Market Definition

The high purity gas market involves the production and supply of gases with minimal impurities, essential for industries such as semiconductors, pharmaceuticals, aerospace, and medical applications.

These gases, including oxygen, nitrogen, hydrogen, and argon, are critical for precision-based processes, where contaminants can impact product quality and performance, driving demand in advanced technologies and specialized sectors.

High Purity Gas Market Overview

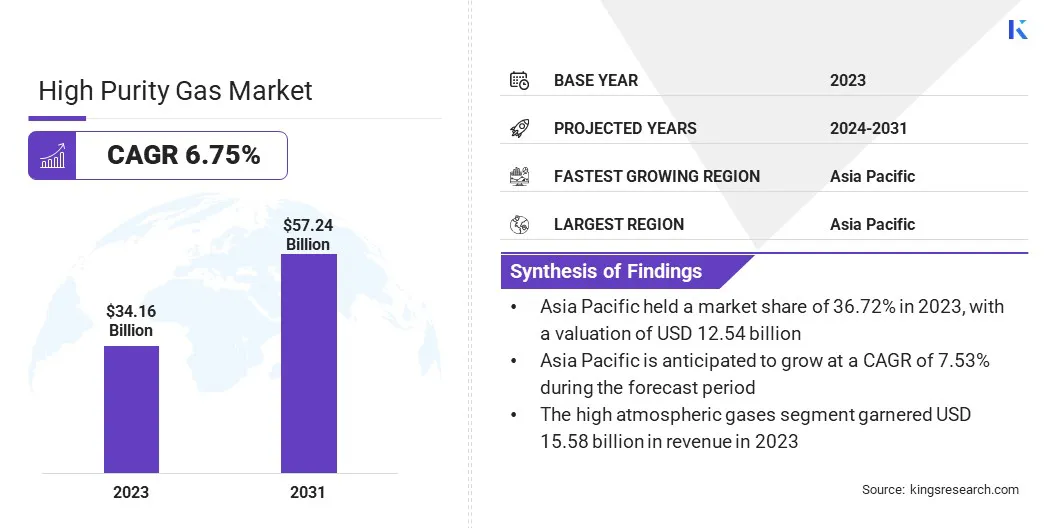

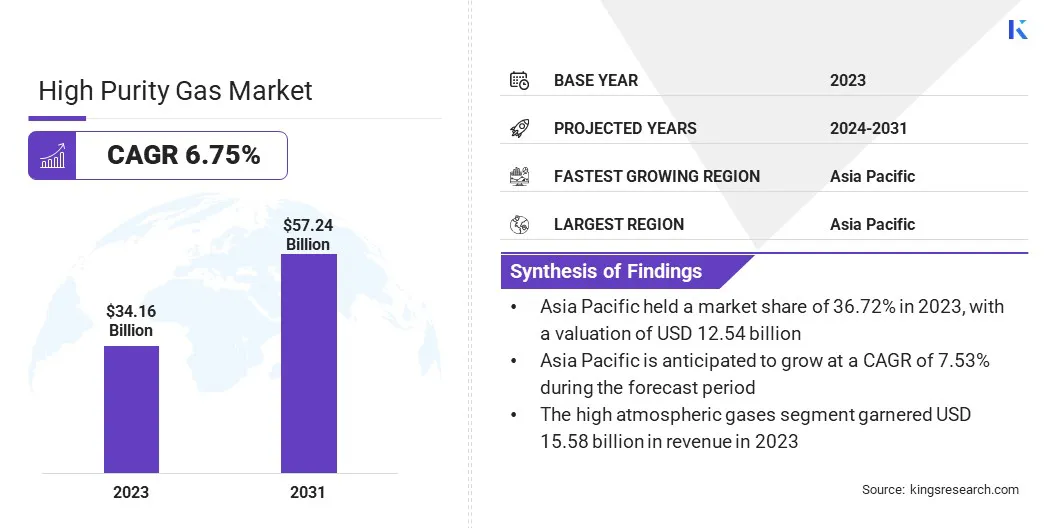

Global high purity gas market size was valued at USD 34.16 billion in 2023, which is estimated to be valued at USD 36.23 billion in 2024 and reach USD 57.24 billion by 2031, growing at a CAGR of 6.75% from 2024 to 2031.

