Market Definition

The market comprises digital systems and platforms that support the administration, resolution, and reporting of insolvency and bankruptcy cases.

Key components include case-management platforms, e-filing and court-integration modules, creditor portals, document repositories, creditor voting modules, claims management, payment and distribution engines, reporting and compliance tools, and data utilities, serving trustees, courts, insolvency practitioners (IPs), creditors, and government agencies.

Insolvency Software Market Overview

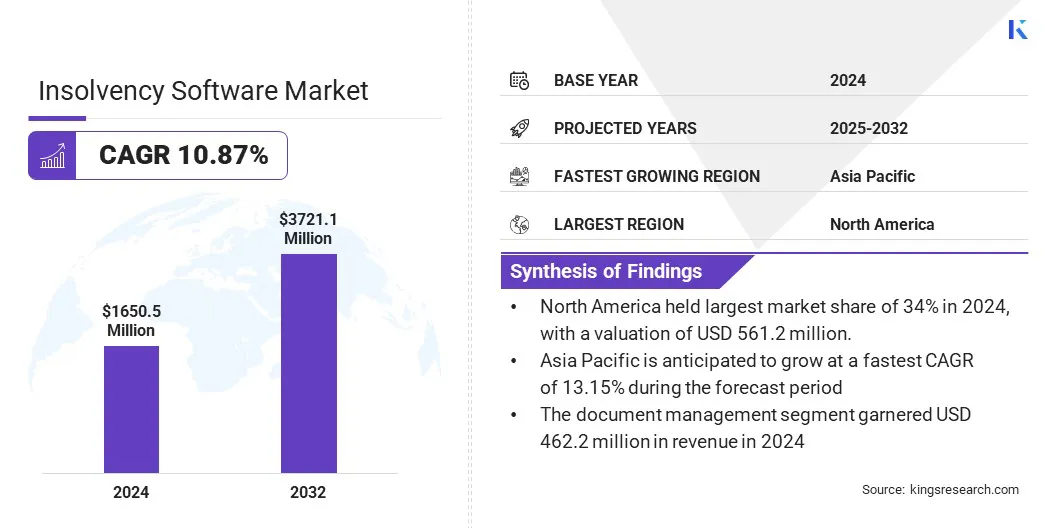

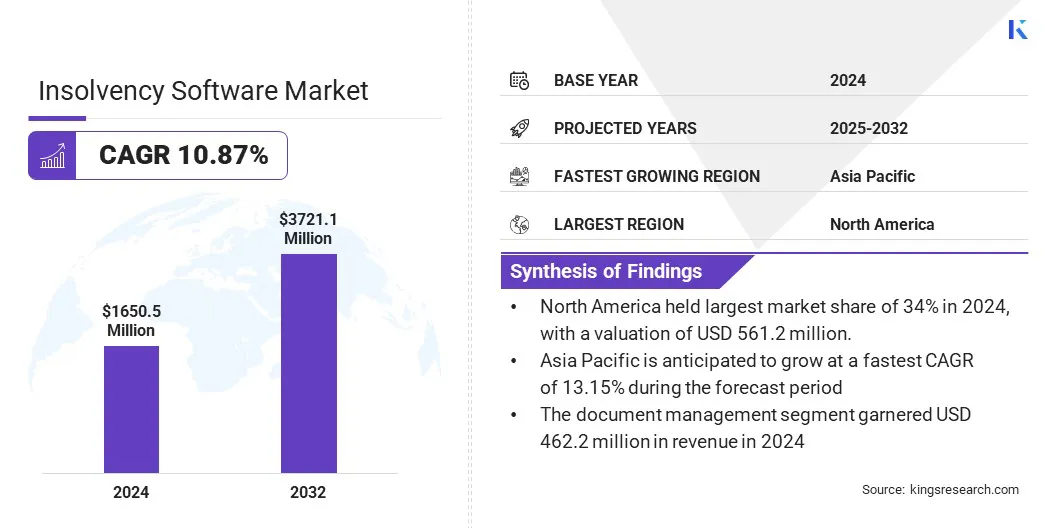

The global insolvency software market size was valued at USD 1,650.5 million in 2024 and is projected to grow from USD 1,806.9 million in 2025 to USD 3,721.1 million by 2032, exhibiting a CAGR of 10.87% during the forecast period.

