Market Definition

A heat exchanger is a device designed to efficiently transfer heat from one fluid (liquid or gas) to another without mixing them. It is commonly used in heating, cooling, and energy recovery applications across industries such as HVAC, power generation, chemical processing, and automotive engineering.

Heat exchangers operate through various mechanisms, including conduction and convection, and come in different types, such as shell-and-tube, plate, and finned-tube heat exchangers, each suited for specific applications based on heat transfer efficiency, pressure drop, and maintenance requirements.

Heat Exchangers Market Overview

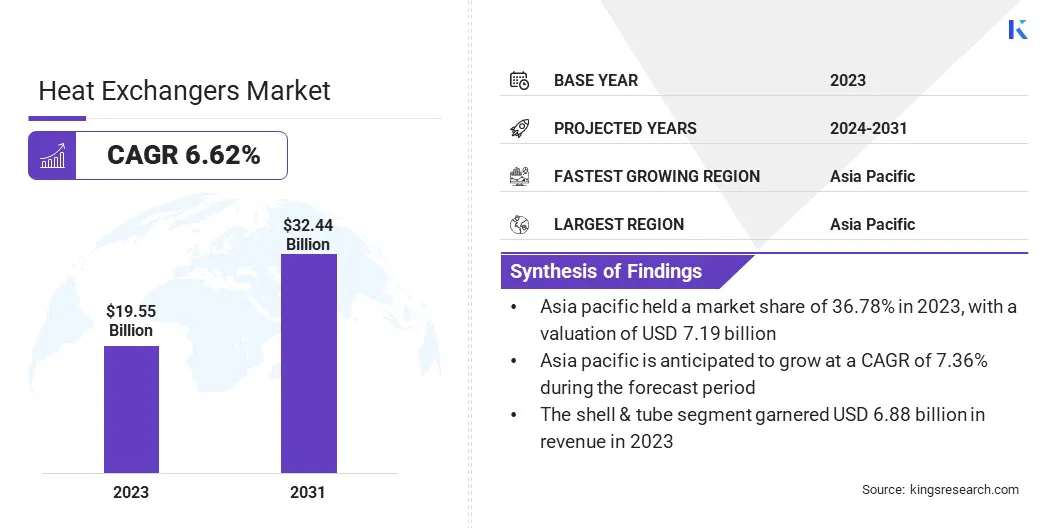

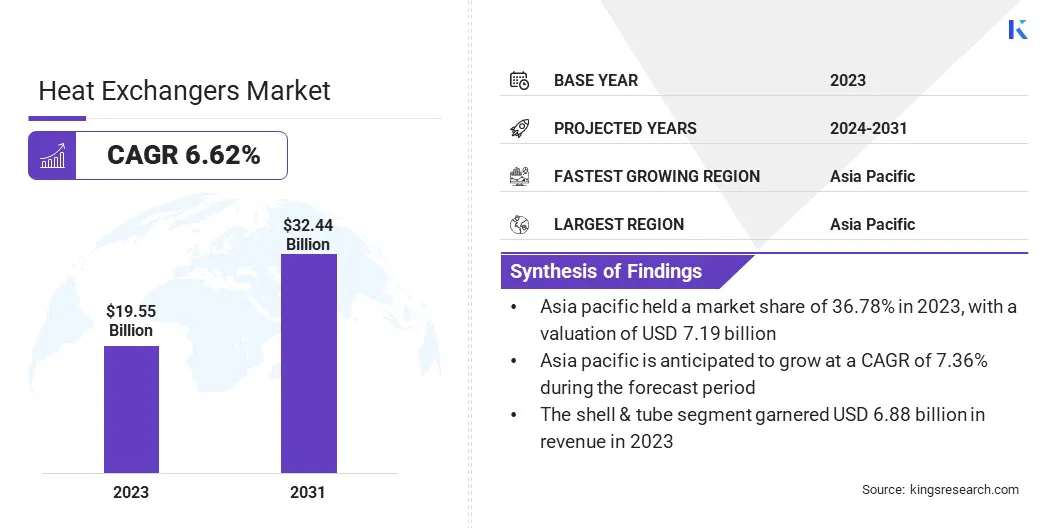

Global heat exchangers market size was USD 19.55 billion in 2023, which is estimated to be valued at USD 20.71 billion in 2024 and is projected to reach USD 32.44 billion by 2031, growing at a CAGR of 6.62% from 2024 to 2031.

