Market Definition

The market involves technologies and solutions used to accurately recognize individuals based on biological, genetic, or biometric data. This market encompasses a wide range of applications, including forensic investigations, law enforcement, healthcare diagnostics, border security, and civil identification.

Its scope continues to expand with advances in DNA analysis, biometrics, and digital forensics, supporting public safety and personalized healthcare. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Human Identification Market Overview

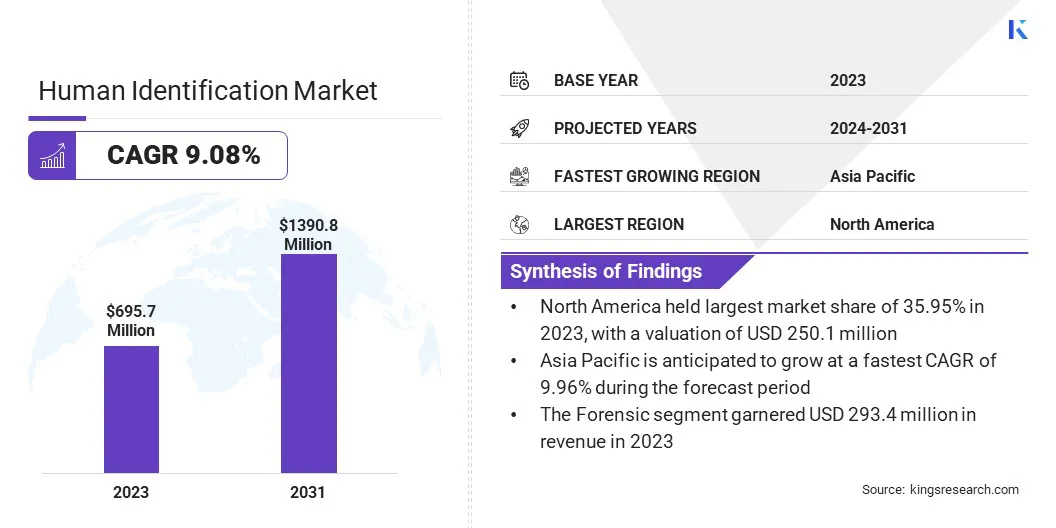

The global human identification market size was valued at USD 695.7 million in 2023 and is projected to grow from USD 756.9 million in 2024 to USD 1390.8 million by 2031, exhibiting a CAGR of 9.08% during the forecast period.

The growing use of forensic investigative genetic genealogy (FIGG) and the rising demand for DNA analysis in both forensic and healthcare applications are driving innovations in human identification. These advancements enable more accurate investigations, disease detection, and personalized medicine.

Major companies operating in the human identification industry are Thermo Fisher Scientific Inc., QIAGEN, Promega Corporation, ANDE, FUJIFILM Wako Pure Chemical Corporation, Bio-Rad Laboratories, Inc., NEC Corporation India Private Limited, IDEMIA, Cognitec Systems GmbH, Daon, Inc., Aware, Inc., Precise Biometrics, ZKTECO CO., LTD. and IDEX Biometrics ASA, and Others

Rising security concerns across various sectors are significantly driving the demand for human identification technologies. With the increasing incidence of cybercrime, identity theft, and unauthorized access, organizations are seeking robust and reliable identification methods to enhance security.

Biometric authentication solutions such as facial recognition, fingerprint scanning, and iris recognition are being widely adopted to safeguard sensitive data and ensure secure access control.

This growing emphasis on security is propelling the integration of advanced human identification systems across diverse sectors, including government, financial services, healthcare, education, and transportation.

- In March 2025, M2SYS launched the M2-LR and M2F PRO-LR terminals to meet growing demand for affordable human identification solutions among SMEs. Featuring fingerprint and facial recognition with anti-spoofing and network integration, these devices support secure and efficient workforce management.

Key Highlights

- The human identification industry size was recorded at USD 695.7 million in 2023.

- The market is projected to grow at a CAGR of 9.08% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 250.1 million.

- The consumables segment garnered USD 267.5 million in revenue in 2023.

- The polymerase chain reaction segment is expected to reach USD 494.5 million by 2031.

- The forensic segment secured the largest revenue share of 42.17% in 2023.

- The forensic laboratories segment is estimated to register a CAGR of 9.20% through the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 9.96% over the forecast period.

Market Driver

"Rising Demand for DNA Analysis in Forensic and Healthcare Applications"

The growth of the human identification market is propelled by the growing demand for DNA analysis, which plays a critical role in both forensic and healthcare applications.

