Market Definition

Industrial enzymes are biological catalysts utilized to enhance the efficiency of chemical processes by improving operational productivity, product quality, and process sustainability across various industrial applications.

The market comprises the development, production, and commercial use of enzymes across sectors such as food processing, pharmaceuticals, biofuels, textiles, detergents, and paper manufacturing.

Industrial Enzyme Market Overview

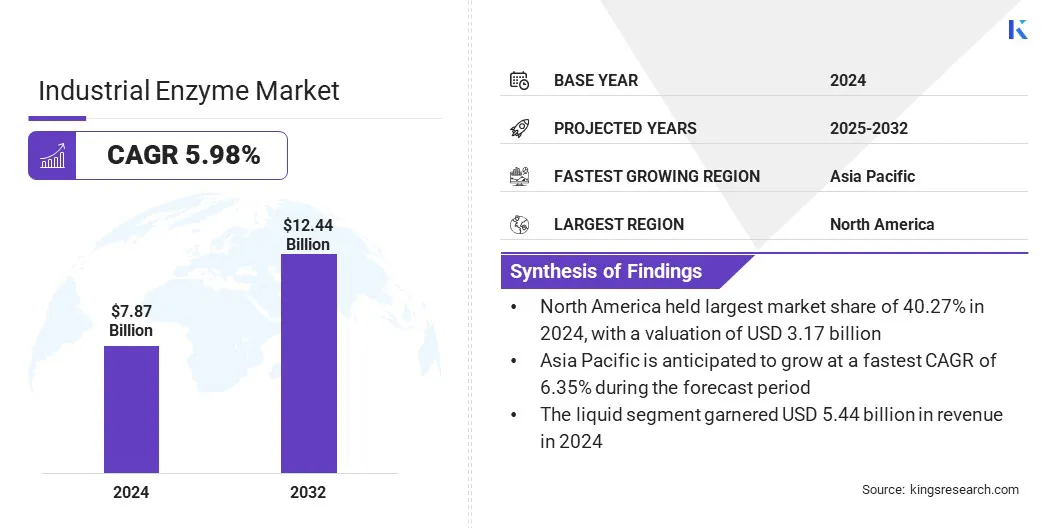

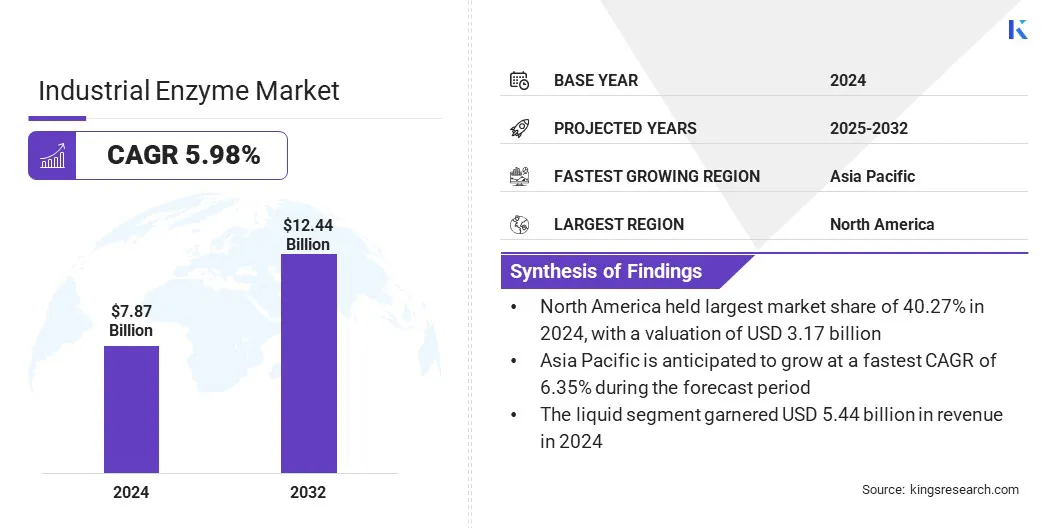

The global industrial enzyme market size was valued at USD 7.87 billion in 2024 and is projected to grow from USD 8.28 billion in 2025 to USD 12.44 billion by 2032, exhibiting a CAGR of 5.98% during the forecast period.

