Market Definition

The market includes a broad range of technologies, systems, and services that facilitate reliable data exchange between machines, control systems, and enterprise applications.

It covers wired & wireless communication networks, industrial protocols, and connectivity solutions used to support automation, monitoring, and process control across industries such as manufacturing, energy, transportation, and utilities. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

Industrial Communication Market Overview

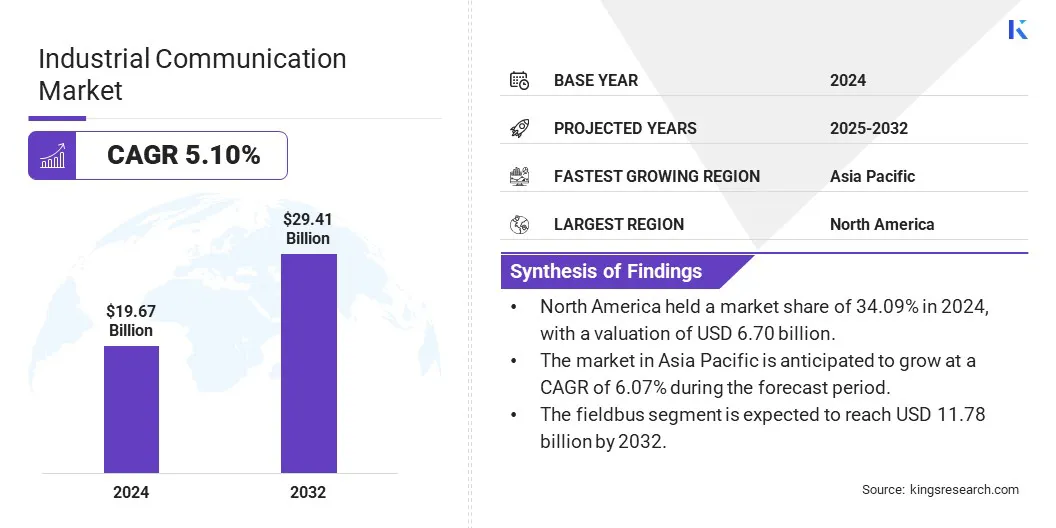

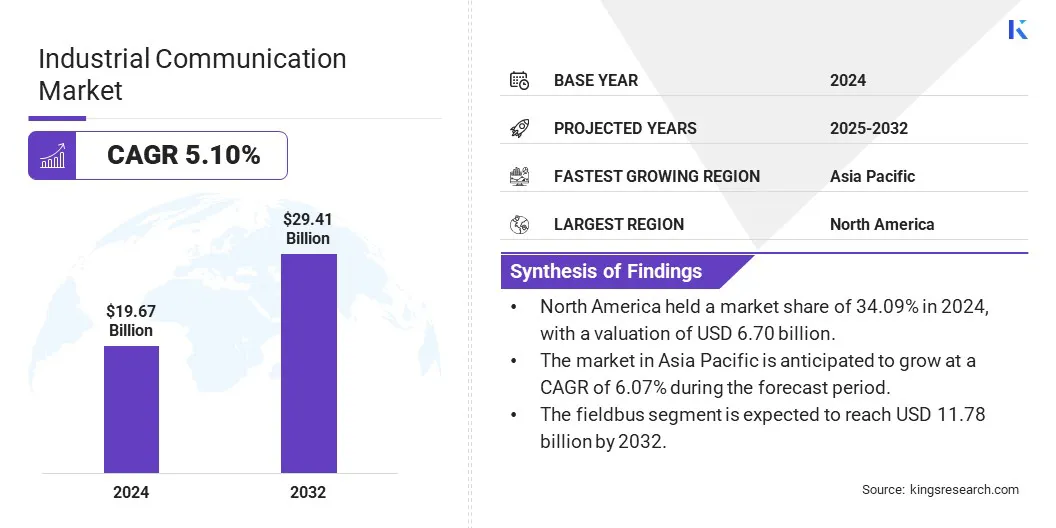

The global industrial communication market size was valued at USD 19.67 billion in 2024 and is projected to grow from USD 20.62 billion in 2025 to USD 29.41 billion by 2032, exhibiting a CAGR of 5.10% during the forecast period.

The market is registering growth, due to the adoption of smart manufacturing and Industry 4.0 initiatives. The increasing integration of connected devices and automation technologies across industries is boosting the demand for robust and real-time communication networks.