This growth is fueled by the shift from desktop tools to cloud-native platforms that integrate with court systems, creditors, and analytics engines. Rising demand is further supported by courts and tribunals mandating electronic filing and machine-readable records, prompting software providers to enhance platforms for regulatory compliance.

Key Market Highlights:

- The insolvency software industry size was recorded at USD 1,650.5 million in 2024.

- The market is projected to grow at a CAGR of 10.87% from 2024 to 2032.

- North America held a market share of 34.00% in 2024, with a valuation of USD 561.2 million.

- The solutions segment garnered USD 1,188.4 million in revenue in 2024.

- The document management segment is expected to reach USD 996.2 million by 2032.

- The large enterprises segment was valued at USD 1,105.9 million in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 13.15% over the forecast period.

Major companies operating in the insolvency software market are Stretto, Epiq, Aderant, Jubilee, Alto Software, Themis Solutions Inc., Thomson Reuters, LexisNexis, Mitratech, Inc., Wolters Kluwer N.V., PracticePanther, ProfitSolv, LLC, STP Informationstechnologie GmbH, CaseFox, and Aryza.

Adoption is highest among law firms, trustees, claims agents, and courts that prioritize faster case handling and reliable audit trails. Vendors are enhancing solutions with automation for form population, secure document exchange, and notifications. Demand is further bolstered by the need to centralize creditor communications and shorten case timelines while retaining regulatory compliance.

- In May 2025, Epiq partnered with BigHand to launch an integrated solution connecting BigHand’s Workflow Management with Epiq Connect through an API. The solution allows law firms and corporate legal teams to submit, track, and manage outsourced service requests in real time, improving efficiency, accountability, and reporting. Additionally, it delivers financial metrics and operational insights to support data-driven staffing and resource allocation.

Market Driver

Rise of Judicial and Tribunal Digitalization Programs

Courts and insolvency tribunals are increasingly mandating electronic filing and adopting modern case management systems, fueling consistent demand for integrated insolvency software. Digitalization streamlines processes by reducing manual data entry, accelerating administrative tasks, and automating creditor notifications.

Software vendors offering secure e-filing, compatibility with systems such as CM/ECF, and API-driven data exchange are seeing faster adoption. This further encourages cloud migration, enabling scalable, accessible solutions. Furthermore, it promotes standardized data models across jurisdictions, enhancing interoperability and efficiency.

As courts prioritize digital transformation, secure and integrated software solutions remain essential to address evolving legal and administrative needs.

- The U.S. Federal Judiciary's FY 2025 IT Long Range Plan highlights the shift to electronic filing and modernized case systems. CM/ECF upgrades support secure e-filing, automated creditor notifications, and API integrations, minimizing manual tasks. The plan prioritizes cloud migration for scalable hosting and standardized data models through enterprise standards.

Market Challenge

Data Integrity, Transparency, and Cross-jurisdictional Trust

The growth of the insolvency software market is constrained by its role in jurisdictions where legal outcomes depend on accurate, auditable records. Inconsistent registry data or opaque processes can erode stakeholder trust, particularly in regions with disputed enforcement or weak disclosure practices.

To address this challenge, leading providers are including tamper-evident audit trails, standardized claim tables, validated registry data imports, and role-based audit logs to ensure transparency and accountability. They are also offering multilingual support, cross-border data exchange standards, and secure hosting that complies with local regulations.

These features enhance trust, streamline insolvency processes, and meet the diverse needs of global jurisdictions, ensuring reliable outcomes.

