Market Definition

The market encompasses a broad range of equipment designed for high-volume food processing operations across multiple end-use industries. This market includes machines such as food slicers, dicers, shredders, and other specialized cutting systems that support the efficient and precise preparation of food products.

These machines are deployed in diverse processing environments and are categorized based on their level of automation, catering to varying operational needs and capacities. The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape.

Industrial Food Cutting Machines Market Overview

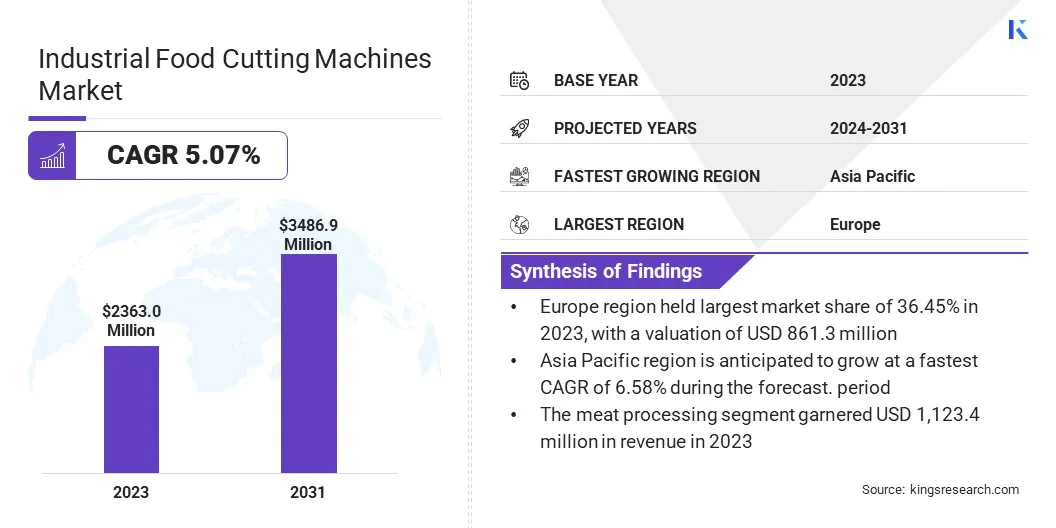

The global industrial food cutting machines market size was valued at USD 2,363.0 million in 2023 and is projected to grow from USD 2,467.2 million in 2024 to USD 3,486.9 million by 2031, exhibiting a CAGR of 5.07% during the forecast period.

The rising demand for processed and packaged foods and the increasing adoption of automation in food processing operations are driving the market. As consumers increasingly prefer convenient, ready-to-eat, and hygienically packaged food, manufacturers are investing in advanced cutting technologies to meet volume and quality demands.

Major companies operating in the industrial food cutting machines industry are Zibo Taibo Industrial Co., Ltd., Hiwell Machinery, Bettcher Industries, Inc., Marel, SPX FLOW, Inc., FAM STUMABO, Deville Technologies, Urschel Laboratories, Inc., Marchant Schmidt, Baker Perkins, Bühler AG, JBT, GEA Group Aktiengesellschaft, Hillenbrand, Inc., and Alfa Laval.

The growing awareness of food safety and product quality is prompting producers to shift from manual processes to automated cutting solutions that ensure uniformity and reduce human error.

Additionally, rapid urbanization and the expansion of modern retail channels are further accelerating the demand for high speed food cutting equipment across meat, dairy, and fruit and vegetable processing applications.

Key Highlights

- The industrial food cutting machines industry size was recorded at USD 2,363.0 million in 2023.

- The market is projected to grow at a CAGR of 5.07% from 2024 to 2031.

- Europe held a market share of 36.45% in 2023, with a valuation of USD 861.3 million.

- The food slicers segment garnered USD 915.2 million in revenue in 2023.

- The automatic segment is expected to reach USD 1,805.9 million by 2031.

- The meat processing segment is expected to reach USD 1,650.9 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.58% during the forecast period.

