Market Definition

The market encompasses the development, manufacturing, and commercialization of biologic therapeutics designed for pulmonary delivery. The market is fueled by the growing demand for non-invasive drug delivery, progress in inhalation technologies, and the increasing prevalence of respiratory and systemic conditions.

Key stakeholders include biopharmaceutical companies, healthcare providers, and regulatory bodies. The report highlights the primary market drivers, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the market expansion in the coming years.

Inhalable Biologics Market Overview

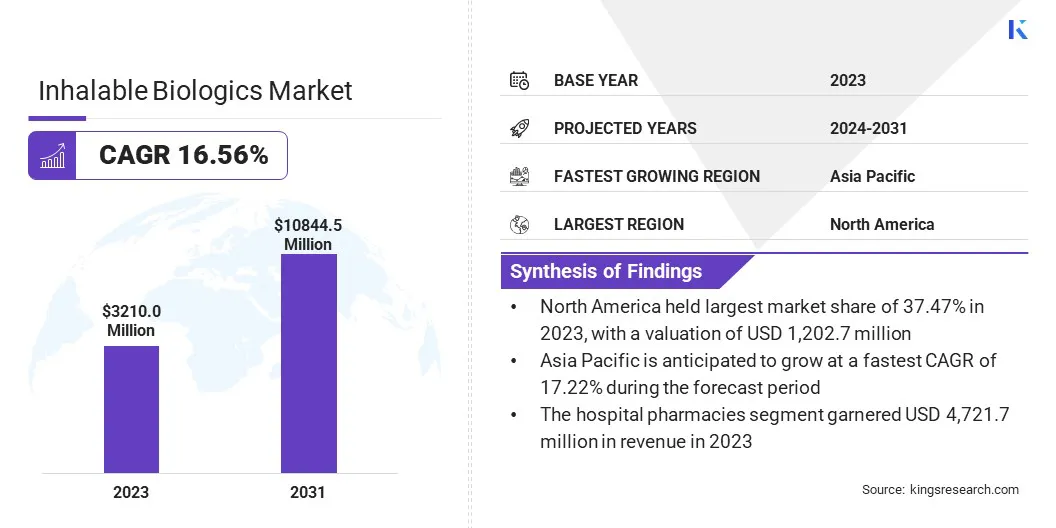

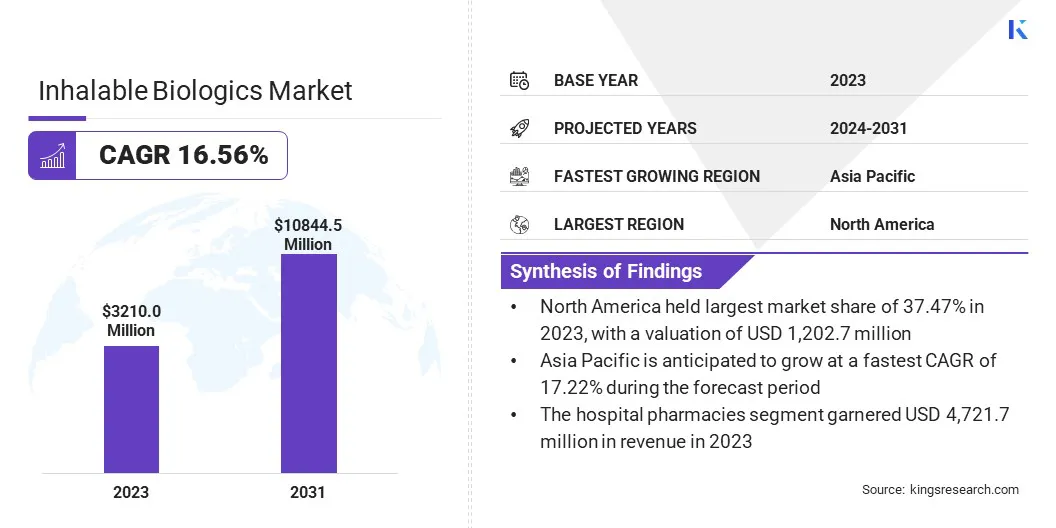

The global inhalable biologics market size was valued at USD 3,210.0 million in 2023 and is projected to grow from USD 3,710.4 million in 2024 to USD 10,844.5 million by 2031, exhibiting a CAGR of 16.56% during the forecast period.

