Market Definition

The market encompasses the production, distribution, and application of graphene-based nanomaterials across various industries, including electronics, energy storage, automotive, aerospace, and coatings.

Key participants include manufacturers, suppliers, and research institutions focused on enhancing properties and expanding commercial applications. Market growth is driven by increasing demand for lightweight, high-strength, and conductive materials, along with advancements in nanotechnology and material science.

Graphene nanoplatelets Market Overview

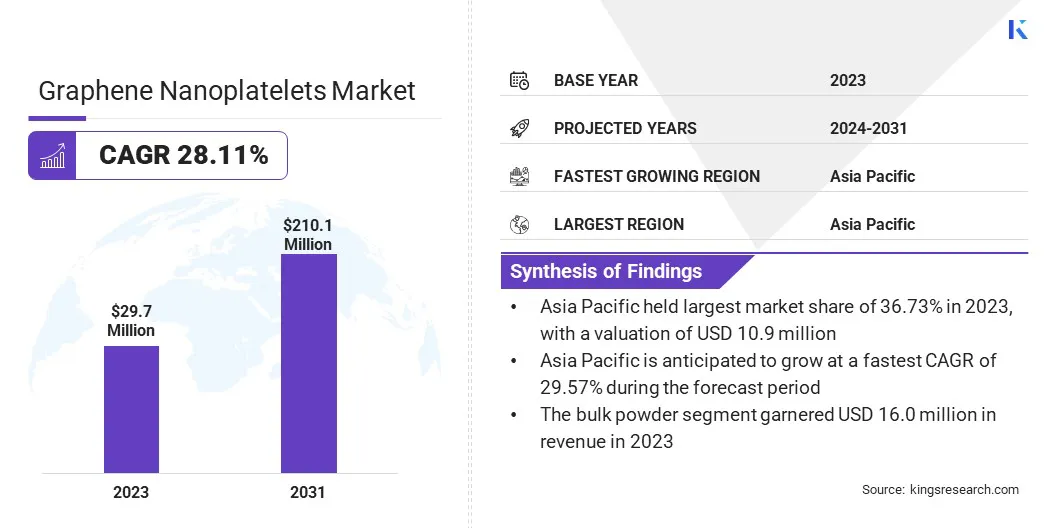

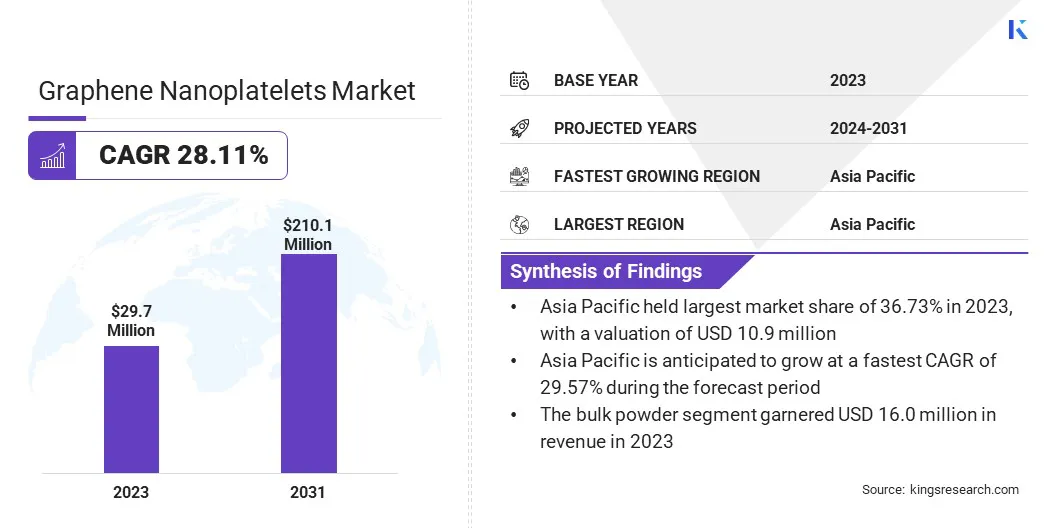

The global graphene nanoplatelets market size was valued at USD 29.7 million in 2023 and is projected to grow from USD 37.1 million in 2024 to USD 210.1 million by 2031, exhibiting a CAGR of 28.11% during the forecast period.

