Histone Deacetylase Inhibitors Market Size

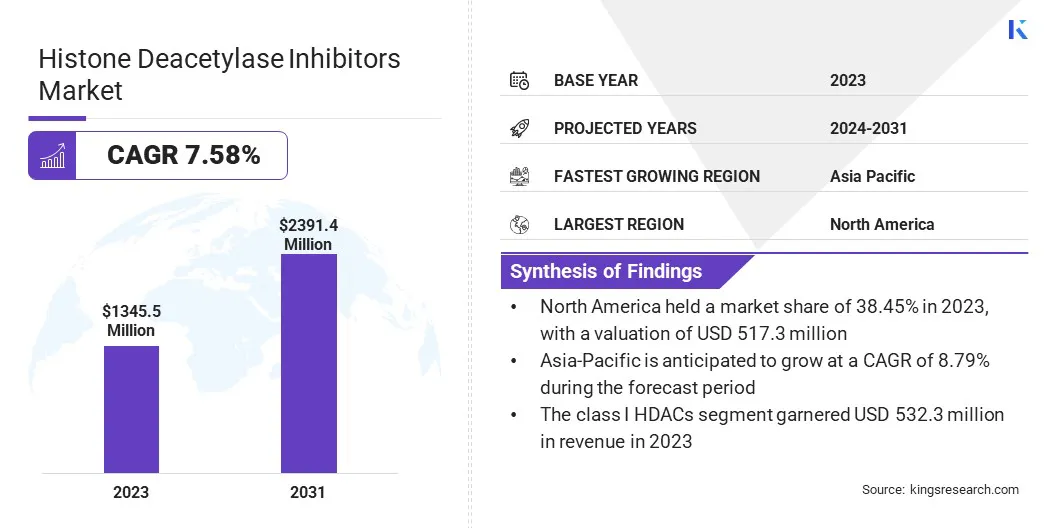

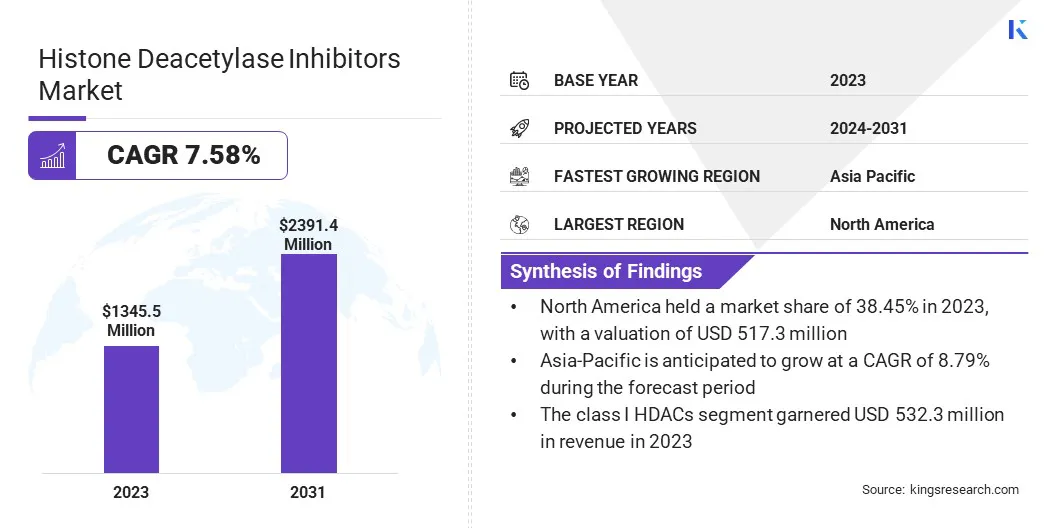

The global Histone Deacetylase Inhibitors Market size was valued at USD 1,345.5 million in 2023 and is projected to grow from USD 1,434.0 million in 2024 to USD 2,391.4 million by 2031, exhibiting a CAGR of 7.58% during the forecast period. The histone deacetylase (HDAC) inhibitors market is growing due to expanding applications in cancer and neurological disorders, advancements in drug discovery technologies, and increasing research in therapeutic effectiveness.

These factors are contributing significantly to market growth by enhancing treatment options and broadening therapeutic applications. In the scope of work, the report includes solutions offered by companies such as 4SC AG, Merck KGaA, Celleron Therapeutics, Shenzhen Chipscreen Biosciences Co., Ltd, CG Invites Co., Ltd., Curis, Inc, MEI Pharma, Inc., Mirati Therapeutics, Inc., Novartis AG, HUYA Bioscience International, LLC, and others.

The histone deacetylase inhibitors market is experiencing robust growth, mainly due to expanding therapeutic applications and advancements in drug discovery technologies. Key factors supporting this growth include the increasing prevalence of cancers and neurological disorders, which underscore the demand for innovative treatments such as HDAC inhibitors.

