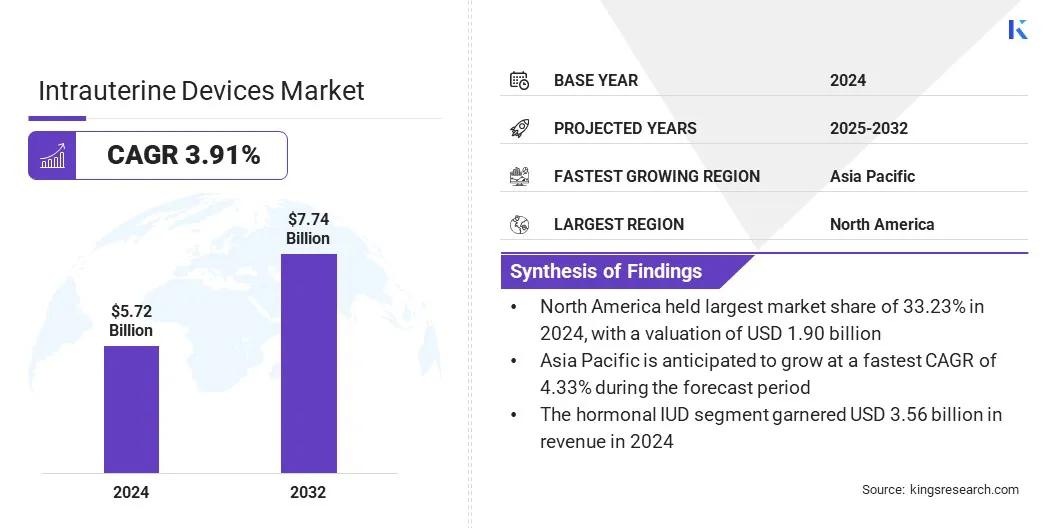

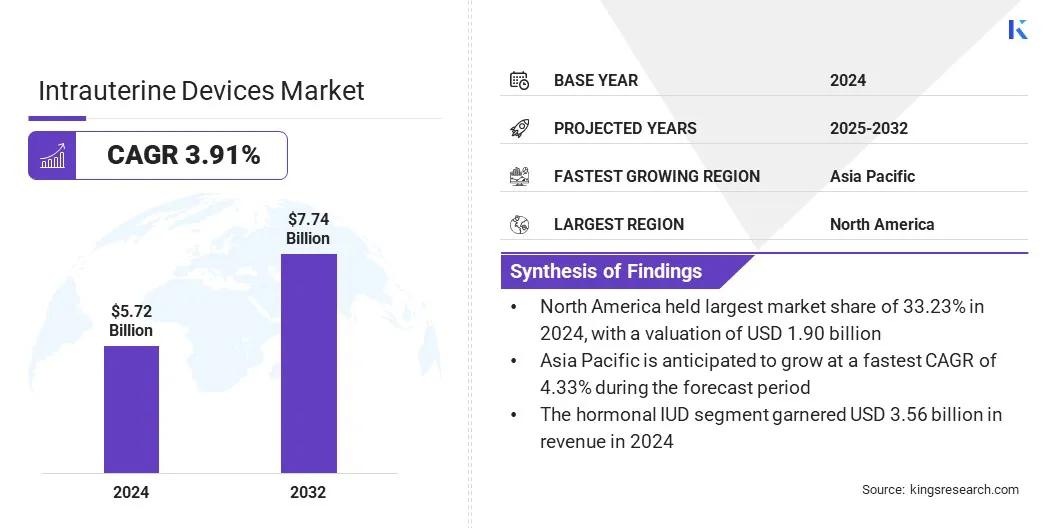

The global intrauterine devices market size was valued at USD 5.72 billion in 2024 and is projected to grow from USD 5.92 billion in 2025 to USD 7.74 billion by 2032, exhibiting a CAGR of 3.91% during the forecast period.

The market is witnessing steady growth due to rising demand for long-acting reversible contraceptives, increasing awareness of family planning, and supportive government initiatives promoting reproductive health. Expanding availability of advanced hormonal and copper IUDs through hospitals and specialized clinics further supports adoption across developed and emerging regions.