The rising demand for semiconductors is boosting market growth, as the production of electronics and microchips requires ultra-pure gases. These gases ensure precision in manufacturing, preventing contamination and ensuring high-quality performance in advanced technologies.

Major companies operating in the global high purity gas industry are Linde plc, AIR LIQUIDE, Air Products and Chemicals, Inc., Taiyo Nippon Sanso JFP Corporation, Messer SE & Co. KGaA, MATHESON Tri-Gas, Inc, OSAKA GAS CO.,LTD, SOL India Private Limited, Gruppo SIAD, Resonac Holdings Corporation, Alchemie Gases & Chemicals Pvt. Ltd., Advanced Specialty Gases, Airgas, Inc., INOX-Air Products Inc, Ultra Pure Gases Pvt. Ltd., and others.

The market, a subset of the industrial gas sector, is expanding as industries prioritize precision, purity, and sustainability. These gases are essential for sectors like semiconductors, pharmaceuticals, aerospace, and healthcare, where the highest levels of quality and reliability are crucial.

Technological advancements, manufacturing innovations, and scientific research are driving demand for gases with extremely low impurity levels. As industries continue to require more contaminant-free environments, the market plays a vital role in supporting these evolving needs.

- In August 2024, Linde signed a long-term agreement with Dow to supply clean hydrogen for the Path2Zero project in Canada. This partnership underscores Linde’s commitment in delivering high-purity gases crucial for advancing sustainability and supporting industrial decarbonization.

Key Highlights:

- The global high purity gas market size was recorded at USD 34.16 billion in 2023.

- The market is projected to grow at a CAGR of 6.75% from 2024 to 2031.

- Asia Pacific held a share of 36.72% in 2023, valued at USD 12.54 billion.

- The high atmospheric gases segment garnered USD 15.58 billion in revenue in 2023.

- The electronics and semiconductors segment is expected to reach USD 21.23 billion by 2031.

- North America is anticipated to grow at a CAGR of 6.80% over the forecast period.

Market Driver

"Rising Demand for Semiconductors"

The rising demand for semiconductors is fueling the growth of the high purity gas market.

The production of electronics and microchips demands ultra-pure gases to maintain precision and performance in semiconductor manufacturing. Even minor impurities can cause defects, making it crucial for semiconductor companies to use gases with minimal contaminants.

The increasing use of electronic devices across industries is increasing the demand for high purity gases in semiconductor fabrication and production processes

- In June 2024, Air Liquide secured a contract with Micron Technology to support the semiconductor industry in the U.S., investing over USD 250 million. The new facility in Idaho is designed to supply high-purity gases, including ultra-pure nitrogen, to meet the growing demand for precision gases in memory chip production.

Market Challenge

"Rising Raw Material Prices"

Rising raw material prices pose a significant challenge to the progress of the high purity gas market, as fluctuations in hydrogen, nitrogen, and helium costs can directly affect production costs and profitability.

To address this challenge, companies can invest in more efficient production technologies, optimize supply chain management, and explore alternative sources for raw materials. Additionally, long-term contracts with suppliers and strategic partnerships can stabilize costs and minimize price volatility, ensuring predictable pricing.

Market Trend

"Rising Focus on Circular Economy"

A key trend in the high purity gas market is the growing emphasis on circular economy principles. Companies are increasingly focusing on recycling and reusing gases such as CO2 to reduce waste, and minimize environmental impact.

This approach enhances sustainability and improves resource efficiency by capturing and utilizing industrial byproducts, supporting carbon footprint reduction efforts.

- In September 2024, Suntory, Tokyo Gas, and Tokyo Gas Engineering Solutions (TGES) successfully demonstrated the high-purity recovery of CO2 using a solid sorbent process at Suntory’s Hakushu Distillery. This innovative technology promotes sustainability by capturing CO2 emissions, contributing to decarbonization and resource circularity in the beverage industry.