The growth of the global market is driven by rising energy efficiency requirements, expanding industrial sectors, and the growing use of renewable energy. Industries are adopting waste heat recovery systems to reduce energy consumption, propelled by rising demand in power generation, chemical processing, and HVAC applications.

Additionally, the shift toward sustainable technologies, including hydrogen and carbon capture systems, is supporting market expansion.

Major companies operating in the heat exchangers market are ALFA LAVAL, Danfoss, Güntner GmbH & Co. KG, API Heat Transfer, HISAKA WORKS, LTD., Xylem, Mersen, Kelvion Holding Gmbh, GEA Group Aktiengesellschaft, Linde PLC, Johnson Controls, SPX FLOW, Metalforms, LLC, General Electric Company, Tranter, Inc., and others.

The increasing focus on energy conservation across industries is boosting the growth of the market. These systems enhance energy efficiency by optimizing heat transfer processes, reducing fuel consumption, and minimizing operational costs. The growing adoption of energy recovery solutions in power plants, industrial facilities, and HVAC systems is fueling market expansion.

- In March 2023, Alfa Laval launched the AlfaNova GL50, the first heat exchanger tailored specifically for fuel cell systems. This breakthrough technology is designed to utilize energy from hydrogen and its derivatives, such as ammonia, methanol, and methane, facilitating the decarbonization of hard-to-abate sectors, including shipping and heavy industry. By improving system efficiency and reducing energy losses, the AlfaNova GL50 aids fuel cell manufacturers in optimizing performance while advancing the broader objective of accelerating decarbonization efforts.

Key Highlights:

- The heat exchangers industry size was recorded at USD 19.55 billion in 2023.

- The market is projected to grow at a CAGR of 6.62% from 2024 to 2031.

- Asia Pacific held a share of 36.78% in 2023, valued at USD 7.19 billion, and is anticipated to grow at a CAGR of 7.36% over the forecast period.

- The shell & tube segment garnered USD 6.88 billion in revenue in 2023.

- The nickel & nickel alloys segment is expected to reach USD 9.79 billion by 2031.

- The chemical & petrochemical segment secured the largest revenue share of 22.60% in 2023.

Market Driver

"Surging Need for HVAC Sytems in Several Applications"

The increasing need for heating, ventilation, and air conditioning (HVAC) systems in residential, commercial, and industrial sectors is significantly contributing to the growth of the heat exchangers market.

These are essential components in chillers, heat pumps, and air conditioning units, ensuring efficient temperature regulation and energy conservation. The rising demand for cold storage solutions and refrigeration systems in the food and pharmaceutical industries further supports market expansion.

- In February 2024, the U.S. government announced a USD 63 million initiative to strengthen domestic manufacturing of electric heat pumps. The U.S. Department of Energy (DOE) allocated funds to accelerate the production of residential heat pumps, heat pump water heaters, and related components. This effort aligns with the Investing in America Agenda, promoting clean energy technologies.

Market Challenge

"High Initial Investment and Maintenance Costs"

The substantial upfront costs associated with heat exchangers, including manufacturing, installation, and maintenance expenses, present a major challenge to market growth.

Advanced technologies, particularly in nuclear and renewable energy applications, require high-quality materials and precision engineering, further increasing costs and hampering the growth of the heat exchangers market.

To address this challenge, companies are investing in research and development to create cost-effective, durable, and energy-efficient heat exchangers. The adoption of advanced manufacturing techniques, including 3D printing and automation, is reducing production costs.

Additionally, companies are offering predictive maintenance solutions using IoT and AI to enhance operational efficiency and minimize long-term maintenance expenses.

Market Trend

"Rising Global Investments in Nuclear Energy"

Increasing investments in nuclear power as a reliable and low-carbon energy source are increasing demand for heat exchangers. Governments and private entities are expanding nuclear capacity to meet growing electricity needs while reducing reliance on fossil fuels.

This surge in nuclear power plant construction is highlighting the need for efficient heat exchange systems for cooling and thermal management.

- In April 2024, the United Arab Emirates announced plans to issue a tender for a new nuclear power plant, doubling the country's nuclear reactor count. This developments is expected to boost demand for heat exchangers in the power sector.

