Market Definition

Glass substrates are thin, flat, and rigid sheets of glass that serve as foundational materials in the production of semiconductors, electronic displays, and high-performance electronic components. The glass substrates market encompasses substrates used in advanced semiconductor packaging, liquid crystal displays (LCD), organic light-emitting diode (OLED) panels, solar photovoltaic modules, and radio frequency (RF) systems.

It includes various glass types such as borosilicate, aluminosilicate, and fused silica, supporting applications across consumer electronics, automotive systems, telecommunications, and industrial equipment worldwide.

Glass Substrate Market Overview

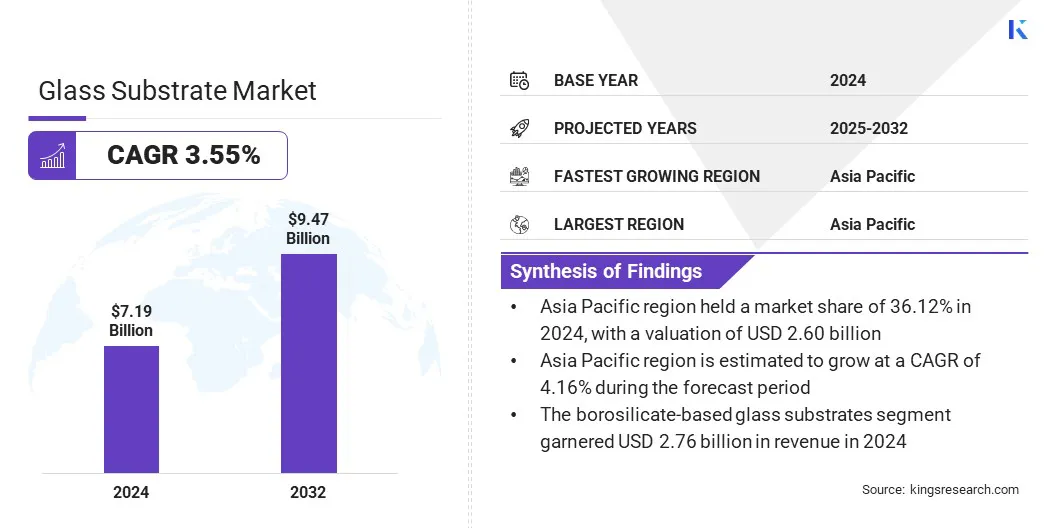

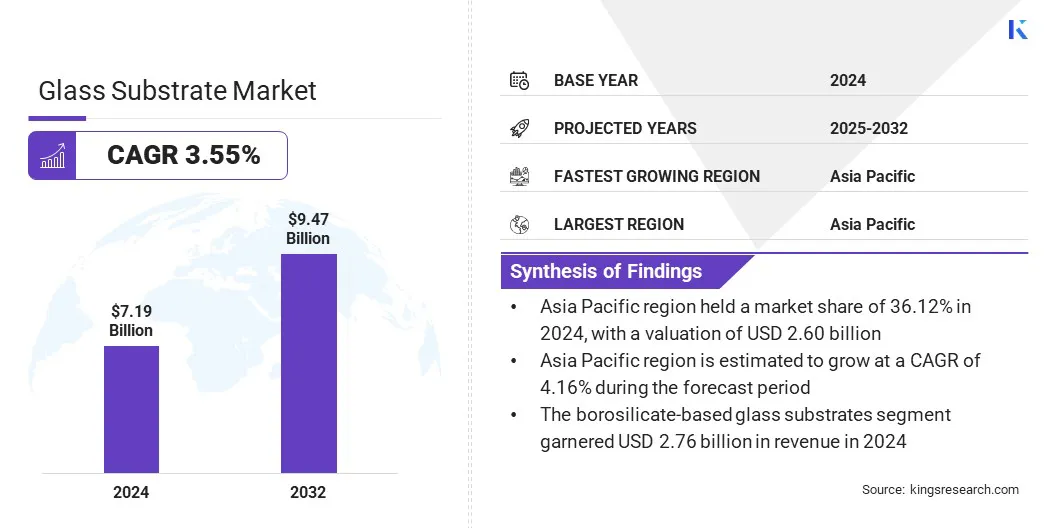

The global glass substrate market size was valued at USD 7.19 billion in 2024 and is projected to grow from USD 7.42 billion in 2025 to USD 9.47 billion by 2032, exhibiting a CAGR of 3.55% during the forecast period.