Key Highlights

- The intrauterine devices industry size was USD 5.72 billion in 2024.

- The market is projected to grow at a CAGR of 3.91% from 2025 to 2032.

- North America held a share of 33.23% in 2024, valued at USD 1.90 billion.

- The hormonal IUD segment garnered USD 3.56 billion in revenue in 2024.

- The hospital segment is expected to reach USD 3.38 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 4.33% over the forecast period.

Major companies operating in the intrauterine devices market are Bayer, CooperSurgical, Inc., AbbVie, Pregna International Limited, DKT INTERNATIONAL, EUROGINE, S.L., Mona Lisa N.V., Prosan International BV, OCON Medical Ltd., Eightwe Digital Transformations Pvt. Ltd, Sebela Pharmaceuticals, SMB Corporation of India, Gedeon Richter Polska Sp. z o.o., EurimPharm Arzneimittel GmbH, and Aetos Pharma Private Limited.

Government-supported family planning initiatives are significantly boosting intrauterine device adoption. Expanded access to subsidized or free contraception and targeted reproductive health programs have improved awareness and availability of long-acting reversible contraceptives among women.

Enhanced funding and strategic implementation enable informed choices, increasing uptake. These initiatives contribute to sustained market growth while advancing broader reproductive health goals.

- In December 2024, Ireland’s Minister for Health, Stephen Donnelly, reported significant uptake of the Free Contraception Scheme, with approximately 245,000 users between January and September and a projected 320,000 women accessing it by year-end. The expansion received USD 49.68 million in funding under the Women’s Health Action Plan 2024-2025.

Market Driver

Growing Adoption of Long-Acting Reversible Contraceptives

The intrauterine devices market is witnessing notable expansion, mainly fueled by the rising demand for long-acting reversible contraceptives (LARC). IUDs provide highly reliable protection with minimal user compliance, often providing protection for several years.

Their long duration reduces the need for frequent medical visits and replacement, making them cost-efficient and convenient for women seeking sustained contraception. Moreover, the consistent efficacy without daily adherence has increased their adoption across both developed and emerging regions, contributing to market growth.

- According to the Centers for Disease Control and Prevention (CDC), fewer than one in 100 IUD users becomes pregnant within the first year of typical use, indicating that both copper and levonorgestrel intrauterine devices are highly effective long-acting reversible contraceptives.

Market Challenge

Risk of Infection Associated with IUD Usage

A significant challenge impeding the expansion of the intrauterine devices market is the risk of post-insertion infections, which can deter both patients and healthcare providers despite the method's proven effectiveness as a long-acting contraceptive. Conditions such as pelvic inflammatory disease may occur if bacteria are introduced during insertion, raising safety concerns and limiting adoption.

To address this challenge, manufacturers are developing IUDs with antimicrobial coatings and biocompatible materials to inhibit bacterial growth. They are also introducing sterile, single-use insertion systems and improving device designs to reduce contamination risks. These advancements enhance safety and reliability, supporting wider acceptance of IUDs.

Market Trend

Advancements in Non-Hormonal IUD Technology

The global intrauterine devices market is witnessing significant advancements in non-hormonal IUDs, fueled by the introduction of newly approved copper-based devices. These innovations aim to offer effective, hormone-free contraception while improving user comfort and reducing potential side effects. Manufacturers are developing IUDs with flexible frames, optimized copper content, and enhanced insertion techniques to facilitate placement.

The focus on product innovation reflects a broader effort to diversify the IUD portfolio and cater to users seeking long-acting, reversible, and non-hormonal contraceptive options. Such technological improvements are expected to increase adoption over the forecast period.

- In February 2025, the U.S. Food and Drug Administration (FDA) approved Miudella, a new hormone-free copper IUD. Manufactured by Sebela Women's Health, Miudella is the first new copper IUD to be approved in the U.S. in over 40 years.