In forensics, advancements in DNA technologies, such as next-generation sequencing, are enabling more accurate identification from limited or degraded samples, highlighting the need for improved forensic tools.

In healthcare, DNA analysis is essential for personalized medicine, offering insights into genetic predispositions and helping with early disease detection. This growing reliance on DNA analysis is fueling innovations and investments in advanced DNA testing technologies.

- In May 2024, QIAGEN partnered with the Federal Bureau of Investigation to develop a digital PCR assay for improved DNA quantification in forensic and healthcare applications. This technology enhances analysis of challenging forensic samples and supports next-generation sequencing, meeting the growing demand for more accurate DNA analysis in human identification and forensic investigations.

Market Challenge

"Lack of Standardization Across Systems and Regions"

A major challenge hampering the development of the human identification market is the lack of standardization in technologies, protocols, and regulatory frameworks across different regions and systems.

This fragmentation creates compatibility issues and hinders the seamless exchange of identification data between agencies, sectors, and countries. It also complicates efforts to implement unified identification systems on a global or national scale.

To overcome this challenge, companies are actively participating in international working groups and alliances aimed at developing common standards and interoperable frameworks. They are also investing in flexible platforms that can adapt to varying regulatory and technical requirements, allowing easier integration across different jurisdictions.

Market Trend

"Growing Use of Forensic Investigative Genetic Genealogy (FIGG)"

The surging use of forensic investigative genetic genealogy (FIGG) iis propelling the expansion of the human identification market. This helps law enforcement agencies solve complex and cold cases that traditional DNA methods fail to resolve.

By combining DNA analysis with public genealogy databases, FIGG enables investigators to trace familial connections and identify unknown individuals with greater accuracy.

The technology is increasingly being adopted by forensic laboratories worldwide due to its high success rate and ability to bring resolution to long-standing investigations. This growing application highlights the expanding role of advanced DNA tools in strengthening public safety and justice systems.

- In July 2024, QIAGEN partnered with the Snow Molecular Anthropology Lab at the University of Montana to enhance the identification of human remains, particularly those of Indigenousand African American individuals. The partnership aims to advance forensic human identification using next-generation sequencing (NGS) and forensic investigative genetic genealogy (FIGG), and supports the development of the first Indigenous-owned DNA database.

Human Identification Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Consumables, Instruments, Software

|

|

By Technology

|

Polymerase Chain Reaction, Next-Generation Sequencing, Capillary Electrophoresis, Others

|

|

By Application

|

Forensic, Paternity Identification, Others

|

|

By End User

|

Forensic Laboratories, Research Centers & Academic, Government Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Consumables, Instruments, and Software): The consumables segment earned USD 267.5 million in 2023 due to high demand for DNA testing kits, reagents, and forensic sampling tools across law enforcement and healthcare sectors.

- By Technology (Polymerase Chain Reaction, Next-Generation Sequencing, Capillary Electrophoresis, and Others): The polymerase chain reaction segment held a share of 35.65% in 2023, attributed to its reliability, speed, and established role as a standard technique in DNA-based human identification.

- By Application (Forensic, Paternity Identification, and Others): The forensic segment is projected to reach USD 580.3 million by 2031, owing to growing demand for advanced identification techniques in solving crimes, managing criminal databases, and strengthening forensic infrastructure globally.

- By End User (Forensic Laboratories, Research Centers & Academic, and Government Institutes). The forensic laboratories segment is estimated to grow at a CAGR of 9.20% through the forecast period, attributed to increased government funding, modernization of forensic infrastructure, and demand for high-precision identification tools in legal and investigative processes