This growth is primarily driven by increasing demand from the food and beverage industry, supported by rising adoption in pharmaceuticals, research, and biotechnology. In food processing, enzymes are essential for enhancing texture, flavor, and shelf life, supporting the global shift toward clean-label and sustainable products.

Major companies operating in the industrial enzyme industry are Novo Nordisk Fonden, dsm-firmenich, BASF, Amano Enzyme Inc., AB Enzymes, BRAIN Biotech AG, Codexis, Inc., Sunson Industry Group Co., Ltd., Shandong Lonct Enzymes Co., Ltd., Creative Enzymes, Enzymatic Deinking Technologies, LLC, Advanced Enzyme Technologies, Adisseo, Kerry Group plc., and Antozyme Biotech Pvt Ltd.

Enzyme-based solutions are increasingly being integrated into industrial processes, replacing conventional chemical methods to deliver improved selectivity, lower energy consumption, and reduced environmental impact.

- For instance, in February 2025, thyssenkrupp Uhde and Novonesis launched a joint enzymatic esterification technology aimed at replacing traditional chemical catalysts with bespoke enzymes. The innovation significantly reduces energy consumption and emissions, enhances product quality, and enables sustainable production of bio-based esters for use in food, personal care, home care, and technical applications.

As industries prioritize low-emission, high-efficiency production methods, advancements are boosting a broader transition to enzyme-integrated manufacturing models that align with both performance and sustainability objectives.

Key Highlights

- The industrial enzyme market size was valued at USD 7.87 billion in 2024.

- The market is projected to grow at a CAGR of 5.98% from 2025 to 2032.

- North America held a market share of 40.27% in 2024, with a valuation of USD 3.17 billion.

- The carbohydrases segment garnered USD 2.96 billion in revenue in 2024.

- The microorganisms segment is expected to reach USD 7.58 billion by 2032.

- The liquid segment is projected to generate a revenue of USD 8.96 billion by 2032.

- The food and beverages segment is estimated to reach USD 4.96 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.35% over the forecast period.

Market Driver

Rising Demand for Sustainable and Low-Energy Industrial Processes

The market is witnessing strong growth as manufacturers across sectors increasingly prioritize sustainable and energy-efficient operations. Enzymes enable precise biochemical transformations under mild temperatures and pressures, significantly reducing energy input compared to traditional chemical processes.

This lowers operational costs, which aligns with global ESG targets and decarbonization strategies. Industries such as food processing, textiles, and leather are replacing resource-intensive methods with enzyme-based solutions to comply with evolving regulatory standards and consumer demand for sustainability.

Additionally, the reduced use of harsh chemicals minimizes waste generation and environmental risks.

- In November 2024, Creative Enzymes launched a range of enzymatic solutions for sustainable leather processing. The new formulations, comprising protease, lipase, deliming, and bating enzymes, are designed to replace traditional chemical-intensive methods, reduce water and energy usage, and improve product quality, supporting environmentally responsible and efficient leather manufacturing practices.

Market Challenge

Limited Enzyme Reusability and Stability Under Harsh Processing Conditions

A key challenge limiting the expansion of the industrial enzyme market is the limited reusability and operational stability of enzymes under extreme processing environments, such as high temperatures, pH fluctuations, and the presence of solvents or inhibitors.

These conditions can lead to enzyme denaturation, reduced catalytic efficiency, and frequent replenishment, increasing operational costs and hindering large-scale adoption in sectors such as chemical processing, textiles, and pulp & paper.

To address this challenge, manufacturers are increasingly turning to enzyme immobilization technologies, which anchor enzymes onto solid supports to enhance structural integrity, extend functional lifespan, and enable recovery and reuse.

