Market Definition

The market encompasses the production and distribution of transformers designed to supply voltage to control circuits in industrial applications. These transformers are engineered to deliver constant voltage and withstand high inrush currents, ensuring reliable operation of control devices such as relays, solenoids, and timers.

They are widely used across industries including manufacturing, automotive, oil & gas, and utilities. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

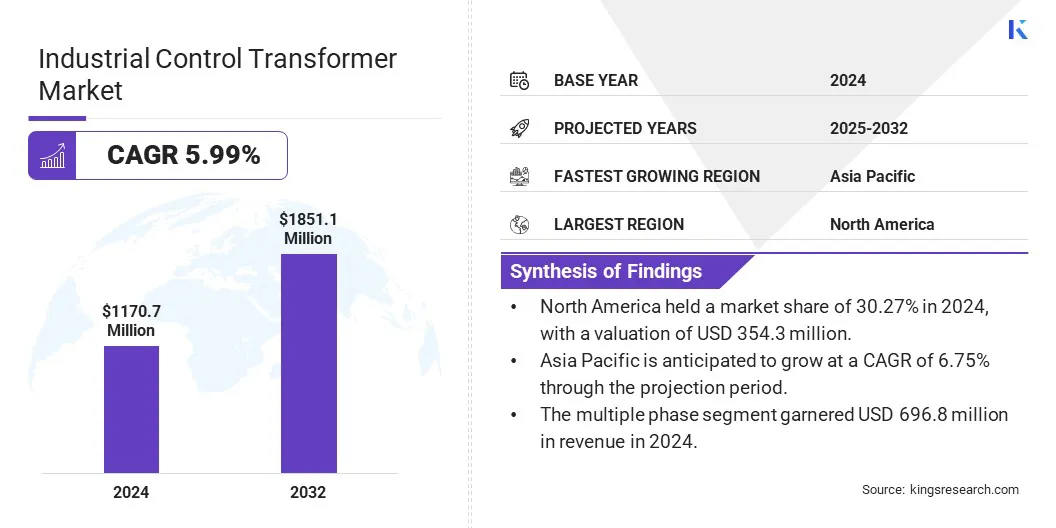

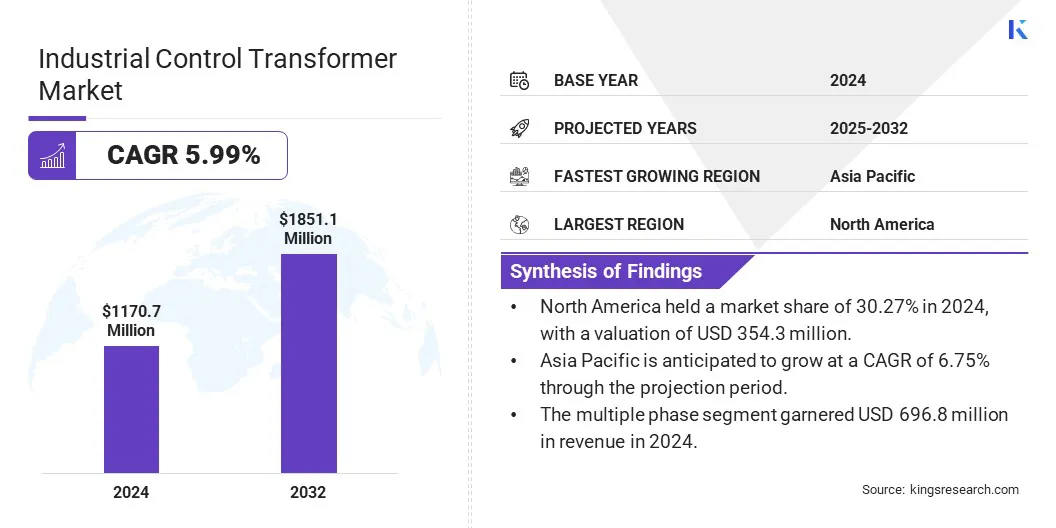

The global industrial control transformer market size was valued at USD 1170.7 million in 2024 and is projected to grow from USD 1232.0 million in 2025 to USD 1851.1 million by 2032, exhibiting a CAGR of 5.99% during the forecast period.

