Market Definition

The market encompasses the ecosystem of organizations, technologies, and services involved in the electronic exchange of healthcare-related information. This includes payers, providers, clearinghouses, and software vendors that facilitate the secure and standardized transfer of medical, administrative, and financial data.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Healthcare EDI Market Overview

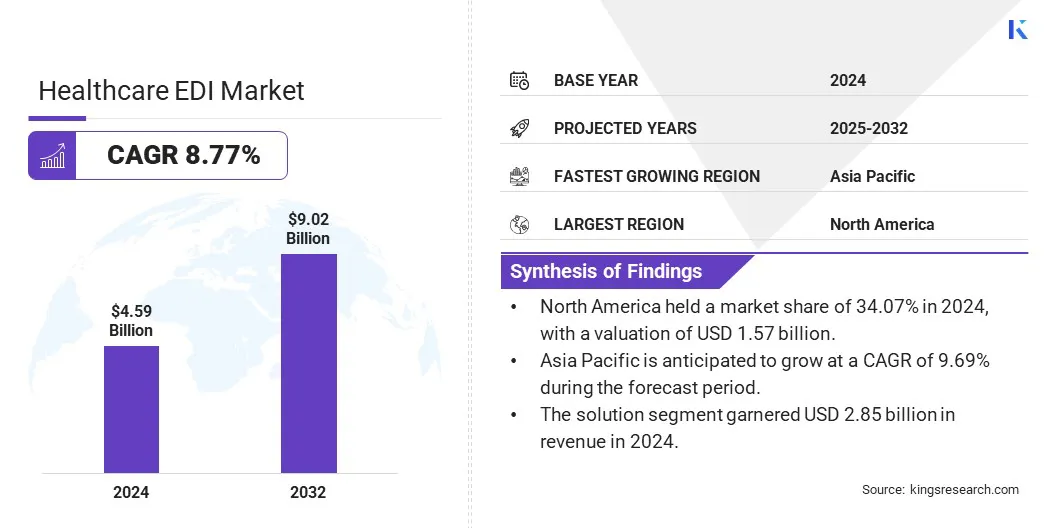

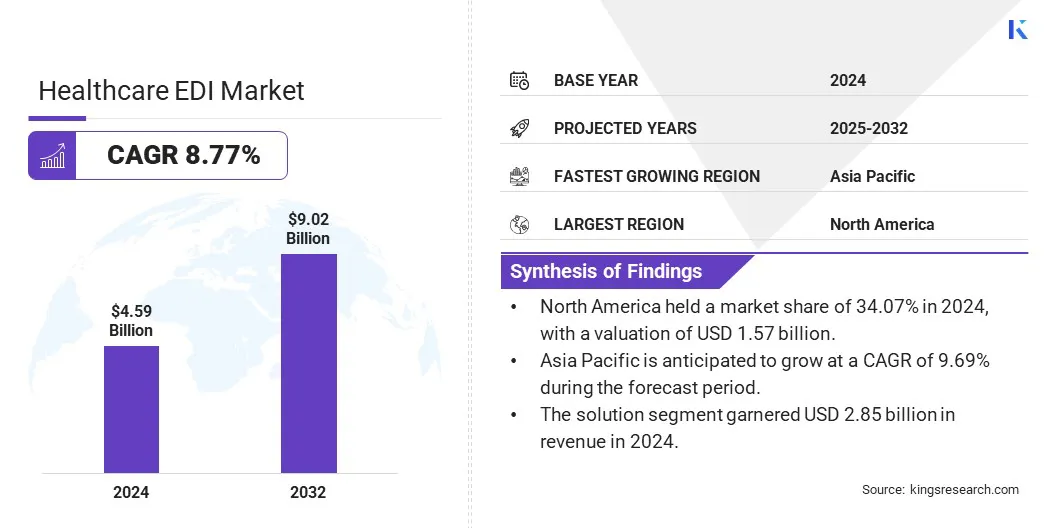

The global healthcare EDI market size was valued at USD 4.59 billion in 2024 and is projected to grow from USD 4.99 billion in 2025 to USD 9.02 billion by 2032, exhibiting a CAGR of 8.77% during the forecast period.

