Hydrogen Storage Tanks and Transportation Market Size

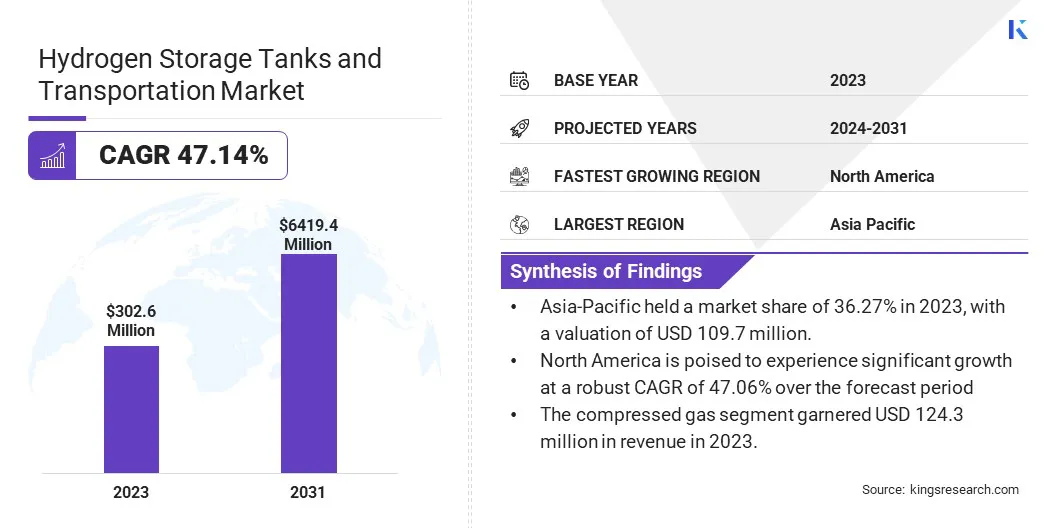

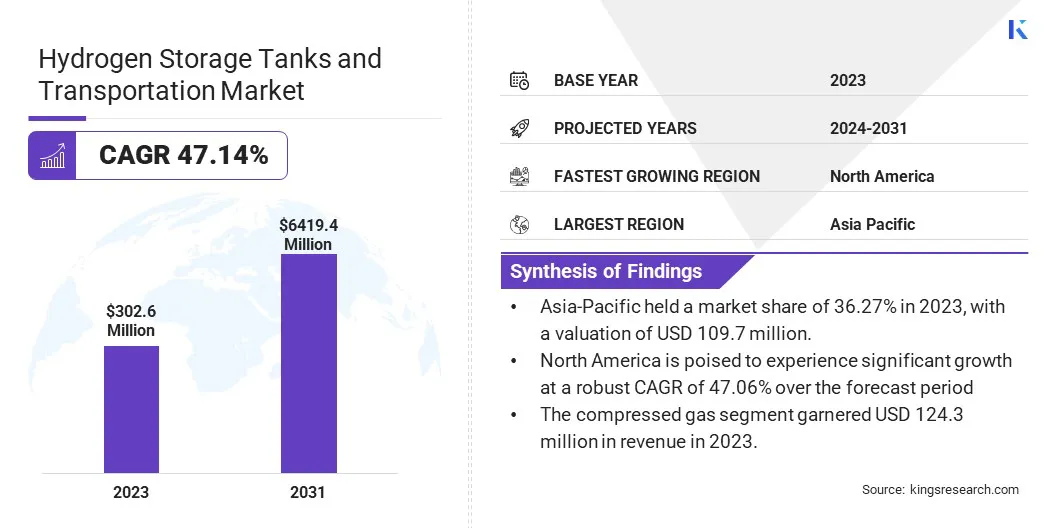

The global Hydrogen Storage Tanks and Transportation Market size was valued at USD 302.6 million in 2023 and is projected to grow from USD 429.8 million in 2024 to USD 6,419.4 million by 2031, exhibiting a CAGR of 47.14% during the forecast period. The growth of the market is driven by increasing investments in hydrogen as a clean energy source, ongoing advancements in storage technology, and the global shift toward carbon neutrality.

In the scope of work, the report includes products offered by companies such as Composite Advanced Technologies, LLC., Hexagon Purus, Luxfer Gas Cylinders, Quantum Fuel Systems, Taian Strength Equipments Co., Ltd., Tenaris, Weldship, Worthington Enterprises, OP Mobility, NPROXX, and others.

The expansion of the hydrogen storage tanks and transportation market is mainly fueled by increasing investments in hydrogen as a clean energy source. Governments worldwide are prioritizing hydrogen for reducing carbon emissions, which boosts the demand for efficient storage and transport solutions.