Human Identification Market Regional Analysis

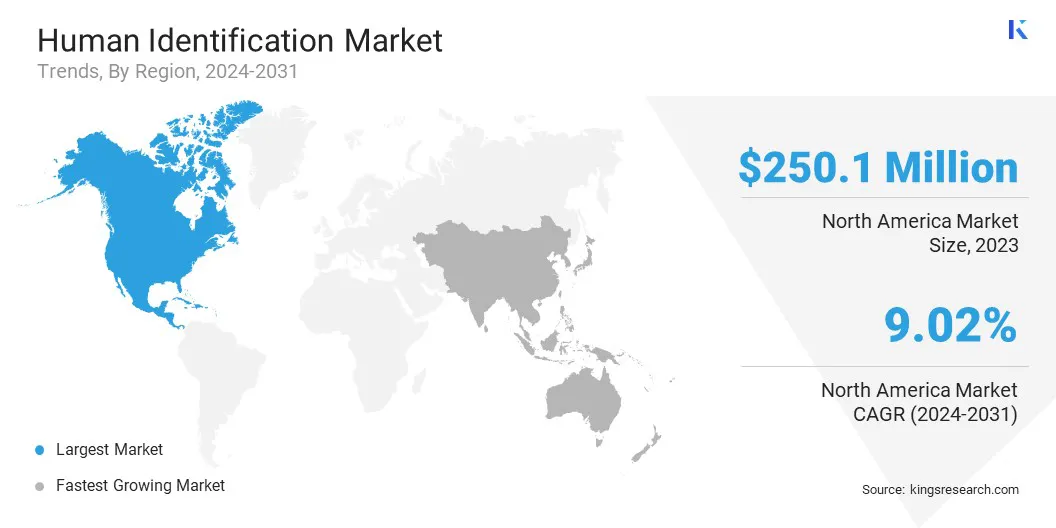

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America human identification market share stood at around 35.95% in 2023, valued at USD 250.1 million. This dominance is reinforced by the rising adoption of advanced technologies, strong consumer demand, and continuous technological innovation.

The region has seen rapid integration of biometric and DNA-based identification solutions across sectors such as law enforcement, healthcare, and finance. Additionally, ongoing investments in AI-powered biometrics and next-generation sequencing technologies are enhancing system accuracy and security, further driving market growth.

The Asia Pacific human identification industry is estimated to grow at a CAGR of 9.96% over the forecast period. The growing use of biometrics in consumer electronics, particulalry smartphones and smart devices with fingerprint and facial recognition, is making biometric technology increasingly accessible.

As digital lifestyles expand and consumers prioritize secure, convenient identity verification, demand for biometric solutions is rising. Additionally, government initiatives promoting digital identity systems and national ID programs are accelerating regional market growth.

- In November 2024, Aware partnered with Finema to promote biometrics-based digital identity solutions across the Asia-Pacific region. The collaboration combines Aware’s biometric authentication technologies with Finema’s decentralized identity infrastructure, aiming to enhance security, reduce fraud, and strengthen digital trust for enterprises, financial institutions, and government agencies.

Regulatory Frameworks

- In the U.S., human identification is governed by the Federal Trade Commission (FTC), which focuses on ensuring consumer privacy, data security, and protection against bias or discrimination in the use of biometric information and related technologies. The FTC promotes transparency and safeguards by combating unfair or deceptive practices in the collection and use of biometric data.

- In the Europen Union, human identification is governed by the General Data Protection Regulation (GDPR), the proposed EU Artificial Intelligence (AI) Act, the ePrivacy Directive, and national biometric data protection laws. These regulations ensure privacy, data security, and ethical use of biometric technologies while promoting transparency and consumer rights.

Competitive Landscape

In the human identification industry, key players are increasingly focusing on collaborations and partnerships to gain a competitive edge. By forming alliances with technology providers, research institutions, and government agencies, companies can enhance their biometric solutions and integrate advanced technologies such as AI and machine learning.

These partnerships enable the development of more accurate and efficient human identification systems, facilitating their adoption across various sectors such as security, healthcare, and law enforcement.

- In September 2024, QIAGEN partnered with Bode Technology to expand the use of the GEDmatch PRO forensic genealogy database. This collaboration aims to advance human identification and forensic investigations by integrating next-generation sequencing and FIGG technologies, enabling law enforcement to solve complex and cold cases more efficiently.

List of Key Companies in Human Identification Market:

Recent Developments (Product Launches)

- In March 2025, Precise Biometrics announced a significant development with the approval of its BioLive anti-spoofing technology for integration into India’s Aadhaar ID system, supporting the country’s efforts to strengthen biometric security. This advancement addresses identity fraud concerns by enhancing the accuracy and reliability of human identification through secure biometric verification.

- In April 2025, Europol released the Biometric Vulnerabilities - Ensuring Future Law Enforcement Preparedness Observatory Report, addressing the security of biometric recognition systems in law enforcement and outlining efforts to identify and mitigate vulnerabilities

- In January 2025, authID introduced PrivacyKey, a biometric authentication solution that eliminates the storage of biometric data, addressing privacy and compliance concerns. Utilizing public-private key cryptography, PrivacyKey ensures secure identity verification without retaining sensitive biometric information. This innovation enables enterprises to adopt seamless authentication methods while reducing risks associated with data retention, positioning authID as a leader in privacy-focused biometric solutions.

- In September 2024, Promega announced the development of a novel reduced stutter polymerase to enhance forensic DNA analysis. The enzyme significantly minimizes stutter artifacts in Short Tandem Repeat profiling, improving the accuracy and reliability of human identification in forensic laboratories.