Major companies operating in the industrial communication industry are Siemens AG, ABB, Rockwell Automation, Schneider Electric, Cisco Systems, Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, GE Vernova, PHOENIX CONTACT, NATIONAL INSTRUMENTS CORP., Advantech Co., Ltd., Hitachi, Ltd., OMRON Corporation, Delta Electronics, Inc., and MOXA.

Expansion of industrial IoT, rising focus on predictive maintenance, and the need for seamless data exchange between operational and information technologies are further supporting the market expansion.

Additionally, advancements in wireless communication, growing deployment of Ethernet-based protocols, and rising investments in digital transformation by sectors such as energy, automotive, and pharmaceuticals are contributing significantly to the growth of the market.

- In November 2024, Bosch Digital Twin Industries and Pepperl+Fuchs launched the Digital Twin Starter Kit, a plug-and-play solution combining sensors, IO-Link communication, and cloud-based AI analytics. The kit enables real-time monitoring, predictive maintenance, and remote access, enhancing plant efficiency and reducing downtime through seamless data transmission from field devices to the cloud.

Key Highlights

- The industrial communication market size was valued at USD 19.67 billion in 2024.

- The market is projected to grow at a CAGR of 5.10% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 6.70 billion.

- The hardware segment garnered USD 7.56 billion in revenue in 2024.

- The fieldbus segment is expected to reach USD 11.78 billion by 2032.

- The automotive segment is expected to reach USD 6.56 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.07% during the forecast period.

Market Driver

Increasing Demand for Seamless Network Interoperability

The market is driven by the growing need for seamless interoperability between diverse industrial networks and communication protocols. This interoperability enables efficient coordination of processes, real-time monitoring, and effective automation control, which ultimately improves operational productivity and reduces downtime.

Moreover, the ability to integrate legacy systems with modern communication technologies without extensive modifications or replacements further accelerates the market growth by providing cost-effective and scalable solutions for industrial communication challenges.

- In March 2024, Deutschmann Automation introduced the UNIGATE FALCON Embedded, a compact, modular protocol converter/gateway designed for direct integration into final products. This embedded solution provides Industrial Ethernet or fieldbus interfaces without the need for housing or redesign, optimizing installation in space-constrained applications and accelerating time-to-market for automation solutions.

Market Challenge

Network Security Challenges in Industrial Communications

A major challenge in the industrial communication market is ensuring robust network security amid increasing connectivity & digitization. Industrial systems that integrate more devices and adopt IoT technologies are vulnerable to cyberattacks that can disrupt operations and compromise sensitive data. The complexity of managing diverse protocols and legacy equipment makes it difficult to secure these networks.

The market is moving toward implementing advanced cybersecurity frameworks, including encryption, secure authentication methods, and real-time threat detection. Additionally, adopting standardized security protocols and continuous network monitoring helps protect industrial communication systems, ensuring operational reliability and safeguarding critical infrastructure from evolving cyber threats.

Market Trend

Adoption of Compact Embedded Solutions

The market is registering the growing trend of adopting compact, embedded communication solutions that enable seamless integration with existing equipment. These small form-factor modules support miniaturization, allowing manufacturers to optimize space and avoid extensive system redesigns.

This accelerates the deployment of industrial automation applications while improving scalability and flexibility. Industries increasingly demand cost-effective and efficient connectivity. Embedded solutions become vital for meeting the evolving needs of smart factories and automated environments.

Ultimately, this trend enhances deployment efficiency, optimizes resource use, and promotes scalability, empowering industries to quickly adapt to shifting market demands and technological advancements.

- In December 2024, Murata Manufacturing Co., Ltd. launched ultra-compact Type 2FR/2FP and cost-effective Type 2KL/2LL tri-radio modules supporting Wi-Fi 6, Bluetooth LE, and Thread with Matter provisioning . These modules target smart homes, buildings, and industrial IoT applications, offering high integration, security compliance, and energy-efficient wireless connectivity for advanced IoT deployments.

Industrial Communication Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Switches, Gateways, Routers & WAP, Controllers & Connectors, Power Supply Devices, Others), Software, Services

|

|

By Protocol

|

Fieldbus, Industrial Ethernet, Wireless

|

|

By Vertical

|

Automotive, Aerospace & Defense, Electrical & Electronics, Chemicals, Oil & Gas, Energy & Power, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 7.56 billion in 2024, due to the widespread deployment of industrial devices requiring robust communication interfaces and network infrastructure.

- By Protocol (Fieldbus, Industrial Ethernet, and Wireless): The fieldbus segment held 40.47% share of the market in 2024, due to its established use in legacy systems and cost-effective deployment in process automation.