This growth is fueled by the rising demand for advanced materials with superior mechanical, thermal, and electrical properties. The expanding use of graphene nanoplatelets in energy storage devices, including batteries and supercapacitors, is further boosting this expansion.

Additionally, their adoption in the automotive and aerospace sectors enhances fuel efficiency, durability, and performance. Their lightweight nature and superior conductivity further expand applications in electronics, thermal management, and structural reinforcement.

Major companies operating in the graphene nanoplatelets industry are Directa Plus S.p.A., First Graphene, Applied Graphene Materials, NanoXplore Inc., Merck KGaA, ACS Material LLC, BeDimensional, Thomas Swan & Co. Ltd., Ahlatcı Holding, Techinstro, CD Bioparticles, Otto Chemie Pvt. Ltd., Ossila, CTI Materials, and Nanographenex.

Continuous advancements in nanomaterial engineering, coupled with growing investments in research and development, are further accelerating market expansion. Additionally, the demand for sustainable, high-performance materials in coatings, polymers, and conductive inks is fostering commercialization. Industry collaborations and advanecments in next-generation material innovations are expected to propel market expansion in the coming years.

Key Highlights:

- The graphene nanoplatelets industry size was valued at USD 29.7 million in 2023.

- The market is projected to grow at a CAGR of 28.11% from 2024 to 2031.

- Asia Pacific held a share of 36.73% in 2023, valued at USD 10.9 million.

- The bulk powder segment garnered USD 16.0 million in revenue in 2023.

- The composites segment is expected to reach USD 101.6 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 27.20% during the forecast period.

Market Driver

"Rising Demand for Advanced Composites"

The graphene nanoplatelets market is witnessing substantial growth, primarily fueled by the rising demand for advanced composites and their increasing utilization in energy storage applications.

These nanoplatelets are widely interated into aerospace, automotive, and construction materials due to their ability to improve mechanical strength, thermal stability, and electrical conductivity. These nanoplatelets enhance the flexural and tensile properties of composite materials, making them stronger, more durable, and resistant to wear and corrosion.

Additionally, their lightweight nature contributes to weight reduction in components, supporting fuel efficiency in vehicles and aircraft. As industries prioritize high-performance materials with enhanced durability, the adoption of graphene nanoplatelets in composites continues to expand.

Market growth is further propelled by the increasing use of graphene nanoplatelets in energy storage applications, including batteries, supercapacitors, and fuel cells. Their superior electrical conductivity enables faster charge-discharge cycles and improved energy density, essential for next-generation storage solutions.

Additionally, graphene nanoplatelets reduce internal resistance and enhance thermal management, improving battery lifespan and better efficiency. With increasing global energy demands and a focus on renewable energy integration and electric vehicle development, these materials are key to advancing high-performance, sustainable energy storage.

Market Challenge

"Ensuring Uniform Dispersion"

A major challenge influencing the graphene nanoplatelets market is the ensuring uniform dispersion and integration into various materials. Due to their high surface energy and strong intermolecular forces, graphene nanoplatelets tend to agglomerate, forming clusters instead of dispersing evenly in host materials such as polymers, resins, coatings, and composites.

This aggregation compromises the material's ability to enhance mechanical strength, electrical conductivity, and thermal performance. The issue is particularly significant in high-performance applications such as automotive, aerospace, energy storage, and electronics, where consistent material properties are essential.

Poor dispersion of graphene nanoplatelets can weaken composites, reduce conductivity in energy storage devices, and compromised protective coatings, limiting their commercial viability.

This challenge can be addressed through the development of functionalized graphene nanoplatelets with modified surface chemistry to improve their compatibility and interaction with different matrices. Functionalization techniques reduce agglomeration and enhance dispersion, ensuring that the nanoplatelets remain evenly distributed in the host material.

Market Trend

"Advancements in Functionalization and High-Performance Coatings"

The graphene nanoplatelets market is evolving rapidly, propelled by key advancements in functionalized graphene nanoplatelets and their growing adoption in high-performance coatings and paints.

Surface modifications to improve dispersion and compatibility with various matrices, improving mechanical strength, conductivity, and chemical resistance. As a result, industries such as electronics, aerospace, and coatings are integrating these materials to optimize performance and durability.

Additionally, the use of graphene nanoplatelets in coatings and paints is rapidly expanding due to their exceptional barrier properties, anti-corrosion characteristics, and electrical conductivity.