This market is registering significant growth, driven by advancements in drug delivery technologies, rising prevalence of respiratory diseases, and increasing demand for non-invasive treatment options. The market benefits from ongoing innovations in formulation techniques, enabling biologics such as monoclonal antibodies, peptides, and proteins to be effectively delivered via inhalation.

The expanding adoption of biologics for conditions beyond respiratory disorders, including systemic diseases, further accelerates market expansion. Strategic partnerships among pharmaceutical companies, biotechnology firms, and device manufacturers are fostering innovation and commercial success.

Major companies operating in the inhalable biologics industry are AstraZeneca, MannKind Corporation, Synairgen plc., Pulmocide, Aerogen Ltd, Liquidia Corporation, Nephron Pharmaceuticals Corporation, InCarda Therapeutics, Inc., Agomab Therapeutics, Acu-Flow Limited, ReCode Therapeutics, AATec Medical GmbH, Avalyn Pharma Inc., VERO Biotech, and Spexis Ltd.

Additionally, growing investments in research and development, coupled with favorable regulatory frameworks, are supporting the rapid introduction of novel inhalable biologics.

The increasing preference for patient-centric therapies, driven by enhanced convenience, efficacy, and targeted drug delivery, is further propelling the market growth. The market continues to evolve as a key segment in modern therapeutics as healthcare providers and patients seek effective and non-invasive treatment solutions.

- In January 2025, Iconovo AB and Lonza announced their collaboration to develop spray-dried formulations for an intranasally delivered biologic drug candidate targeting obesity. The partnership focuses on utilizing Iconovo’s proprietary ICOone Nasal device for non-invasive drug administration. Lonza’s Bend site, specializing in bioavailability enhancement and inhaled delivery, will optimize particle size, stability, and biological activity to ensure compatibility with the nasal device.

Key Highlights:

- The inhalable biologics industry size was valued at USD 3,210.0 million in 2023.

- The market is projected to grow at a CAGR of 16.56% from 2024 to 2031.

- North America held a market share of 37.47% in 2023, with a valuation of USD 1,202.7 million.

- The proteins & peptides segment garnered USD 939.8 million in revenue in 2023.

- The diabetes segment is expected to reach USD 3,796.7 million by 2031.

- The dry powder inhalers segment is expected to reach USD 1,260.7 million by 2031.

- The hospital pharmacies segment is expected to reach USD 1,389.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 17.22% during the forecast period.

How is growing demand for non-invasive drug delivery driving this market?

The market is being driven by the rising demand for non-invasive drug delivery and the growing interest in mucosal immunity and inhaled vaccines. Traditional injectable biologics, while effective, often pose challenges such as pain, needle phobia, risk of infection, and the need for healthcare professional administration.

Inhalable biologics provide a patient-friendly, needle-free alternative that enhances compliance, convenience, and ease of self-administration. This shift toward non-invasive drug delivery is particularly important for chronic conditions and infectious diseases, where frequent dosing may be required.

Additionally, mucosal immunity and inhaled vaccines have gained traction as a promising approach to disease prevention and treatment. Inhaled vaccines activate immune responses directly at mucosal surfaces, the primary entry points for many pathogens, unlike traditional vaccines that stimulate systemic immunity.

This targeted immune response not only enhances protection at the site of infection but also contributes to longer-lasting immunity and potentially reduced transmission rates.

The growing focus on developing inhaled gene therapies, monoclonal antibodies, and vaccines for respiratory and infectious diseases further strengthens the market growth, leading to increased research, regulatory approvals, and commercial interest in inhalable biologics.

