Market Definition

A graph database is a specialized data management system designed to capture and analyze relationships between data entities through nodes, edges, and properties. This structure allows for more efficient handling of complex, highly connected datasets compared to traditional relational databases.

The market encompasses software vendors, cloud providers, system integrators, and enterprises adopting graph technology. It supports critical applications such as fraud detection, recommendation engines, social network analysis, supply chain optimization, and knowledge graphs across industries, including finance, healthcare, retail, and logistics.

Graph Database Market Overview

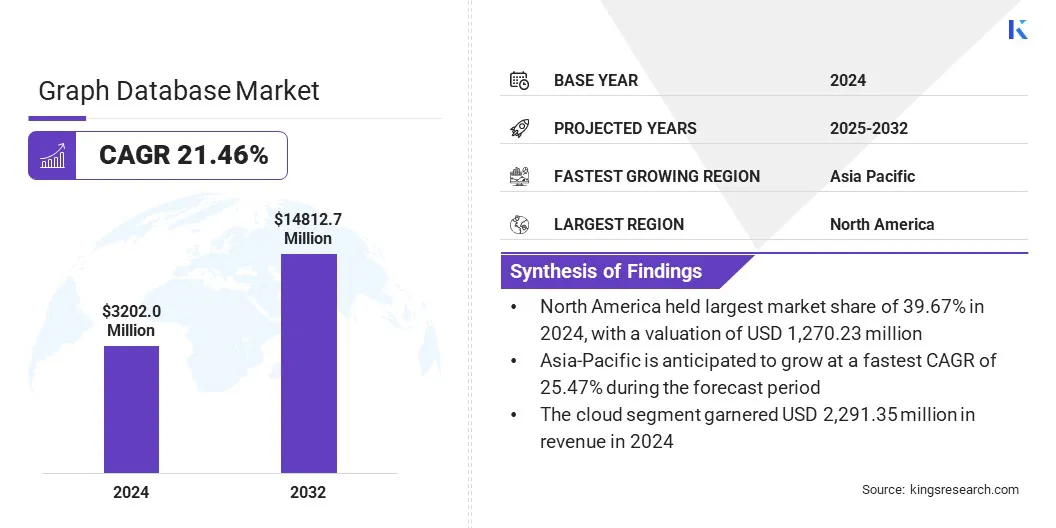

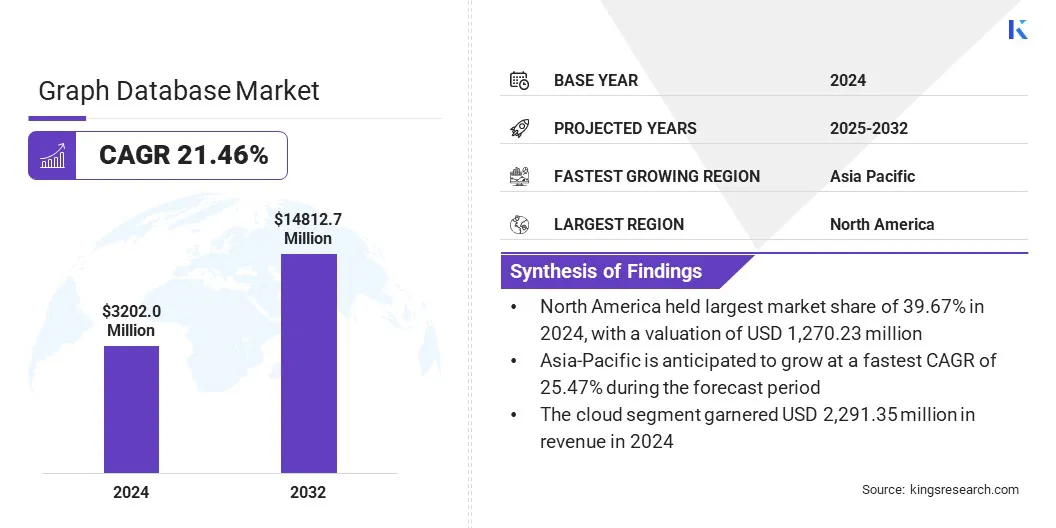

The global graph database market size was valued at USD 3,202.0 million in 2024 and is projected to grow from USD 3,797.48 million in 2025 to USD 14,812.70 million by 2032, exhibiting a CAGR of 21.46% over the forecast period.

The growth of the market is fueled by rising enterprise demand for solutions that efficiently analyze complex, highly connected datasets to drive faster decision-making. Additionally, the expanding use of graph technology in fraud detection, recommendation engines, and supply chain optimization is creating new opportunities across industries.

Key Highlights

- The graph database industry size was valued at USD 3,202.0 million in 2024.

- The market is projected to grow at a CAGR of 21.46% from 2024 to 2032.

