Market Definition

An internal combustion engine (ICE) is a heat engine that produces mechanical power by combusting fuel and air within a sealed chamber. This combustion generates high-pressure gases that drive pistons, rotors, or turbines.

The engine consists of various components including cylinders, pistons, crankshafts, camshafts, valves, and fuel injection or ignition systems. It is widely used in transportation, including cars, motorcycles, and aircraft, as well as in industrial machinery, power generation, and marine propulsion.

Internal Combustion Engine Market Overview

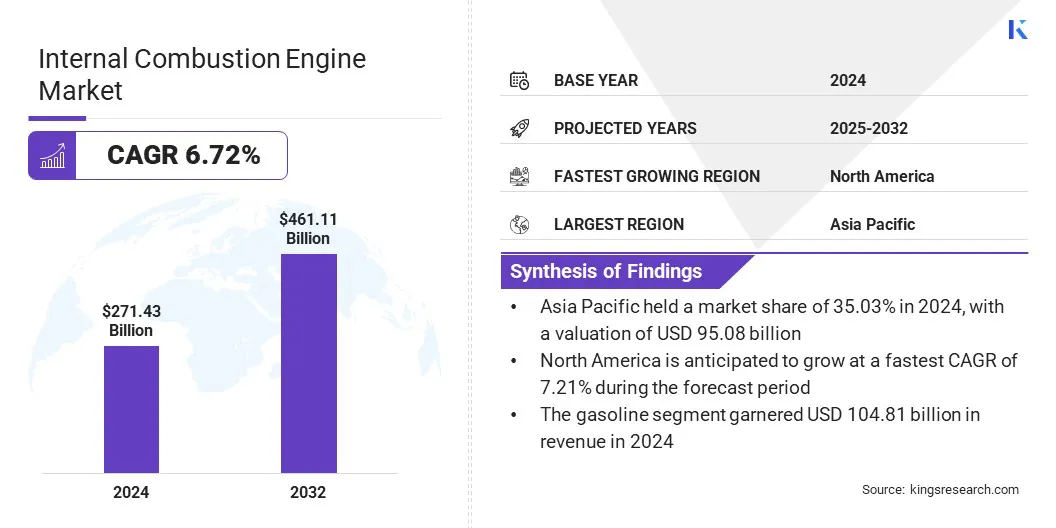

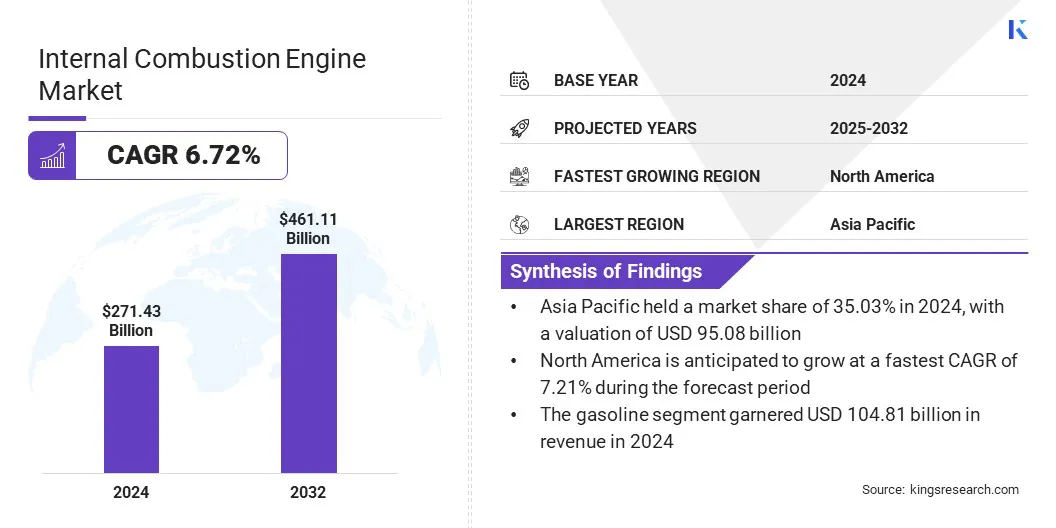

The global internal combustion engine market was valued at USD 271.43 billion in 2024 and is projected to grow from USD 287.93 billion in 2025 to USD 461.11 billion by 2032, exhibiting a CAGR of 6.72% over the forecast period.