Market Driver

"Rising Demand for Processed and Packaged Foods"

The industrial food cutting machines market is primarily driven by the rising demand for processed and packaged foods globally. Rapid urbanization, changing lifestyle habits and the increasing need for convenience are turning consumers to ready-to-eat and minimally prepared food products, fueling the demand for efficient food processing equipment.

Industrial food cutting machines play a crucial role in meeting this demand by ensuring uniformity, precision, and speed in food preparation. Their ability to handle large volumes while maintaining consistent quality makes them suitable for modern food production environments, including meat, vegetable, bakery, and dairy processing.

This growing reliance on packaged food continues to stimulate investments in advanced cutting technologies to meet evolving consumer and industry needs, in turn, driving the growth of the market.

- In November 2024, the India Brand Equity Foundation reported that India's food processing sector is experiencing robust growth, primarily fueled by the surging demand for processed and packaged foods. The sector’s market size is projected to reach USD 1,274 billion by 2027.

Market Challenge

"High Initial Investment and Maintenance Cost"

High initial investment and maintenance cost associated with automated food cutting machines is a key challange in the market. High cost is restraining the adoption of industrial food cutting machines, particularly among small and medium-scale food processors.

Budget limitations, along with the added expenses of maintenance, skilled labor, and system upgrades, make it challenging for these businesses to invest in advanced equipment.

A potential solution lies in the development of cost-effective, modular cutting machines that offer scalability, allowing businesses to upgrade components as needed without replacing entire systems. Additionally, leasing models or government subsidies for food processing technology adoption could help alleviate the financial strain for smaller enterprises.

Market Trend

"Growing Adoption of Automation"

The industrial food cutting machines market is increasingly shaped by the growing adoption of automation, as manufacturers and food processors seek to improve efficiency, consistency, and hygiene in high-volume operations.

Automated cutting machines are equipped with advanced controls, programmable settings, and smart interfaces that significantly reduce the need for manual intervention.

These systems streamline production workflows by enabling precise, repeatable cuts at high speeds, minimizing product waste, and ensuring uniformity across batches. Automation also enhances workplace safety by reducing operator contact with sharp blades and moving parts.

Moreover, integration with digital monitoring tools allows for real-time diagnostics and predictive maintenance, further improving uptime and reducing operational costs. As food processing facilities modernize, automation is becoming a central focus in machinery design and procurement decisions across the market.

Industrial Food Cutting Machines Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Food Slicers, Food Dicers, Food Shredders, Others

|

|

By Technology

|

Automatic, Semi-Automatic, Manual

|

|

By Application

|

Meat Processing, Fruits and Vegetables Processing, Cheese Processing, Other

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Food Slicers, Food Dicers, Food Shredders, Others): The food slicers segment earned USD 915.2 million in 2023 due to its widespread use in commercial kitchens and processing plants.

- By Technology (Automatic, Semi-Automatic, Manual): The automatic segment held 48.64% of the market in 2023, due to the increasing demand for labor-saving solutions and enhanced productivity in large-scale food processing facilities.

- By Application (Meat Processing, Fruits and Vegetables Processing, Cheese Processing, and Other): The meat processing segment is projected to reach USD 1,650.9 million by 2031, owing to rising global meat consumption and the need for consistent, hygienic, and high-speed cutting solutions.

