Market Definition

The market focuses on the development and commercialization of energy storage solutions utilizing graphene-based materials. By integrating graphene into electrodes, these batteries enhance conductivity, charge retention, and thermal stability.

The manufacturing process involves incorporating graphene sheets into lithium-ion, lithium-sulfur, or supercapacitor cells to improve energy density and charge cycles. Graphene formulations include pure graphene, graphene oxide, and reduced graphene oxide, tailored for specific applications.

Industries such as consumer electronics, electric vehicles (EVs), aerospace, and renewable energy storage benefit from graphene batteries due to their fast charging, lightweight structure, and superior efficiency over traditional lithium-ion counterparts.

Graphene Battery Market Overview

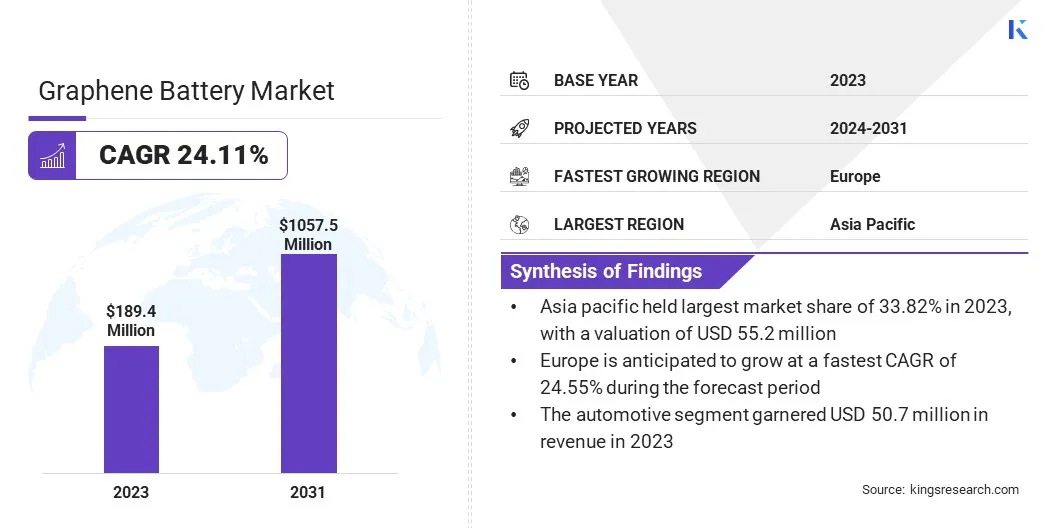

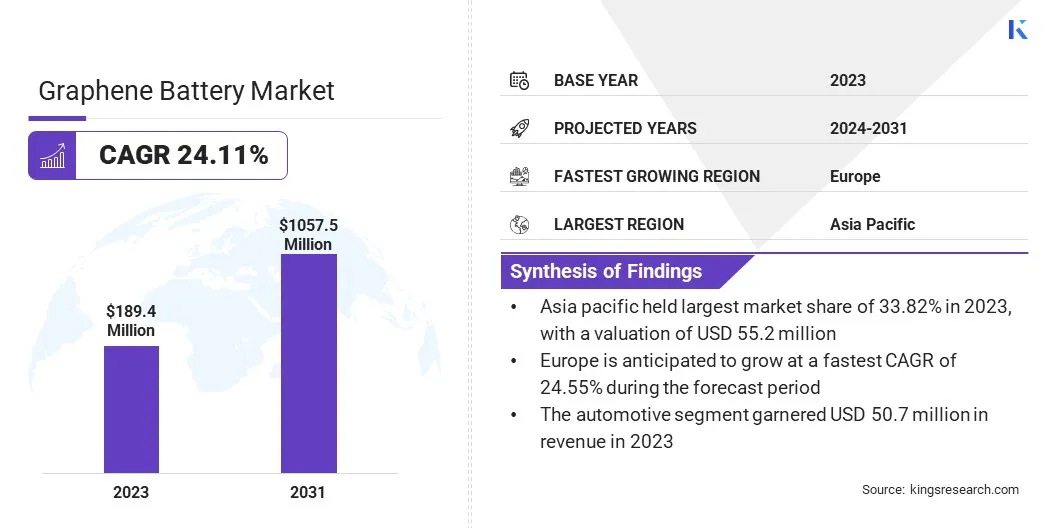

The global graphene battery market size was valued at USD 189.4 million in 2023 and is projected to grow from USD 233.2 million in 2024 to USD 1057.5 million by 2031, exhibiting a CAGR of 24.11% during the forecast period.

The market is expanding due to increasing demand for high-performance energy storage solutions in electric vehicles and consumer electronics. Superior properties such as faster charging, higher energy density, and improved thermal management are further boosting adoption.

Additionally, advancements in manufacturing processes and large-scale commercialization efforts by key industry players are fostering market growth, making graphene batteries a viable alternative to conventional lithium-ion technology.