The market is driven by the rising global vehicle production, which increases the demand for internal combustion engines to support expanding mobility needs. It is further growing due to the adoption of multi-fuel engines supporting diverse energy sources and emission norms.

Key Highlights

- The internal combustion engine industry size was recorded at USD 271.43 billion in 2024.

- The market is projected to grow at a CAGR of 6.72% from 2025 to 2032.

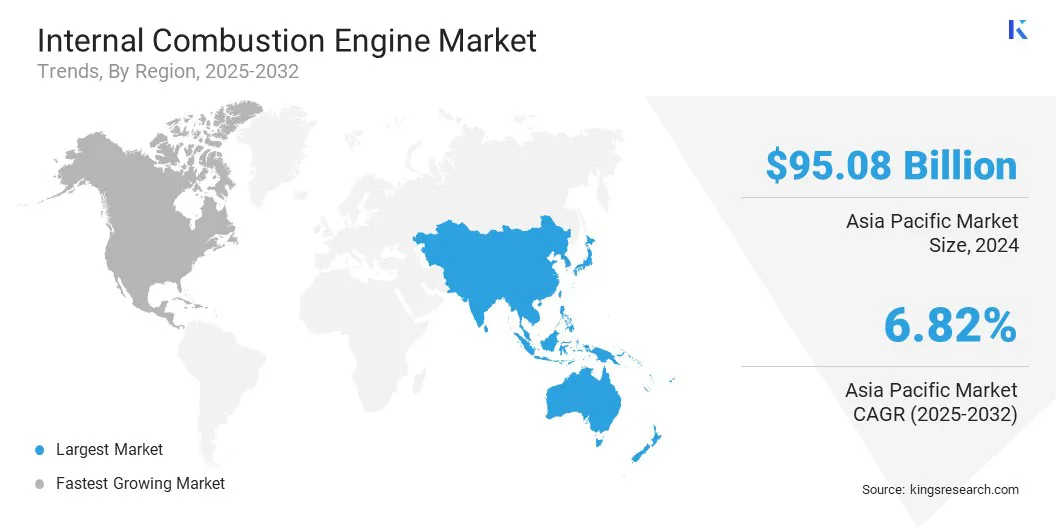

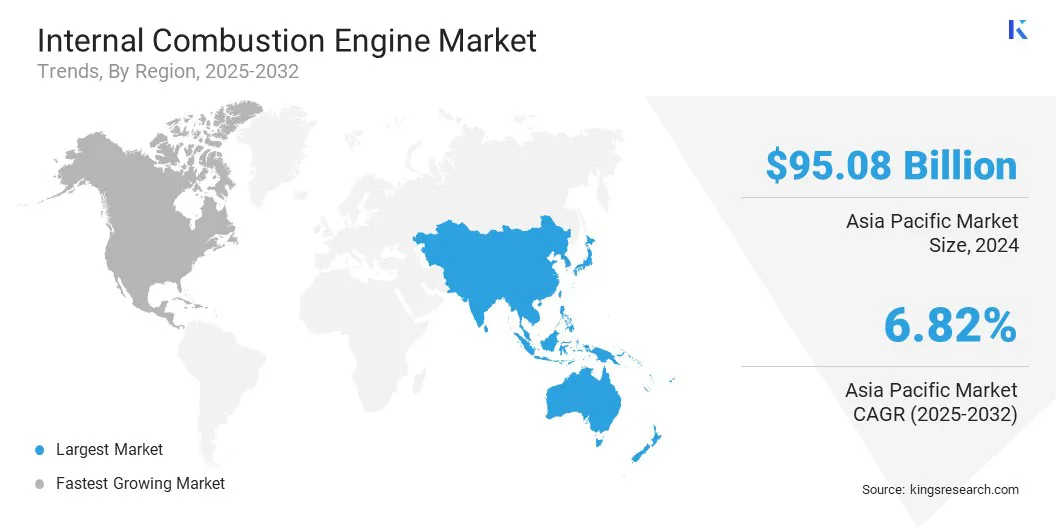

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 95.08 billion.

- The below 1500 cc segment garnered USD 90.22 billion in revenue in 2024.

- The gasoline segment is expected to reach USD 176.18 billion by 2032.

- The oil & gas segment is anticipated to witness the fastest CAGR of 7.02% during the forecast period.