This growth is driven by the increasing demand for streamlined administrative processes and enhanced operational efficiency. Healthcare providers and payers are adopting EDI solutions to automate claims processing, eligibility verification, and payment reconciliation, which reduces errors and accelerates transaction times.

Major companies operating in the healthcare EDI industry are SSI Group, HealthEdge Software, Inc., Epic Systems Corporation, Edifecs, athena, Availity, LLC., Optum, Inc., Infor Healthcare, Avaneer Health, Inc., MCKESSON CORPORATION, Netsmart Technologies, Inc., General Electric Company, NextGen Healthcare Information Systems, Inc., Oracle, and Medical Information Technology, Inc.

The shift toward cloud-based EDI platforms is transforming the market by offering greater scalability, flexibility, and remote accessibility. Integration of emerging technologies such as artificial intelligence is also enhancing the accuracy and speed of data exchange, making EDI systems more intelligent and efficient.

- In April 2025, HealthEdge launched its AI-driven Provider Data Management platform designed to help health payers automate and maintain accurate healthcare provider information. The first deployment of this solution was with PEHP Health & Benefits, a division of the Utah Retirement Systems.

Key Highlights:

- The healthcare EDI market size was recorded at USD 4.59 billion in 2024.

- The market is projected to grow at a CAGR of 8.77% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 1.57 billion.

- The solution segment garnered USD 2.85 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 5.32 billion by 2032.

- The value added network segment is expected to reach USD 3.76 billion by 2032.

- The healthcare providers segment is expected to reach USD 2.54 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.69% during the forecast period.

Market Driver

Rising Demand for Automated Claims Processing

The market is driven by the rising demand for automated claims processing and a reduction in administrative costs. Healthcare providers and payers are adopting EDI solutions to streamline operations, improve accuracy, and minimize manual interventions in billing and reimbursement workflows.

EDI enables faster data exchange between stakeholders, significantly reducing paperwork and processing errors. This not only accelerates claim settlements but also helps organizations cut down on labor costs and operational inefficiencies. As a result, the need for cost-effective administrative solutions is propelling the adoption of EDI across the global healthcare sector, thereby driving market growth.

- In February 2025, EDI Sumo launched an advanced platform aimed at transforming electronic data interchange (EDI) management for health insurance payers. The platform automates 95% of manual tasks, offers real-time transaction monitoring, and tracks service level agreements (SLAs) and performance guarantees (PGs). Designed to enhance operational efficiency and ensure HIPAA compliance, the solution centralizes and standardizes EDI data management, enabling payers to reduce IT dependency and focus on core business functions.

Market Challenge

Data Security Risks from Cyberattacks

A major challenge in the healthcare EDI market is ensuring data security. Sensitive healthcare information is a prime target for cyberattacks, which can lead to significant financial and reputational damage. Compliance with stringent regulatory requirements adds further complexity.

To address this challenge, organizations are adopting robust security measures such as end-to-end encryption and multi-factor authentication. Regular security audits are also conducted to identify vulnerabilities and maintain compliance. These strategies help safeguard data, build stakeholder trust, and minimize the risk of breaches.

Market Trend

Growing Shift Toward Cloud-based EDI Platforms

The market is witnessing a growing shift toward cloud-based EDI platforms. This is due to the growing need for scalable and flexible solutions that can support dynamic healthcare environments.

Cloud-based EDI enables real-time data exchange, remote access, and faster deployment compared to traditional on-premises systems. It reduces the burden of infrastructure maintenance and allows healthcare providers and payers to streamline operations while ensuring data security and compliance.

As organizations continue to modernize their IT ecosystems, cloud-based EDI adoption is expected to accelerate across both developed and emerging markets.

- In June 2024, Oracle introduced the Oracle Health Insurance Data Exchange Cloud Service to help health insurers simplify data exchange and reduce IT costs. The cloud-native solution enables insurers to onboard new data formats quickly, create custom mapping and validation rules, and integrate seamlessly with partners like the Centers for Medicare and Medicaid Services (CMS).

Healthcare EDI Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, Services

|

|

By Deployment

|

On-premises, Web & Cloud-based EDI

|

|

By Transmission

|

Value Added Network, Point to Point EDI, Multi-channel EDI

|

|

By End User

|

Healthcare Providers (Hospitals & Clinics, Ambulatory Surgical Centers, Others), Healthcare Payers (Private Players, Public Players), Medical Device Companies, Pharmaceutical & Biotechnological Companies, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, Services): The solution segment earned USD 2.85 billion in 2024 due to the increasing demand for automated claims management and streamlined administrative workflows.

