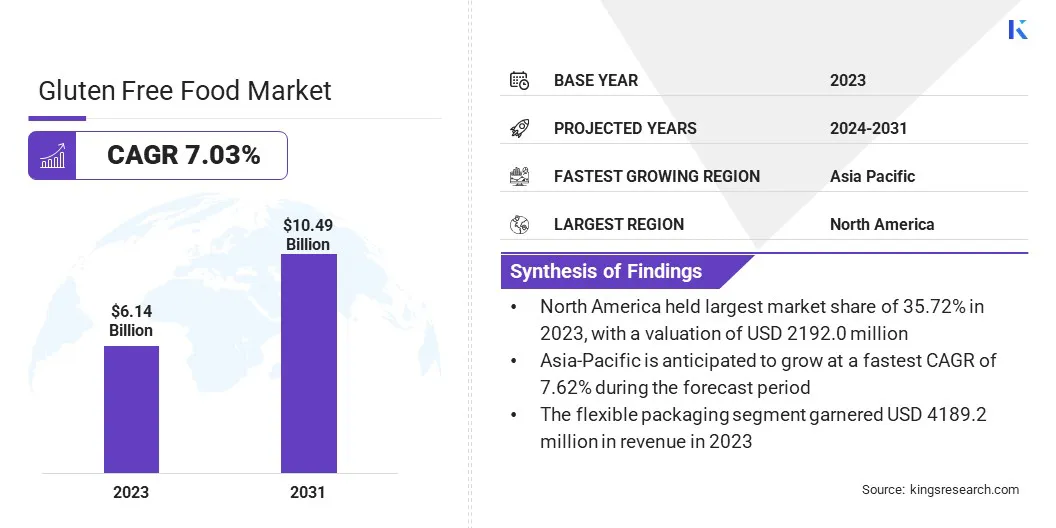

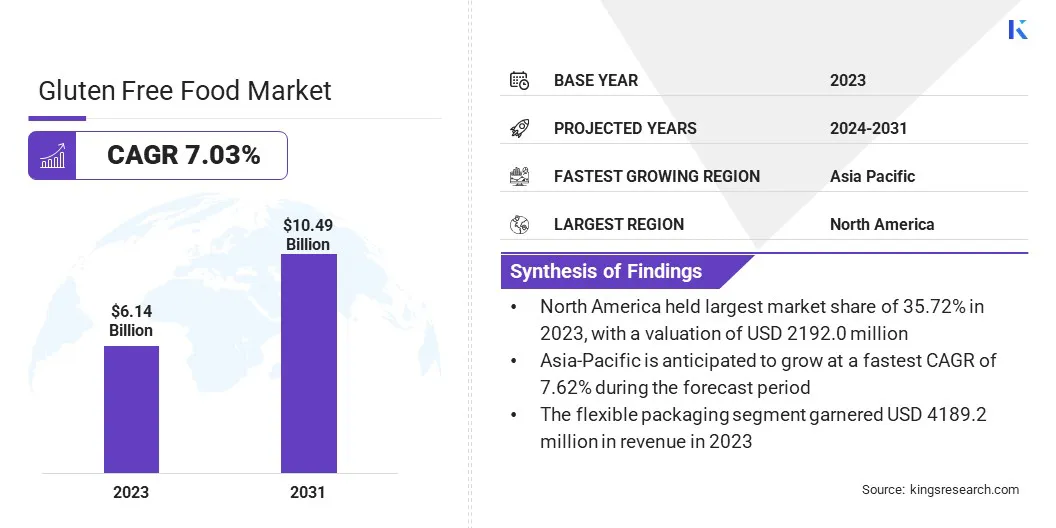

Gluten-Free Food Market Size

The global gluten-free food market size was valued at USD 6.14 billion in 2023 and is projected to grow from USD 6.52 billion in 2024 to USD 10.49 billion by 2031, exhibiting a CAGR of 7.03% during the forecast period. The market is experiencing steady growth due to surging consumer reliance on processed food items and increasing health consciousness.

In the scope of work, the report includes services offered by companies such as Alara Wholefoods Ltd., Barilla G. e R. Fratelli S.p.A, Conagra Brands, Inc., Ecotone, Freedom Foods Group Limited, General Mills Inc., The Hain Celestial Group, Kellogg Co., The Kraft Heinz Company, Seitz glutenfrei, and others.

The implementation of favorable government policies is boosting the gluten-free food market. These initiatives focus on raising awareness about gluten intolerance, celiac disease, and health benefits of these food products. For instance, the Agricultural and Processed Food Products Export Development Authority (APEDA), a statutory body of the Government of India, has launched various food products at reasonable prices.

