Market Definition

The market covers the production and commercial use of a non-essential amino acid. It is widely used in food processing, pharmaceuticals, and animal feed. It is primarily manufactured through microbial fermentation using strains like Corynebacterium glutamicum.

Glutamic acid is formulated into monosodium glutamate (MSG) for flavor enhancement and is also used in drug formulations and protein supplements. The market includes applications across food ingredients, cosmetics, and chemical intermediates.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Glutamic Acid Market Overview

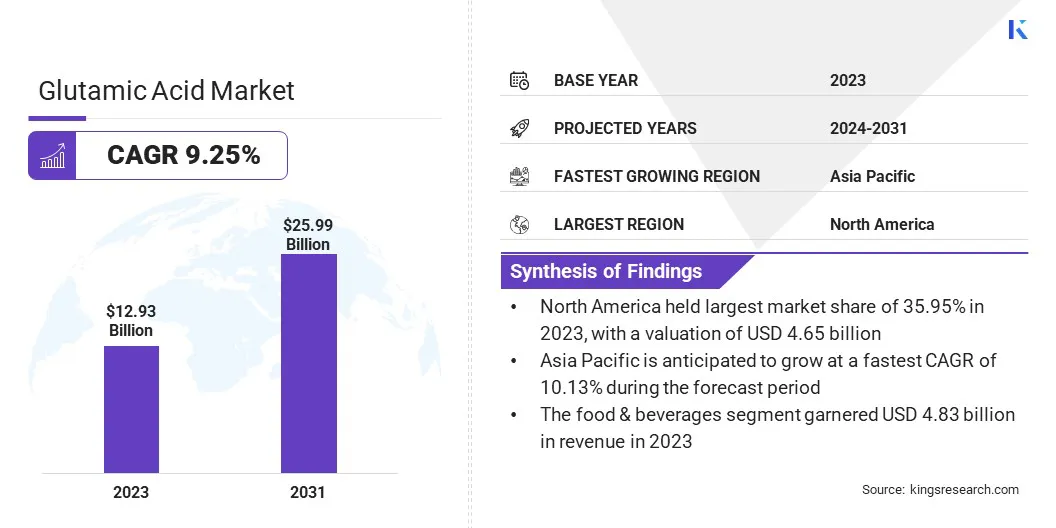

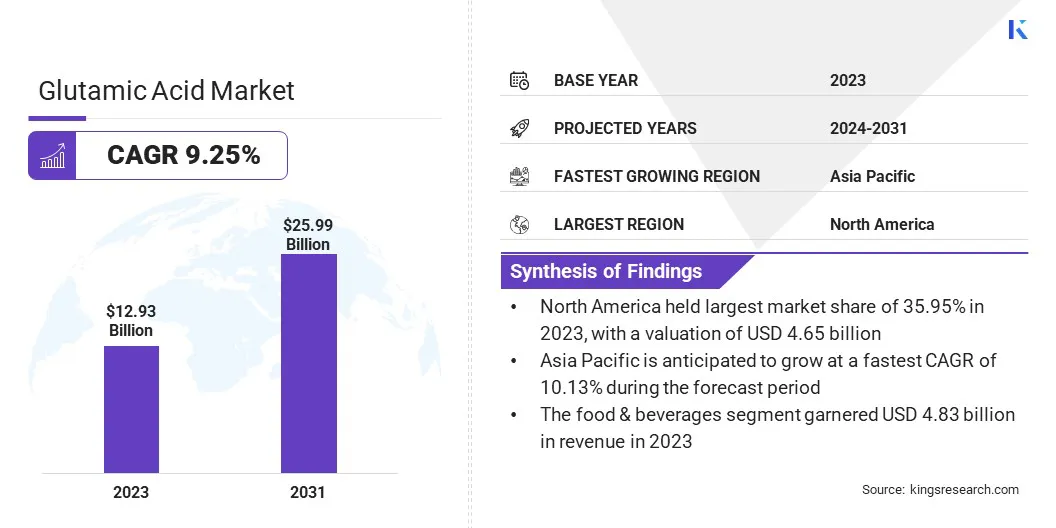

The global glutamic acid market size was valued at USD 12.93 billion in 2023 and is projected to grow from USD 13.99 billion in 2024 to USD 25.99 billion by 2031, exhibiting a CAGR of 9.25% during the forecast period.

