Healthcare Business Intelligence Market Overview

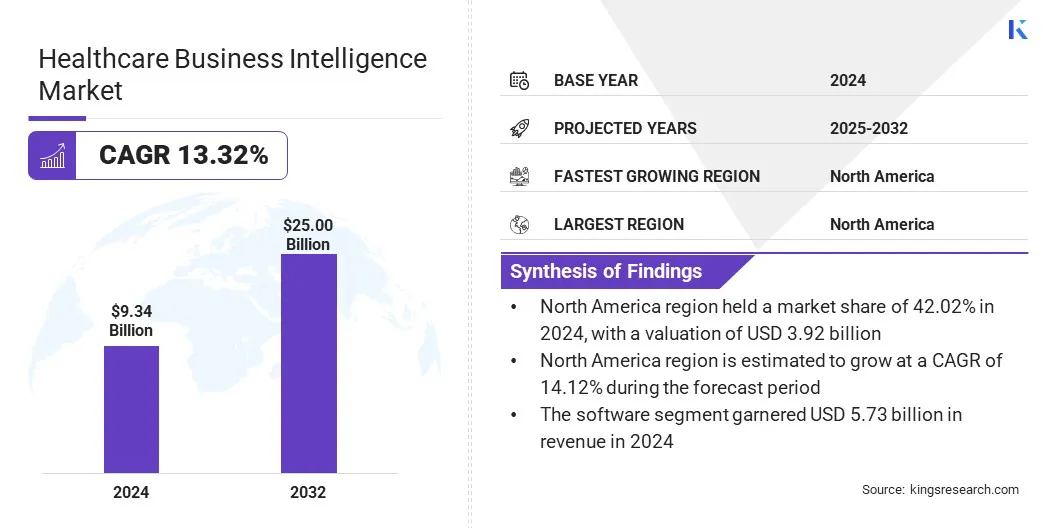

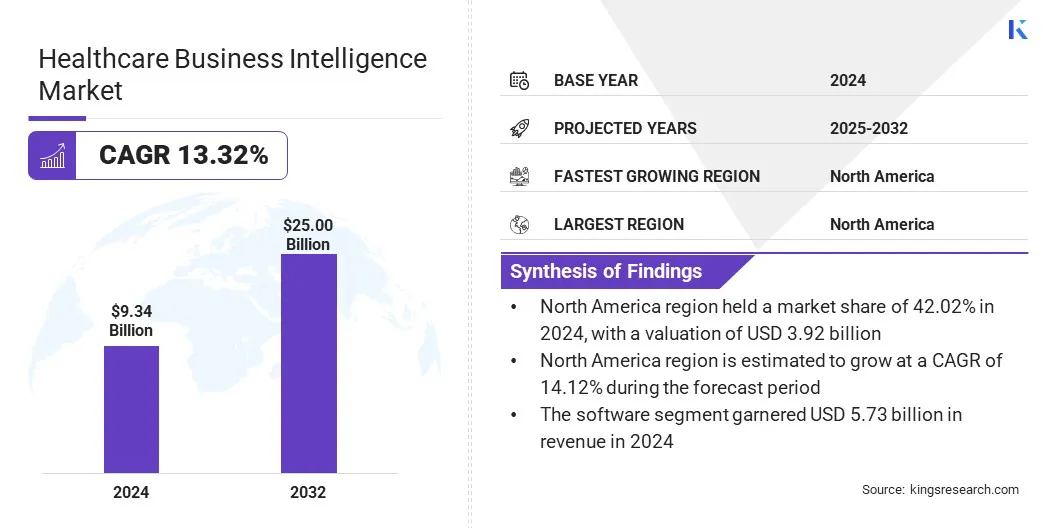

According to Kings Research, the global healthcare business intelligence market size was valued at USD 9.34 billion in 2024 and is projected to grow from USD 10.42 billion in 2025 to USD 25.00 billion by 2032, exhibiting a CAGR of 13.32% during the forecast period.

The market is expanding with the increased adoption of cloud-based Electronic Health Record (EHR) solutions and AI integration in clinical workflows to improve operational efficiency and decision-making. Simultaneously, intelligent tools in urgent care centers further streamline revenue cycle management and enhance care delivery.

Major companies operating in the healthcare business intelligence industry are Microsoft, IBM, Oracle, SAP SE, SAS Institute Inc., Salesforce, Inc., MicroStrategy Incorporated, QlikTech International AB, Cloud Software Group, Inc., Sisense Ltd., Idera, Inc., Perficient Inc, Infor, Domo, Inc., and Top Group Company.

Key Market Highlights:

- The healthcare business intelligence industry size was valued at USD 9.34 billion in 2024.

- The market is projected to grow at a CAGR of 13.32% from 2025 to 2032.

- North America held a market share of 42.02% in 2024, with a valuation of USD 3.92 billion.

- The software segment garnered USD 5.73 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 12.19 billion by 2032.