Advancements in hydrogen technology, such as high-capacity and lightweight storage tanks, further propel market development. Additionally, the growing adoption of hydrogen across diverse industries such as automotive, aviation, and energy sectors creates significant demand.

- For instance, in May 2023, Quantum Fuel Systems introduced its next-generation Hydrogen Fuel Storage System at the ACT Expo in May 2023. The system, specifically designed for heavy-duty applications, incorporates lightweight, durable Type 4 hydrogen tanks and offers configurations for back-of-cab and frame-rail mounting. Additionally, the system is equipped with an automotive-grade, CAN-based controller to facilitate easy installation, and features an aerodynamic design that adheres to industry standards for quality and safety.

The rising need for robust infrastructure to support hydrogen distribution further stimulates market growth. Economic incentives and policy frameworks, especially in regions including Europe and Asia, are further strengthening market dynamics, positioning hydrogen as a pivotal component in the global energy transition.

The hydrogen storage tanks and transportation market is poised to experience substantial growth due to the global shift toward sustainable energy. This market encompasses the development, production, and distribution of hydrogen storage solutions and transportation infrastructure.

Key players are focusing on innovation to enhance storage capacity, safety, and cost-effectiveness. The market is witnessing increased collaboration between technology providers, manufacturers, and governments to address existing challenges such as infrastructure limitations and cost barriers.

Additionally, the market is experiencing geographical expansion, accompanied by significant investments in hydrogen. As industries increasingly transition toward decarbonization, the market for hydrogen storage and transportation is expected to grow significantly, thereby offering new opportunities across various sectors.

The market refers to the sector that develops, manufactures, and distributes equipment and systems for storing and transporting hydrogen. Hydrogen, as a clean energy carrier, requires specialized storage solutions, typically in the form of high-pressure tanks or cryogenic containers, to maintain its efficiency and safety during transportation.

The market includes various technologies and materials used in manufacturing these tanks, including carbon fiber composites and metal hydrides. Additionally, it encompasses the logistical infrastructure needed to transport hydrogen from production sites to end-users.

Analyst’s Review

Manufacturers in the hydrogen storage tanks and transportation market are actively innovating to enhance product efficiency and reduce costs. Companies are developing advanced storage solutions, including lightweight, high-capacity tanks made from carbon fiber composites, which are improving safety and performance. New products focused on increasing storage density and reducing the weight of tanks are being introduced to the market, addressing critical industry needs.

- For instance, in June 2024, Luxfer Gas Cylinders introduced the G-Stor® Hydrosphere, an advanced hydrogen transportation system that feature high-capacity Multiple Element Gas Containers (MEGCs). This innovation, unveiled at the World Hydrogen Summit, enhances the safe and sustainable transport of hydrogen by offering over 1 ton of storage capacity in both 20-ft and 40-ft units. The system is designed to optimize payload and cost efficiency while addressing existing hydrogen supply chain challenges.

Collaborations between manufacturers and technology providers are pivotal in advancing these innovations. To Sustain growth, it is recommended that companies invest in R&D to further optimize materials and production processes. Expanding partnerships with governments to secure funding and incentives are anticipated to be crucial in promoting the adoption of hydrogen technologies across various industries.

Hydrogen Storage Tanks and Transportation Market Growth Factors

The growing emphasis on reducing carbon emissions is fueling the demand for hydrogen storage tanks and transportation solutions. Governments and industries are increasingly focusing on hydrogen as a key element in achieving carbon neutrality.

This shift is particularly evident in the automotive sector, where hydrogen fuel cell vehicles are gaining significant traction. As the adoption of hydrogen technology increases, the need for efficient storage and safe transportation of hydrogen is becoming increasingly critical.

Innovations in materials and tank designs are enhancing storage capacities and reducing costs, making hydrogen a more viable option for large-scale applications. The ongoing investment in hydrogen infrastructure is augmenting market growth and establishing hydrogen as a fundamental element in the global transition to clean energy.

A key challenge impeding the development of the hydrogen storage and transportation market is the high cost associated with storage solutions, particularly high-pressure tanks and cryogenic containers. This cost barrier is hindering the widespread adoption of hydrogen, especially in emerging markets. Overcoming this challenge requires continued research and development to create more cost-effective materials and manufacturing processes.

Furthermore, industry collaboration is essential, requiring partnerships among technology providers, manufacturers, and governments to facilitate the exchange of resources and knowledge. Scaling production and improving economies of scale further reduces costs. Additionally, financial incentives and subsidies from governments helps offset initial investment costs, thereby enhancing the accessibility of hydrogen storage solutions and fostering market growth.