The growth of the market is supported by the expansion of the nutritional supplements industry, where glutamic acid is used for protein metabolism and cognitive support. Additionally, advancements in fermentation technology are improving production efficiency and cost-effectiveness, enabling manufacturers to meet increasing global demand across food and health sectors.

Major companies operating in the glutamic acid industry are Zhengzhou Megaman Chemical Co., Ltd., Aquapharm Chemicals Pvt. Ltd, Ajinomoto Co., Inc., Evonik, Meihua Holdings Group Co., Ltd., Kyowa Hakko Bio Co., Ltd., Amino GmbH, Sichuan Tongsheng Amino Acid Co., Ltd., Medinex Laboratories Pvt. Ltd., Wuhan Amino Acid Bio-Chemical Co., Ltd., Global Bio-Chem Technology Group Company Limited, Iris Biotech GmbH, Aquapharm Chemical Pvt. Ltd., NACALAI TESQUE, INC., and Otto Chemie Pvt. Ltd.

The increasing demand for flavor enhancers, particularly monosodium glutamate (MSG), is a major contributor to the growth of market. MSG is widely used in processed foods to improve taste without altering the core ingredients.

With growing consumption of packaged meals, snacks, and instant noodles in both developed and developing economies, manufacturers are investing in glutamic acid production to meet food industry requirements. This rising application in the food sector continues to support long-term market expansion.

- In February 2023, Ajinomoto Malaysia introduced Smart Salt, a healthy eating campaign aimed at reducing salt intake among Malaysians. The initiative encourages the use of AJI-NO-MOTO monosodium glutamate (MSG) to maintain flavor while reducing sodium consumption. AJI-NO-MOTO contains two-thirds less sodium than regular salt, aligning with the World Health Organization's recommendation of a maximum 5g daily salt intake.

Key Highlights

- The glutamic acid industry size was valued at USD 12.93 billion in 2023.

- The market is projected to grow at a CAGR of 9.25% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 4.65 billion.

- The Food & Beverages segment garnered USD 4.83 billion in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 10.13% during the forecast period.

Market Driver

"Expansion of Nutritional Supplements Industry"

The growing popularity of dietary supplements among health-conscious consumers is accelerating the growth of glutamic acid market. Glutamic acid is included in many amino acid blends for muscle recovery and brain function.

Sports nutrition brands and pharmaceutical firms are incorporating this compound in powder, capsule, and functional drink formats. The growing focus on personalized nutrition and cognitive support among aging populations is increasing demand for glutamic acid-based formulations across global markets.

- For instance, Jo Mar Labs offers a 100% pure U.S.P. grade crystalline free-form L-Glutamic Acid powder. This water-soluble powder offers a sweet-sour taste and is marketed for its potential benefits in cognitive function and muscle recovery. The product is available in bulk quantities, catering to both individual consumers and businesses aiming to incorporate glutamic acid into their formulations.

Market Challenge

"Raw Material Cost Fluctuations"

A significant challenge for the growth of the glutamic acid market is the volatility in raw material prices, such as starch and sugar, which are essential for its production. Price fluctuations can lead to increased production costs and affect profit margins.

To address this, key players are adopting strategies like diversifying raw material sources, investing in more efficient production technologies, and exploring alternative, more cost-effective feedstocks. Additionally, key players are enhancing supply chain management to reduce dependency on single suppliers and mitigate the impact of price fluctuations.

Market Trend

"Advancements in Fermentation Technology"

Ongoing improvements in microbial fermentation techniques have streamlined the production of glutamic acid, contributing to reduced costs and higher yields. The use of genetically modified strains like Corynebacterium glutamicum has enhanced efficiency and purity in amino acid production.

These advancements are improving scalability for industrial manufacturers and encouraging new entrants in the market. This progress is strengthening the industrial foundation of the glutamic acid market and supporting its global expansion.

- In April 2024, a study published in the Journal of Agricultural and Food Chemistry explored the integration of glutamate synthesis features from Corynebacterium glutamicum into Bacillus tequilensis BL01. This genetic modification led to a 2.18-fold increase in poly-γ-glutamic acid (γ-PGA) production. Furthermore, the engineered strain achieved a γ-PGA titer of 25.73 g/L using cost-effective molasses as a substrate, highlighting the economic viability of this approach.