- North America is projected to grow at a CAGR of 7.21% over the forecast period.

Major companies operating in the internal combustion engine market are AB Volvo, TOYOTA MOTOR CORPORATION, Rolls-Royce plc, Renault Group, MITSUBISHI HEAVY INDUSTRIES, LTD, General Motors, Ford Motor Company, Stellantis NV, Robert Bosch GmbH, AGCO Corporation, Yamaha Motor Co., Ltd., Suzuki Motor Corporation, YANMAR HOLDINGS CO., LTD, Isuzu Motors LLC, and Cummins Inc.

Additionally, the internal combustion engine technology continues to improve across fuel systems, design efficiencies, and emission control capabilities. This ongoing development is driving market growth by supporting regulatory compliance, extending product relevance, and enabling integration into hybrid vehicle architectures.

Market Driver

Rising Global Vehicle Production

A major factor driving growth in the internal combustion engine market is rising global vehicle production across developing economies and major automotive manufacturing hubs. Automakers are constantly building vehicles powered by the ICE technology to meet sustained demand in regions with limited electric vehicle infrastructure.

This production growth is strengthening the position of ICEs as reliable, cost-effective, and scalable powertrain solutions. Manufacturers are utilizing existing platforms to cater to diverse consumer needs across passenger and commercial vehicles.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 92.5 million units in 2024, reflecting continued demand across passenger and commercial segments..

Market Challenge

Rising Adoption of Electric Vehicles

A key challenge in the internal combustion engine (ICE) market is the rising adoption of electric vehicles. Governments are offering incentives and enforcing stricter emissions regulations aimed at reducing carbon emissions and achieving sustainability targets.

Battery technologies are becoming more efficient, encouraging consumers to choose electric vehicles over ICE-powered options. This ongoing shift in consumer demand toward cleaner and more sustainable mobility solutions is significantly reducing the long-term market potential for ICE vehicles.

To address this challenge, market players are diversifying their powertrain portfolios by investing in hybrid and alternative fuel technologies. Manufacturers are developing more fuel-efficient ICE models that comply with evolving emission norms.

They are forming strategic partnerships to develop low-carbon technologies and improve production flexibility. These efforts are helping automakers remain competitive and appeal to a broader consumer base in regions where ICE vehicles still hold significant demand.

Market Trend

Growing Adoption of Multi-fuel ICEs

A key trend in the internal combustion engine market is the growing adoption of multi-fuel engine designs, which support cleaner and more adaptable mobility. Manufacturers are developing ICEs that are capable of running on gasoline, biodiesel, synthetic fuels, and hydrogen to meet varying regulatory and performance requirements without modifying existing powertrains. This trend is enabling a gradual shift toward low-emission transport by integrating alternative fuels into traditional engines.

- In June 2024, Toyota introduced a new internal combustion engine capable of running on gasoline, synthetic fuel, biodiesel, and hydrogen. Developed from its hydrogen racing program, the engine is 10–20% smaller yet more efficient and powerful, supporting Toyota’s multi-pathway strategy toward carbon neutrality. It aims to meet future emission regulations through integration into hybrid drivetrains.

Internal Combustion Engine Market Report Snapshot

|

Segmentation

|

Details

|

|

By Displacement

|

Below 1500 cc, 1501 – 3000 cc, 3001 – 5000 cc, Above 5000 cc

|

|

By Fuel

|

Natural Gas, Gasoline, Others

|

|

By End Use

|

Automotive, Marine, Industrial & Manufacturing, Aerospace & Defense, Oil & Gas, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Displacement (Below 1500 cc, 1501 – 3000 cc, 3001 – 5000 cc, and Above 5000 cc): The below 1500 cc segment earned USD 90.22 billion in 2024, due to the rising demand for compact and fuel-efficient vehicles in urban areas.

- By Fuel (Natural Gas, Gasoline, and Others): The gasoline segment held 38.61% of the market in 2024, due to its widespread availability and compatibility with existing ICE technologies.

- By End Use (Automotive, Marine, Industrial & Manufacturing, Aerospace & Defense, Oil & Gas, and Others): The automotive segment is projected to reach USD 138.06 billion by 2032, owing to the sustained production of passenger and commercial ICE-powered vehicles.

