Market Definition

An HVAC linset consist of insulated copper tubes designed to transport refrigerant between the outdoor condenser unit and the indoor evaporator coil in heating, ventilation, and air conditioning systems. This market encompasses the production, distribution, and installation of copper, aluminum, and alternative material piping systems used in residential, commercial, and industrial HVAC applications.

It covers related components such as insulation, fittings, and connectors, covering manufacturers, suppliers, and service providers focused on system efficiency, durability, and compliance with regional building standards.

HVAC Linset Market Overview

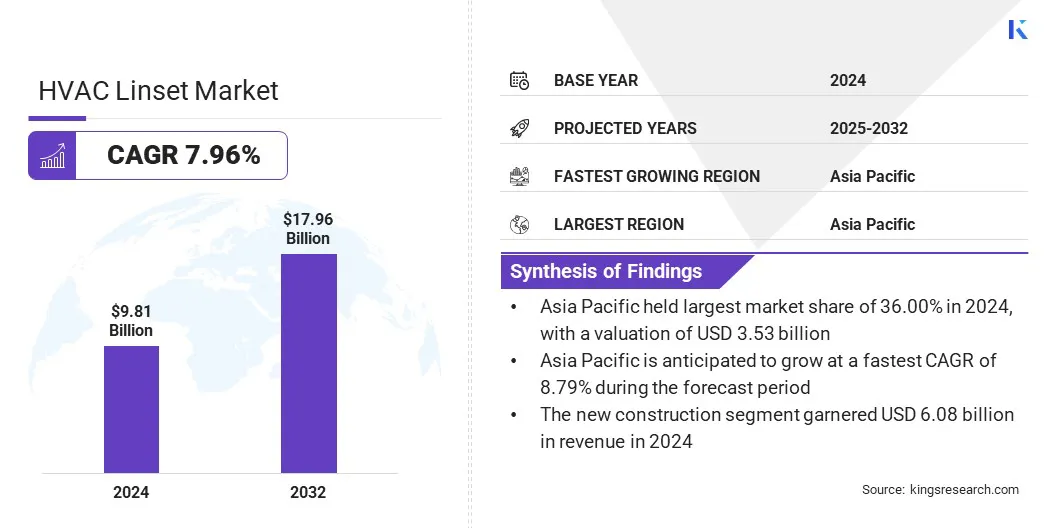

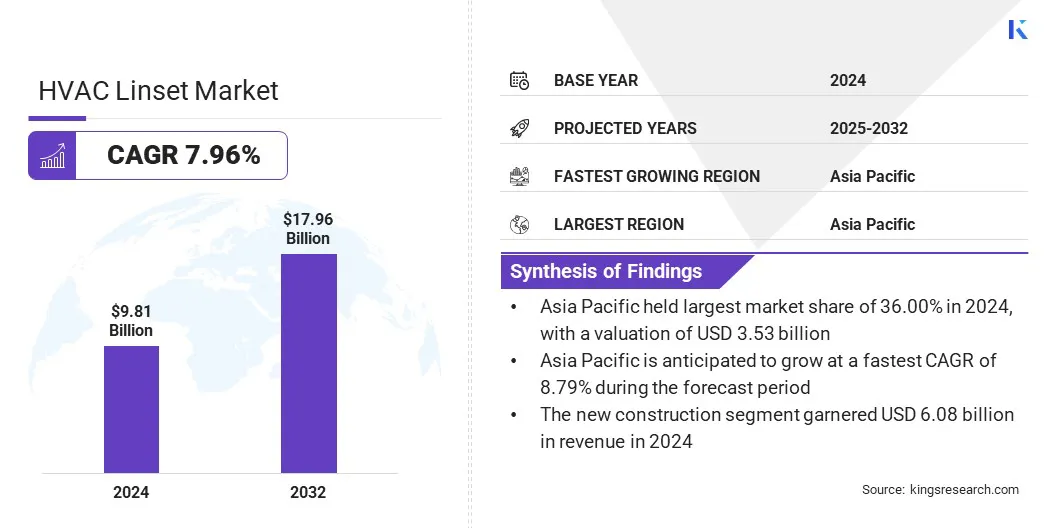

The global HVAC linset market was valued at USD 9.81 billion in 2024 and is projected to grow from USD 10.51 billion in 2025 to USD 17.96 billion by 2032, exhibiting a CAGR of 7.96% during the forecast period. The market is experiencing steady growth, mainly driven by expanding construction activities, rising demand for energy-efficient climate control systems, and the replacement of aging infrastructure.