Glutamic Acid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Food & Beverages, Pharmaceuticals, Animal Feed, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Food & Beverages, Pharmaceuticals, Animal Feed, and Others): The Food & Beverages segment earned USD 4.83 billion in 2023 due to the widespread use of glutamic acid as a flavor enhancer in processed foods, snacks, and savory products.

Glutamic Acid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America glutamic acid market share stood at around 35.95% in 2023, with a valuation of USD 4.65 billion. The North American processed food industry is growing rapidly, with a strong demand for frozen meals, snacks, sauces, and ready-to-eat products.

Food producers are relying on monosodium glutamate to meet taste preferences without adding extra fat or sodium. This is increasing the need for high-purity glutamic acid, especially in large-scale food processing facilities.

Moreover, glutamic acid’s role in brain function and neurotransmission is gaining attention in clinical research across North America. Healthcare providers and pharmaceutical companies are exploring glutamic acid formulations for cognitive health, memory support, and nerve-related disorders.

- In July 2024, the University of California initiated a study focusing on the safety, tolerability, biomarker, cognitive, and clinical efficacy of investigational products in participants with Alzheimer's disease-causing mutations. This research aims to determine if treatment with the study drug can slow the progression of cognitive impairment or improve disease-related biomarkers, emphasizing the role of glutamate transporters in neurodegenerative diseases.

Asia Pacific glutamic acid industry is poised for significant growth at a robust CAGR of 10.13% over the forecast period. The expanding livestock and aquaculture sectors in the Asia Pacific are major consumers of amino acid-enriched feed. Glutamic acid is used to enhance nutrient availability and digestion in poultry, fish, and swine.

With rising meat and seafood consumption, animal feed producers are increasing their use of amino acids to improve efficiency. This ongoing demand from the feed industry is contributing to the growth of the market in this region.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) classifies glutamic acid and its salts, such as monosodium glutamate (MSG), as Generally Recognized As Safe (GRAS). Under the Food Additives Amendment of 1958, substances with a long history of safe use are exempt from pre-market approval. However, labeling requirements mandate that if MSG is added to food, it must be declared on the ingredient list. The term "natural flavor" may encompass glutamic acid, but MSG must be specifically listed.

- In China, the National Health Commission (NHC) regulates food additives through the National Food Safety Standards (GB standards). GB 2760-2024 outlines the usage scope and maximum levels for food additives, including glutamic acid. Manufacturers must comply with these standards and ensure proper labeling as per GB 7718-2011.

- The Food Safety and Standards Authority of India (FSSAI) regulates food additives under the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011. Glutamic acid and its salts are allowed in specific food categories, with prescribed limits. Proper labeling, including the additive's name or INS number, is mandatory.

Competitive Landscape

Market players are increasingly focusing on securing approvals and certifications to strengthen their product credibility and meet international standards. Through these strategies, companies are demonstrating environmental responsibility and product safety, which supports customer trust.

Several companies are also investing in third-party audits and aligning their processes with international environmental and quality management systems to maintain competitiveness in regulated markets.

- In December 2024, Tongliao Meihua Biotechnology Co., Ltd. successfully completed a full life cycle carbon and water footprint assessment of its MSG products and received official certification from Shanghai Ingeer Certification Assessment Co., Ltd. The assessment followed a scientifically rigorous methodology to measure the carbon and water footprints of MSG products, covering every stage from raw material sourcing and production to product usage and end-of-life disposal.

List of Key Companies in Glutamic Acid Market:

- Zhengzhou Megaman Chemical Co., Ltd.

- Aquapharm Chemicals Pvt. Ltd

- Ajinomoto Co., Inc.

- Evonik

- Meihua Holdings Group Co., Ltd.

- Kyowa Hakko Bio Co., Ltd.

- Amino GmbH

- Sichuan Tongsheng Amino Acid Co., Ltd.

- Medinex Laboratories Pvt. Ltd.

- Wuhan Amino Acid Bio-Chemical Co., Ltd.

- Global Bio-Chem Technology Group Company Limited

- Iris Biotech GmbH

- Aquapharm Chemical Pvt. Ltd.

- NACALAI TESQUE, INC.

- Otto Chemie Pvt. Ltd.

Recent Developments (Product Launch)

- In April 2025, BASF Care Chemicals introduced Trilon G, a sustainable chelating agent based on glutamic acid diacetate (GLDA) technology. This product is designed to enhance cleaning performance in home care and industrial applications. Trilon G is partially biobased, with approximately 56% renewable carbon atoms and it is readily biodegradable.