This market growth is attributed to the rising demand for consumer electronics driven by increasing digital consumption and device penetration. Additionally, the adoption of ultra-thin glass substrates in advanced display technologies is accelerating market expansion.

Key Highlights

- The glass substrate industry size was valued at USD 7.19 billion in 2024.

- The market is projected to grow at a CAGR of 3.55% from 2025 to 2032.

- Asia Pacific held a market share of 36.12% in 2024, with a valuation of USD 2.60 billion.

- The borosilicate-based glass substrates segment garnered USD 2.76 billion in revenue in 2024.

- The automotive segment is expected to reach USD 3.34 billion by 2032.

- Europe is anticipated to grow at a CAGR of 3.56% during the forecast period.

Major companies operating in the Glass Substrate industry are AGC Inc., SCHOTT Envases Argentina S.A., Corning Incorporated, Nippon Electric Glass Co., Ltd, HOYA CORPORATION, PLANOPTIK AG, Ohara Inc., TOPPAN Inc., AvanStrate Inc., Specialty Glass Products, Viracon, NOVA Electronic Materials, LLC., Biotain Crystal Co., Ltd., Nanoshel, Saint-Gobain, TCL China Star Optoelectronics Technology Co., Ltd., and BOE Technology Group Co., Ltd.

The expansion of semiconductor manufacturing is a key driver for market expansion, as these materials are essential in advanced packaging and wafer-level chip fabrication. Their high thermal stability, strong electrical insulation, and precise dimensional control support the integration of dense chip architectures.

The demand for high-performance substrates continues to rise with the increasing adoption of heterogeneous integration and chiplet-based designs in next-generation semiconductor devices.

Market Driver

Rising Demand for Consumer Electronics

The rising demand for consumer electronics is a key driver in the glass substrate market, supported by the growing production of smartphones, tablets, and laptops.

Glass substrates offer optical clarity, mechanical strength, and dimensional accuracy required for advanced displays, including liquid crystal displays (LCD) and organic light-emitting diode (OLED) panels. The demand for glass substrates is fuelling the development of thinner electronic devices and higher-resolution display technologies.

- In May 2025, Samsung Electronics announced that its upcoming Galaxy S25 Edge smartphone will feature Corning Gorilla Glass Ceramic 2, offering enhanced protection while maintaining an ultra-thin design.

Market Challenge

High Production Costs

High production cost is a critical challenge in the glass substrate market. The complexity of manufacturing processes, stringent quality standards, and dependence on advanced fabrication equipment contribute to elevated operational expenses. These factors reduce cost efficiency, limit participation from smaller market players, and constrain pricing flexibility, particularly in high-volume applications such as consumer electronics.

To address this challenge, manufacturers are implementing process improvements, increasing automation, and enhancing yield management to lower production expenses while maintaining product standards. These ongoing efforts aim at reducing cost pressures and supporting sustainable market growth.

Market Trend

Adoption of Ultra-Thin Glass Substrates in Advanced Display Technologies

The adoption of ultra-thin glass substrates in high-resolution liquid crystal displays (LCD) and miniature light emitting diode (MiniLED) displays is emerging as a key trend in the glass substrate market.

These substrates enable precise light control, enhanced brightness, and reduced thickness, supporting next-generation display technologies. Their dimensional stability and optical clarity are critical for achieving higher resolution and energy-efficient performance in compact designs.

- In April 2025, WG Tech introduced a 27-inch MiniLED display with a 0.55 mm glass substrate. It features 1,152 dimming zones and 10,368 LEDs, enhancing Hisense’s G9 panel with improved contrast and reduced halo effects.

Glass Substrate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Borosilicate-Based Glass Substrates, Silicon-Based Glass Substrates, Ceramic-Based Glass Substrates

|

|

By End-Use Industry

|

Electronics, Automotive, Medical, Aerospace & Defense, Energy

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Borosilicate-Based Glass Substrates, Silicon-Based Glass Substrates, and Ceramic-Based Glass Substrates): The borosilicate-based glass substrates segment earned USD 2.76 billion in 2024, due to its superior thermal stability, chemical resistance, and cost-effective suitability for high-volume electronics and display applications.