Industries such as automotive, marine, and construction are incorporating graphene nanoplatelets into protective coatings to enhance scratch resistance, UV stability, and moisture protection. Furthermore, their use in conductive and anti-static coatings for electronics is further driving demand.

Graphene nanoplatelets Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Form

|

Bulk Powder, Dispersions

|

|

By Application

|

Composites, Energy Storage, Conductive Inks and Coatings, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Form (Bulk Powder and Dispersions): The bulk powder segment earned USD 16.0 million in 2023 due to its high demand in industrial applications, ease of handling, and cost-effectiveness in large-scale production.

- By Application (Composites, Energy Storage, Conductive Inks and Coatings, Electronics, and Others): The composites segment held a share of 35.33% in 2023, fueled by the growing use of graphene nanoplatelets in enhancing the strength, conductivity, and thermal stability of polymer-based and structural materials.

Graphene Nanoplatelets Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific graphene nanoplatelets market accounted for a substantial share of 36.73% in 2023, valued at USD 10.9 million. This dominance is reinforced by the region’s strong manufacturing base, rapid industrialization, and increasing demand for advanced materials across key industries such as electronics, automotive, aerospace, and energy storage.

Countries such as China, Japan, and South Korea are at the forefront of graphene nanoplatelets adoption, benefiting from robust government support, extensive research initiatives, and a well-established supply chain for nanomaterials.

Additionally, the expanding electric vehicle (EV) industry in the region has contributed to increased demand for graphene nanoplatelets in batteries, composites, and lightweight materials.

A robust electronics sector, propelled by the surging adoption of graphene-based conductive inks and coatings, solidifies the region’s leading position. Moreover, rising investments in renewable energy and thermal management solutions are expected to sustain regional market growth.

North America graphene nanoplatelets industry is expected to register the fastest projected CAGR of 27.20% over the forecast period. This growth is supported by increasing investments in graphene research and development, rising demand for high-performance materials, and a growing focus on sustainable technologies.

Furthermore, increasing adoption of graphene nanoplatelets in high-performance industries such as aviation, military technology, renewable energy, and advanced electronics is bolstering this expansion.

The region’s expanding battery market, aided by advancements in next-generation lithium-ion and solid-state batteries, is accelerating graphene nanoplatelets adoption. Additionally, North America's robust research ecosystem, including universities, startups, and private companies, supports graphene commercialization.

The rising demand for lightweight and durable materials in the automotive and space exploration sectors, along with increased use in thermal management and conductive coatings, is expected to drive significant market expansion.

Regulatory Frameworks

- In the United States, graphene nanoplatelets are regulated under the Toxic Substances Control Act (TSCA), requiring manufacturers to submit safety data and undergo risk assessments before market entry.

- In the EU, graphene nanoplatelets fall under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework, mandating registration based on their production volume and evaluation of health and environmental risks prior to commercialization.

Competitive Landscape

The graphene nanoplatelets industry is characterized by key players implemeting strategic initiatives to strengthen their market position and expand product portfolios.

Companies are heavily investing in research and development (R&D) to enhance graphene nanoplatelets properties, focusing on product innovation through advanced formulations and customized solutions for industries such as aerospace, energy storage, and coatings.

Additionally, strategic partnerships with research institutions, universities, and technology firms are accelerating the commercialization of next-generation graphene nanoplatelets products. Companies are scaling production through technological advancements to meet growing demand while reducing costs.

Sustainability initiatives, environmentally friendly production methods and integration into green energy solutions, are gaining traction. Additionally, distribution agreements and regional partnerships are enabling companies to tap into emerging markets.

List of Key Companies in Graphene Nanoplatelets Market:

- Directa Plus S.p.A.

- First Graphene

- Applied Graphene Materials

- NanoXplore Inc.

- Merck KGaA

- ACS Material LLC

- BeDimensional

- Thomas Swan & Co. Ltd.

- Ahlatcı Holding

- Techinstro

- CD Bioparticles

- Otto Chemie Pvt. Ltd.

- Ossila

- CTI Materials

- Nanographenex

Recent Developments (New Product Launch)

- In April 2024, Black Swan Graphene Inc. commercialized and launched the GraphCore 01 series of graphene nanoplatelet products. Now in full production, these offerings, including powders and polymer-ready masterbatches, target the polymer industry.