Industrial Food Cutting Machines Market Regional Analysis

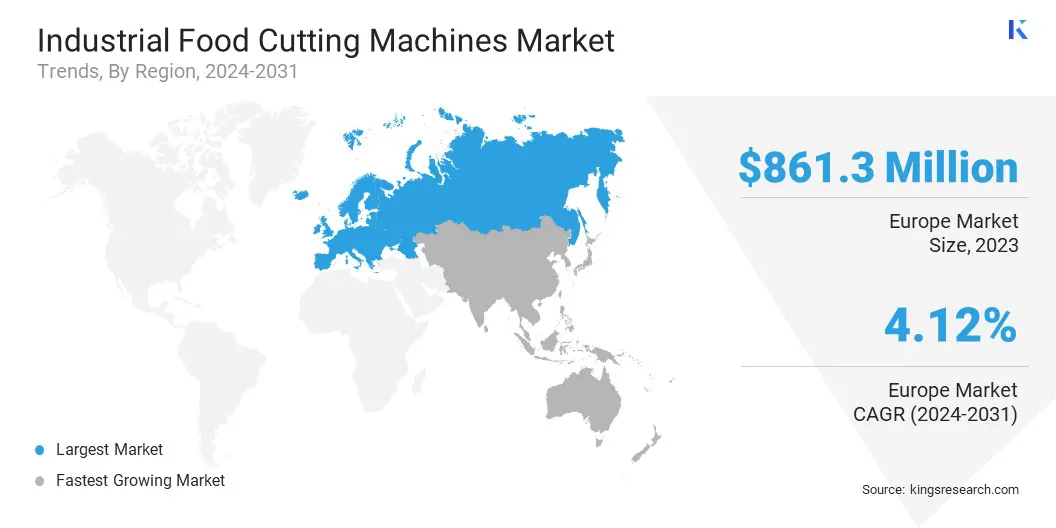

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe industrial food cutting machines market share stood around 36.45% in 2023 in the global market, with a valuation of USD 861.3 million. This dominance is driven by the region's well-established food processing industry, high adoption of automation technologies, and food safety regulations that promote the use of advanced processing equipment.

Additionally, the presence of leading food machinery manufacturers and a strong focus on efficiency and hygiene standards in food production have further contributed to the growth of the market in this region.

Rising demand for ready-to-eat meals and government support for the modernization of food facilities are further driving market growth in Europe. According to the European Commission, the food and drink industry remained the EU’s largest manufacturing sector in 2024, in terms of employment and value added.

Asia Pacific industrial food cutting machines industry is poised to grow at a significant growth at a CAGR of 6.58% over the forecast period, fueled by rapid urbanization, rising disposable incomes, and the increasing demand for processed and packaged food products across emerging economies such as China, India, and Southeast Asian countries.

The expanding food and beverage industry, coupled with rising investments in automation and modernization of food processing facilities, is expected to accelerate the adoption of industrial food cutting machines in the region.

Furthermore, government initiatives to enhance food production capabilities and the entry of global food brands are boosting demand for advanced cutting technologies, in turn, driving market growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates industrial food cutting machines under its Current Good Manufacturing Practices (CGMPs), which require that all equipment used in food processing be designed and maintained to ensure cleanliness and prevent contamination. The machines must be constructed using food-grade materials that are non-toxic, corrosion-resistant, and easy to sanitize.

- In India, the Food Safety and Standards Authority of India (FSSAI) oversees the regulation of industrial food cutting machines under the Food Safety and Standards (Licensing and Registration of Food Businesses) Regulations, 2011. FSSAI mandates that all equipment and machinery used in food processing must be made of food-grade, non-reactive materials to prevent contamination.

Competitive Landscape

The industrial food cutting machines industry remains highly competitive, with key players prioritizing innovation and strategic expansion. Companies are developing advanced machines featuring automation, real-time monitoring, and programmable controls to improve precision and efficiency. Key players are also diversifying their product lines with modular, customizable solutions to cater to varied food types and production needs.

To reach new markets and support customers effectively, players are forming strategic partnerships, pursuing mergers and acquisitions, and establishing local service and support centers. Additionally, a strong focus on cost-effective production and compliance with international safety regulations is helping firms maintain a competitive edge.

List of Key Companies in Industrial Food Cutting Machines Market:

- Zibo Taibo Industrial Co., Ltd.

- Hiwell Machinery

- Bettcher Industries, Inc.

- Marel

- SPX FLOW, Inc.

- FAM STUMABO

- Deville Technologies

- Urschel Laboratories, Inc.

- Marchant Schmidt

- Baker Perkins

- Bühler AG

- JBT

- GEA Group Aktiengesellschaft

- Hillenbrand, Inc.

- Alfa Laval

Recent Developments (Product Launch)

- In February 2025, Taylor Farms announced the rollout of fully automated technology for its fresh-cut foodservice vegetable production. The company introduced advanced robotics at its Yuma facility to enhance efficiency, food quality, and worker safety, with plans to fully automate all 22 lines at its Salinas facility by 2027.