Market Definition

The market encompasses the processes, solutions, and services of handling medical insurance claims from submission to reimbursement. It comprises software platforms, automation tools, and third-party services that streamline claims processing, reduce errors, ensure compliance with regulations, and enhance payment accuracy.

The market serves healthcare providers, payers, and insurance companies, aiming to optimize revenue cycles, minimize claim denials, and improve operational efficiency in the healthcare reimbursement ecosystem. This report focuses on the key factors that fuel the market, while offering a detailed regional analysis and an overview of the competitive landscape that shapes future possibilities.

Healthcare Claims Management Market Overview

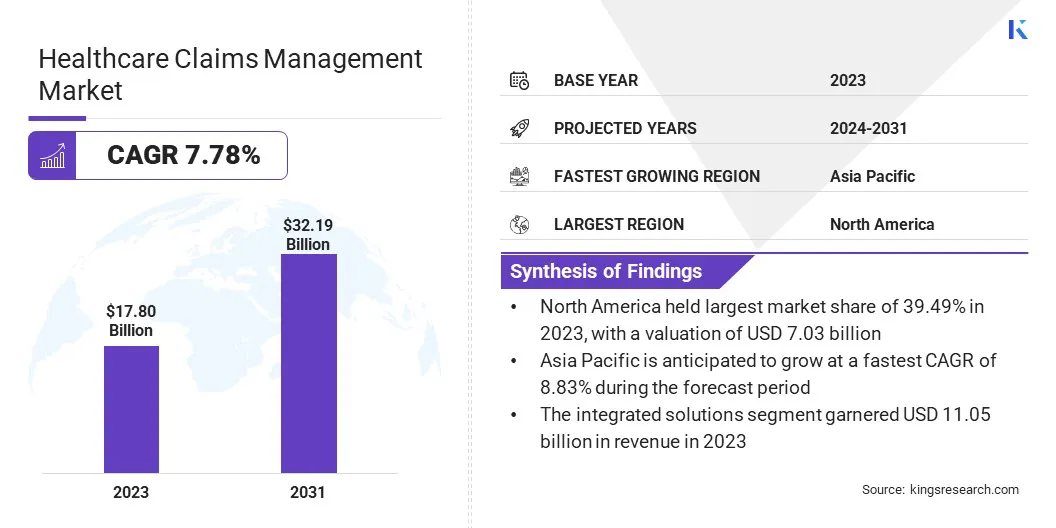

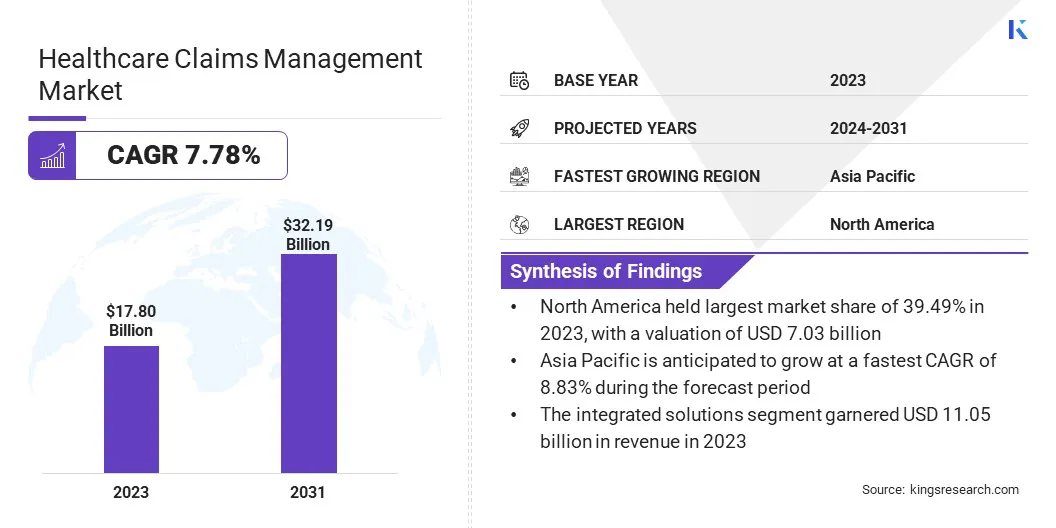

According to Kings Research, the global healthcare claims management market size was valued at USD 17.80 billion in 2023 and is projected to grow from USD 19.05 billion in 2024 to USD 32.19 billion by 2031, exhibiting a CAGR of 7.78% during the forecast period.

