Market Definition

The market encompasses systems, solutions, and services designed to protect workers, equipment, and the environment in industrial settings. It includes safety instrumented systems, emergency shutdown systems, fire and gas monitoring, and related compliance solutions across sectors such as manufacturing, oil and gas, chemicals, mining, and energy.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Industrial Safety Market Overview

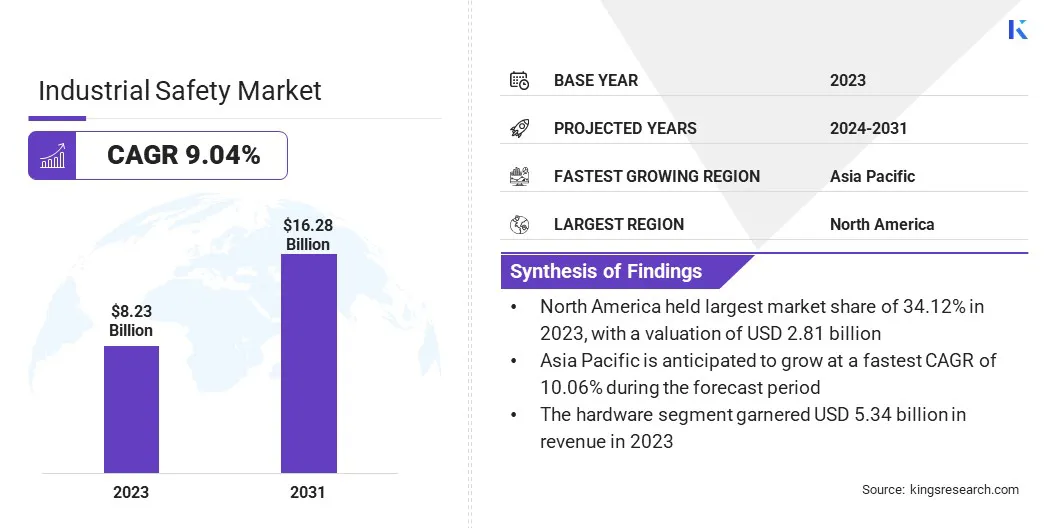

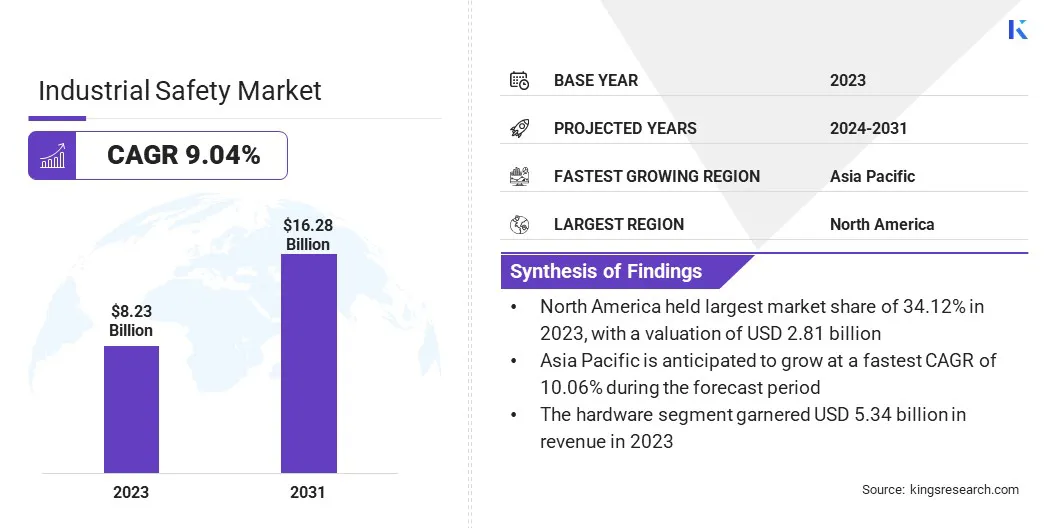

The global industrial safety market size was valued at USD 8.23 billion in 2023 and is projected to grow from USD 8.88 billion in 2024 to USD 16.28 billion by 2031, exhibiting a CAGR of 9.04% during the forecast period. Market growth is driven by the increasing emphasis on workplace safety and stringent regulatory standards across industries.