- In January 2025, Ocugen, Inc. announced that the FDA reviewed and accepted its Investigational New Drug application for OCU500, an inhaled mucosal vaccine for COVID-19. The Phase 1 clinical trial, sponsored by the National Institute of Allergy and Infectious Diseases, will assess the safety, tolerability, and immunogenicity of OCU500 administered via inhalation and as a nasal spray. The vaccine, based on a novel chimpanzee adenovirus-vectored technology, aims to provide durable protection against COVID-19 and other respiratory threats.

What are the major obstacles for this market?

A major challenge in the inhalable biologics market is ensuring the stability, bioavailability, and proper delivery of biologic drugs when administered via inhalation. Unlike traditional injectable biologics, which are designed for direct bloodstream absorption, inhaled biologics must traverse multiple layers of defense in the respiratory system, including the nasal passages, throat, and lungs.

Biologic drugs, such as proteins, peptides, and monoclonal antibodies, are often more complex and sensitive than small-molecule drugs, making them prone to degradation due to environmental factors like humidity, temperature, and mechanical stress during the inhalation process.

These biologic molecules also face challenges such as aggregation or denaturation, which can compromise their effectiveness when delivered through inhalation. Additionally, the formulation must be designed to ensure that the drug can reach the intended target in the lungs, release the active ingredient efficiently, and maintain its therapeutic function.

The inhalation process also requires precise dosing, as the dose must be consistent and effective with each administration. Advanced formulation technologies such as spray-drying, lyophilization, and nanoparticle-based systems are being developed to enhance the stability and solubility of biologic drugs.

Additionally, device innovations such as inhalers designed to optimize the delivery of biologics to the lungs, are being introduced.

How are changing trends in Gene and mRNA-based Therapies affecting the market?

The market is registering significant trends driven by evolving treatment modalities. A key trend is the increasing focus on inhaled gene therapy for respiratory diseases. This approach aims to directly deliver therapeutic genes to the lungs, targeting the root cause of diseases like cystic fibrosis and chronic respiratory conditions.

Inhaled gene therapy has the potential to improve lung function, reduce disease progression, and offer long-term benefits by addressing genetic abnormalities at the cellular level. The targeted delivery mechanism avoids systemic side effects, providing a more efficient and localized treatment option.

Another prominent trend is the rising interest in mRNA-based inhalable biologics. With the success of mRNA technologies in vaccines, this approach is expanding into the inhalable biologics space. mRNA therapies can be delivered directly to the lungs, enabling faster and more effective treatment for respiratory diseases.

These therapies offer the advantage of non-invasive administration, rapid response times, and the ability to quickly adapt to emerging diseases, making them highly promising for the treatment of a range of respiratory conditions.

- In February 2025, Boehringer Ingelheim, IP Group, the UK Respiratory Gene Therapy Consortium, and Oxford Biomedica announced the initiation of LENTICLAIR 1, a Phase I/II trial for BI 3720931, an inhaled lentiviral vector-based gene therapy for cystic fibrosis. The therapy aims to deliver a functional Cystic Fibrosis Transmembrane Conductance Regulator (CFTR) gene to airway epithelial cells, offering a potential treatment for CF patients who cannot benefit from CFTR modulators.

Inhalable Biologics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Proteins & Peptides, Monoclonal Antibodies, Vaccines, Gene Therapy Products, Others

|

|

By Indication

|

Respiratory Diseases, Infectious Diseases, Diabetes, Pain Management, Others

|

|

By Delivery Device

|

Dry Powder Inhalers, Metered-dose Inhalers, Nebulizers, Soft Mist Inhalers

|

|

By Distribution Channel

|

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Proteins & Peptides, Monoclonal Antibodies, Vaccines, Gene Therapy Products, and Others): The proteins & peptides segment earned USD 939.8 million in 2023, due to their growing adoption in targeted therapies, improved stability in inhalable formulations, and expanding applications in respiratory & metabolic disorders.