A notable trend is the exploration of these inhibitors beyond oncology, extending into the fields of inflammatory diseases, psychiatric disorders, and cardiovascular conditions, thereby broadening their market scope.

- In 2023, class I HDACs captured the largest market share of 39.56%, highlighting their significant impact. As research advances in specificity and efficacy through computational methods such as molecular docking and pharmacophore modeling, the market continues to expand, offering promising avenues for new therapies across various medical fields.

Histone acetylase inhibitors, also known as histone deacetylase (HDAC) inhibitors, are a class of compounds that inhibit the activity of enzymes referred to as histone deacetylases. These enzymes play a crucial role in modifying chromatin structure by removing acetyl groups from histone proteins, leading to chromatin condensation and transcriptional repression.

By inhibiting histone deacetylases, HDAC inhibitors promote histone acetylation, which typically relaxes chromatin structure and enhances gene transcription. This modulation of gene expression impact various cellular processes and has therapeutic implications, particularly in cancer, neurodegenerative diseases, inflammatory conditions, and other disorders involvng epigenetic regulation.

Analyst’s Review

The histone deacetylase inhibitors market is poised to witness robust growth, mainly fueled by expanding research activities and the broadening of therapeutic applications. Advances in computational methods are enhancing drug discovery, particularly in developing more targeted and effective inhibitors.

Ongoing efforts to refine these inhibitors are expected to result in safer and more potent treatments. This growth is further propelled by an increasing number of clinical trials and potential regulatory approvals across multiple disease indications.

- For instance, the recent approval of Duvyzat (givinostat) by the U.S. Food and Drug Administration for Duchenne Muscular Dystrophy marks a significant advancement in treatment options for patients across diverse genetic profiles of the disease.

These factors are expected to contribute significantly to the expansion of the market.

What are the major factors affecting the market growth?

The increasing prevalence of cancer and neurological disorders is spurring the demand for innovative therapies, making histone deacetylase (HDAC) inhibitors crucial in treating these conditions. HDAC inhibitors are effectively targeting and inhibiting tumor growth, offering a promising option in oncology.

Additionally, their potential neuroprotective effects are addressing complex neurological disorders such as Alzheimer's, Huntington's, and multiple sclerosis. As these diseases are becoming more widespread, the need for effective, targeted treatments is growing. Moreover, the expanding applications of HDAC inhibitors in both cancer and neurology are fostering the histone deacetylase inhibitors market growth, as healthcare providers and patients are increasingly seeking advanced therapeutic options.

- According to the World Health Organization (WHO), in 2022, there were an estimated 20 million new cancer cases and 9.7 million deaths globally. Additionally, the estimated number of people who were alive within five years following a cancer diagnosis was 53.5 million. The statistics further reveal that about 1 in 5 people develop cancer in their lifetime, with approximately 1 in 9 men and 1 in 12 women dying from the disease. These statistics underscore the significant healthcare burden posed by cancer, which is boosting the demand for innovative treatments and contributing to market growth.

Histone deacetylase (HDAC) inhibitors have been extensively utilized for their therapeutic potential across various diseases such as cancers, neurodegenerative disorders, and autoimmune conditions over the past three decades. Despite their effectiveness, current HDAC inhibitor drugs are constrained by limitations due to toxic side effects resulting from a lack of target selectivity.

This challenge is advancing active research aimed at developing more precise class-selective or isoform-selective inhibitors. Computational methods such as scaffold hopping, pharmacophore modeling, and molecular docking are pivotal in identifying HDAC inhibitors with enhanced potency and selectivity, which are essential for improving drug safety profiles.

Refining these computational approaches is crucial for advancing the next generation of HDAC inhibitors toward regulatory approval and achieving broader market acceptance across diverse therapeutic applications. This progress is anticipated to fuel market expansion in the coming years.

Which technological trends are shaping the market?

Continuous advancements in drug development technologies and streamlined regulatory approval processes are supporting the evolution of HDAC inhibitor research. Latest trends emphasize combining molecular dynamics simulations with MM-PBSA/MM-GBSA to enhance ligand binding affinity predictions.

These multilayered strategies are pivotal in designing and identifying potent HDAC inhibitors, which is augmenting the growth of the HDAC inhibitors market. The rapid introduction of new, highly targeted therapies reflects the successful integration of scientific innovation with regulatory efficiency, meeting the increasing demand for effective treatments in oncology and neurology.

HDAC inhibitors, which have traditionally played a pivotal role in cancer cells treatment, are increasingly being investigated for diverse therapeutic applications. In addition to their applications in oncology, these treatments exhibit potential in the management of inflammatory diseases by modulating immune responses, in psychiatry for managing conditions such as depression and neurodegenerative disorders, and in cardiovascular medicine for their potential protective effects against heart disease and stroke.

This diversification highlights their versatility and potential to address various unmet medical needs. As research expands, HDAC inhibitors are poised to widen the scope of treatment options available, offering new avenues for effective therapies across multiple medical fields beyond their initial role in combating cancer, thereby bolstering market growth.

