Hydrogen in Automotive Market Size

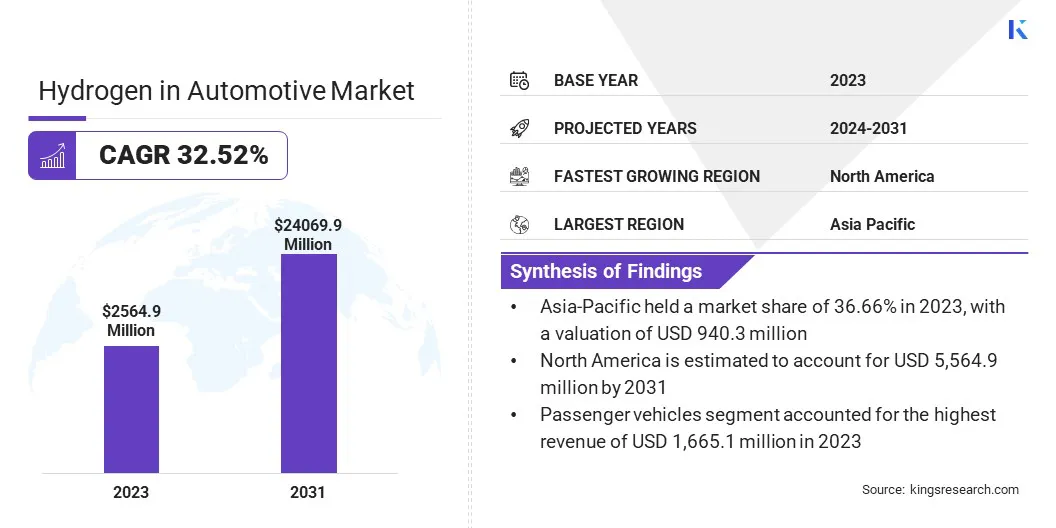

The global Hydrogen in Automotive Market size was valued at USD 2,564.9 million in 2023 and is projected to reach USD 24,069.9 million by 2031, growing at a CAGR of 32.52% from 2024 to 2031. The hydrogen in automotive market is experiencing rapid expansion, driven by the increasing global emphasis on sustainable transportation solutions. Fuel cell vehicles (FCVs) are at the forefront of this market, offering zero-emission mobility powered by hydrogen.

In the scope of work, the report includes products offered by companies such as Ballard Power Systems Inc., Plug Power Inc., Cummins Inc., Symbio, H2 Energy AG, Loop Energy Inc., Hyster-Yale Materials Handling, Inc., Toyota, BMW AG, Hyundai Motor Company and others.

Governments worldwide are incentivizing hydrogen infrastructure development and offering subsidies to boost FCV adoption. Moreover, automakers are investing heavily in hydrogen technology and collaborating with energy companies to establish hydrogen refueling stations. The market is witnessing significant growth in regions such as Europe, where stringent emissions regulations are propelling the shift toward clean transportation alternatives.

Additionally, advancements in hydrogen production, storage, and distribution technologies are enhancing the viability of hydrogen-powered vehicles. As a result, the hydrogen in automotive market is poised to experience substantial expansion in the coming years, with a growing focus on achieving decarbonization targets and mitigating climate change.

Analyst’s Review

The hydrogen in automotive market is witnessing rapid evolution, fueled by government support, technological advancements, and increasing environmental consciousness. With major players expanding their portfolios and governments worldwide prioritizing hydrogen infrastructure, the market presents lucrative growth opportunities.

However, infrastructure development and cost competitiveness factors to pose challenges for the market. Companies that strategically position themselves to capitalize on the growing demand, while addressing these challenges, stand to benefit from the market's evolution. As the market continues to mature, stakeholders must remain agile and innovative to navigate the dynamic landscape and secure a competitive edge.

Market Definition

The hydrogen in automotive market encompasses the production, distribution, and adoption of vehicles that are powered by hydrogen fuel cells or hydrogen combustion engines. It includes passenger cars, commercial vehicles, buses, and other transportation modes utilizing hydrogen as a primary energy source.

The market further comprises hydrogen infrastructure, such as refueling stations, production facilities, and storage systems. Key stakeholders include automakers, energy companies, government agencies, research institutions, and consumers.

The primary objective of using hydrogen in automotive applications is to offer sustainable transportation solutions by reducing greenhouse gas emissions and dependence on fossil fuels.

Hydrogen-powered vehicles provide zero-emission mobility, offering a viable alternative to conventional internal combustion engine vehicles and battery electric vehicles. As the market continues to evolve, efforts are being focused on advancing hydrogen technologies, expanding infrastructure, and promoting consumer acceptance to realize the full potential of hydrogen as a clean energy carrier in the automotive sector.