The rise of industrial automation and the integration of advanced technologies such as IoT, AI, and real-time monitoring systems have significantly enhanced the implementation of safety protocols.

Governments and regulatory bodies worldwide are enforcing compliance, particularly in high-risk industries such as oil and gas, chemicals, and manufacturing, leading to increased adoption of safety systems.

Major companies operating in the industrial safety industry are Schneider Electric, Honeywell International Inc, ABB, Emerson Electric Co., Rockwell Automation, Siemens, Yokogawa India Ltd., HIMA, Omron Corporation, 3M, DuPont, MSA Worldwide, LLC, Eaton, Pilz GmbH & Co. KG, and SICK AG.

The shift toward digital transformation has enabled predictive safety mechanisms, improving response times and minimizing human error. Additionally, growing demand for safety instrumented systems, fire and gas detection, and emergency shutdown systems are fueling market expansion.

The rise of smart factories and Industry 4.0 initiatives further accelerates the need for intelligent safety solutions to ensure uninterrupted operations and workforce protection.

- In March 2025, Hindustan Zinc Limited implemented Detect AI, an advanced AI-powered surveillance system, across its operations. The solution focused on enhancing workplace safety and operational efficiency by using AI, machine learning, and computer vision to detect unsafe practices and ensure compliance with safety protocols.

Key Highlights

- The industrial safety industry size was valued at USD 8.23 billion in 2023.

- The market is projected to grow at a CAGR of 9.04% from 2024 to 2031.

- North America held a market share of 34.12% in 2023, with a valuation of USD 2.81 billion.

- The network security systems segment garnered USD 1.80 billion in revenue in 2023.

- The hardware segment is expected to reach USD 10.24 billion by 2031.

- The oil & gas segment is projected to generate a revenue of USD 3.79 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.06% over the forecast period.

Market Driver

"Major Emphasis on Employee Health and Injury Prevention"

The industrial safety market is experiencing significant growth, fueled by an increasing emphasis on employee health, well-being, ergonomics, and injury prevention.

As industrial operations become more complex, organizations are recognizing that employee health is essential for regulatory compliance and for business resilience and performance. Ergonomics and injury prevention have emerged as critical priorities in workplace safety programs.

Musculoskeletal disorders (MSDs), commonly resulting from repetitive tasks, awkward postures, or poorly designed work environments, are a leading cause of lost workdays and increased compensation costs.

In response, companies are proactively conducting ergonomic risk assessments and redesigning workstations to reduce physical strain. Solutions such as adjustable equipment, ergonomic tools and employee training on safe movement techniques are being widely implemented across industries.

- In January 2025, VelocityEHS introduced significant enhancements to its Accelerate Platform by integrating four leading EHS solutions into a unified experience. This uograde aims to streamline safety, chemical management, industrial ergonomics, and operational risk processes, providing businesses with actionable insights to protect their workforce and improve operational performance.

Market Challenge

"Ensuring Consistent Employee Engagement"

A significant challenge hindering the progress of the industrial safety market is ensuring consistent employee engagement in safety programs. While safety regulations and training are widely implemented, their effectiveness depends heavily on the active participation and adherence of workers.

However, employees often view safety training as a routine task, leading to complacency and ineffective safety practices. This disengagement can result in preventable accidents, compromising worker safety and operational efficiency.

To address this challenge, companies should foster a safety culture that prioritizes continuous learning and active participation. This can be achieved through engaging, interactive training methods and real-time safety feedback systems.