Segmentation Analysis

The global market is segmented based on drug, class, application, route of administration, and geography.

Which class of HDAC inhibitors has the largest share?

Based on class, the histone deacetylase inhibitors market is categorized into class I HDACs, class II HDACs, class III HDACs, and class IV HDACs. The class I HDACs segment garnered the highest revenue of USD 532.3 million in 2023 owing to its role as a key target for therapeutic innovation. Inhibitors targeting HDAC1, HDAC2, HDAC3, and HDAC8 have demonstrated promising results in both oncology and neurology, thereby bolstering the demand for effective treatments.

Research into selective inhibitors and the expansion therapeutic applications is boosting the growth of the segment. Strategic collaborations and technological advancements further propel this growth, facilitating the development of new therapies and enhancing market penetration.

What is the market share of oncology segment in this market?

Based on application, the market is divided into oncology, neurology, and others. The oncology segment captured the largest histone deacetylase inhibitors market share of 69.12% in 2023. This notable expansion is majorly attributed to its focus on developing treatments for various cancers. HDAC inhibitors have shown significant potential in inducing cancer cell death, inhibiting tumor growth, and enhancing the efficacy of other cancer therapies.

The field of oncology is experiencing robust investment in research and development, with numerous clinical trials aimed at validating the efficacy and safety of HDAC inhibitors in treating hematological malignancies and solid tumors. Key players in the pharmaceutical industry are actively seeking regulatory approvals and launching innovative HDAC inhibitor-based therapies, thereby propelling segmental expansion.

How big is the oral HDAC inhibitors segment?

Based on route of administration, the market is bifurcated into oral HDAC inhibitors and parenteral HDAC inhibitors. The oral HDAC inhibitors segment garnered the highest revenue of USD 838.8 million in 2023. Oral HDAC inhibitors offer enhanced patient compliance and convenience compared to injectable forms.

Significant investment are being made in research and development related to oral HDAC inhibitors, with promising clinical trials underway for various conditions, including cancers and neurological disorders. The ease of oral administration is broadening the patient base and facilitating long-term treatment adherence. Pharmaceutical companies are actively developing new oral HDAC inhibitors and seeking regulatory approvals, which is expected to boost segmental growth.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America histone deacetylase inhibitors market share stood around 38.45% in 2023 in the global market, with a valuation of USD 517.3 million. This expansion is stimulated by robust healthcare infrastructure, extensive research and development activities, and proactive regulatory support. The presence of major pharmaceutical companies and research institutions fosters innovation and clinical trials, particularly in oncology and neurology. Increasing prevalence of cancer and neurological disorders further boosts the demand for HDAC inhibitors.

Additionally, favorable government policies and substantial funding for healthcare research bolster regional market growth. The region's focus on advanced therapeutic solutions and its rapid adoption of new treatments position North America as a key region in the global HDAC inhibitors market.

Asia-Pacific is anticipated to witness notable growth at a CAGR of 8.79% over the forecast period, largely due to increasing investment in healthcare infrastructure and the rising prevalence of cancer and neurological disorders. Emerging economies such as China and India are investing heavily in research and development, fostering innovation in HDAC inhibitor therapies. Growing awareness regarding advanced treatments and expanding access to healthcare services further contribute to domestic market expansion.

Additionally, supportive government policies and initiatives to enhance drug discovery and development are propelling regional market growth. The region's large patient pool and the increasing adoption of novel therapies position Asia Pacific as a significant market for HDAC inhibitors.

Competitive Landscape

The histone deacetylase inhibitors market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic decisions, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

Key Companies in Histone Deacetylase Inhibitors Market

- 4SC AG

- Merck KGaA

- Celleron Therapeutics

- Shenzhen Chipscreen Biosciences Co., Ltd

- CG Invites Co., Ltd.

- Curis, Inc

- MEI Pharma, Inc.

- Mirati Therapeutics, Inc.

- Novartis AG

- HUYA Bioscience International, LLC

Key Industry Development

- March 2024 (Product Approval): ITF Therapeutics, LLC announced that the FDA has granted approval to DUVYZA (givinostat), a histone deacetylase (HDAC) inhibitor, for the treatment of Duchenne muscular dystrophy in individuals aged six years and older. The approval of DUVYZAT represents a significant advancement in the treatment of Duchenne muscular dystrophy (DMD), as it targets pathogenic processes to alleviate inflammation and muscle loss, independent of specific genetic variants. This breakthrough positions DUVYZAT as the first nonsteroidal drug approved for DMD across all genetic profiles, expanding its market potential.

The global histone deacetylase inhibitors market is segmented as:

By Drug

- Vorinostat

- Romidespin

- Belinostat

- Panabinostat

- Others

By Class

- Class I HDACs

- Class II HDACs

- Class III HDACs

- Class IV HDACs

By Application

- Oncology

- Neurology

- Others

By Route of Administration

- Oral HDAC Inhibitors

- Parenteral HDAC Inhibitors

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America