- The predictive analytics segment is anticipated to register a CAGR of 15.68% during the forecast period.

- The financial analysis segment held a market share of 27.90% in 2024.

- The healthcare providers segment is estimated to grow at a share of 49.17% by 2032.

- The market in Europe is anticipated to grow at a CAGR of 13.23% during the forecast period.

The market is driven by the rising demand for data-driven decision-making to improve patient outcomes. Advanced AI technologies are being used to extract, analyze, and deliver clinically validated insights directly into provider workflows. These tools help transform complex patient data into actionable information, enabling personalized treatment strategies and faster clinical decisions.

By bridging the gap between raw data and real-time application, BI solutions are empowering healthcare professionals to enhance care quality and achieve better health outcomes.

- In January 2025, Atropos Health and xCures partnered to advance data-driven decision-making in healthcare by integrating AI with Real-world Evidence (RWE). Leveraging the Atropos Evidence Network and xCures Platform, they aim to deliver validated, source-verified insights from clinical data directly into workflows. This collaboration enhances clinical decision-making, enabling personalized, outcome-focused care through faster, evidence-based treatment strategies.

Rising Demand for Cloud-based EHR Solutions

The healthcare business intelligence market is driven by the rising demand for cloud-based EHR solutions that offer high performance, scalability, and advanced security. These platforms support seamless integration with various healthcare applications, enabling real-time data access and efficient information exchange.

Cloud-based systems automate routine tasks, enhance clinical decision-making, and simplify regulatory compliance by embedding AI into clinical workflows. This shift helps healthcare providers optimize operations, reduce IT infrastructure costs, and accelerate the adoption of data-driven, value-based care models.

- In October 2024, Oracle launched its next-generation EHR, built on Oracle Cloud Infrastructure to integrate AI across clinical workflows. With seamless integration across Oracle Health applications, it streamlines payer-provider collaboration, supports clinical trials, ensures compliance, improves financial outcomes, and promotes value-based care adoption.

The healthcare business intelligence market faces a major challenge in integrating modern BI tools with legacy systems. Many healthcare institutions still rely on outdated software and infrastructure that lack compatibility with advanced analytics platforms. This leads to data silos, inefficiencies, and increased costs in data migration and system upgrades. The lack of seamless integration hampers real-time data access and slows decision-making processes.

Companies are developing middleware solutions, adopting open APIs, and investing in cloud-based platforms that support interoperability. These strategies enable smoother data exchange and gradual modernization without disrupting the existing workflow.

The trend integrating intelligent tools in urgent care centers is growing in the healthcare business intelligence market. These AI-powered solutions are enhancing revenue cycle management by automating medical coding, improving accuracy, and accelerating reimbursement processes.

This trend supports increased efficiency, better financial performance, and data-informed decision-making, reflecting a broader industry move toward technology-driven, value-based care models in fast-paced clinical environments.

- In August 2024, Exdion Health launched ProMaxAI, an AI-powered solution designed to transform medical coding and reimbursement processes. Targeting urgent care centers, the tool enhances the company’s revenue cycle management suite by automating complex coding tasks. This launch supports healthcare providers in streamlining operations, increasing coding accuracy, accelerating reimbursements, and ultimately improving overall financial performance and profitability.

Healthcare Business Intelligence Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services, Hardware

|

|

By Deployment Model

|

Cloud-based, On-premise, Hybrid

|

|

By Functionality

|

Query & Reporting Tools, OLAP, Predictive Analytics, Performance Management Tools, Real-time Analytics

|

|

By Application

|

Financial Analysis, Clinical Analysis, Operational & Performance Analysis, Strategic Planning & Forecasting, Regulatory Reporting & Compliance

|

|

By End User

|

Healthcare Providers, Payers & Insurers, Pharmaceutical & Life Sciences , Academic & Research Institutions, Government & Public Health Agencies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software, Services, and Hardware): The software segment earned USD 5.73 billion in 2024, due to the increasing adoption of advanced analytics platforms that enable real-time, data-driven clinical and operational decision-making.

- By Deployment Model (Cloud-based, On-premise, and Hybrid): The cloud-based segment held 52.80% share of the market in 2024, due to its scalability, cost-efficiency, and ability to support remote access and real-time data integration across healthcare systems.

- By Functionality (Query & Reporting Tools, OLAP, Predictive Analytics, Performance Management Tools, and Real-time Analytics): The predictive analytics segment is projected to reach USD 8.52 billion by 2032, due to the growing demand for proactive healthcare solutions that anticipate patient risks and optimize treatment outcomes through advanced data modeling.

- By Application (Financial Analysis, Clinical Analysis, Operational & Performance Analysis, Strategic Planning & Forecasting, and Regulatory Reporting & Compliance): The operational & performance analysis segment is expected to grow at a CAGR of 14.55% during the forecast period, due to increasing pressure on healthcare providers to enhance efficiency, reduce costs, and improve resource utilization through data-driven insights.