Heat Exchangers Market Report Snapshot

| Segmentation |

Details |

| By Product |

Plate & Frame (Gasketed Plate Heat Exchangers, Brazed Plate Heat Exchangers, Welded Plate Heat Exchangers), Shell & Tube (Fixed Tube Sheet, Floating Head, U-Tube), Air-cooled (Forced Draft, Induced Draft), Others |

| By Material |

Hastelloy (Hastelloy C-22, Hastelloy C-276, Hastelloy X), Titanium (Grade 1 Titanium, Grade 2 Titanium, Grade 5 Titanium), Nickel & Nickel Alloys (Inconel, Monel, Alloy 600/625), Tantalum (Pure Tantalum, Tantalum Alloys), Steel (Stainless Steel, Carbon Steel, Duplex Steel), Others |

| By End-User |

Chemical & Petrochemical (Chemical Processing, Refineries, Fertilizers & Agrochemicals, Specialty Chemicals), Oil & Gas (Upstream , Midstream , Downstream), HVAC & Refrigeration (Residential HVAC, Commercial HVAC, Industrial Refrigeration), Power Generation (Thermal Power Plants, Nuclear Power Plants, Renewable Energy), Food & Beverage (Dairy Processing, Beverages & Brewing, Meat & Poultry Processing, Confectionery & Bakery), Pulp & Paper (Paper Mills, Pulp Processing), Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Plate & Frame, Shell & Tube, Air-cooled, and Others): The shell & tube segment earned USD 6.88 billion in 2023, fueled by its high thermal efficiency, durability, and ability to withstand extreme temperatures and pressures, making it ideal for power generation, oil and gas, and chemical processing industries.

- By Material (Hastelloy, Titanium, Nickel & Nickel Alloys, and Tantalum, Steel, and Others): The nickel & nickel alloys segment held a share of 24.31% in 2023, attributed to its superior corrosion resistance, high thermal stability, and durability, making it well-suited for chemical processing, power generation, and marine applications.

- By End-User (Chemical & Petrochemical, Oil & Gas, HVAC & Refrigeration, Power Generation, Food & Beverage, Pulp & Paper, and Others): The chemical & petrochemical segment is projected to reach USD 7.97 billion by 2031, owing to its high demand for efficient thermal management in processes such as heat recovery, condensation, and cooling.

Heat Exchangers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific heat exchangers market share stood around 36.78% in 2023 in the global market, with a valuation of USD 7.19 billion . The expansion of refining and petrochemical projects in countries such as China, India, and Southeast Asia is creating a strong demand for heat exchangers.

These industries rely on efficient heat transfer equipment for crude oil processing, LNG liquefaction, and gasification operations. Rising foreign investments and joint ventures in refining capacity expansion are further supporting regional market growth.

- For instance, in January 2025, CNOOC and Shell Petrochemicals Company Limited (CSPC), a joint venture of Shell Nanhai B.V. and CNOOC Petrochemicals Investment Ltd, approved the expansion of its petrochemical complex in Daya Bay, Huizhou, South China. This expansion includes the development of a new facility capable of producing 320,000 tonnes annually of high-performance specialty chemicals, including polycarbonates and carbonate solvents.

- In November 2024, Aramco, a leading global energy and chemicals company, along with China Petroleum & Chemical Corporation (SINOPEC) and Fujian Petrochemical Company Limited (FPCL), commenced construction of an integrated refining and petrochemical complex in Fujian Province, China. The facility is designed to include a 16 million tons-per-year oil refining unit (equivalent to 320,000 barrels per day) and is anticipated to be fully operational by 2030.

Europe heat exchangers industry is poised to grow at a robust CAGR of 7.36% over the forecast period. With rapid urbanization and stringent energy efficiency regulations, the adoption of advanced heating, ventilation, and air conditioning (HVAC) systems is growing across residential, commercial, and industrial sectors.

The rising demand for heat pumps, supported by European Union (EU) policies promoting electrification and decarbonization of heating, is significantly contributing to market growth. Heat exchangers are essential in heat pump systems, ensuring optimal thermal efficiency.

Furthermore, the region is witnessing significant developments in nuclear energy. For instance, in February 2025, Belgium's new government is considering doubling its nuclear capacity from 4 gigawatts (GW) to 8 GW by constructing new reactors. This move underscores the country's commitment to expanding its nuclear energy infrastructure.