Intrauterine Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hormonal IUD, Copper IUD

|

|

By Distribution Channel

|

Hospital, Gynecology Clinics, Community Health Care Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hormonal IUD and Copper IUD): The hormonal IUD segment earned USD 3.56 billion in 2024, mainly due to its high efficacy, ease of use, and growing preference among women seeking long-acting reversible contraception.

- By Distribution Channel (Hospital, Gynecology Clinics, Community Health Care Centers, and Others): The hospital segment held a share of 43.67% in 2024, attributed to the availability of trained medical staff, advanced facilities for safe insertion, and higher patient trust in clinical settings.

Intrauterine Devices Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America intrauterine devices market accounted for a substantial share of 33.23% in 2024, valued at USD 1.90 billion. This dominance is reinforced by high adoption of long-acting reversible contraception (LARC) methods. Both copper and levonorgestrel IUDs offer highly reliable, long-term pregnancy prevention, which promotes widespread use.

Advanced IUD designs accommodate nulliparous women, while topical anesthetics and pain management options improve patient comfort during insertion. The region’s well-established healthcare infrastructure, multidisciplinary clinical support, and extensive awareness programs further enhance accessibility and acceptance, reinforcing North America’s leading position.

The Asia-Pacific intrauterine devices industry is expected to register the fastest CAGR of 4.33% over the forecast period. This growth is fueled by rising awareness of long-term contraceptive methods and increasing preference for reversible contraception among women seeking reliable family planning solutions. Government initiatives and family planning programs promoting contraceptive use further support IUD adoption.

Urbanization and higher literacy rates among women contribute to greater acceptance of intrauterine devices. Additionally, expanding availability of modern IUD designs, reduced procedure-related discomfort through advanced inserters, and better-trained healthcare providers are aiding regional market growth across both urban and semi-urban areas.

Regulatory Frameworks

- In the U.S., intrauterine devices are regulated by the U.S. Food and Drug Administration (FDA) under the Center for Devices and Radiological Health (CDRH), which evaluates IUD safety, efficacy, and quality before approval.

- In Europe, IUDs are governed under the Medical Device Regulation (MDR 2017/745), requiring CE marking and compliance with safety and performance standards before market entry.

- In China, the National Medical Products Administration (NMPA) oversees IUD approval, registration, and post-market surveillance.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates IUDs, ensuring clinical evaluation and safety monitoring.

- In India, the Central Drugs Standard Control Organization (CDSCO) governs IUD approval and quality standards.

Competitive Landscape

Key players in the global intrauterine devices industry are strengthening their market presence through strategic product innovation. Companies are developing advanced IUDs with smaller-diameter, flexible, and pain-minimizing devices to enhance patient comfort and clinical outcomes. Innovations also focus on improved insertion mechanisms, extended device longevity, and compatibility for nulliparous and adolescent women.

Key Companies in Intrauterine Devices Market:

- Bayer

- CooperSurgical, Inc.

- AbbVie

- Pregna International Limited

- DKT INTERNATIONAL

- EUROGINE, S.L.

- Mona Lisa N.V.

- Prosan International BV

- OCON Medical Ltd.

- Eightwe Digital Transformations Pvt. Ltd

- Sebela Pharmaceuticals

- SMB Corporation of India

- Gedeon Richter Polska Sp. z o.o.

- EurimPharm Arzneimittel GmbH

- Aetos Pharma Private Limited

Recent Developments (Partnership/Product Launch)

- In July 2025, Meliodays Medical and Celanese Corporation partnered for the pre-clinical development of MelioOne, a hormone-free non-contraceptive IUD designed to relieve menstrual pain. The collaboration utilizes Celanese’s VitalDose Drug Delivery Platform to provide localized, controlled-release therapy, providing targeted pain management while minimizing systemic side effects.

- In September 2024, CooperSurgical launched a new single-hand inserter for Paragard, the FDA-approved copper intrauterine device. The device simplifies placement for healthcare providers while maintaining Paragard’s hormone-free composition, immediate reversibility, and over 99% efficacy for up to 10 years, enhancing accessibility and convenience for providers and patients.