- North America held a market share of 39.67% in 2024, valued at USD 1,270.23 million.

- The property graph segment garnered USD 2,072.33 million in revenue in 2024.

- The cloud segment is expected to reach USD 11,490.36 million by 2032.

- The AI & machine learning integration segment is anticipated to witness the fastest CAGR of 24.08% over the forecast period.

- The BFSI segment garnered USD 956.76 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 25.47% through the projection period.

Major companies operating in the graph database market are Neo4j, Inc., Aerospike, Inc., Amazon Web Services, Inc., Microsoft, ArangoDB, Graphwise, OpenLink Software, Memgraph Ltd., vesoft Inc., JanusGraph, Stardog Union, TigerGraph, SurrealDB, Franz Inc., and Blazegraph DB.

Technology advancements, including the integration with artificial intelligence and machine learning for predictive insights and automation are further increasing the adoption of graph database. This is accelerating deployment across banking, healthcare, retail, logistics, and other data-driven sectors, thereby driving market expansion globally.

- In February 2025, Valkyrie announced plans to deploy the first-ever knowledge graph database on the Moon via Intuitive Machines' IM-2 Mission from Kennedy Space Center. The initiative combines artificial intelligence with space exploration, aiming to transform data storage and processing in space.

Market Driver

Increasing Complexity of Data Relationships

The growth of the graph database market is driven by the increasing complexity of data relationships across industries as enterprises seek faster and more accurate insights from highly connected datasets. Traditional relational databases are limited in their ability to analyze these linkages efficiently, creating demand for graph-based models that can deliver real-time discovery of patterns and connections.

This demand is driving adoption in key applications such as fraud detection, recommendation engines, knowledge graphs, and supply chain optimization, where understanding complex relationships between data entities is critical. The integration of graph databases with artificial intelligence and machine learning is further enhancing predictive analytics and personalization capabilities, thereby strengthening their role in enterprise data strategies.

Organizations are adopting data-driven strategies, making graph databases a critical technology for identifying complex relationships, enhancing operational efficiency, and enabling enterprise-scale digital transformation, thereby supporting overall market growth.

Market Challenge

Complexities in Integrating with Legacy Systems

The graph database market faces a significant barrier due to the complexities in integrating with legacy systems that continue to dominate enterprise IT environments. Migrating large volumes of data from relational databases and ensuring seamless interoperability with existing applications often requires extensive customization, data transformation, and infrastructure reconfiguration.

These complexities increase implementation costs, extend deployment timelines, and raise the risk of operational disruptions, limiting adoption for organizations with resource-constrained IT environments.

To address these barriers, vendors are investing in tools that simplify migration, enhance interoperability, and support hybrid deployments for a gradual transition. Expanded services and technical support from cloud providers are also helping reduce integration challenges and accelerate adoption across industries.

Market Trend

Accelerating Transition to Cloud-Based Deployments

The accelerating transition to cloud-based deployments is shaping the graph database market as enterprises increasingly seek scalable, flexible, and cost-efficient solutions for managing connected data. Cloud-native platforms eliminate the burden of heavy infrastructure investments while enabling rapid deployment and seamless updates compared to traditional on-premise systems.

This trend is further supported by leading cloud providers offering integrated graph database services, which simplify adoption and enhance interoperability with existing enterprise ecosystems. The ability to dynamically scale resources also makes cloud-based solutions attractive for organizations dealing with fluctuating workloads and real-time analytics.

- In November 2024, Neo4j exceeded USD 200 million in annual recurring revenue, fueled by rising adoption of graph databases for Generative AI use cases.

Graph Database Market Report Snapshot

|

Segmentation

|

Details

|

|

By Graph Type

|

Property Graph, RDF Graph, and Hypergraph

|

|

By Deployment

|

On-Premise, Cloud, and Hybrid

|

|

By Application

|

Social Network Analysis, Fraud Detection, Recommendation Systems, Knowledge Graphs, Supply Chain and Logistics, Customer 360, AI & Machine learning Integration, and Others

|

|

By Industry

|

BFSI, Healthcare & Life Science, Retail & E-Commerce, IT & Telecommunications, Manufacturing, Energy & Utilities, Government, Media & Entertainment, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Graph Type (Property Graph, RDF Graph, and Hypergraph): The property graph segment earned USD 2,072.33 million in 2024 due to its wide adoption for handling highly connected data in real-time applications.

- By Deployment (On-Premise, Cloud, and Hybrid): The cloud held 71.56% of the market in 2024, attributed to its scalability, cost efficiency, and ease of integration with enterprise systems.

- By Application (Social Network Analysis, Fraud Detection, Recommendation Systems, Knowledge Graphs, Supply Chain and Logistics, Customer 360, AI & Machine learning Integration, and Others): The social network analysis segment is projected to reach USD 4,397.79 million by 2032, owing to rising demand for relationship mapping, community detection, and behavioral analytics across digital platforms.