Hydrogen Storage Tanks and Transportation Market Trends

The rising integration of digital technologies in hydrogen storage and transportation is emerging as a significant trend reshaping the market landscape. Companies are increasingly adopting IoT (Internet of Things) sensors and AI-based systems to monitor and optimize the storage and transportation of hydrogen. These technologies are enhancing the safety, efficiency, and reliability of hydrogen logistics by providing real-time data on pressure levels, temperature, and tank conditions.

The use of digital twins, which are virtual replicas of physical systems, is gaining immense traction, allowing for predictive maintenance and reducing downtime. This trend improves operational efficiency and assists companies in adhering to stringent safety regulations, thereby making hydrogen a more attractive option for large-scale energy solutions.

The growing focus on green hydrogen is influencing the hydrogen storage and transportation market. Green hydrogen, produced using renewable energy sources, is gaining popularity as both industries and governments increasingly prioritize sustainable energy solutions. This trend is fueling the demand for specialized storage and transportation infrastructure that suitably handles green hydrogen's unique characteristics.

Investments in green hydrogen projects are increasing, particularly in Europe and Asia, where there are ambitious goals for carbon neutrality. Companies are innovating to develop tanks and containers designed specifically for green hydrogen, aiming to ensure its purity and stability during storage and transport. This trend is supporting the growth of the market and is expected to play a crucial role in the global energy transition.

Segmentation Analysis

The global market is segmented based on technology, end-use industry, and geography.

By Technology

Based on technology, the market is categorized into compressed gas, liquefied hydrogen, solid-state hydrogen, and pipeline transportation. The compressed gas segment led the hydrogen storage tanks and transportation market in 2023, reaching a valuation of USD 124.3 million. This notable expansion is stimulated by its widespread adoption and proven efficiency.

Compressed gas technology is being highly preferred due to its relatively lower cost and simpler infrastructure requirements compared to other technologies such as liquefied hydrogen or solid-state storage.

It is widely used in the transportation and industrial sectors, where high-pressure hydrogen tanks are integral for fuel cell vehicles and industrial processes. Additionally, advancements in materials and tank designs are improving storage capacities, thereby supporting the growth of the compressed gas segment.

By End-Use Industry

Based on end-use industry, the hydrogen storage tanks and transportation market is classified into transportation, industrial, residential, and stationary energy storage. The transportation segment is poised to witness significant growth at a staggering CAGR of 47.62% through the forecast period (2024-2031), mainly due to the rising adoption of hydrogen fuel cell vehicles and the global shift toward decarbonizing transportation.

Governments and automotive manufacturers are investing heavily in hydrogen technology to meet stringent emissions regulations and reduce dependence on fossil fuels. Innovations in fuel cell technology, coupled with the development of robust hydrogen refueling infrastructure, are further contributing to this growth.

The increasing availability of hydrogen-powered vehicles across different markets is creating a strong demand for reliable storage and transportation solutions, thereby aiding the expansion of the segment.

Hydrogen Storage Tanks and Transportation Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