Increasing investments in modernizing manufacturing facilities and enhancing operational efficiency are fueling market growth and supporting clean energy transitions. Growing demand for eco-friendly and biodegradable insulating fluids is fueling a shift toward sustainable and safer technologies.

Major companies operating in the industrial control transformer industry are Schneider Electric, Siemens, Mitsubishi Electric Corporation, Hitachi Energy Ltd, DTG BHEL, Voltamp Transformer, Eaton, Rockwell Automation, Hubbell, Dongan Electric Manufacturing Company, Lenco Electronics, Inc., Kirloskar Electric Company, EVR Electricals, TBEA, and SHUOGONG POWER.

Additionally, the increasing demand for high-voltage direct current transmission systems is driving transformer manufacturers to expand production facilities. These upgrades support the development of advanced converter transformers with enhanced capacity and improved performance, aligning with the increasing global focus on renewable energy projects.

- In September 2024, GE Vernova announced the expansion of its existing manufacturing capabilities at two key sites in Stafford, UK. The Stafford HVDC Facility at Redhill is set to double its manufacturing capacity with an additional VSC valve assembly line to meet the rising demand for HVDC systems. Meanwhile, the Stafford Transformer Facility at Lichfield Road is being upgraded to enhance the production of HVDC converter transformers. This expansion aligns with increasing global demand for HVDC transmission driven by renewable energy projects across Europe, Asia, and North America.

Key Highlights:

- The industrial control transformer industry size was recorded at USD 1170.7 million in 2024.

- The market is projected to grow at a CAGR of 5.99% from 2025 to 2032.

- North America held a market share of 30.27% in 2024, with a valuation of USD 354.3 million.

- The multiple phase segment garnered USD 696.8 million in revenue in 2024.

- The low voltage segment is expected to reach USD 907.2 million by 2032.

- The manufacturing segment held a share of 34.27% in 2024.

- The industrial segment is anticipated to grow at a CAGR of 6.41% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.75% through the projection period.

Market Driver

Rising Use of HVAC Systems

The rising use of HVAC systems is propelling the growth of the industrial control transformer market. These transformers provide constant low-voltage power to control circuits, ensuring efficient and safe HVAC operation. Industrial and commercial facilities, particularly in manufacturing and data centers, are increasingly deploying HVAC systems to maintain optimal climate conditions.

Control transformers are integral in managing fans, compressors, and relays. The growing emphasis on energy efficiency and environmental control is increasing the demand for dependable transformer integration.

- According to the International Energy Agency (IEA), the global stock of air conditioning units is projected to exceed 5.5 billion by 2050.

Market Challenge

Volatility in Raw Material Prices

A significant challenge limiting the growth of the industrial control transformer market is the volatility in raw material prices, particularly copper, steel, and insulation materials. These materials are essential in transformer manufacturing, and their unpredictable price variations increase production costs and complicate pricing strategies. Such fluctuations also affect inventory management and financial planning, making it difficult for manufacturers to maintain consistent profit margins.

To address this challenge, manufacturers are exploring alternative materials and optimizing supply chains to reduce dependency on highly volatile resources. Additionally, long-term contracts and strategic sourcing are increasingly adopted to ensure material availability and cost stability.

Investments in recycling and material recovery processes are rising reduce dependence on raw materials. However, price instability remains a a key challenge impacting market competitiveness and growth.

Market Trend

Rising Adoption of Sustainable Solutions

A notable trend in the industrial control transformer market is the rising adoption of sustainable solutions to meet growing environmental and safety demands. Innovations include biodegradable insulating fluids that reduce environmental risks associated with leaks and spills. These eco-friendly materials offer improved safety features such as higher flash points and self-extinguishing properties, enhancing operational reliability.

Additionally, manufacturers are upgrading production facilities to optimize efficiency and minimize carbon footprints. These advancements support support effective transformer performance while aligning with global sustainability goals and regulatory requirements.