High Purity Gas Market Report Snapshot

|

Segmentation

|

Details

|

|

By Gas Type

|

High Atmospheric Gases, Noble Gases, Other Gases

|

|

By End-Use Industry

|

Electronics and Semiconductors, Healthcare, Chemicals, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Gas Type (High Atmospheric Gases, Noble Gases, and Other Gases): The high atmospheric gases segment earned USD 15.58 billion in 2023, mainly due to increased demand in industrial applications, energy production, and environmental management technologies.

- By End-Use Industry (Electronics and Semiconductors, Healthcare, Chemicals, Automotive, and Others): The electronics and semiconductors segment held a share of 35.02% of the market in 2023, propelled by the rising demand for high-purity gases in advanced manufacturing and cleanroom applications.

High Purity Gas Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific high purity gas market share stood at around 36.72% in 2023, valued at USD 12.54 billion. This dominance is reinforced by rapid industrialization, growing electronics and semiconductor sectors, and increased demand for high-purity gases in healthcare and manufacturing.

Countries such as China, Japan, and South Korea are at the forefront of the this growth due to their advanced technological capabilities and strong industrial base. Moreover, the region's commitment to sustainability, coupled with large-scale infrastructure projects, contributes to its dominance.

- In September 2023, Hyundai Motor Group partnered with Sudokwon Landfill Site Management Corporation to demonstrate green hydrogen production from biogas. The initiative targets a daily output of 216 kg, supporting sustainable energy and carbon neutrality goals.

The high purity gas industry in North America is estimated to grow at a CAGR of 6.80% over the forecast period. This rapid expansion is fueled by technological advancements and significant investments in semiconductor manufacturing and healthcare applications.

The U.S. is leading this growth due to its strong focus on clean energy, environmental sustainability, and the increasing demand for specialty gases in various industries. Additionally, the advancement of carbon capture technologies and the expansion of high-tech industries are positioning North America as a key market for high purity gas.

- In February 2025, Plug Power's Louisiana hydrogen plant, slated to begin operations in Q1, aims to expand North America's high-purity hydrogen production capacity. This 15-ton-per-day facility is designed to enhance hydrogen availability for key customers, supporting Plug's green hydrogen ecosystem and network.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates and enforces environmental policies to safeguard public health and the environment.

- The Occupational Safety and Health Administration (OSHA) in the U.S. ensures safe working conditions through standards, enforcement, and training.

- In the EU, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation safeguards human health and the environment from chemical risks.

Competitive Landscape

In the high purity gas market, companies frequently form strategic partnerships and joint ventures to enhance production capabilities and expand their market reach. These collaborations focus on developing advanced technologies, optimizing supply chains, and improving sustainability practices.

By pooling resources and expertise, companies can innovate in gas production, meet increasing demand, and address regulatory and environmental challenges more effectively.

- In September 2024, POSCO and Zhongtai Cryogenic Technology launched POSCO Zhongtai Air Solution, a joint venture focused on high-purity rare gas production. This partnership aims to localize rare gas production for semiconductors, reducing dependence on imports and stabilizing supply chains for companies such as Samsung, SK Hynix, and Intel.

List of Key Companies in High Purity Gas Market:

- Linde plc

- AIR LIQUIDE

- Air Products and Chemicals, Inc.

- Taiyo Nippon Sanso JFP Corporation

- Messer SE & Co. KGaA

- MATHESON Tri-Gas, Inc

- OSAKA GAS CO.,LTD

- SOL India Private Limited

- Gruppo SIAD

- Resonac Holdings Corporation

- Alchemie Gases & Chemicals Pvt. Ltd.

- Advanced Specialty Gases

- Airgas, Inc.

- INOX-Air Products Inc

- Ultra Pure Gases Pvt. Ltd.

Recent Developments (Partnership)

- In November 2024, Toshiba Energy Systems & Solutions partnered with Nimbus Power Systems to develop a next-generation pure hydrogen fuel cell stack, addressing the rising demand for high-purity hydrogen in clean energy.

- In October 2024, UNICAT Technologies formed an exclusive partnership with an Asian-based PSA specialist to enhance high-purity hydrogen production. The collaboration integrates advanced gas separation systems with world-leading adsorbents, improving, cost-effectiveness, and sustainability in industrial hydrogen production.