Market Dynamics

The global hydrogen in automotive market is experiencing dynamic shifts driven by a confluence of technological advancements, regulatory initiatives, and market demand dynamics. Government initiatives and stringent environmental regulations aimed at reducing carbon emissions are significant factors boosting the global market development.

Countries worldwide are implementing policies to incentivize the adoption of hydrogen fuel cell vehicles, such as subsidies, tax breaks, and investment in infrastructure. For instance, countries such as Japan, South Korea, and Germany have ambitious hydrogen strategies, offering substantial support for hydrogen vehicle development and deployment.

Additionally, the expansion of renewable hydrogen production presents promising opportunities for the global hydrogen in automotive market. Renewable energy sources, such as wind, solar, and hydroelectric power, are increasingly utilized for hydrogen production through electrolysis. The shift toward green hydrogen reduces carbon emissions associated with hydrogen production and enhances the sustainability of hydrogen-powered vehicles, thereby driving market expansion.

Moreover, increasing focus on energy security and diversification is propelling market growth. Hydrogen is recognized as a versatile energy carrier that can be produced from various domestic sources, including natural gas, biomass, and renewable electricity. This diversity in feedstock options reduces dependence on imported fossil fuels and enhances energy security for countries seeking to diversify their energy mix.

Additionally, hydrogen production can be integrated with existing industrial processes, such as refining and ammonia production, thereby enhancing energy efficiency and security. As nations strive to reduce reliance on traditional fossil fuels and mitigate geopolitical risks associated with energy imports, the potential for the use of hydrogen as a sustainable and domestically sourced energy solution is driving the growth of hydrogen automotive applications.

Despite technological advancements, hydrogen vehicles often face higher upfront costs compared to conventional vehicles. Additionally, the lack of consumer awareness and concerns regarding infrastructure availability and hydrogen safety hinder widespread adoption.

Overcoming these challenges requires concerted efforts from industry stakeholders to reduce costs, enhance consumer awareness, and expand infrastructure, ensuring the long-term viability of hydrogen automotive technology.

Additionally, a significant challenge hindering the widespread adoption of hydrogen vehicles is the lack of infrastructure, including hydrogen production, storage, and refueling stations. Establishing a comprehensive hydrogen infrastructure requires substantial investment and coordination among stakeholders. Limited infrastructure availability restricts consumer confidence and product adoption, thereby impeding market growth.

Segmentation Analysis

The global hydrogen in automotive market is segmented based on vehicle type, technology, vehicle class, and geography.

By Vehicle Type

Based on vehicle type, the market is categorized into commercial vehicles and passenger vehicles. Passenger vehicles accounted for the highest revenue of USD 1,665.1 million in 2023 and are anticipated to continue their dominance through the forecast period. This trend is expected to continue, indicating a growing preference among consumers for clean and environmentally-friendly transportation options.

With increasing concerns over emissions and a shift toward sustainability, hydrogen-powered passenger vehicles offer a promising solution. Their appeal lies in their ability to provide long-range capabilities and quick refueling, effectively addressing key concerns associated with electric vehicles. As infrastructure develops and technology advances, the passenger vehicles segment is expected to maintain its leading position in the hydrogen in automotive market.

By Technology

Based on technology, the market is divided into proton exchange membrane (PEM) fuel cell, phosphoric acid fuel cells, and others. Proton exchange membrane (PEM) fuel cells asserted their dominance in the hydrogen in automotive market, capturing 42.29% of the revenue share in 2023. This trend is set to strengthen further, with PEM fuel cells projected to maintain a robust growth trajectory, boasting a CAGR of 33.14% from 2024 to 2031.

The popularity of PEM fuel cells can be attributed to their high efficiency, low operating temperatures, and suitability for various vehicle types. As advancements continue to enhance their performance and reduce costs, PEM fuel cells are positioned to remain the preferred technology, driving significant expansion in the hydrogen in automotive market.

By Vehicle Type

Based on vehicle class, the market is categorized into luxury vehicles, mid-range vehicles, and economy vehicles. Economy vehicles accounted for the largest share, generating a revenue of USD 1,348 million in 2023. This dominance underscores a growing trend toward integrating hydrogen technology into affordable, mass-market vehicles.

The rising demand for hydrogen-powered economy vehicles is mainly boosted by their potential to offer clean, efficient transportation solutions at accessible price points.

As infrastructure improves and manufacturing costs decrease, the adoption of hydrogen-powered economy vehicles is expected to accelerate, driving further growth in the market. This highlights a significant shift toward sustainability in the automotive industry, with economy vehicles leading the charge in promoting a greener future.