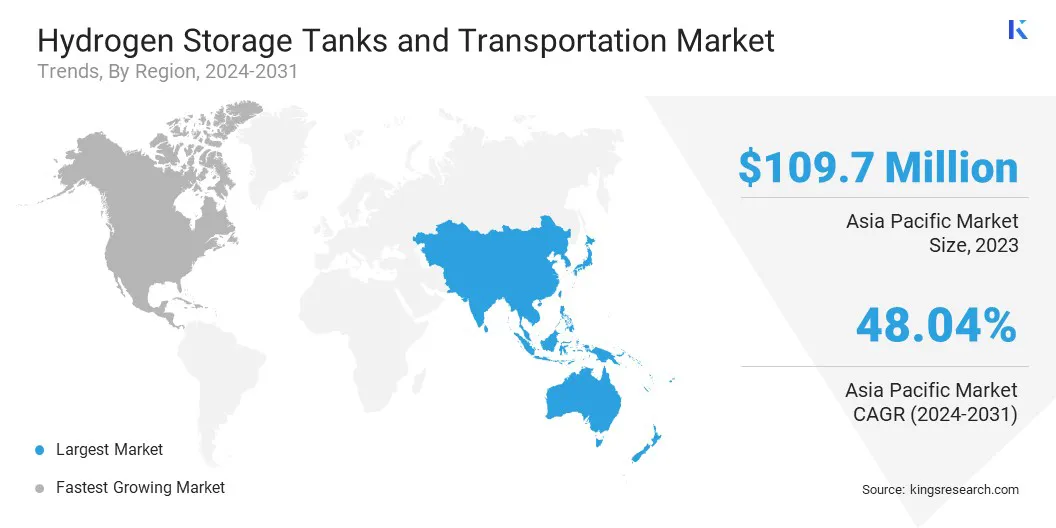

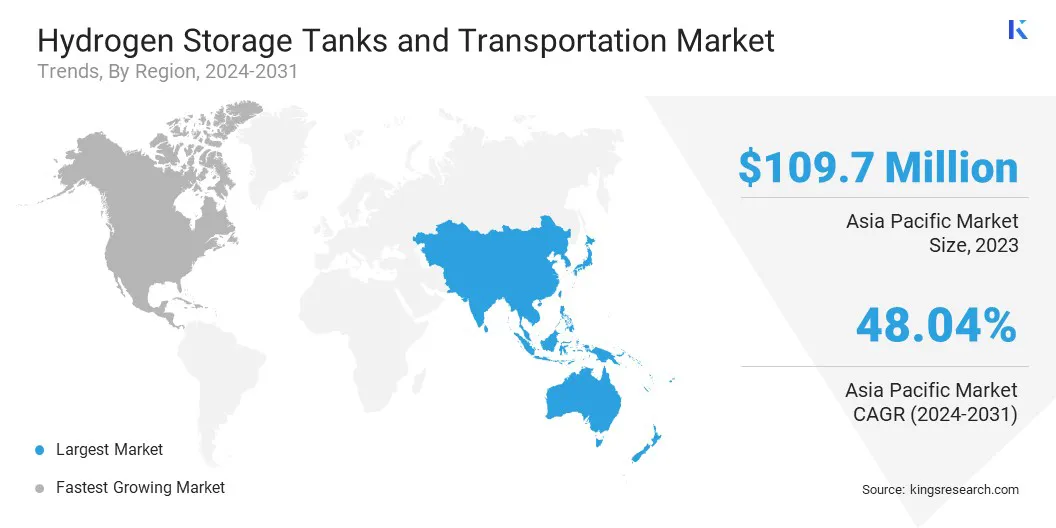

Asia-Pacific hydrogen storage tanks and transportation market captured a considerable share of around 36.27% in 2023, with a valuation of USD 109.7 million. This dominance is largely attributed to favorable government initiatives and significant investments in hydrogen infrastructure. Countries such as Japan, China, and South Korea are at the forefront in adopting hydrogen technology as a key component of their strategies to reduce carbon emissions and enhance energy security. These nations are investing heavily in hydrogen production, storage, and transportation technologies, thereby fostering regional market growth.

The presence of major industrial players and a robust manufacturing base in Asia-Pacific further supports market dominance. Additionally, the region's major focus on developing hydrogen-powered transportation and expanding renewable energy sources is contributing significantly to the expansion of the Asia-Pacific market.

North America is poised to experience significant growth at a robust CAGR of 47.06% through the estimated timeframe. This notable growth is augmented by increasing investments in clean energy and supportive government policies. The United States is at the forefront of this growth, with federal and state governments providing substantial funding and incentives for hydrogen projects.

The transition to decarbonizing the transportation sector, particularly through the adoption of hydrogen fuel cell vehicles, is emerging a key factor aiding this expansion. Additionally, the development of hydrogen infrastructure is advancing rapidly. Collaboration between public and private sectors is significantly fostering innovation, positioning North America as one of the fastest-growing regions in the market.

Competitive Landscape

The global hydrogen storage tanks and transportation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Hydrogen Storage Tanks and Transportation Market

- Composite Advanced Technologies, LLC.

- Hexagon Purus

- Luxfer Gas Cylinders

- Quantum Fuel Systems

- Taian Strength Equipments Co., Ltd.

- Tenaris

- Weldship

- Worthington Enterprises

- OP Mobility

- NPROXX

Key Industry Developments

- August 2024 (Partnership): Hexagon Purus, a provider of zero-emission mobility solutions, announced the signing of a long-term agreement with GILLIG. This partnership involves the supply of hydrogen fuel storage systems for GILLIG’s new transit buses.

- September 2023 (Expansion): Plastic Omnium initiated the construction of a hydrogen tank plant dedicated to producing lorries and buses. With an annual production capacity of 80,000 hydrogen containers, the factory is set to supply companies such as Stellantis and HYVIA. The facility is designed to meet rigorous environmental standards, aligning with the Group's goals for carbon neutrality and producing a significant portion of its own energy requiements.

The global hydrogen storage tanks and transportation market is segmented as:

By Technology

- Compressed Gas

- Liquefied Hydrogen

- Solid-State Hydrogen

- Pipeline Transportation

By End-Use Industry

- Transportation

- Industrial

- Residential

- Stationary Energy Storage

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America