- In March 2025, Enzyme Supplies Ltd and Ecovyst signed a Memorandum of Understanding to accelerate the development and commercialization of immobilized enzyme technologies. The collaboration combines Enzyme Supplies’ expertise in industrial enzyme applications with Ecovyst’s advanced silica-based material capabilities, aiming to enhance enzyme stability, enable reusability, and improve process efficiency across industries such as biofuels, agriculture, pulp and paper, food processing, and brewing.

This approach improves process economics while supporting sustainability goals by minimizing enzyme waste and optimizing input efficiency.

Market Trend

Rapid Expansion of Enzyme Use in Plant-Based and Functional Food Processing

The market is experiencing notable growth, fueled by the rising adoption of enzyme technologies in plant-based and functional food processing. As consumer demand grows for clean-label, allergen-free, and nutritionally enhanced alternatives, food manufacturers are leveraging enzymes to improve the texture, flavor, digestibility, and shelf life of plant-derived products.

Enzymes such as proteases, amylases, and lipases play a crucial role in modifying plant proteins, reducing off-notes, and enhancing functional properties, enabling manufacturers to meet evolving sensory and nutritional requirements.

- In November 2024, Biocatalysts Ltd launched the PlantPro enzyme range to enhance taste, texture, and flavour in plant-based foods. The range features PlantPro 726L, an enzyme that boosts umami flavour in dairy alternatives, meat, and cheese substitutes.

This trend is accelerating innovation across the food value chain and strengthening enzyme integration into mainstream production.

Industrial Enzyme Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Carbohydrases, Proteases, Lipases, Polymerases & Nucleases, Others

|

|

By Source

|

Microorganisms, Plant-based, Animal-derived

|

|

By Form

|

Liquid, Dry

|

|

By Application

|

Food and Beverages, Pharmaceuticals, Research & Biotechnology, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Carbohydrases, Proteases, Lipases, Polymerases & Nucleases, and Others): The carbohydrases segment earned USD 2.96 billion in 2024, due to their extensive use in food processing, particularly in baking, brewing, and starch conversion applications.

- By Source (Microorganisms, Plant-based, and Animal-derived): The microorganisms segment held a share of 61.09% in 2024, propelled by their high enzyme yield, cost-effective production, and scalability in industrial fermentation processes.

- By Form (Liquid and Dry): The liquid segment is projected to reach USD 8.96 billion by 2032, owing to its higher solubility, better mixing properties, and widespread use in industries such as food processing and textiles.

- By Application (Food and Beverages, Pharmaceuticals, Research & Biotechnology, and Others): The food and beverages segment is estimated to reach USD 4.96 billion by 2032, fueled by the increasing use of enzymes in drug synthesis, biologics manufacturing, and enzymatic API production.

Industrial Enzyme Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America industrial enzyme market accounted for a substantial share of 40.27% in 2024, valued at USD 3.17 billion. This dominance is largely attributed to the region’s advanced food and beverage processing infrastructure, particularly in the United States, where companies are actively scaling production and modernizing operations.

- For instance, in May 2025, Anheuser-Busch announced a USD 300 million investment to enhance its brewing operations across the U.S.

This development supports the growth of high-capacity brewing operations, where enzyme-dependent processes are essential for efficiency. Enzymes such as amylases and proteases are critical for converting starches, optimizing fermentation, and ensuring consistent product quality.

As breweries scale and integrate advanced technologies, the use of enzyme-based solutions becomes increasingly important for maintaining operational efficiency, improving product consistency, and meeting evolving production demands. These ongoing investments across key industries position North America as a major market for industrial enzymes.

The Asia-Pacific industrial enzyme industry is expected to register the fastest CAGR of 6.35% over the forecast period. This growth is fueled by rapid industrial expansion, rising demand for sustainable manufacturing, and increased enzyme usage across sectors such as food processing, pharmaceuticals, and pulp and paper.