- By Industry (BFSI, Healthcare & Life Science, Retail & E-Commerce, IT & Telecommunications, Manufacturing, Energy & Utilities, Government, Media & Entertainment, and Others): The healthcare & life science segment anticipated to grow at a CAGR of 24.30% through the projection period driven by increasing use of graph databases for patient data management, drug discovery, and precision medicine applications.

Graph Database Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America graph database market share stood at 39.67% in 2024, valued at USD 1,270.23 million. This dominance is attributed to the region’s advanced data infrastructure and widespread adoption of analytics-driven strategies by enterprises and government organizations, enabling informed decision-making, operational efficiency, and advanced insights from complex datasets.

Additionally, the concentration of major graph database vendors and continuous enterprise investment in AI-driven solutions are accelerating deployment across key industries.

Advancements in real-time data processing and cloud-native services are further strengthening the capabilities of graph platforms in North America. Furthermore, ongoing collaboration between technology providers, enterprises, and research institutions is driving innovation and expanding the application scope of graph databases across the region.

- In December 2023, ArangoDB and Intel collaborated to advance Graph Machine Learning (GraphML) performance using Intel’s Xeon CPUs and Flex and Max GPUs. The partnership focuses on speeding up complex graph analytics and pattern recognition while enhancing scalability and efficiency. This collaboration is part of Intel’s Disruptor Program, promoting innovation through strategic technology initiatives.

Asia-Pacific graph database industry is poised for significant CAGR of 25.47% over the forecast period. This growth is attributed to rapid digital transformation across industries, rising investments in advanced data management solutions, and increasing reliance on connected insights to support business decisions in the region.

The expansion of smart city initiatives, large-scale telecommunications upgrades, and digital healthcare projects is creating strong demand for graph database adoption in key Asia-Pacific countries.

Collaborative initiatives between leading graph database providers, enterprise users, and government agencies are accelerating adoption by enhancing solution scalability, interoperability, and industry-specific applications, thereby driving market growth. are driving innovation and improving accessibility of graph-based solutions.

Additionally, advancements in cloud infrastructure across the Asia Pacific and growing support for AI-driven applications are enhancing scalability and performance, thereby accelerating market growth in this region.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, processing, and storage of personal data. It ensures data privacy and security, requiring organizations using graph databases to implement secure data handling practices and provide mechanisms for data access, correction, and deletion.

- In Singapore, the Personal Data Protection Act (PDPA) regulates the processing of personal data by private organizations. It requires enterprises utilizing graph databases to safeguard sensitive information, maintain data accuracy, and implement proper access controls.

Competitive Landscape

Companies operating in the graph database industry are actively expanding their offerings by developing advanced platforms that support high-performance querying, real-time analytics, and seamless integration with enterprise systems. Key players are investing in cloud-native architectures, AI-driven capabilities, and improved query languages to enhance the usability, scalability, and interoperability of graph database solutions.

They are also leveraging partnerships with cloud providers, system integrators, and analytics firms to strengthen ecosystem support and accelerate enterprise adoption across diverse industries.

Additionally, market players are focusing on acquisitions, strategic collaborations, and open-source initiatives to broaden their technology portfolios, expand global reach, and address the growing demand for graph-powered applications in areas such as fraud detection, recommendation systems, and knowledge management.

- In March 2025, TigerGraph unveiled a hybrid search combining graph and vector capabilities to accelerate AI applications with improved speed and accuracy. The company also released a Community Edition offering 16 CPUs, 200GB graph storage, and 100GB vector storage, allowing developers to build AI-driven solutions without licensing restrictions.

Key Companies in Graph Database Market:

- Neo4j, Inc.

- Aerospike, Inc.

- Amazon Web Services, Inc.

- Microsoft

- ArangoDB

- Graphwise

- OpenLink Software

- Memgraph Ltd.

- vesoft Inc.

- JanusGraph

- Stardog Union

- TigerGraph

- SurrealDB

- Franz Inc.

- Blazegraph DB

Recent Developments (Partnerships/Innovations)

- In May 2025, Neo4j introduced Neo4j Aura Graph Analytics, a serverless platform designed to perform graph analytics directly across multiple data sources without requiring ETL processes. The solution helps users identify hidden connections and patterns in complex datasets, providing deeper insights and context compared to traditional analytics.

- In October 2023, Aerospike partnered with gdotv to enhance graph data visualization through G.V, a Gremlin IDE integrated with Aerospike Graph. The tool enables developers to explore graphs, debug queries, and optimize data models with features like smart autocomplete, real-time exploration, and a no-code interface, improving accessibility and efficiency in handling complex datasets.

-making