Increasing urbanization and the higher adoption of centralized air conditioning in residential, commercial, and industrial facilities are boosting demand. Advancements in materials, including corrosion-resistant coatings and improved insulation, are enhancing system efficiency and lifespan.

Key Highlights

- The HVAC linset industry was valued at USD 9.81 billion in 2024.

- The market is projected to grow at a CAGR of 7.96% from 2025 to 2032.

- Asia Pacific held a share of 36.00% in 2024, valued at USD 3.53 billion.

- The copper segment garnered USD 5.49 billion in revenue in 2024.

- The new construction segment is projected to generate a valuation of USD 10.26 billion by 2032.

- The residential segment is expected to reach USD 8.98 billion by 2032.

- North America is anticipated to grow at a CAGR of 7.81% over the forecast period.

Major companies operating in the HVAC linset market are PDM Corporation, Mueller Industries, Marmon Holdings, Inc. (Cerro), Partners Group AG (DiversiTech), Changzhou DABUND Pipe Co., Ltd., Gastite, MRCOOL, JMF Company, Reliance, Inc. (United Pipe & Steel), Scottfrio Technologies Co., Ltd., CHANGZHOU SANHUA REFRIGERATION TECHNOLOGY CO., LTD., INABA DENKI SANGYO CO., LTD., Everwell Parts Inc., SAUERMANN GROUP, and PTubes, Inc..

The growing shift toward eco-friendly refrigerants requires specialized linsets with enhanced insulation and durability. Increased emphasis on sustainability prompts the adoption of materials that ensure compatibility with low global warming potential systems. This shift improves system reliability and reduces environmental impact. Additionally, expanding construction and retrofit projects in commercial and residential sectors fuel demand for high-performance linesets.

Market Driver

Rising Demand for Energy-Efficient HVAC Systems

The HVAC linset market is experiencing growth due to the increasing demand for energy-efficient heating and cooling systems. Advanced linsets with superior insulation reduce refrigerant leakage and enhance overall system efficiency. Regulatory standards aimed at reducing energy consumption and environmental impact are prompting manufacturers to innovate and improve product performance.

This trend supports the widespread adoption of high-quality linsets in residential, commercial, and industrial sectors. Moreover, rapid urbanization and expanding construction activities are boosting HVAC system installation, further propelling market growth.

Market Challenge

Rising Complexity of Meeting Evolving Environmental and Safety Regulations

A significant challenge impeding the progress of the HVAC linset market is the increasing complexity of meeting evolving environmental and safety regulations. Manufacturers must continuously update product designs and materials to comply with stricter standards on energy efficiency, refrigerant compatibility, and emissions. This requires substantial investment in research, testing, and certification, which can increase costs and delay product launches.

To address this challenge, companies invest in advanced R&D and engage with regulatory bodies to anticipate changes. They adopt flexible design approaches to ensure compliance, minimize disruptions, and control costs.

- In May 2025, Carrier Global Corporation committed a USD 1 billion investment over five years to expand U.S. manufacturing, innovation, and workforce. The investment will fund new facilities and accelerate R&D for heat pumps, battery assemblies, and advanced climate solutions.

Market Trend

Advancements in Materials and Insulation Technologies

The HVAC linset market is witnessing a notable trend toward the adoption of advanced materials and enhanced insulation technologies, which significantly improve product durability and thermal efficiency. These developments help linsets withstand corrosion, temperature fluctuations, and environmental stress, extending their operational lifespan. Enhanced insulation minimizes energy loss during heat transfer, leading to improved system performance and lower energy consumption.

This focus on material innovation supports compliance with stringent energy efficiency regulations and sustainability goals. Manufacturers respond by investing in research and development to produce linsets that offer superior reliability and meet evolving market needs. These technological advancements, in turn, fuel market growth and increased demand for high-performance HVAC linsets.

- In November 2024, Daikin invested in Advanced Composite Corporation to develop lightweight high-strength aluminum composite materials for HVAC&R compressors. This collaboration aims to reduce component weight, improve energy efficiency, and drive production innovation, supporting Daikin’s efforts to enhance HVAC&R product performance through advanced material technologies.

HVAC Linset Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Copper, Low Carbon Steel, Aluminum, Composites / Others

|

|

By Implementation

|

New Construction, Retrofit

|

|

By End-Use Industry

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Copper, Low Carbon Steel, Aluminum, Composites / Others): The copper segment earned USD 5.49 billion in 2024, mainly due to its superior thermal conductivity and corrosion resistance.