Regulatory Framework

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations that impact the heat exchanger industry, particularly concerning emissions and energy efficiency. The Clean Air Act mandates industries to limit air pollutants, influencing the design and operation of heat exchangers to ensure compliance. Additionally, the Department of Energy (DOE) sets energy efficiency standards for various equipment, including HVAC systems with heat exchangers. Compliance with these standards is mandatory for market entry and operation.

- The European Union (EU) has implemented stringent environmental regulations that significantly affect the heat exchanger industry. The Ecodesign Directive establishes minimum energy efficiency requirements for energy-related products, including heat exchangers. Manufacturers must ensure their products meet these standards to be sold within the EU. Additionally, the EU's Emissions Trading System (ETS) imposes limits on greenhouse gas emissions, prompting industries to adopt efficient heat exchange solutions to reduce their carbon footprint.

- China has been strengthening its environmental regulations to combat pollution and improve energy efficiency. The Ministry of Ecology and Environment enforces industrial emissions limit, necessitating the use of efficient heat exchangers across various sectors. The country's 14th Five-Year Plan emphasizes green development, urging industries to adopt advanced heat exchange technologies to meet energy efficiency and emission reduction targets.

- Japan's Top Runner Program sets energy efficiency benchmarks for various products, including heat exchangers, requiring manufacturers to meet or exceed these benchmarks. Additionally, Japan's Air Pollution Control Act regulates emissions from industrial sources, influencing the design and operation of heat exchangers to ensure compliance.

- India's Bureau of Energy Efficiency (BEE) establishes standards and labeling programs for energy-intensive systems, including heat exchangers. The Perform, Achieve, and Trade (PAT) scheme mandates efficiency targets for key industries, promotingg the adoption of efficient heat exchanger technologies.

Competitive Landscape

Companies in the heat exchangers industry are actively forming strategic partnerships to integrate advanced technologies that enhance energy efficiency and reduce carbon emissions. These collaborations focus on developing innovative materials, optimizing heat recovery systems, and improving the thermal performance of exchangers to support sustainability goals.

By partnering with research institutions, energy companies, and material suppliers, manufacturers are advancing low-carbon solutions and aligning with global decarbonization initiatives.

- In December 2023, Alfa Laval collaborated with Outokumpu, a global steel manufacturer, to lower carbon emissions by incorporating Outokumpu’s Circle Green stainless steel into its heat exchanger production. This initiative aims to reduce the carbon footprint of Alfa Laval’s heat exchangers, which are composed of up to 80% stainless steel, by replacing conventional stainless steel with a more sustainable alternative. The transition is expected to cut emissions by half, aligning with the company’s commitment to sustainability and energy-efficient manufacturing.

List of Key Companies in Heat Exchangers Market:

- ALFA LAVAL

- Danfoss

- Güntner GmbH & Co. KG

- API Heat Transfer

- HISAKA WORKS, LTD.

- Xylem

- Mersen

- Kelvion Holding Gmbh

- GEA Group Aktiengesellschaft

- Linde PLC

- Johnson Controls

- SPX FLOW

- Metalforms, LLC

- General Electric Company

- Tranter, Inc.

Recent Developments (New Product Launch)

- In November 2024, Alfa Laval launched the T25 semi-welded plate heat exchanger, a compact and high-performance solution designed to meet the evolving needs of modern energy systems. As the first in its new series, the T25 offers a range of plate and gasket materials designed for demanding applications.

- In September 2024, Alfa Laval introduced three new heat exchangers at Chillventa 2024, optimized for propane (R290), CO₂ (R744), and ammonia (R717) systems. These advanced heat exchangers cater to residential, commercial, and industrial applications, enhancing efficiency and sustainability across various sectors.

- In February 2024, Danfoss India introduced its innovative Microchannel Heat Exchanger (MCHE) technology at the ACREX India 2024 exhibition. This energy-efficient advancement revolutionizes air-cooled units with its state-of-the-art Next Gen Evaporator, offering significant advantages over conventional fin tube heat exchangers.

- In September 2023, APV, part of SPX FLOW's portfolio of process solutions, introduced the FastFrame Plate Heat Exchanger. Designed for improved usability and durability, this new solution aims to enhance efficiency while reducing operational costs for food and beverage operators.