Market Trend

Technological Advancements

The industrial safety market is evolving rapidly, fueled by technological advancements. Technological innovations, particularly in the fields of artificial intelligence (AI) and real-time data analytics, are transforming traditional safety systems into predictive and adaptive frameworks.

These technologies enable continuous monitoring of environmental conditions, machinery performance, and human behavior, allowing for real-time risk assessments and quicker decision-making to prevent accidents. Smart systems can now anticipate hazardous events and trigger alerts or corrective actionsproactively, enhancing workplace safety.

- In February 2025, Schneider Electric revealed a new patent that incorporate artificial intelligence (AI) to enhance process safety and risk assessments. The innovation automates hazard analysis and validates protection mechanisms in industrial processes, thereby reducing the likelihood of process safety hazards.

Industrial Safety Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Emergency Shutdown Systems (ESD), Fire & Gas Monitoring Systems, High Integrity Pressure Protection Systems (HIPPS), Burner Management Systems (BMS), Turbomachinery Control (TMC) Systems, Access control & Intrusion Detection Systems, Process Control Systems (PCS), Network Security Systems

|

|

By Offering

|

Hardware, Software

|

|

By End-user Industry

|

Oil & Gas, Energy & Power, Chemicals, Water & Wastewater, Construction, Aerospace & Defense, Automotive, Semiconductor, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Emergency Shutdown Systems (ESD), Fire & Gas Monitoring Systems, High Integrity Pressure Protection Systems (HIPPS), Burner Management Systems (BMS), Turbomachinery Control (TMC) Systems, Access control & Intrusion Detection Systems, Process Control Systems (PCS), and Network Security Systems): The network security systems segment earned USD 1.80 billion in 2023 due to the growing need for rapid operational shutdowns in hazardous environments to prevent accidents and ensure personnel safety.

- By Offering (Hardware, Software): The hardware segment held a share of 64.87% in 2023, attributed to the widespread deployment of physical safety components such as sensors, controllers, and actuators essential for real-time risk detection and mitigation.

- By End-user Industry (Oil & Gas, Energy & Power, Chemicals, Water & Wastewater, Construction, Aerospace & Defense, Automotive, Semiconductor, and Others): The oil & gas segment is projected to reach USD 3.79 billion by 2031, fueled by the industry's high-risk operational environments and strict regulatory mandates requiring advanced safety infrastructure.

Industrial Safety Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America industrial safety market accounted for a substantial share of 34.12% in 2023, valued at USD 2.81 billion. This dominance is reinforced by the concentration of industrial operations in sectors such as shale gas extraction, petrochemicals, and aerospace, particularly in the U.S. Gulf Coast, Alberta’s oil sands, and key manufacturing hubs.

Companies in these regions are early adopters of technologies such as AI-driven safety analytics, redundant control systems, and integrated fire and gas detection platforms. The presence of global safety solution providers has further fueled innovation and large-scale deployment.

Additionally, ongoing plant modernization and brownfield upgrades in the U.S. energy and chemical sectors have sustained investment in high-integrity pressure protection and turbomachinery control systems tailored for complex operational environments.

- In April 2025, DORN Companies and Cardinus Risk Management partnered to expand DORN’s ergonomics and injury prevention services for office teams in North America. The collaboration integrated Cardinus’ HealthyWorking software for desktop ergonomics with DORN’s hands-on industrial safety solutions, aiming to reduce musculoskeletal disorders and improve workplace safety across industries.

Asia Pacific industrial safety industry is expected to register the fastest CAGR of 10.06% over the forecast period. This rapid growth is largely propelled by China’s eastern industrial corridor, India’s expanding oil refining zones, and electronics manufacturing hubs in South Korea and Taiwan.

In China, refinery expansions and coal-to-chemical plant developments in provinces such as Shandong and Inner Mongolia are boosting demand for emergency shutdown and burner management systems. India's growing integrated petrochemical complexes are fostering the uptake of scalable process control and access control systems.