- By Vertical (Automotive, Aerospace & Defense, Electrical & Electronics, Chemicals, Oil & Gas, Energy & Power, Healthcare, Others): The automotive segment is projected to reach USD 6.56 billion by 2032, owing to increased automation in vehicle manufacturing and the integration of connected production systems.

Industrial Communication Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% share of the industrial communication market in 2024, with a valuation of USD 6.70 billion. This dominance is largely attributed to the early adoption of advanced automation technologies in sectors such as automotive, aerospace, and oil & gas.

The region is supported by a mature industrial infrastructure and a strong presence of major players delivering state-of-the-art communication solutions. Extensive deployment of industrial Ethernet, growing use of digital twin technologies, and rising investments in industrial cybersecurity are further strengthening its market position.

Moreover, proactive government initiatives to advance smart manufacturing, alongside sustained efforts to upgrade aging infrastructure in the U.S. and Canada, are playing a vital role in driving continued market growth.

The industrial communication industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 6.07% over the forecast period. This growth is primarily attributed to rapid industrialization in countries such as China, India, and Vietnam, where manufacturers are embracing automation to enhance operational efficiency and reduce costs.

The region is registering significant investments in industrial IoT infrastructure, particularly in the automotive, electronics, and energy sectors. Countries like South Korea and Taiwan are leading in high-tech manufacturing, boosting the demand for seamless industrial communication systems.

Additionally, favorable government policies supporting smart factory development, growing demand for real-time monitoring, and the rising adoption of wireless technologies across emerging economies are accelerating market adoption across Asia Pacific.

- In April 2025, ABB and the Instrumentation Technology and Economy Institute (ITEI) launched the Ethernet-APL + PROFINET Application Technology Joint Laboratory in Beijing. The collaboration aims to promote standardization, compatibility testing, and adoption of Ethernet-APL & PROFINET technologies to support industrial digital transformation and smart manufacturing initiatives in China.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) is the primary regulatory authority for industrial communication. The FCC regulates interstate and international communications, including those by radio, television, wire, satellite, and cable. They ensure a robust & competitive market and promote connectivity.

- In Europe, the primary regulatory authority for telecommunications and electronic communications is the Body of European Regulators for Electronic Communications (BEREC). BEREC works with the European Commission and national regulatory authorities (NRAs) to ensure consistent implementation of EU telecom rules and promote best practices.

Competitive Landscape

The industrial communication market is characterized by key players focusing on innovation, strategic partnerships, and acquisitions to strengthen their positions. Companies invest heavily in R&D to develop protocol-independent platforms and enhance interoperability for seamless real-time data exchange in complex industrial settings.

Collaborations with automation vendors and system integrators are common to deliver integrated solutions. The emphasis on software-defined networking and cloud-based communication frameworks that provide scalability and flexibility is growing. Market leaders are expanding into fast-growing regions like Asia Pacific and Latin America through joint ventures and local partnerships.

Overall, the competitive landscape revolves around delivering secure, reliable, and adaptable communication systems to meet evolving industrial requirements.

- In June 2024, FieldComm Group completed the acquisition of FDT Group's assets, including the widely used FDT/DTM technology standards. The integration enhances FieldComm Group’s device management capabilities across the industrial automation hierarchy, aiming to improve interoperability, streamline device integration, and support the transition to unified standards for intelligent device configuration in both process and factory automation markets.

List of Key Companies in Industrial Communication Market:

- Siemens AG

- ABB

- Rockwell Automation

- Schneider Electric

- Cisco Systems, Inc.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- GE Vernova

- PHOENIX CONTACT

- NATIONAL INSTRUMENTS CORP.

- Advantech Co., Ltd.

- Hitachi, Ltd.

- OMRON Corporation

- Delta Electronics, Inc.

- MOXA

Recent Developments (Collaboration/Product Launch)

- In March 2025, Infineon Technologies AG and RT-Labs integrated six key industrial communication protocols into the Infineon XMC7000 microcontroller family. The collaboration enables seamless implementation of protocols such as PROFINET RT, EtherNet/IP, CANopen, CC-Link, Modbus/TCP, and EtherCAT Master via Infineon's ModusToolbox platform. The solution aims to accelerate development for industrial applications like servo drives, PLCs, and robotic arms.

- In February 2025, Softing Industrial released version V1.21 of its FG-200 gateway, enhancing the integration of FOUNDATION Fieldbus H1 field devices into Modbus TCP and FF HSE systems. The update features improved hardware for stable communication, enhanced firmware functions, and unique support for simultaneous control and asset management access, making it ideal for process automation applications in industries such as oil & gas.