- In September 2024, Hitachi Energy has introduced its first 66 kV WindSTAR transformer using natural ester insulating fluid, marking a significant advancement in offshore wind technology. This transformer, designed for fixed and floating offshore turbines, features a nearly 100% biodegradable fluid, enhancing safety and reducing environmental impact. The upgraded 66 kV capacity doubles previous voltage limits, supporting larger turbines with improved efficiency and reduced electricity losses.

|

Segmentation

|

Details

|

|

By Type

|

Single Phase, Multiple Phase

|

|

By Voltage Level

|

Low Voltage, Medium Voltage, High Voltage

|

|

By Application

|

Manufacturing, Energy Distribution, Infrastructure, Transportation

|

|

By End User Industry

|

Industrial, Commercial, Utilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Single Phase and Multiple Phase): The multiple phase segment earned USD 696.6 million in 2024 due to increasing demand for complex electrical systems requiring efficient power distribution across various industries.

- By Voltage Level (Low Voltage, Medium Voltage, and High Voltage): The low voltage segment held a share of 49.90% in 2024, propelled by its widespread use in residential and commercial applications that prioritize safety and cost-effectiveness.

- By Application (Manufacturing, Energy Distribution, Infrastructure, and Transportation): The manufacturing segment is projected to reach USD 645.7 million by 2032, owing to rapid industrial automation and the expansion of smart factories driving transformer requirements.

- By End User Industry (Industrial, Commercial, and Utilities) The industrial segment earned USD 520.6 million in 2024, largely attributed to growing industrial electrification and increased demand for reliable power control solutions.