- By Indication (Respiratory Diseases, Infectious Diseases, Diabetes, Pain Management, and Others): The diabetes segment held 35.26% share of the market in 2023, due to the increasing prevalence of asthma, COPD, and cystic fibrosis, alongside advancements in inhalable biologics for more effective localized treatment.

- By Delivery Device (Dry Powder Inhalers, Metered-dose Inhalers, Nebulizers, and Soft Mist Inhalers): The dry powder inhalers segment is projected to reach USD 4,278.2 million by 2031, owing to their ease of use, enhanced drug stability, and growing preference for portable, propellant-free inhalation devices.

- By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies): The hospital pharmacies segment is projected to reach USD 4,721.7 million by 2031, owing to the increasing administration of biologics in clinical settings, rising patient hospital visits, and the availability of specialized inhalation therapies.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 37.47% share of the inhalable biologics market in 2023, with a valuation of USD 1,202.7 million. This dominance is attributed to the region’s strong biopharmaceutical industry, extensive R&D investments, and the presence of key market players driving innovation in inhalable biologics.

Advanced healthcare infrastructure, high adoption rates of novel drug delivery systems, and supportive regulatory frameworks have further accelerated market growth. Additionally, the rising prevalence of respiratory diseases, along with the increasing demand for non-invasive treatment options, has contributed significantly to market expansion.

The region benefits from well-established clinical research facilities and collaborations between pharmaceutical companies and research institutions, facilitating the rapid development and commercialization of inhalable biologics. Strong government funding for biotechnology advancements, coupled with a high rate of regulatory approvals for innovative biologic therapies, further strengthens market growth.

Moreover, the increasing adoption of personalized medicine and precision therapies in respiratory care has spurred the demand for inhalable biologics, positioning North America as a leader in this evolving industry.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 17.22% over the forecast period. This rapid expansion is driven by increasing healthcare investments, rising awareness of biologic therapies, and the growing burden of respiratory and chronic diseases in the region.

Emerging economies such as China and India are registering strong pharmaceutical industry growth, leading to higher production and adoption of inhalable biologics. Additionally, government initiatives to enhance healthcare accessibility, coupled with expanding pharmaceutical manufacturing capabilities, are fostering market development.

The rising geriatric population, increasing prevalence of asthma and Chronic Obstructive Pulmonary Disease (COPD), and improving regulatory frameworks are further propelling the demand for advanced inhalation therapies. Moreover, the expansion of online and retail pharmacy networks, along with a shift toward patient-centric treatment approaches, is positioning Asia Pacific as a key growth hub in the market.

- In December 2024, Cipla Limited announced that it received regulatory approval from the Central Drugs Standard Control Organisation (CDSCO) for the exclusive distribution and marketing of Afrezza (insulin human) Inhalation Powder in India. Developed and manufactured by MannKind Corporation (USA), Afrezza is rapid-acting inhaled insulin designed to improve glycemic control in adults with diabetes mellitus.

Regulatory Frameworks

- In the U.S., inhalable biologics are regulated by the U.S. Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FDCA) and the Public Health Service Act (PHSA). The Center for Drug Evaluation and Research (CDER) oversees small-molecule inhalable drugs, while the Center for Biologics Evaluation and Research (CBER) regulates complex biologics.

- In the European Union (EU), inhalable biologics fall under the European Medicines Agency (EMA) and must comply with Regulation. The Committee for Medicinal Products for Human Use (CHMP) evaluates marketing applications submitted through the Centralized Procedure. The European Pharmacopoeia provides specific quality standards for inhaled formulations, and manufacturers must adhere to Good Manufacturing Practice guidelines.

- In China, the National Medical Products Administration (NMPA) regulates inhalable biologics under the Drug Administration Law. The Center for Drug Evaluation (CDE) oversees clinical trial approvals, requiring compliance with Good Clinical Practice standards. Biologics must also meet Chinese Pharmacopoeia standards for inhaled drug formulations.