Major companies operating in the global graphene battery industry are Nanotech Energy, Log9 Materials, Skeleton Technologies, OCSiAl, NanoGraf Corporation, Global Graphene Group, Toray Industries, Inc., LG Chem, Ltd., PPG Industries, Inc., Sekisui Chemical Co., Ltd., Fraunhofer-Gesellschaft, Samsung, Graphene Manufacturing Group, BYD, Solidion Technology, and others.

Graphene-based batteries offer high energy density and charge efficiency, making them ideal for various industries. The superior electrical conductivity allows ultra-fast charging and discharging cycles, enhancing performance in electric vehicles, consumer electronics, and energy storage systems.

With higher charge retention and minimal degradation, they extend battery lifespan and reduce replacement costs. These advantages are pfuel the growth of the market, increasing adoption across industrial and commercial applications.

Key Highlights:

- The graphene battery industry size was recorded at USD 189.4 million in 2023.

- The market is projected to grow at a CAGR of 24.11% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 64.1 million.

- The lithium-ion graphene battery segment garnered USD 60.3 million in revenue in 2023.

- The consumer electronics segment is set to grow at a robust CAGR of 24.71% through the projection period.

- Europe is anticipated to grow at a CAGR of 24.55% over the forecast period.

Market Driver

"Expanding Electric Vehicle (EV) Adoption"

The global transition to electric mobility is boosting demand for high-performance batteries with extended range and rapid charging capabilities, propelling the growth of the graphene battery market. These batteries provide improved power efficiency, reducing charging time while maintaining long-lasting durability.

Automakers are integrating advanced battery technologies to enhance vehicle efficiency and meet regulatory standards on carbon emissions. Increased investment in battery research and production is accelerating the large-scale deployment of graphene batteries in electric vehicles.

With superior energy density and high-performance applications, graphene batteries are strengthening their position in the automotive industry.

- The International Energy Agency's 2024 report indicates that electric car sales approached 14 million in 2023, with China, Europe, and the United States accounting for 95% of the total. This marks a 3.5 million increase from 2022, reflecting 35% year-on-year growth. Electric vehicles comprised 18% of total car sales in 2023, up from 14% in 2022 and just 2% in 2018.

Market Challenge

"High Production Costs and Scalability Issues"

The high production cost of graphene batteries poses a major challenge to market progress, limiting large-scale commercialization. Complex and expensive manufacturing processes for graphene synthesis and battery integration reduce cost efficiency, limiting competitiveness with traditional lithium-ion alternatives.

To address this challenge, companies are investing in advanced production techniques such as chemical vapor deposition (CVD) and roll-to-roll manufacturing to enhance scalability and reduce costs.

Additionally, strategic partnerships and government funding initiatives are supporting research into cost-effective raw material sourcing and process optimization, enabling manufacturers to improve affordability while maintaining the superior performance of graphene-based energy storage solutions.

Market Trend

"Increasing Aerospace and Defense Applications"

The aerospace and defense sectors are adopting graphene battery technology to improve energy storage efficiency and power delivery. The lightweight nature of graphene reduces battery weight while maintaining high power density, enhancing aircraft, electronic gear for soldiers and military equipment performance.

Thermal stability and resistance to extreme conditions make graphene batteries suitable for satellite systems, drones, and combat applications. Defense organizations are investing in advanced battery technologies to enhance operational capabilities and reduce reliance on conventional power sources. These developments are expanding the application scope of graphene batteries, propelling market growth.

- In August 2024, U.S.-based NanoGraf, a developer of high-performance lithium-ion batteries, delivered its silicon anode batteries to Thales Defense & Security, Inc., a global aerospace and defense contractor. Thales will integrate NanoGraf’s M38 18650 cells into its multiband software-defined tactical hand-held radios for the U.S. military, extending mission duration by 10% without adding size or weight.

Graphene Battery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium Sulphur Graphene Battery, Others

|

|

By Application

|

Automotive, Consumer Electronics, Aerospace & Defense, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium Sulphur Graphene Battery, and Others): The lithium-ion graphene battery segment earned USD 60.3 million in 2023 due to its superior energy density, faster charging capabilities, and extended lifespan, making it the preferred choice for electric vehicles, consumer electronics, and renewable energy storage applications.

- By Application (Automotive, Consumer Electronics, Aerospace & Defense, and Industrial): The consumer electronics segment is set to grow at a CAGR of 24.71% through the forecast period, largely attributed to the rising demand for high-performance batteries with faster charging, longer lifespan, and enhanced energy efficiency in smartphones, laptops, and wearable devices. This trend is boosting adoption among manufacturers seeking advanced energy storage solutions.