Internal Combustion Engine Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific internal combustion engine market share stood at 35.03% in 2024, with a valuation of USD 95.08 billion. This dominance is attributed to the growing development of next-generation internal combustion and hybrid powertrains that meet regional emission targets and performance requirements. The market continues to grow through integrated advancements in engine design, alternative fuels, and lubricants that address transportation demands across the region.

Moreover, the market maintains its lead through increased investment in low-emission technologies and the expansion of supply chains for powertrain components. The region shows steady progress through the alignment of product strategies with regulatory expectations.

Collaborations among engine manufacturers, fuel producers, and lubricant suppliers are driving the delivery of cleaner internal combustion solutions, thereby fueling market expansion in the region.

- In December 2024, Aramco acquired Horse Powertrain Limited at a 10% equity stake to support the development of next-generation internal combustion engine. The acquisition focuses on advancing low-emission technologies, including alternative fuels and lubricants, and aims to reduce transport-related emissions while strengthening Horse Powertrain’s global position as a Tier 1 powertrain supplier.

North America internal combustion engine industry is set to grow at a CAGR of 7.21% over the forecast period. This growth is attributed to the increasing focus on internal combustion engine development that supports low- and zero-carbon fuel technologies across the region. Companies in North America are strengthening their engineering and testing capabilities to cater to ongoing demand in the medium- and heavy-duty vehicle segments, which is rapidly expanding the market.

Additionally, regional manufacturers are expanding their presence by investing in local facilities that provide specialized development and testing services for internal combustion engines. The market continues to benefit from efforts to localize engineering operations and support engine advancements that align with evolving performance and emission requirements. These activities are contributing to market growth in the region.

- In January 2025, Dumarey Group acquired MAHLE Powertrain LLC (MPT U.S.A.) to expand its engineering services in the U.S. market. The acquisition is intended to increase Dumarey’s capacity in internal combustion engine testing and development, with a focus on low- and zero-carbon fuel technologies and medium- and heavy-duty vehicles.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates internal combustion engines through its Office of Transportation and Air Quality. It oversees emission standards, fuel economy, and certification processes for light-duty and heavy-duty engines. The EPA enforces Clean Air Act provisions, ensuring manufacturers reduce pollutants such as NOx, CO2, and particulate matter.

- In China, the Ministry of Ecology and Environment oversees the regulation of internal combustion engines by setting and enforcing national emission standards, such as the China VI. The MEE monitors pollutant outputs, certifies engine compliance, and coordinates with local authorities to ensure air quality targets are met across industrial and automotive sectors.

- In India, the Central Pollution Control Board under India’s Ministry of Environment regulates internal combustion engine emissions by implementing Bharat Stage emission norms. CPCB monitors compliance, sets permissible limits for pollutants, and collaborates with testing agencies like ARAI to certify engines for on-road and non-road applications.

Competitive Landscape

Major players in the internal combustion engine industry are exploring hydrogen-powered technologies to meet decarbonization goals. Engine developers are focusing on hydrogen-specific fuel injection systems that enable efficient combustion while reducing emissions.

They are adapting existing diesel engine platforms to hydrogen use without compromising durability or performance. Additionally, manufacturers are prioritizing solutions that offer rapid refueling and compatibility with current fueling infrastructure.

- In April 2025, PHINIA collaborated with KG Mobility to develop the 2.2L hydrogen internal combustion engine for light commercial vehicles. The partnership integrates PHINIA’s hydrogen-specific fuel injection technology with KGM’s diesel engine knowledge to create a zero-carbon alternative that enables rapid refueling, preserves performance levels, and is compatible with existing commercial infrastructure.

Key Companies in Internal Combustion Engine Market:

- AB Volvo

- TOYOTA MOTOR CORPORATION

- Rolls-Royce plc

- Renault Group

- MITSUBISHI HEAVY INDUSTRIES, LTD

- General Motors

- Ford Motor Company

- Stellantis NV

- Robert Bosch GmbH

- AGCO Corporation

- Yamaha Motor Co., Ltd.

- Suzuki Motor Corporation

- YANMAR HOLDINGS CO., LTD

- Isuzu Motors LLC

- Cummins Inc

Recent Developments (M&A/Partnership/Product Launch)

- In May 2024, Subaru, Toyota, and Mazda announced plans to develop next-generation internal combustion engines optimized for electrification. The engines aim to be more compact, emission-compliant, and compatible with carbon-neutral fuels like e-fuels, biofuels, and hydrogen.