- By End-Use Industry (Electronics, Automotive, Medical, Aerospace & Defense, and Energy): The electronics segment held 36.12% of the market in 2024, due to the high demand for precision substrates in consumer devices, displays, and semiconductor components, which require dimensional accuracy and optical clarity.

Glass Substrate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific glass substrate market share stood at 36.12% in 2024, with a valuation of USD 2.60 billion. This dominance is attributed to Asia Pacific’s strong electronics manufacturing base, supported by the presence of major producers of smartphones, televisions, and computer monitors.

Asia Pacific accounts for a substantial share of global consumer electronics and display panel production, thereby driving consistent demand for high-performance glass substrates. High-volume manufacturing of consumer electronics in countries such as China, South Korea, and Japan fuels large-scale substrate consumption, thereby driving market growth across the region.

- According to China’s Ministry of Industry and Information Technology (MIIT), the country’s electronic information manufacturing sector recorded an 11.8% year-on-year increase in 2024. Moreover, integrated circuit production grew by 22% in 2024, highlighting the continued expansion of China’s semiconductor and electronics manufacturing capabilities.

Europe glass substrate industry is poised for a CAGR of 3.56% over the forecast period. This growth is driven by the strong presence of automotive original equipment manufacturers (OEMs), that are driving the demand for advanced display and sensor technologies. Leading automakers in Europe are increasingly integrating digital dashboards, head-up displays, and driver-assistance systems that rely on high-performance glass substrates.

The shift toward electric vehicles and connected mobility is further accelerating the need for durable and high-precision substrate materials. These factors position Europe as the fastest-growing region in the market.

Regulatory Frameworks

- In China, the Ministry of Industry and Information Technology (MIIT) oversees the electronics and IT sectors, setting regulations and standards for materials such as glass substrates used in displays and semiconductors.

- In South Korea, the Ministry of Trade, Industry, and Energy (MOTIE) establishes industry standards for electronic components and advanced materials, including glass substrates used in semiconductor packaging and display technologies.

Competitive Landscape

The glass substrate industry is characterized by continuous innovation and the introduction of high-performance materials. Leading manufacturers are developing ultra-thin, low-dielectric, and thermally stable glass substrates to meet the evolving demands of advanced semiconductor packaging, high-definition displays, and radio frequency (RF) modules.

These next-generation substrates are engineered to enhance signal integrity, heat dissipation, and component density-key factors in modern electronic design. Strategic product innovations are closely aligned with emerging applications in 5G, 6G, AI infrastructure, and next-generation electronics, reflecting the industry's focus on enabling faster, smaller, and more efficient technologies.

- In August 2024, SCHOTT introduced a low-loss glass substrate with a dielectric constant of 4.0 and a minimal dielectric loss of 0.0021, delivering high efficiency for advanced packaging in 5G/6G communications, high-speed digital circuits, and radio frequency (RF) systems operating at gigahertz (GHz) frequencies.

Key Companies in Glass Substrate Market:

- AGC Inc.

- SCHOTT Envases Argentina S.A.

- Corning Incorporated

- Nippon Electric Glass Co., Ltd

- HOYA CORPORATION

- PLANOPTIK AG

- Ohara Inc.

- TOPPAN Inc.

- AvanStrate Inc.

- Specialty Glass Products

- Viracon

- NOVA Electronic Materials, LLC.

- Biotain Crystal Co., Ltd.

- Nanoshel

- Saint-Gobain

- TCL China Star Optoelectronics Technology Co., Ltd.

- BOE Technology Group Co., Ltd.

Recent Developments (Launches)

- In February 2025, TASMIT Inc. launched a new inspection system for glass substrates under its INSPECTRA series of semiconductor wafer inspection tools. The system is designed to detect micro-defects and surface irregularities with high precision, supporting quality assurance in advanced display and semiconductor applications.

- In September 2023, Intel introduced advanced glass substrates developed to support the increasing need for high-performance computing in next-generation packaging technologies. These substrates are designed to enable transistor scaling within packages, helping extend Moore’s Law and power future data-driven applications.

are