- The IBBI's 2023 amendment to the Insolvency Resolution Process for Corporate Persons underscores the importance of robust insolvency software. It mandates detailed, auditable records for claims and creditor notifications in a complex legal environment.

Market Trend

Rising Integration of AI and Analytics for Claims & Restructuring Decisions

Vendors are embedding artificial intelligence (AI), natural language processing (NLP), and advanced analytics to optimize corporate restructuring processes, emerging as a key trend in the market. These technologies expedite document review, extract creditor claims with precision, forecast recovery scenarios, and automate routine communications.

AI further streamlines manual schedule reconciliation, empowering trustees and administrators to prioritize claims effectively. This enhances efficiency in high-volume restructurings and mass-noticing workflows. Early adopters integrate analytics dashboards with real-time court filing feeds to deliver actionable intelligence.

By automating repetitive tasks and providing predictive insights, AI-driven solutions improve accuracy, reduce costs, and accelerate complex workflows, setting new standards in corporate restructuring.

- In January 2025, Stretto launched Stretto Conductor, an AI-powered bankruptcy case management platform. The solution streamlines document analysis, creditor communications, and information retrieval, using AI to process inquiries in real time, summarize legal documents, and generate verifiable citations while securely handling public filings.

Insolvency Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offerings

|

Solutions, Services (Professional Services (Consulting, Implementation, Support and Maintenance), Managed Services)

|

|

By Application

|

Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management, Others

|

|

By Organization Size

|

Large Enterprises, Small and Medium Enterprises

|

|

By Vertical

|

BFSI, Government, IT and Telecom, Manufacturing, Energy and Utility, Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offerings (Solutions and Services): The solutions segment earned USD 1,188.4 million in 2024, mainly due to the rising adoption of cloud case-management platforms that integrate with court e-filing systems and reduce manual processing time.

- By Application (Document Management, Financial Transaction Management, Reporting, Compliance, Creditor Management, and Others): The document management segment held a share of 28.00% in 2024, fueled by mandatory electronic filing requirements, growth in cloud document repositories, and demand for secure, auditable storage of schedules and claims.

- By Organization Size (Large Enterprises and Small and Medium Enterprises): The small and medium enterprises segment is projected to reach USD 1,379.4 million by 2032, owing to SaaS pricing models, lower deployment barriers for cloud-based case tools, and the growing availability of off-the-shelf insolvency modules for smaller trustees and firms.

- By Vertical (BFSI, Government, IT and Telecom, Manufacturing, Energy and Utility, Retail, and Others): The BFSI segment accounted for a share of 36.00% in 2024, reflecting its high exposure to corporate restructuring, frequent creditor claim workflows, and regulatory reporting needs requiring integrated case and claims management.

Insolvency Software Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America insolvency software market share stood at 34.00% in 2024, valued at USD 561.2 million. This dominance is reinforced by a strong demand for integrated platforms. Modernization efforts in U.S. courts, including upgrades to PACER/CM-ECF systems as per the 2024 update to the Long Range Plan for Information Technology in the Federal Judiciary, boosted the need for advanced e-filing and audit tools.

Large law firms and trustee services invested in analytics and mass-notification systems to manage high volumes of Chapter 11 and consumer bankruptcy cases. A surge in insolvencies among leveraged or private equity-backed firms increased corporate restructuring demands, fueling the need for scalable software. Vendors offering secure cloud hosting and direct court integrations captured significant market share in the region.

The Asia-Pacific insolvency software industry is set to grow at a robust CAGR of 13.15% over the forecast period. This significant growth is propelled by governments and regulators strengthening insolvency regimes and digitizing tribunals. India’s NCLT e-filing portal and active IBBI rulemaking increase demand for certified e-filing, claims modules, and beneficial-ownership checks.

China’s cross-border bankruptcy practice and reform discussion create a demand for case workflows that support cross-border asset tracing and multilingual filing. In Japan, rehabilitation and reorganization frameworks require software that supports court procedures and claim priorities. The combination of mature courts and fast-moving reforms across the region is generating a strong demand for localized software.