- In Japan, inhalable biologics are regulated by the Pharmaceuticals and Medical Devices Agency (PMDA) under the Pharmaceuticals and Medical Devices Act (PMD Act). Approval requires adherence to Japanese Pharmacopoeia standards, Good Clinical Practice, and Good Manufacturing Practice (GMP).

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates inhalable biologics under the Drugs and Cosmetics Act, 1940. The Drug Controller General of India (DCGI) evaluates clinical trial applications, while the Indian Pharmacopoeia Commission (IPC) sets quality standards for inhalable formulations.

Competitive Landscape

The inhalable biologics industry is characterized by rapid innovation, strategic collaborations, and increasing investments in advanced drug delivery technologies. Key market players focus on developing novel inhalation formulations for biologics, leveraging proprietary platforms to enhance drug stability, bioavailability, and targeted pulmonary delivery.

Expansion into new therapeutic areas beyond respiratory diseases is a core strategy, with ongoing efforts to adapt inhalable biologics for systemic conditions. Companies are also prioritizing regulatory approvals and clinical trials to accelerate market entry and strengthen their portfolios.

This market is shaped by strategic initiatives aimed at maintaining a strong market presence. Companies are actively engaging in mergers and acquisitions to enhance research capabilities, expand product pipelines, and accelerate commercialization. Collaborations with device manufacturers play a crucial role in optimizing inhalation systems for biologic formulations, ensuring efficiency and patient compliance.

Continuous investments in next-generation aerosol and nanoparticle-based technologies are leading to advancements in drug deposition and absorption. Additionally, firms are expanding their geographic reach through partnerships with regional distributors, enabling broader market penetration. R&D investments remain a key focus, fostering sustained innovation and the development of cutting-edge inhalable biologics.

- In March 2025, Kenox Pharmaceuticals Inc. and Lactiga US, Inc. announced a strategic collaboration to advance mucosal-targeted Secretory IgA (sIgA) therapies for immunodeficient patients. The partnership aims to accelerate the preclinical development of novel therapies enhancing mucosal immunity. Kenox Pharmaceuticals will leverage its expertise in nasal and inhaled biologic delivery systems to support Lactiga’s platform sIgA technology, addressing an unmet medical need for intranasal sIgA therapy in immunodeficient patients.

List of Key Companies in Inhalable Biologics Market:

- AstraZeneca

- MannKind Corporation

- Synairgen plc.

- Pulmocide

- Aerogen Ltd

- Liquidia Corporation

- Nephron Pharmaceuticals Corporation

- InCarda Therapeutics, Inc.

- Agomab Therapeutics

- Acu-Flow Limited

- ReCode Therapeutics

- AATec Medical GmbH

- Avalyn Pharma Inc.

- VERO Biotech

- Spexis Ltd.

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In January 2025, Ethris GmbH announced positive Phase 1 results for ETH47, an mRNA-based nasal therapy for uncontrolled asthma. ETH47 showed dose-dependent interferon lambda (IFNλ) expression, confirming target engagement with no serious adverse events. Ethris plans to begin a Phase 2a trial in Q2 2025 to assess ETH47’s effect on asthma symptoms after rhinovirus infection.

- In November 2024, AlveoGene received Rare Pediatric Disease Designation from the U.S. FDA for AVG-002, its novel inhaled gene therapy for lethal neonatal Surfactant Protein B deficiency. AVG-002, developed using the InGenuiTy platform, delivers a functional SP-B gene directly to the neonatal lung via respiratory instillation. Preclinical data suggest that a single administration could provide lifelong treatment.

- In October 2024, Kither Biotech announced the initiation of a Phase 1 clinical study for KIT2014, a novel inhaled peptide therapy for Cystic Fibrosis. KIT2014 is designed as an add-on treatment to existing CFTR modulators, enhancing CFTR function, promoting bronchodilation, and reducing inflammation through PDE3/4 inhibition. The study will evaluate the safety, tolerability, and pharmacokinetics of KIT2014 in healthy adult volunteers.