This market is registering significant growth, driven by increasing healthcare expenditures, rising insurance coverage, and the adoption of advanced digital solutions. The demand for automated claims processing is growing as healthcare providers and insurers seek to improve efficiency, reduce administrative costs, and enhance patient satisfaction.

The integration of Artificial Intelligence (AI), Machine Learning (ML), and cloud-based solutions is transforming the market by enabling faster processing, reducing errors, and ensuring regulatory compliance.

Key Market Highlights:

- The healthcare claims management industry size was valued at USD 17.80 billion in 2023.

- The market is projected to grow at a CAGR of 7.78% from 2024 to 2031.

- North America held a market share of 39.49% in 2023, with a valuation of USD 7.03 billion.

- The software segment garnered USD 11.05 billion in revenue in 2023.

- The integrated solutions segment is expected to reach USD 21.53 billion by 2031.

- The cloud-based segment is expected to reach USD 18.56 billion by 2031.

- The healthcare payers segment is expected to reach USD 15.78 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.83% during the forecast period.

Major companies operating in the healthcare claims management industry are athenahealth, Inc. , MCKESSON CORPORATION, CareCloud, Inc., Oracle, eClinicalWorks, Experian Information Solutions, Inc., Optum, Inc., Genpact, Tebra Technologies, Inc, Conduent, Inc., Veradigm LLC, PLEXIS Healthcare Systems, RAM Technologies, Inc., Quadax, Inc., and Waystar.

Additionally, the growing prevalence of health insurance, combined with a rise in the number of healthcare claims, is fueling the demand for robust claims management solutions. Additionally, the rise of outsourcing claims processed by healthcare providers and payers is contributing to the market growth.

- In October 2024, Oracle Health launched Clinical Data Exchange, a cloud-based solution on Oracle Cloud Infrastructure (OCI) to streamline medical claims processing. The platform enables an automated and secure data exchange between healthcare providers and payers, manual processes, administrative costs, and reimbursement delays.

Rising Costs and Operational Challenges

The market is driven by growing healthcare costs and increasing focus on operational efficiency. Factors like aging populations, advanced medical technologies, higher demand for services and healthcare organizations are facing an increase in financial pressures as healthcare expenses continue to rise.

This makes the claims management processes more crucial, as inefficiencies can further inflate costs. Efficient claims management helps in making sure that healthcare providers and payers can maintain profitability and operational sustainability, even with rising expenditures. Additionally, the rise of claim denials and payment delays is an enduring problem in the healthcare system.

Denied claims occur when insurance providers fail to approve claims on account of errors, incomplete documentation, and eligibility issues, which leads to delayed payments for providers. This not only affects cash flow but also increases administrative costs associated with the resubmitting and appealing of denied claims.

The results can lead to a backlog of claims, further impacting financial stability and patient satisfaction. As a result, healthcare organizations are seeking technologies that can improve the accuracy of claims submissions, reduce manual errors, and streamline the approval process to fasten reimbursement cycles and minimize the operational burden.

- In December 2024, the U.S. healthcare spending grew by 7.5%, reaching USD 4.9 trillion, or USD 14,570 per person, accounting for 17.6% of the nation's GDP. This data, provided by the Centers for Medicare & Medicaid Services (CMS), tracks spending on healthcare goods, services, public health, government administration, and health insurance.

Claim Denials and Payment Delays

A major challenge in the healthcare claims management market is the high rate of claim denials and payment delays. Claims can be denied for various reasons, including errors in data entry, incomplete or inaccurate documentation, coding mistakes, and issues related to patient eligibility or benefits.

In some cases, insurance providers may reject claims if they are unable to meet the payer’s specific criteria. These denials lead to delayed payments for healthcare providers, which can cause significant problems in cash flow. The time and effort required for resolving denied claims places an additional burden on healthcare organizations.