Regulatory Frameworks

- In the U.S., Title 11 (Bankruptcy Code) and the Federal Rules of Bankruptcy Procedure govern insolvency processes. Courts utilize CM/ECF and PACER systems to facilitate e-filing and public access.

- In the UK, the Insolvency Service regulates bankruptcy, liquidations, and other insolvency procedures. Both the courts and the Insolvency Service publish guidance and digital reforms for practitioner regulation.

- In India, the Insolvency and Bankruptcy Code (IBC) serves as the primary statute. The National Company Law Tribunal (NCLT) adjudicates corporate insolvency through an e-filing portal, while the Insolvency and Bankruptcy Board of India (IBBI) issues rules and amendments governing disclosure and process flows.

- In China, the Enterprise Bankruptcy Law sets the statutory framework. Recent develoments emphasize procedural transparency and cross-border coordination.

- In Japan, the Civil Rehabilitation Act and related corporate reorganisation laws define the legal framework for rehabilitation and restructuring proceedings. Compliance requires alignment of software systems with court procedures and statutory timelines.

Competitive Landscape

Major companies operating in the insolvency software market are expanding features to incorporate AI for document management and automated notifications, and integrating directly with court systems for e-filing. They are also acquiring smaller firms to create comprehensive software suites covering claims, analytics, and other services.

To attract a wider user base, vendors are prioritizing compliance with local regulations, offering multilingual support, and adopting flexible SaaS and tiered subscription models. Additionally, partnerships with law firms and courts are leveraged to secure recurring revenue, while product development emphasizes security, audit logs, and APIs.

- In October 2024, Stretto, a legal services and technology firm, expanded its offerings by acquiring Chapter 11 Dockets. This acquisition added a precedent research database for corporate restructuring attorneys. The platform contains over 5.5 million documents from more than 4,000 of the largest Chapter 11 cases. This initiative reflects Stretto's commitment to delivering innovative tools and AI-powered enhancements to its clients.

Key Companies in Insolvency Software Market:

- Stretto

- Epiq

- Aderant

- Jubilee

- Alto Software

- Themis Solutions Inc.

- Thomson Reuters

- LexisNexis

- Mitratech, Inc.

- Wolters Kluwer N.V.

- PracticePanther

- ProfitSolv, LLC

- STP Informationstechnologie GmbH

- CaseFox

- Aryza

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In August 2025, Aderant signed a definitive agreement to acquire the legal technology assets of HerculesAI, a developer of AI-based billing compliance and decision intelligence tools. The acquisition aimed to integrate HerculesAI’s technology into Aderant’s platform to enhance automation, compliance, and billing efficiency for law firms. The HerculesAI legal technology team joined Aderant as part of the transaction.

- In July 2025, Epiq launched an AI-based legal platform within its Service Cloud, integrating proprietary and third-party technologies to streamline legal workflows. The platform connected AI agents for tasks such as document review, compliance, litigation, and contract management. It was designed to improve efficiency, reduce costs, and support decision-making for law firms and corporate legal teams. Built on Microsoft Azure and AWS, it complied with data privacy laws and held SOC 2 Type 2 accreditation.

- In February 2025, Stretto, a legal services and technology firm, introduced new legal claims administration services. The new services were designed to support professionals in mass torts, regulatory remediations, and class action cases. The company leveraged its expertise in bankruptcy claims management to expand its offerings o enhance operational efficiency across the legal and financial industries.

- In May 2024, Aderant launched Stridyn, an AI-driven cloud platform integrating its product suite to improve interconnectivity, streamline workflows, and enhance business intelligence for law firms. The platform powered all Aderant cloud applications with built-in AI through MADDI and included new features such as AI-powered A/R automation, client terms review, matter reconciliation, email billing automation, AI-driven compliance, centralized analytics, and resource allocation management.