- By Implementation (New Construction and Retrofit): The new construction segment held a share of 62.00% in 2024, propelled by increased infrastructure development and urbanization.

- By End-Use Industry (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 8.98 billion by 2032, owing to growing demand for energy-efficient HVAC systems in housing.

HVAC Linset Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific HVAC linset market accounted for a substantial share of 36.00% in 2024, valued at USD 3.53 billion. This dominance is reinforced by significant investment flows into real estate across key markets such as Japan, South Korea, Australia, and Singapore.

Increasing capital commitments to office, hospitality, and logistics assets support demand for advanced HVAC systems, highlighting the need for reliable and efficient linsets. This ongoing commercial development provides potential opportunities for HVAC linset manufacturers. Additionally, established local production facilities improve supply chain efficiency and cost competitiveness, bolstering regional market growth.

- In June 2025, BentallGreenOak secured over USD 5.1 billion for its Asia Value-Add real estate fund, targeting office, hospitality, and logistics assets in Japan, South Korea, Australia, and Singapore. Supported by 45 institutional investors, this represents the largest closed-end capital raise in BGO’s history, highlighting strong confidence in Asia’s urban markets.

North America HVAC linset industry is expected to register the CAGR of 7.81% over the forecast period. This growth is primarily fueled by rising renovation and retrofit activities across commercial and residential buildings.

Increasing investments in modernizing existing HVAC infrastructure to improve energy efficiency and indoor air quality are boosting the demand for advanced HVAC linsets. Additionally, the regional market benefits from strong technological innovation and high consumer awareness, which promotes the adoption of durable and high-performance linsets, supporting sustained market expansion.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) and the Department of Energy (DOE) regulate HVAC systems, including components such as linsets, by enforcing energy efficiency standards and refrigerant management policies.

- In Europe, the European Union’s Ecodesign Directive and F-Gas Regulation govern HVAC equipment, focusing on energy efficiency requirements and restrictions on high-global-warming-potential refrigerants.

- In China, the Ministry of Ecology and Environment (MEE) regulates refrigerant use and emissions, promoting environmentally friendly HVAC technologies.

- In Japan, the Ministry of Economy, Trade and Industry (METI) enforces energy conservation standards for HVAC products to improve efficiency.

- In India, the Bureau of Energy Efficiency (BEE) sets mandatory energy performance and labeling standards for HVAC equipment, including linsets, to support sustainable energy use.

Competitive Landscape

Key players operating in the global HVAC linset industry are focusing on strategic initiatives to strengthen their market position.They are forming strategic partnerships to enter new regional markets and leverage expertise in installation and service networks.

Additionally, they are investing heavily in research and development for improved material coatings and advanced insulation technologies, aligning with stricter efficiency standards and customer demands. These strategies enable market leaders to expand their reach and meet changing industry demands efficiently.

- In January 2025, F.W. Webb Company partnered with Rheem to distribute Rheem’s complete HVAC product line across the Northeast. The collaboration includes R-454b compliant residential and commercial HVAC solutions such as air conditioners, heat pumps, and rooftop units. It also offers manufacturer-backed training and the Rheem Pro Partner Program to support HVAC professionals.

Key Companies in HVAC Linset Market:

- PDM Corporation

- Mueller Industries

- Marmon Holdings, Inc. (Cerro)

- Partners Group AG (DiversiTech)

- Changzhou DABUND Pipe Co., Ltd.

- Gastite

- MRCOOL

- JMF Company

- Reliance, Inc. (United Pipe & Steel)

- Scottfrio Technologies Co., Ltd.

- CHANGZHOU SANHUA REFRIGERATION TECHNOLOGY CO., LTD.

- INABA DENKI SANGYO CO.,LTD.

- Everwell Parts Inc.

- SAUERMANN GROUP

- PTubes, Inc.

Recent Developments (Product Launches)

- In May 2025, QuickFitting launched patented HVAC Push-to-Connect refrigerant fittings that enable fast, leak-proof connections without flaring or brazing. Compatible with copper and coated aluminum linsets, these fittings improve installation speed and safety. The product supports industry-standard refrigerants, including A2L-class types, offering HVAC professionals a reliable and efficient solution.

- In March 2025, Duro Dyne launched Duro-Line, a high-performance HVAC linset, offering superior flexibility, corrosion resistance, and pressure ratings. Designed to withstand wide temperature ranges, Duro-Line addresses supply chain issues and price volatility, providing reliable and cost-effective solutions for HVAC professionals.