Providers often need to invest significant resources in reviewing, correcting, and resubmitting claims, which leads to an increase in administrative costs.

Moreover, if claims are not corrected promptly, they can remain unresolved, resulting in a backlog that will further delay reimbursements. This extended timeline for receiving payments can create financial strain for providers and negatively impact the overall patient experience, as delays can affect the availability of services.

Implementing automated systems powered by AI and ML can help reduce human error and ensure that claims are submitted with accuracy and complete documentation.

Rising Integration of AI and ML

The market is witnessing multiple trends, particularly an increase in the use of AI and ML for claims processing. These technologies are used for automating and optimizing various stages of the claims lifecycle.

AI and ML can enhance the accuracy and speed of claims processing by identifying patterns, detecting anomalies, and predicting potential issues before they escalate, thus improving operational efficiency and reducing manual errors.

Another significant trend is the shift toward end-to-end integrated claims management solutions. Healthcare organizations are moving away from fragmented systems and opting for unified platforms that streamline the entire claims process.

These solutions enable seamless communication between stakeholders, improve data accuracy, and reduced operational silos, ultimately leading to faster claim resolutions and improved financial outcomes. The shift toward integrated systems, combined with AI and ML, is transforming the healthcare claims management landscape, offering more efficient, accurate, and cost-effective solutions.

- In February 2023, Experian Health launched AI Advantage, an AI-powered solution designed to reduce healthcare claim denials and optimize reimbursement processes. The solution includes Predictive Denials, which analyzes claims before submission to prevent avoidable denials, and Denial Triage, which prioritizes re-submissions based on the likelihood of successful appeals. AI Advantage enhances claims accuracy, reduces administrative burden, and improves revenue recovery for healthcare providers.

Healthcare Claims Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services

|

|

By Type

|

Integrated Solutions, Standalone Solutions

|

|

By Delivery Mode

|

On-premise, Cloud-based

|

|

By End User

|

Healthcare Payers, Healthcare Providers, Other End Users

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software, Services): The software segment earned USD 11.05 billion in 2023, due to its increasing adoption of data management and analytics in healthcare.

- By Type (Integrated Solutions, Standalone Solutions): The integrated solutions segment held 65.48% share of the market in 2023, due to their seamless interoperability and enhanced efficiency.

- By Delivery Mode (On-premise, Cloud-based): The cloud-based segment is projected to reach USD 18.56 billion by 2031, owing to its scalability, cost-effectiveness, and remote accessibility.

- By End User (Healthcare Payers, Healthcare Providers, Other End Users): The healthcare payers segment is projected to reach USD 15.78 billion by 2031, due to the growing demand for advanced claims processing and risk assessment solutions.

Healthcare Claims Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 39.49% share of the healthcare claims management market in 2023, with a valuation of USD 7.03 billion. The region's dominance is driven by the extensive use of advanced healthcare IT solutions, the presence of key market players, and the high volume of healthcare transactions.

The rising demand for automated claims processing to cut down operational costs and improve efficiency has further contributed to the market growth. Additionally, the increasing use of cloud-based and AI-driven claims management solutions by healthcare providers and insurers has enhanced accuracy and streamlined workflows.

The widespread integration of Electronic Health Records (EHRs) and predictive analytics for fraud detection also plays a crucial role in boosting operational efficiency. The growing emphasis on minimizing administrative burdens and accelerating reimbursement cycles further supports the expansion of the market in North America.

The market in Asia Pacific is expected to register rapid growth, with a projected CAGR of 8.83% over the forecast period. This growth is driven by rapid healthcare digitalization, rising healthcare expenditures, and a growing number of insured individuals.

The increasing adoption of cloud-based healthcare solutions and AI-driven automation is improving claims processing efficiency, reducing errors, and minimizing delays. Additionally, the expansion of private healthcare providers and insurance companies in emerging economies is driving the demand for advanced claims management solutions.

The rising penetration of health insurance in countries like China, India, and Japan is further fueling the need for efficient claims processing systems. Moreover, increasing investments in healthcare infrastructure and IT modernization across the region are accelerating the adoption of automated claims management platforms, facilitating smoother operations and cost reductions.