- By End User (Healthcare Providers, Payers & Insurers, Pharmaceutical & Life Sciences , Academic & Research Institutions, and Government & Public Health Agencies): The healthcare providers segment is estimated to hold a market share of 17% in 2032, due to the rising adoption of BI tools to support clinical decision-making, streamline operations, and improve patient care delivery.

Healthcare Business Intelligence Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a market share of around 42.02% in 2024, with a valuation of USD 3.92 billion. The region dominates the healthcare business intelligence market, due to its advanced digital infrastructure and strong focus on AI-driven analytics solutions that streamline data integration and accelerate insight generation.

This technological edge enhances decision-making across clinical, operational, and commercial functions, supporting precision strategies in life sciences. Moreover, the ability to unify fragmented datasets into actionable intelligence positions North America as a leader in adopting next-generation BI tools tailored for healthcare, driving greater efficiency and responsiveness to evolving market needs.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-driven platform that consolidates diverse datasets into a unified analytics workbench. The solution enables faster, multidisciplinary insight generation, seamlessly integrates with existing health applications, and supports life sciences organizations in identifying market needs.

The healthcare business intelligence industry in Europe is poised to grow at a CAGR of 13.23% over the forecast period. The market in Europe is driven by the rising demand for value-based care models that require real-time performance analytics to improve patient outcomes and reduce costs.

Additionally, stringent regulatory frameworks are encouraging the adoption of compliant data management solutions, prompting healthcare providers to invest in advanced BI platforms. These factors collectively support the region’s shift toward data-informed decision-making, fostering greater operational transparency and efficiency across hospitals, research institutions, and public health systems.

Regulatory Frameworks

- In the U.S., the Department of Health and Human Services (HHS) regulates healthcare business intelligence through enforcement of healthcare data privacy, security, and compliance standards, primarily under the Health Insurance Portability and Accountability Act (HIPAA).

- In India, the Ministry of Health and Family Welfare (MoHFW) and National Health Authority (NHA) regulate healthcare BI by setting standards for data use, privacy, and interoperability under frameworks like the Ayushman Bharat Digital Mission and healthcare IT guidelines.

- In Japan, healthcare BI is regulated by the Personal Information Protection Commission (PPC), which enforces the Act on the Protection of Personal Information (APPI), overseeing the handling, anonymization, and secure use of personal and sensitive medical data.

Competitive Landscape

Companies in the healthcare business intelligence industry are actively pursuing strategic initiatives such as mergers, acquisitions, partnerships, and product launches to strengthen their market position. Key players are investing in AI-driven platforms, expanding data integration capabilities, and launching cloud-based analytics tools.

These actions reflect a competitive push to enhance technological capabilities, broaden solution portfolios, and capture a larger share of the evolving healthcare analytics landscape. The market is registering continuous innovation as organizations align with emerging digital transformation trends.

- In January 2025, Clarivate launched DRG Fusion, a healthcare business intelligence platform designed for life sciences. By integrating real-world medical and pharmacy claims data, Fusion enables biopharma and medtech companies to overcome data fragmentation and competitive pressures. With configurable dashboards and modular analytics, it supports patient journey analysis, market access strategies, and commercial optimization, enhancing decision-making across sales, marketing, and product positioning.

Key Companies in Healthcare Business Intelligence Market:

- Microsoft

- IBM

- Oracle

- SAP SE

- SAS Institute Inc.

- Salesforce, Inc.

- MicroStrategy Incorporated

- QlikTech International AB

- Cloud Software Group, Inc.

- Sisense Ltd.

- Idera, Inc.

- Perficient Inc,

- Infor

- Domo, Inc.

- Top Group Company

Recent Developments (Product Launch)

- In May 2025, Innovaccer launched Innovaccer Gravity, a cloud-agnostic healthcare intelligence platform that unifies enterprise data across EHRs, claims, operations, finance, and more into a single source of truth. With built-in security and 400+ connectors, it enhances interoperability, supports AI-driven insights, reduces total cost of ownership, and enables healthcare organizations to improve care delivery, operational efficiency, and financial outcomes.

- In March 2025, Cotiviti acquired Edifecs to strengthen its healthcare business intelligence capabilities. The acquisition enhances Cotiviti’s position in advancing healthcare data analytics and interoperability. By combining technologies, the company aims to accelerate innovation in value-based care solutions, improve data integration across systems, and support more informed decision-making to enhance healthcare delivery and patient outcomes.

- In September 2023, Komodo Health launched MapLab, an all-in-one platform enabling healthcare and life sciences companies to generate actionable insights into disease trends, treatment pathways, and patient populations. By unifying real-world data, advanced analytics, and generative AI tools, MapLab streamlines enterprise-wide insight generation, addressing inefficiencies caused by fragmented data sources and generic BI tools, and accelerating the delivery of therapies to patients in need.