Meanwhile, South Korea’s semiconductor fabrication plants and Japan’s precision manufacturing sectors are investing in advanced safety networks and intrusion detection technologies to protect high-value assets.

The rise of multinational corporations establishing production bases in Southeast Asia is propelling the demand for modular safety infrastructure that can be quickly deployed in new industrial environments.

Regulatory Frameworks

- In the United States, industrial safety is governed by the Occupational Safety and Health Administration (OSHA) under the Occupational Safety and Health Act, which mandates standards for workplace safety, including machinery, chemical handling, and protective equipment.

- In the European Union, industrial safety is regulated under the EU Framework Directive with specific directives such as the Machinery Directive and the Seveso III Directive for controlling major accident hazards involving dangerous substances.

- In China, the Ministry of Emergency Management (MEM) oversees industrial safety through the Work Safety Law and specific sectoral regulations, including mandatory GB standards related to equipment safety, chemical hazards, and risk prevention.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates industrial safety under the Industrial Safety and Health Act, covering machinery, chemical substances, and worker protection protocols.

Competitive Landscape

Companies operating in the industrial safety industry are focusing on the expansion of product portfolios through advanced technological integration, such as incorporating AI-based analytics, real-time monitoring capabilities, and edge computing into safety systems.

They are further engaging in targeted acquisitions and partnerships to access niche technologies, expand application expertise, and enter new geographic markets.

Strategic collaborations with automation providers and industrial software developers are increasingly focused on offering end-to-end safety solutions within broader industrial control systems.

Additionally, considerable investments are being directed toward R&D to innovate scalable, modular safety platforms tailored to evolving industrial needs, including smart factory environments.

Additionally, some players are implementing region-specific customization strategies to meet the operational demands of sectors such as oil & gas, chemicals, power, and electronics manufacturing.

- In January 2025, Benchmark Gensuite and COVE partnered to enhance safety program effectiveness through visual literacy training and EHS software solutions. The collaboration focused on improving hazard recognition, continuous learning, and sustainable management systems by integrating visual literacy principles into EHS processes.

List of Key Companies in Industrial Safety Market:

- Schneider Electric

- Honeywell International Inc

- ABB

- Emerson Electric Co.

- Rockwell Automation

- Siemens

- Yokogawa India Ltd.

- HIMA

- Omron Corporation

- 3M

- DuPont

- MSA Worldwide, LLC

- Eaton

- Pilz GmbH & Co. KG

- SICK AG

Recent Developments (Partnerships/Investment/ Product Launches)

- In April 2025, Green Hills Software and Texas Instruments (TI) expanded their partnership to offer safety-certified solutions for the AM26x microcontroller portfolio. The collaboration focuses on streamlining development for safety-critical systems in industrial and automotive applications through integrated hardware and software solutions, enabling faster, more efficient development with the highest safety certification levels.

- In January 2025, Protex AI secured USD 36 million in Series B funding to accelerate its expansion in the U.S. and advance its AI-driven workplace safety technology. The company utilizes computer vision and AI to improve safety and operations across industrial environments.

- In October 2024, Nokia launched six new industrial applications on its MX Industrial Edge (MXIE) platform to enhance worker safety, site security, operational efficiency, and OT environment protection. Offered as a service, the applications Ascom Ofelia, Fogsphere, innovaphone PBX & myApps, RXRM, OneLayer, and Redinent support digital transformation across the manufacturing, mining, port, and chemical industries by improving situational awareness, enabling real-time teleoperations, and enhancing IIoT asset visibility and security.

- In September 2024, Ansell Ltd. launched the Ansell Technology Experiential Center at the National Safety Council Conference and Expo in Orlando. The center showcased innovative safety solutions, particularly from the HyFlex and AlphaTec product portfolios, aimed at enhancing worker protection and operational efficiency across industries.