Through this initiative, government is promoting the availability of affordable gluten-free products, including millet malts, biscuits, peanut butter, peanut butter, and khichadi while ensuring the production of safe and high-quality options.

Rising consumer inclination towards free-from food is propelling growth of the market. Gluten free food products emerged as popular choice for people who are suffering with celiac disease, gluten sensitivities, and for individuals who prioritize dietary transparency. Surging awareness of the potential health benefits of gluten-free diets, such as improved digestion and reduced inflammation, elevated demand for these foods. Furthermore, manufacturers in market are introducing products to cater increasing consumer demand.

- For instance, in February 2024, Base Culture, a prominent brand in the U.S. frozen bread market, launched its newest line of shelf-stable, gluten-free breads under the Simply brand. This Simply bread line is composed of high-quality flours, including tapioca, flax, hemp, chickpea, and coconut.

Gluten is a protein found in rye, barley, and wheat. Individuals with gluten sensitivity or celiac disease often opt for gluten-free foods, including vegetables, fruits, fish, meat, lentils, and potatoes. These foods offer benefits such as increased energy, improved health, and weight management. The rising number of working professionals has fueled the demand for gluten-free products.

Analyst’s Review

The rising prevalence of gluten-related diseases, increasing health consciousness among consumers, and surging cases of celiac disease and gluten intolerance are prompting companies to focus on producing gluten-free products. These include ready-to-eat foods, bakery items, cereals, bars, and nutrient-rich products.

In response to the fast-paced lifestyles particularly in developed economies, companies are emphasizing the production of gluten-free packaged foods. Technological advancements, such as annealing and extrusion cooking, are enhancing the quality and efficiency of gluten-free food production, including cereals, bakery products, pasta, noodles, and pizza.

- For instance, in May 2023, Crosta and Mollica introduced a gluten-free margherita pizza made entirely from wheat flour, catering to celiac diets. This launch highlights the surging demand for gluten-free food options and fosters innovation in the industry.

Companies are further investing in functional ingredients such as plant-based proteins, and probiotics, which is contributing significantly to market expansion.

Gluten-Free Food Market Growth Factors

The rising prevalence of celiac disease is fostering the growth of the gluten-free food market. Celiac disease, a prevalent autoimmune disorder triggered by gluten consumption, affects millions worldwide. Surging awareness of gluten intolerance and related disorders has prompted consumers to seek products that meet their specific dietary needs.

- According to the Mayo Clinic, approximately 1.8 million Americans suffer from celiac disease, with an estimated 1.4 million unaware of their condition. Adopting a gluten-free diet lowers the risk of complications associated with celiac disease.

Growing awareness of health and an increase in diagnosis have led to increased adoption of gluten-free diets, fueling market growth. This expanding consumer base has further fostered innovation and prompted food manufacturers to offer high-quality gluten-free products.

The gluten-free food market faces challenges due to higher production costs of specialized ingredients, dedicated manufacturing processes, and separate facilities to prevent cross-contamination. These costs result in higher retail prices for consumers, limiting market growth, particularly in price-sensitive economies where cost plays a significant role in purchasing decisions.

Gluten-Free Food Industry Trends

The gluten-free food market is witnessing substantial growth, primarily due to increasing brand offerings. This growth is further supported by a global presence of companies expanding their product portfolios through new product launches and expanded manufacturing capacity.

- For instance, in January 2023, a business unit of Dr. Schar AG named Dr. Schar USA Inc. announced an expansion of its U.S. manufacturing capacity in response to the growing demand for gluten-free foods, fueled by consumers’ focus on health and dietary needs such as gluten intolerance and celiac disease.

Food manufacturers are launching products such as baked goods, snacks, pasta, and beverages, to cater to health-conscious consumers. Furthermore, the surge in online shopping and specialty stores has made these products more accessible.

The growing demand for healthier products, aided by evolving consumer lifestyles, is fostering the growth of the gluten-free food market. Consumers are increasingly prioritizing health-conscious eating habits due to growing health and wellness trends. Hectic lifestyle and increasing prevalence of health issues such as diabetes and obesity are prompting consumers to opt for natural and cleaner food products.

Gluten-free diets, once limited to those with celiac disease or gluten intolerance, are gaining immense popularity among a wider audience seeking benefits such as improved digestion and energy levels. In response, manufacturers are introducing new food products to meet the changing consumer preferences.

Segmentation Analysis

The global market has been segmented based on product type, distribution channel, ingredient type, packaging type, and geography.

By Product Type

Based on product type, the market has been categorized into bakery products, snacks & RTE (ready-to-eat) products, pasta & noodles, dairy & frozen desserts, condiments & dressings, and meat substitutes. The bakery products segment led the gluten-free food industry in 2023, reaching a valuation of USD 1.92 billion.