This move reflects the growing interest in enzyme-based processing, particularly in the pulp and paper industry, where companies are actively shifting toward cleaner and more efficient production methods. Additionally, the region is witnessing increased investment in biopharmaceutical production, where enzymes are essential in drug manufacturing, protein synthesis, and molecular diagnostics.

- In August 2024, AB Enzymespartnered with APC Group to distribute its industrial enzyme solutions for the pulp and paper sector across China, India, Southeast Asia, and the Middle East. The agreement aims to expand access to enzyme-based technologies that promote sustainability and process efficiency, supporting the region’s shift toward environmentally responsible manufacturing practices.

- In January 2024, AbbVie invested USD 223 million to expand its biologics manufacturing facility in Singapore.

These developments are accelerating enzyme adoption and establishing Asia Pacific as a major region for industrial enzyme suppliers targeting scalable, high-growth applications.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates enzymes used in food processing under the Federal Food, Drug, and Cosmetic Act (FFDCA). The Environmental Protection Agency (EPA) oversees industrial enzymes that may affect the environment, particularly those used in products such as detergents and cleaning agents. Additionally, the United States Department of Agriculture (USDA), through its Food Safety and Inspection Service (FSIS), regulates the use of enzymes in the processing of meat, poultry, and egg products.

- In Europe, the European Food Safety Authority (EFSA) evaluates the safety of enzymes used in food processing. The European Chemicals Agency (ECHA) regulates enzymes used in industrial and chemical applications through the REACH framework, focusing on human and environmental safety. Additionally, the European Medicines Agency (EMA) oversees enzymes used in pharmaceutical manufacturing, ensuring that enzyme-based ingredients meet the required standards for quality, safety, and efficacy.

Competitive Landscape

The industrial enzyme market is characterized by strategic collaborations, portfolio expansion, and targeted product differentiation. Key players are forming exclusive distribution agreements and co-development partnerships to enhance market reach and accelerate product innovation.

- For instance, in February 2025, SEQENS and APPLEXION formed a strategic alliance for the exclusive distribution of SEQENZYM FT, a specialized enzyme for producing short-chain fructo-oligosaccharides (scFOS), with a commitment to jointly develop new enzyme-based solutions for the food sector.

Such agreements allow firms to extend market reach, reduce time-to-market, and align commercialization efforts with established customer networks. Additionally, players are adopting co-development models to jointly design next-generation enzymes tailored to specific industrial functions, while also expanding niche product portfolios to meet evolving end-user requirements.

Increasing focus is being placed on enhancing enzyme properties such as yield efficiency, stability under harsh conditions, and application-specific functionality to ensure long-term relevance in industrial operations.

List of Key Companies in Industrial Enzyme Market:

- Novo Nordisk Fonden

- dsm-firmenich

- BASF

- Amano Enzyme Inc.

- AB Enzymes

- BRAIN Biotech AG

- Codexis, Inc.

- Sunson Industry Group Co., Ltd.

- Shandong Lonct Enzymes Co., Ltd.

- Creative Enzymes

- Enzymatic Deinking Technologies, LLC

- Advanced Enzyme Technologies

- Adisseo

- Kerry Group plc.

- Antozyme Biotech Pvt Ltd

Recent Developments (Acquisition/Collaboration)

- In May 2025, BRAIN Biotech AG acquired full ownership of Breatec B.V. and secured a new production and warehousing site near Eindhoven, Netherlands. The initiative includes the expansion of a Baking Application Center and consolidation of enzyme operations to scale capabilities in the growing bakery enzymes segment.

- In September 2024, c-LEcta and Insilico Biotechnology entered a strategic collaboration to develop an optimized enzyme for the large-scale production of a pharmaceutical active ingredient. The partnership aims to replace complex chemical synthesis with an efficient enzymatic route, enhancing process sustainability and scalability in pharmaceutical manufacturing.