Graphene Battery Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific graphene battery market share stood at around 33.82% in 2023, valued at USD 64.1 million. Asia Pacific is a major hub for consumer electronics manufacturing, with companies continuously innovating to improve battery performance in smartphones, laptops, and wearables. Rising demand for compact, high-capacity, and thermally stable batteries is accelerating the adoption of graphene-based solutions.

Leading firms in China, South Korea, and Taiwan are investing in graphene battery research to enhance product efficiency. The increasing need for faster-charging and longer-lasting energy storage in mobile devices is fostering adoption across the region’s electronics industry.

Asia Pacific leads graphene research and commercialization, with several companies and research institutions focusing on scalable and cost-effective production techniques.

Countries such as China and South Korea are focusing on developing high-quality graphene materials for battery applications. Innovations in nanomaterial processing are improving battery conductivity, energy density, and durability, fueling large-scale adoption of graphene batteries.

- In February 2025, researchers from Kyoto University, in partnership with the National University of Singapore, announced the successful development of carbon-based magnets. By designing a precursor molecule and employing a stereoregularly controlled synthesis method, they synthesized graphene nanoribbons (GNRs) that exhibited magnetic properties by localizing spins of the same orientation on one side. This breakthrough is expected to drive advancements in lightweight, rustproof, and rare-earth-free magnets.

Europe graphene battery industry is poised set to grow at a robust CAGR of 24.55% over the forecast period. European governments are actively investing in advanced battery technologies as part of broader initiatives to achieve energy independence and sustainability.

The European Union’s Battery Innovation Roadmap and programs such as the Horizon Europe framework are accelerating graphene battery research and commercialization.

Financial support for R&D, combined with stricter regulations on conventional batteries, is supporting the shift toward graphene-based solutions. The emphasis on reducing reliance on imported raw materials and establishing a domestic battery supply chain is further boosting regional market expansion.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees the manufacturing and use of chemical substances under the Toxic Substances Control Act (TSCA). Manufacturers and importers of chemical substances, including nanomaterials such as graphene, must comply with TSCA requirements, which may include pre-manufacture notifications and risk assessments. The Occupational Safety and Health Administration (OSHA) sets safety standards for handling hazardous materials, ensuring safe manufacturing practices.

- In the EU, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation mandates that manufacturers and importers, including those handling nanoforms, register substances with the European Chemicals Agency (ECHA) and provide safety data.

- China enfoorces the Measures for the Environmental Management of New Chemical Substances, requiring manufacturers and importers of new chemicals, including nanomaterials, to register them and conduct risk assessments to protect environmental and human health.

Competitive Landscape

The graphene battery market is characterized by several market players expanding production facilities and commercializing graphene-based high-performance battery cells. These initiatives are enhancing manufacturing capabilities, enabling large-scale production, and accelerating market penetration.

By investing in advanced production sites, companies are addressing the growing demand for graphene batteries across various industries, including automotive, consumer electronics, and energy storage. The commercialization of next-generation graphene battery cells with improved energy density and efficiency is strengthening their competitive positioning.

- In February 2024, Nanotech Energy launched its Chico 2 production facility Chico, CA, to manufacture advanced 21700 graphene-based lithium-ion battery cells. In 2024, the company introduced three distinct Nanotech Energy 18650 cells with a production capacity of 30,000 units. In 2025, the company plans to expand its portfolio with three additional 21700 cells.

List of Key Companies in Graphene Battery Market:

- Nanotech Energy

- Log9 Materials

- Skeleton Technologies

- OCSiAl

- NanoGraf Corporation

- Global Graphene Group

- Toray Industries, Inc.

- LG Chem, Ltd.

- PPG Industries, Inc.

- Sekisui Chemical Co., Ltd.

- Fraunhofer-Gesellschaft

- Samsung

- Graphene Manufacturing Group

- BYD

- Solidion Technology

Recent Developments (Partnerships/Agreements)

- In April 2024, Log9 Materials partnered with Zeta Energy Corp., a leading company in lithium-sulfur (Li-S) battery technology, to advance next-generation energy storage solutions. Zeta Energy's cutting-edge Li-S materials are expected to enhance Log9’s overall cell performance, enabling the development of energy storage systems with improved range, stability, and cost-effectiveness.

- In November 2024, OCSiAl partnered with GEO to strengthen the battery supply chain in Europe. The collaboration focuses on producing TUBALL BATT graphene nanotube suspensions in the Czech Republic to enhance cathode performance in lithium-ion batteries. This strategic alliance seeks to improve battery efficiency, durability, and sustainability, supporting a more robust European battery ecosystem.

- In March 2025, Graphene Manufacturing Group (GMG) signed a service contract with the Battery Innovation Center (BIC) in Indiana, USA, to advance its Graphene Aluminium-Ion Battery. This agreement enables GMG to refine BIC’s cell design and battery manufacturing equipment during the production scale-up process. By leveraging BIC’s resources, GMG aims to optimize battery performance while deferring capital investments in manufacturing capacity until the technology reaches a more de-risked stage of development.