Hydrogen in Automotive Market Regional Analysis

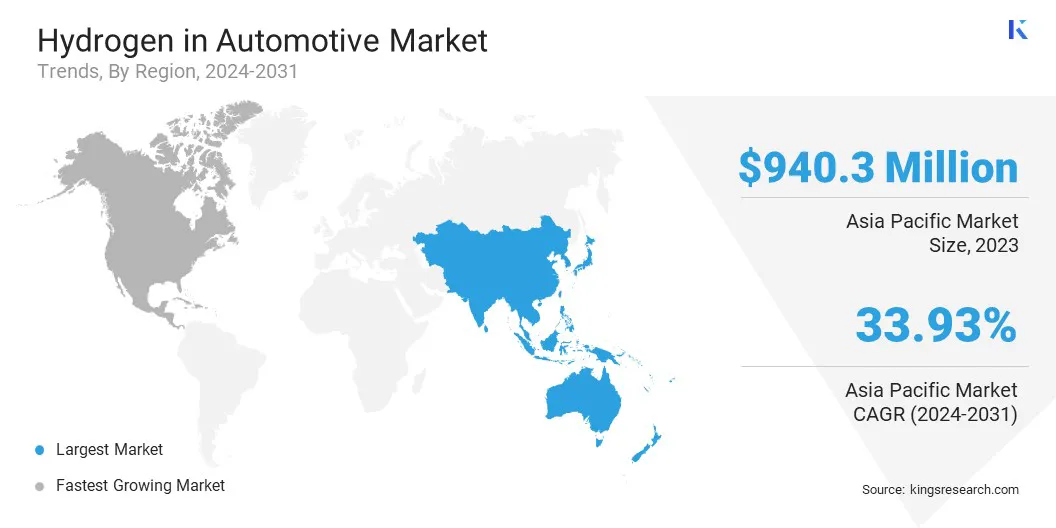

Based on region, the global hydrogen in automotive market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Hydrogen in Automotive Market share stood around 36.66% in 2023 in the global market, with a valuation of USD 940.3 million. The region is witnessing a surge in hydrogen automotive adoption, fueled by a combination of government support, technological advancements, and growing environmental awareness.

Countries such as Japan and South Korea are at the forefront, making significant investments in hydrogen infrastructure and setting ambitious targets for FCV deployment. Japan's "hydrogen society" vision aims to leverage hydrogen as a clean energy source for transportation, industry, and residential use, thereby driving innovation and investment in fuel cell technology.

South Korea's hydrogen roadmap includes plans to deploy thousands of hydrogen-powered vehicles and establish a network of refueling stations nationwide. Automakers such as Toyota, Hyundai, and Honda are leading the market by offering a range of hydrogen-powered models, which are supported by government subsidies and incentives. Collaborations between automakers, energy companies, and government agencies are accelerating infrastructure development and promoting consumer acceptance.

However, challenges such as high production costs and limited refueling infrastructure in some regions pose barriers to widespread adoption. Despite these challenges, the hydrogen in automotive market in Asia-Pacific is poised to witness substantial growth, with strong government commitment and technological advancements driving the transition toward sustainable mobility in the region.

North America is emerging as a promising market for hydrogen-powered vehicles, driven by increasing environmental consciousness and government initiatives promoting clean transportation solutions. Moreover, the presence of robust hydrogen infrastructure is supporting the growth in the region. North America is estimated to account for USD 5,564.9 million by 2031.

The United States and Canada are leading the way in hydrogen infrastructure development, with investments in hydrogen refueling stations and research on fuel cell technology. California, in particular, stands out with its ambitious zero-emission vehicle mandates and incentives for FCV adoption.

Major automakers such as Toyota, Honda, and Hyundai are actively introducing hydrogen-powered models in the region, thereby fostering competition and innovation. However, challenges such as high initial costs and limited refueling infrastructure remain barriers to mass adoption.

Competitive Landscape

The global hydrogen in automotive market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Hydrogen in Automotive Market

- Ballard Power Systems Inc.

- Plug Power Inc.

- Cummins Inc.

- Symbio

- H2 Energy AG

- Loop Energy Inc.

- Hyster-Yale Materials Handling, Inc.

- Toyota

- BMW AG

- Hyundai Motor Company

Key Industry Developments

- July 2023 (Acquisition) - Fortescue Future Industries (FFI), an Australian company specializing in green hydrogen development, initiated its expansion into the U.S. market with the acquisition of the Phoenix Hydrogen Hub (PHH) project in Buckeye, Arizona. The project was purchased from Nikola, a manufacturer of fuel-cell trucks, for a total of $24 million. This strategic move marks FFI's debut in the American market and underscores its dedication to broadening its footprint and investment portfolio within the United States.

The Global Hydrogen in Automotive Market is Segmented as:

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

By Technology

- Proton Exchange Membrane (PEM) Fuel Cell

- Phosphoric Acid Fuel Cells

- Others

By Vehicle Class

- Luxury Vehicles

- Mid-Range Vehicles

- Economy Vehicles

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.