- By Deployment (On-premises, Web & Cloud-based EDI): The on-premises held 59.85% of the market in 2024, due to greater control over data security and compliance with internal IT policies.

- By Transmission (Value Added Network, Point to Point EDI, Multi-channel EDI): The value added network segment is projected to reach USD 3.76 billion by 2032, owing to its ability to support secure, scalable, and standardized data exchange between multiple healthcare entities.

- By End User (Healthcare Providers, Healthcare Payers, Medical Device Companies, Pharmaceutical & Biotechnological Companies, Others): The healthcare providers segment is projected to reach USD 2.54 billion by 2032, owing to the rising adoption of EDI platforms to reduce billing errors and improve operational efficiency.

Healthcare EDI Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America healthcare EDI market share stood at around 34.07% in 2024 in the global market, with a valuation of USD 1.57 billion. This dominance is attributed to the presence of well-established healthcare infrastructure, widespread adoption of digital health technologies, and regulatory mandates like the Health Insurance Portability and Accountability Act (HIPAA) that promote standardized electronic transactions.

High Electronic Health Record (EHR) penetration and the presence of major EDI vendors are further increasing the adoption of healthcare EDI solutions across the region.

- In February 2025, Availity launched its Rapid Recovery model to enhance cybersecurity and resiliency in healthcare. Developed in response to the 2024 ransomware attack on Change Healthcare, the model uses technology trusted by critical U.S. infrastructure sectors like finance and defense. This solution ensures rapid restoration of healthcare operations after cyber attacks to maintain critical services without downtime.

Asia Pacific is poised to grow at a significant growth at a CAGR of 9.69% over the forecast period. The growth is due to increasing government initiatives to digitize healthcare systems, expanding healthcare infrastructure, and rising awareness about the benefits of EDI in reducing administrative workload.

The region is seeing rapid adoption of cloud-based solutions and growing investments in health information technology, particularly in emerging economies such as India and China.

Regulatory Frameworks

- In the U.S., the market operates under the Health Insurance Portability and Accountability Act (HIPAA), which mandates the use of standardized electronic transactions for claims, eligibility, payment, and other administrative processes.

- In Europe, the General Data Protection Regulation (GDPR) governs the handling of personal health information, requiring secure and compliant data exchange practices.

Competitive Landscape

The key players in the healthcare EDI market are focusing on expanding cloud-based EDI solutions to offer scalable and secure infrastructure for healthcare providers and payers. Many are investing in AI and machine learning to automate claim processing and detect anomalies in real-time.

Companies are also offering end-to-end integration services that connect EDI systems with electronic health records and revenue cycle management platforms.

Companies are emphasizing compliance-driven features and offer specialized support to align with national data protection laws. Subscription-based pricing models and modular solutions are being used to target both large institutions and smaller healthcare facilities.

- In May 2024, Avaneer Health launched Avaneer Coverage Direct, a solution delivering real-time, accurate health insurance coverage information to payers and providers. The platform uses a decentralized, peer-to-peer network to reduce operational costs and improve the patient experience. It enables proactive updates and enhanced discovery of insurance coverage, helping to streamline claims management and minimize administrative complexities.

List of Key Companies in Healthcare EDI Market:

- SSI Group

- HealthEdge Software, Inc.

- Epic Systems Corporation

- Edifecs

- athena

- Availity, LLC.

- Optum, Inc.

- Infor Healthcare

- Avaneer Health, Inc.

- MCKESSON CORPORATION

- Netsmart Technologies, Inc.

- General Electric Company

- NextGen Healthcare Information Systems, Inc.

- Oracle

- Medical Information Technology, Inc.

Recent Developments (Partnerships)

- In September 2024, Edifecs and HealthEdge entered a strategic partnership to integrate Edifecs’ EDI Gateway with HealthEdge’s HealthRules Payer claims adjudication system. The collaboration aims to simplify healthcare data exchange for payers, improve operational efficiency, and reduce the total cost of ownership.