The increasing consumption of bakery products is leading to growing demand for fast lifestyle options such as breads, pastries, cookies, and bakery mixes. These products are gaining popularity due to their clean-label status, attributed to natural and organic ingredients. Moreover, there is a rising demand for these products among health-conscious individuals and gluten-intolerant individuals, prompting manufacturers to introduce new gluten-free bakery items.

- For instance, in December 2023, Oreo, a Mondelez brand introduced gluten-free golden cookies in two flavors namely chocolate soft snack cakes filled with peanut butter and peanut butter casters. This move aligns with the growing demand for gluten-free products.

By Distribution Channel

Based on distribution channel, the market has been segmented into retail stores, e-commerce platforms, and foodservice (HORECA). The retail stores segment captured the largest share of 54.25% in 2023. These stores offer a wide range of food products across numerous brands and price categories, providing greater accessibility.

As there is an increasing shift toward e-commerce, the number of online retailers is increasing. To attract consumers, store owners are offering incentives such as bulk purchasing schemes and discounts on prices.

By Ingredient Type

Based on ingredient type, the market has been categorized into rice-based, corn-based, almond-based, coconut-based, and others. The rice-based segment is expected to garner the highest revenue of USD 3.69 billion by 2031. Rice-based products are utilized as a substitute for wheat-based products. These products are rich in antioxidants, dietary fiber, and other nutrients.

Rice-based products such as noodles, flour, and snacks are essential to gluten-free diets, as rice is naturally gluten-free and easy to digest. The rising occurrence of celiac disease and gluten intolerance has increased consumption of rice-based products, thus propelling segmental growth.

By Packaging Type

Based on packaging type, the market has been bifurcated into flexible packaging and rigid packaging. The flexible packaging segment is anticipated to witness the highest revenue of USD 7.23 billion by 2031. Flexible packaging solutions such as bags, wraps, and pouches are favored for their lightweight, cost-effectiveness, and ability to maintain the freshness and quality of these food products.

The growth of e-commerce has increased the demand for durable flexible packaging to ensure product safety. Manufacturers are incorporating eco-friendly packaging materials and sustainable packaging solutions to meet the surging consumer demand.

Gluten-Free Food Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America gluten-free food market accounted for the largest share of 35.72% in 2023, valued at USD 2.19 billion. This dominance is largely reinforced by the growing awareness of gluten related health conditions, such as gluten intolerance and celiac disease, along with a rising demand for gluten-free foods. The rising shift towards healthier lifestyles and heightened health consciousness among consumers further supports this trend. Product advancements further contribute to the growth of the regional market.

- In February 2024, Cannibble Foodtech Ltd., a food technology company which focuses on alternative proteins, secured a CAD 10000 trial order from a California-based food distributor for its Kosher for passover gluten-free pita bread, hamburger buns, and hot dog buns. The company aims to expand its offerings of Kosher for Pass over baked goods to additional U.S. food distributors, driven by favorable regulatory developments and trade agreements.

Asia-Pacific gluten-free food market is anticipated to grow at the fastest CAGR of 7.62% over the forecast period. Rising disposable income, increasing health-consciousness, and shifting dietary preferences are supporting this growth. Region is witnessing higher internet penetration and a growing e-commerce sector. Australia and India are among the top countries with rising incidences of celiac diseases, particularly in North India, where wheat is primary staple.

Competitive Landscape

The global gluten-free food market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Gluten-Free Food Market

Key Industry Developments

- February 2024 (Launch): GOODLES, a food manufacturing company in the U.S., introduced a range of gluten-free products, including Gluten-Free Vegan Be Heroes pasta, Gluten-Free Cheddy Mac. These pasta options are rich in fiber, prebiotics, and 21-essential plant based nutrients, catering to individuals with celiac disease.

- November 2023 (Launch): Sweet Loren's launched three new gluten-free morning biscuit flavors: chocolate, blueberry, and cinnamon sugar. Each serving contains 19 grams of whole grains, 4 grams of protein, 3 grams of fiber, and five key B vitamins. Each single-serving container contains three biscuits, offering a nutritious addition to the morning routine.

The global gluten-free food industry has been segmented as:

By Product Type

- Bakery Products

- Bread.

- Cookies

- Cakes & Pastries

- Pasta & Noodles

- Dairy & Frozen Desserts

- Condiments & Dressings

- Meat Substitutes

By Distribution Channel

- Retail Stores

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- E-commerce Platforms

- Foodservice (HORECA)

By Ingredient Type

- Rice-Based

- Corn-Based

- Almond-Based

- Coconut-Based

- Others

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America