- In August 2024, the Government of India launched the National Health Claims Exchange (NHCX) under the Ayushman Bharat Digital Mission (ABDM) to streamline health insurance claim processing. Supported by the Insurance Regulatory and Development Authority of India (IRDAI) and the General Insurance Council (GIC), NHCX enhances efficiency and transparency.

Regulatory Frameworks

- In the U.S., healthcare claims management is regulated under the Health Insurance Portability and Accountability Act (HIPAA), which mandates data privacy and security, and the Affordable Care Act (ACA), which enforces claim processing standards. The Centers for Medicare & Medicaid Services (CMS) oversee compliance for public healthcare programs.

- In the European Union (EU), claims management must comply with the General Data Protection Regulation (GDPR) for patient data security and the Insurance Distribution Directive (IDD) for insurance-related claims.

- In China, the National Healthcare Security Administration (NHSA) regulates healthcare claims under the Basic Medical Insurance (BMI) system, with the supervision of reimbursement policies and fraud prevention.

- In Japan, the Ministry of Health and Labour and Welfare (MHLW) oversee claims processing under the National Health Insurance (NHI) Act, ensuring proper reimbursement and fraud monitoring.

- In India, the Insurance Regulatory and Development Authority of India (IRDAI) regulates health insurance claims under the Health Insurance Regulations, 2016, while the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana governs claims in public health insurance schemes.

Competitive Landscape

The healthcare claims management industry is characterized by players focusing on strategic initiatives to strengthen their market presence. Companies are heavily investing in advanced technologies such as AI, ML, and automation to enhance claims processing efficiency and accuracy.

Many firms are expanding their cloud-based solutions to offer scalable and flexible platforms that cater to the evolving needs of healthcare providers and payers. Strategic partnerships and collaborations with healthcare organizations, insurance companies, and technology firms are common approaches for improving service offerings and expanding market reach.

Additionally, mergers and acquisitions are being pursued to enhance technological capabilities and gain a competitive edge. Companies are prioritizing compliance with evolving regulatory requirements by integrating advanced analytics and fraud detection tools in their solutions.

Furthermore, the adoption of outsourcing services and business process automation is increasing as firms seek to optimize operational efficiency and reduce administrative costs. These strategies are shaping the competitive landscape of the market.

- In October 2024, ClarisHealth and Expion Health announced their strategic partnership through an integration agreement. The partnership focused on enhancing out-of-network (OON) claims management capabilities on the Pareo platform, using Expion Health's proprietary technology to detect and avoid claims overpayments using advanced data analytics, predictive modeling, and ML.

Key Companies in Healthcare Claims Management Market:

- athenahealth, Inc.

- MCKESSON CORPORATION

- CareCloud, Inc.

- Oracle

- eClinicalWorks

- Experian Information Solutions, Inc.

- Optum, Inc.

- Genpact

- Tebra Technologies, Inc

- Conduent, Inc.

- Veradigm LLC

- PLEXIS Healthcare Systems

- RAM Technologies, Inc.

- Quadax, Inc.

- Waystar

Recent Developments (Partnerships/Product Launches)

- In February 2025, MDI NetworX and WLT Software announced their partnership to revolutionize the process of end-to-end claims. The partnership aimed to streamline claims processing, reduce turnaround times, and enhance overall satisfaction by combining MDI NetworX's expertise in digital mailroom management, data capture, and workflow automation with WLT Software’s MediClaims payment platform.

- In October 2024, Prudential plc partnered with Google Cloud to discover the use of Generative AI in medical claims processing. Prudential is using Google’s MedLM, an AI model fine-tuned for healthcare, for analyzing and summarizing claim-related documents, including medical reports and invoices. Initial tests proved that MedLM doubles automation rates and improves claims accuracy and efficiency, enabling faster approvals and pay-outs while maintaining the supervision of humans in decision-making.

- In October 2024, Infinx announced the launch of its Intelligent Revenue Cycle Automation Platform. The platform combines AI-powered automation, including generative AI and ML, to address key healthcare challenges like claim denials, payment delays, and staff shortages, with the aim of streamlining revenue cycle operations like claims processing, prior authorizations, and eligibility verification.