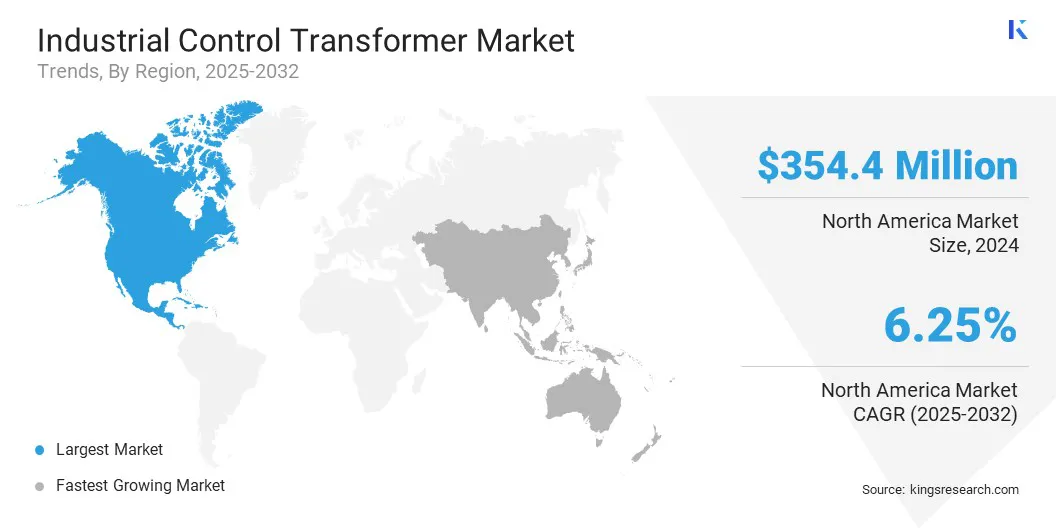

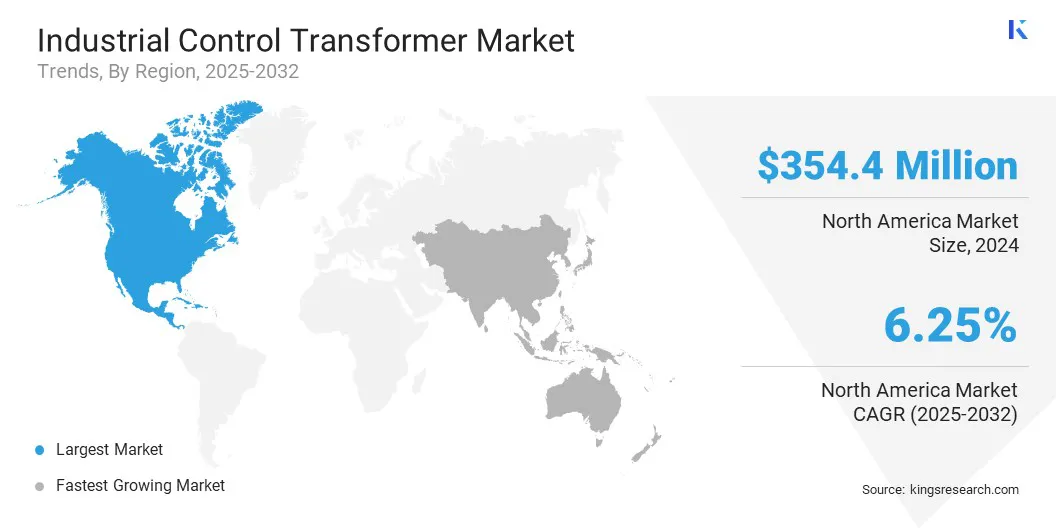

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America industrial control transformer market accounted for a share of around 30.27% in 2024, valued at USD 354.3 million. This dominance is reinforced by strategic expansions that enhance manufacturing capabilities and diversify product portfolios within the region.

The regional market benefits from strong support for OEMs and control system builders through enhanced local production facilities, supporting efficient supply and quick turnaround times. Investments in advanced technologies are further strengthening this expansion.

- In September 2024, Hammond Power Solutions acquired the assets of Micron Industries, a U.S.-based supplier of control transformers serving OEMs and control system builders. The acquisition, completed via Hammond’s U.S. subsidiary as an asset purchase, enhances Hammond’s manufacturing capabilities and product portfolio in control transformers. Micron Industries, with approximately USD 23 million in revenue in 2023, operates from its manufacturing facility and headquarters in Sterling, Illinois.

The Asia-Pacific industrial control transformer industry is set to grow at a CAGR of 6.75% over the forecast period. This growth is fueled by strategic business expansions and investments in the transformer manufacturing sector. Companies are strengthening their local presence through acquisitions, which enhance manufacturing capabilities and support broader market reach.

This expansion is further propelled by increasing demand for reliable and efficient power solutions, along with rising infrastructure development. The domestic market further benefits from increased production capacities and the integration of advanced technologies.

- In May 2025, Waaree Energies Limited acquired 100% equity in Kamath Transformers Private Limited for approximately USD 34.2 million, advancing its expansion into the transformer manufacturing segment.

Regulatory Frameworks

- In the U.S., Department of Energy (DOE) is the primary regulatory authority for industrial control transformers. The DOE sets and enforces energy efficiency standards for these transformers, as outlined in the CFR at 10 CFR Part 429.

- In the UK, the Ecodesign Directive governs industrial control transformers by establishing minimum energy performance standards (MEPS) for power transformers used in industrial settings.

- In India, the Bureau of Indian Standards (BIS) develops and enforces standards for control transformers, along with other products.

Competitive Landscape

Major players in the industrial control transformer industry are enhancing their capabilities through strategic acquisitions that expand their technological capabilities and engineering expertise in key segments.

By integrating specialized firms, they broaden their footprint in rapidly growing, high-margin sectors, driving accelerated revenue growth and improved financial performance. Additionally, players are aligning their operations to capitalize on cross-selling opportunities and support their competitive positioning globally.

- In October 2024, Standex International Corporation acquired the Amran Instrument Transformers and Narayan Powertech Pvt. Ltd., significantly expanding its presence in the low to medium voltage instrument transformer market. The acquisitions enhance Standex’s technology platform and engineering expertise, broadening its footprint in the electrical grid sector. With combined revenues expected to reach approximately USD 100 million in 2024 and strong EBITDA margins, the move supports Standex’s strategy to accelerate growth in high-margin, fast-growing markets.

List of Key Companies in Industrial Control Transformer Market:

- Schneider Electric

- Siemens

- Mitsubishi Electric Corporation

- Hitachi Energy Ltd

- DTG BHEL

- Voltamp Transformer

- Eaton

- Rockwell Automation

- Hubbell

- Dongan Electric Manufacturing Company

- Lenco Electronics, Inc.

- Kirloskar Electric Company.

- EVR Electricals

- TBEA

- SHUOGONG POWER

Recent Developments (M&A)

- In October 2024, Hammond Power Solutions, through its US-based subsidiary, acquired assets from Micron Industries’ operations. The acquisition enables Hammond Power Solutions to continue operating the acquired assets and market the existing branded product offerings. This intiative expands Hammond’s capabilities and product portfolio.